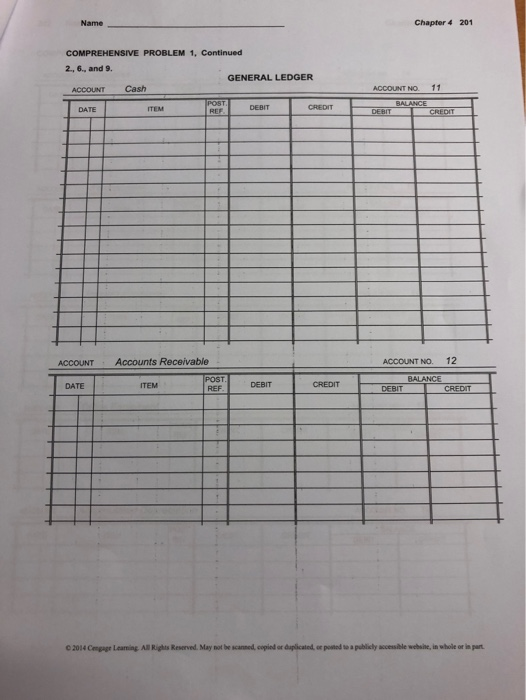

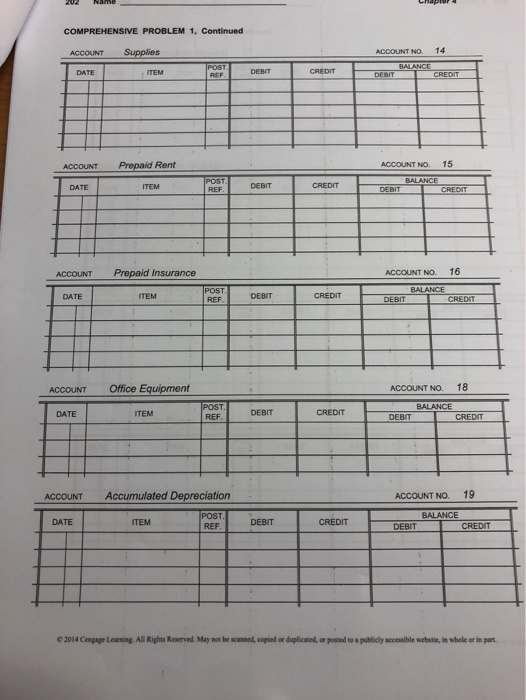

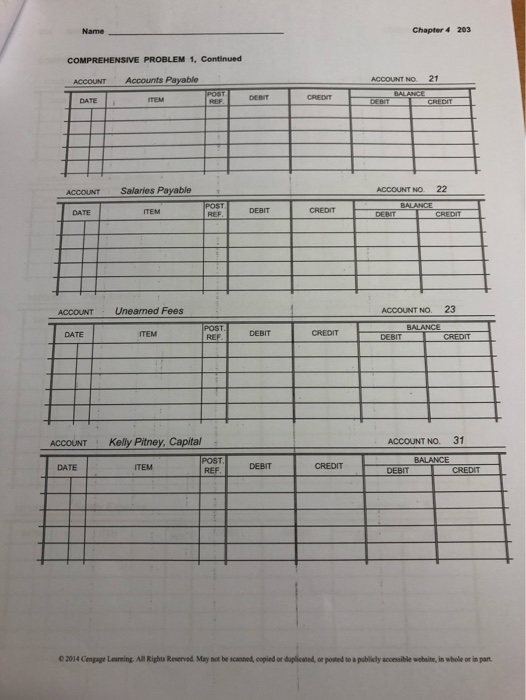

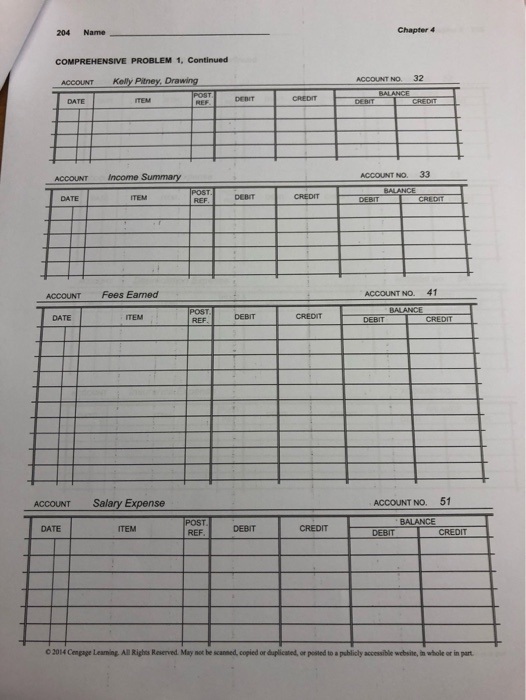

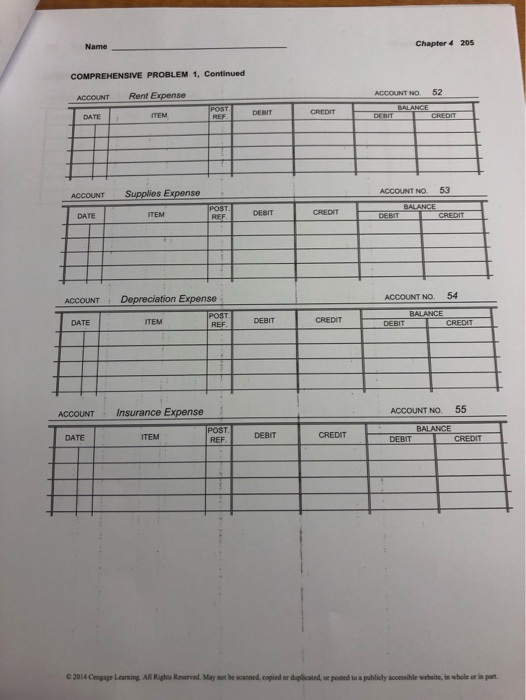

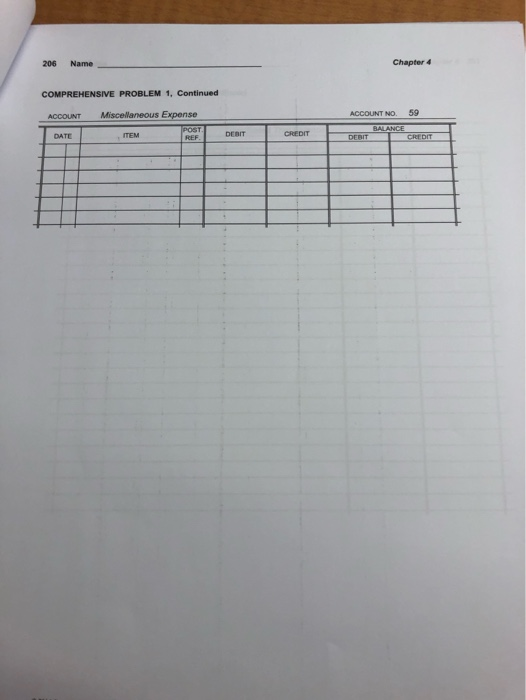

Comprehensive Problem 1 8. Net income, $33,425 Excel Kelly Pitney began her consulting business, Kelly Consulting, on April 1, 2019. The ac- counting cycle for Kelly Consulting for April, including financial statements, was illustrated in this chapter. During May, Kelly Consulting entered into the following transactions: May 3. Received cash from clients as an advance payment for services to be provided and recorded it as unearned fees, $4,500. 5. Received cash from clients on account, $2,450. 9. Paid cash for a newspaper advertisement, $225. 13. Paid Office Station Co. for part of the debt incurred on April 5, $640. 15. Provided services on account for the period May 1-15, $9,180. 16. Paid part-time receptionist for two weeks' salary including the amount owed on April 30, $750. 17. Received cash from cash clients for fees earned during the period May 1-16, $8,360. Record the following transactions on Page 6 of the journal: 20. Purchased supplies on account, $735. 21. Provided services on account for the period May 16-20, $4,820. 25. Received cash from cash clients for fees earned for the period May 17-23, $7.900. 27. Received cash from clients on account, $9,520. 28. Paid part-time receptionist for two weeks' salary, $750. 30. Paid telephone bill for May, $260. 