Answered step by step

Verified Expert Solution

Question

1 Approved Answer

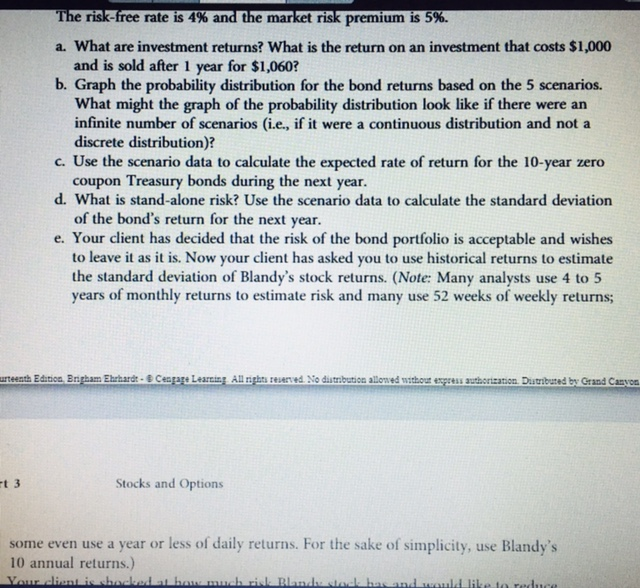

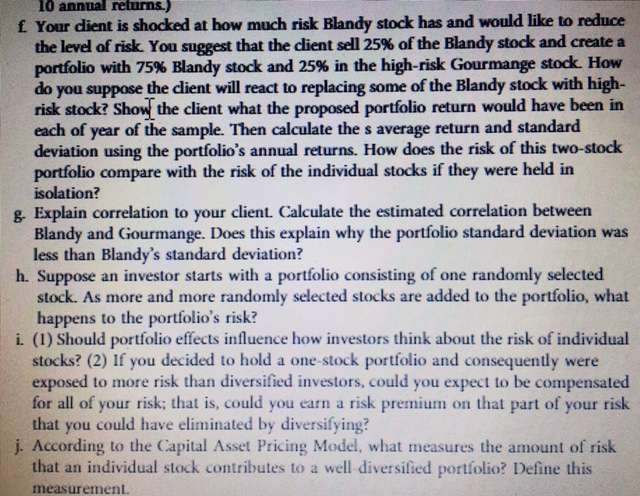

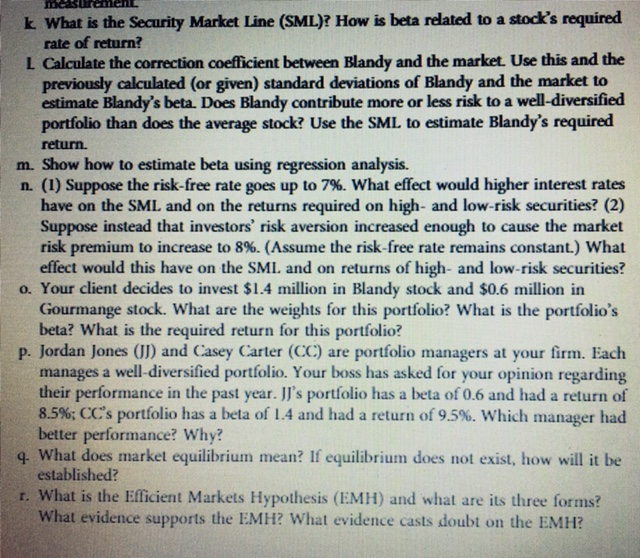

Comprehensive Financial Management 14th edition Ch. 6: Mini-Case (p. 284), Parts a, c, d, e, h, n, o, p, & q only yes for p

Comprehensive Financial Management 14th edition

Ch. 6: Mini-Case (p. 284), Parts a, c, d, e, h, n, o, p, & q only

yes for p and q

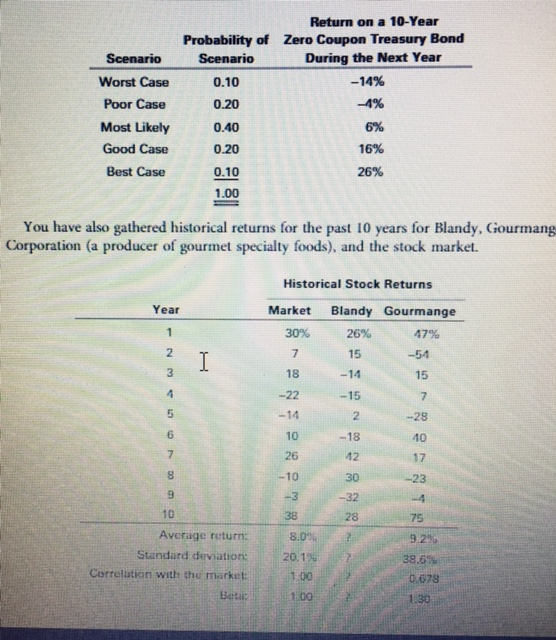

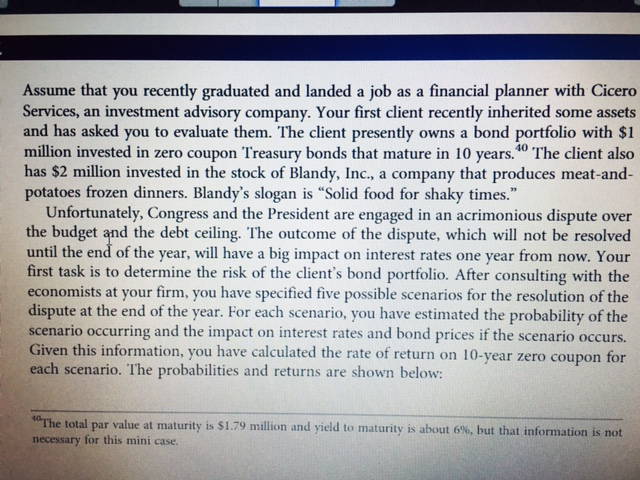

Return on a 10-Year Zero Coupon Treasury Bond During the Next Year Worst Case Poor Case Most Likely Good Case Best Case Probability of Scenario 0.10 0.20 0.40 0.20 0.10 1.00 -14% -4% 16% 26% You have also gathered historical returns for the past 10 years for Blandy, Gourmang Corporation (a producer of gourmet specialty foods), and the stock market. Historical Stock Returns Market Blandy Gourmange 26% Year 30% 47% 2 15 -14 -22 15 7 -54 18 15 5 10 26 10 28 40 17 -23 6 -18 12 30 10 28 75 9.24% 38.6 Average return: Standard deviation: Correlation with the market: Betar 8.0% 20.1% 1.00 678 1.30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started