31. Paid electricity bill for May, $810. 31. Received cash from cash clients for fees earned for the period May 26-31, $3,300. 31. Provided services on account for the remainder of May, $2,650. 31. Kelly withdrew $10,500 for personal use. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2019, is shown in Exhibit 17. For each account in the post-closing trial balance, enter the balance in the appropriate Balance column of a four-column account. Date the balances May 1, 2019, and place a check mark (V) in the Posting Reference column. Journalize each of the May transactions in a two- column journal starting on Page 5 of the journal and using Kelly Consulting's chart of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6). a. Insurance expired during May is $275. b. Supplies on hand on May 31 are $715. 202 Name COMPREHENSIVE PROBLEM 1, Continued ACCOUNT Supplies DATE ITEM RERI ACCOUNT NO. 14 DEBIT CREDIT BALANCE DEBIT CREDIT ACCOUNT Prepaid Rent ACCOUNT NO 15 BALANCE DEBIT CREDIT DATE ITEM REI DEBIT CREDIT ACCOUNT Prepaid Insurance ACCOUNT NO. 16 POST DATE ITEM REF DEBIT CREDIT BALANCE CREDIT DEBIT ACCOUNT Office Equipment ACCOUNT NO. 18 Pos DATE ITEM REF. DEBIT CREDIT BALANCE DEBIT CREDIT ACCOUNT Accumulated Depreciation ACCOUNT NO. 19 DATE ITEM POST. REF. DEBIT CREDIT BALANCE CREDIT DEBIT 2014 Cepage Leaming. All Rights Reserved. May not be somed, copied or duplicated, ce posted to a publicly accessible website, in whole or in part Name Chapter 4 203 COMPREHENSIVE PROBLEM 1, Continued ACCOUNT Accounts Payable DATE : FEM I ACCOUNT NO 21 DEBIT CREDIT ACCOUNT DATE Salaries Payable ITEM ACCOUNT NO. 22 BALANCE DEBIT CREDIT RESTO DEBIT CREDIT T ACCOUNT Uneamed Fees ACCOUNT NO. 23 DATE ITEM POST REFT DEBIT CREDIT DEBIT BALANCE CREDIT ACCOUNT Kelly Pitney, Capital ACCOUNT NO. 31 DATE ITEM POST REF DEBIT CREDIT DEBIT CREDIT 2014 Cmpe Lewi Al Rights Reserved. May mothecae, copied or ap p l y w in whole or input 204 Name Chapter 4 COMPREHENSIVE PROBLEM 1, Continued ACCOUNT Kaly Pitney. Drawing DATE TEM P O ACCOUNT NO. 32 RALANCE DEBIT CREDIT DEBIT CREDIT Income Summary ACCOUNT NO. 33 TEN DEBIT CREDIT DET TCHET ACCOUNT Fees Earned ACCOUNT NO. 41 BALANCE DEBIT CREDIT DATE ITEM REI DEBIT CREDIT ACCOUNT Salary Expense ACCOUNT NO. 51 DATE ITEM POSTI REF DEBIT CREDIT BALANCE CREDIT DEBIT 2014 Cmp All Righe Red Mystemed op p y whole in part Name Chapter 4 205 COMPREHENSIVE PROBLEM 1. Continued ACCOUNT Rent Expense ACCOUNT NO. 52 BALANCE DEBIT CREDIT DATE ITEM DEBIT CREDIT ACCOUNT Supplies Expense ACCOUNT NO. 53 DATE DEBIT CREDIT DEBIT CRED TTT ACCOUNT: Depreciation Expense ACCOUNT NO. 54 DATE TEM POST REF DEBIT CREDIT BALANCE DEBIT CREDIT ACCOUNT Insurance Expense ACCOUNT NO 55 BALANCE DEBIT CREDIT DATE ITEV POST REF DEBIT CREDIT 2014 Cmape Learning. All Rights Reserved. May to be and copied or dupliwie posted to a publicly c ible website, in whole a la part 206 Name Chapter COMPREHENSIVE PROBLEM 1Continued ACCOUNT ACCOUNT NO. 59 Miscellaneous Expense ITEM ALANCE DATE I DEBIT CREDIT DEBIT