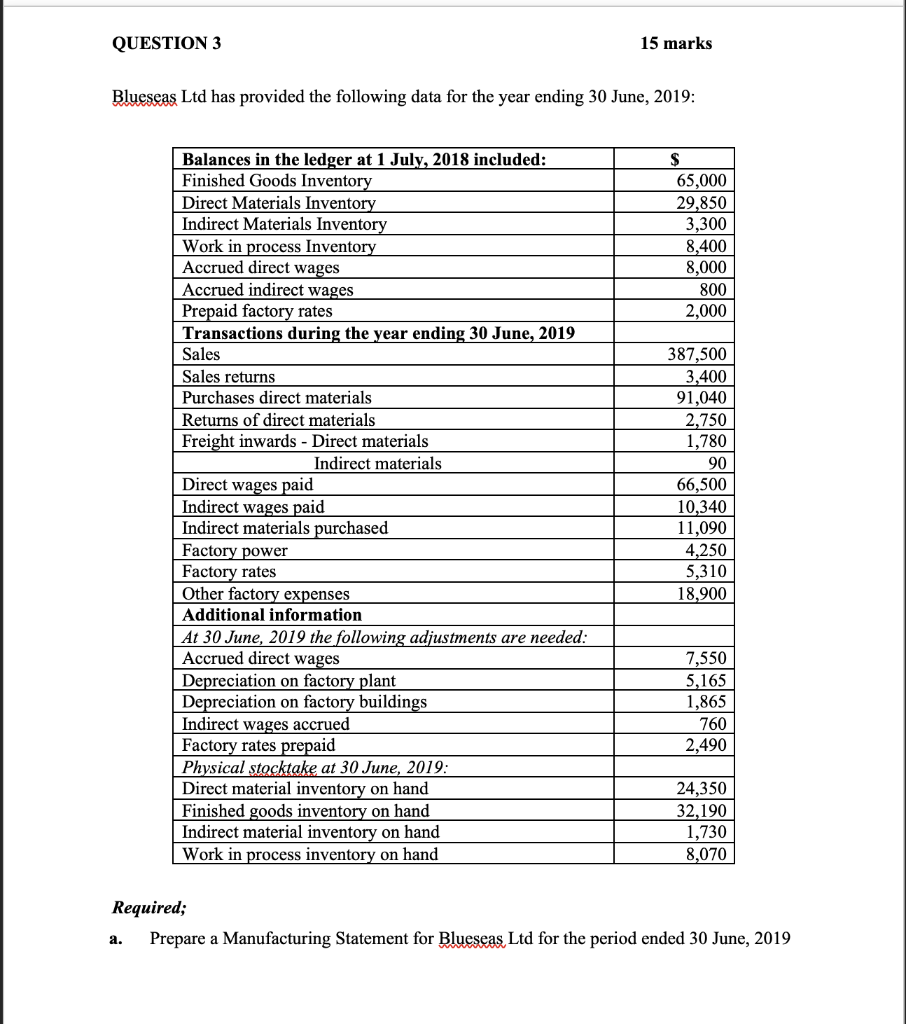

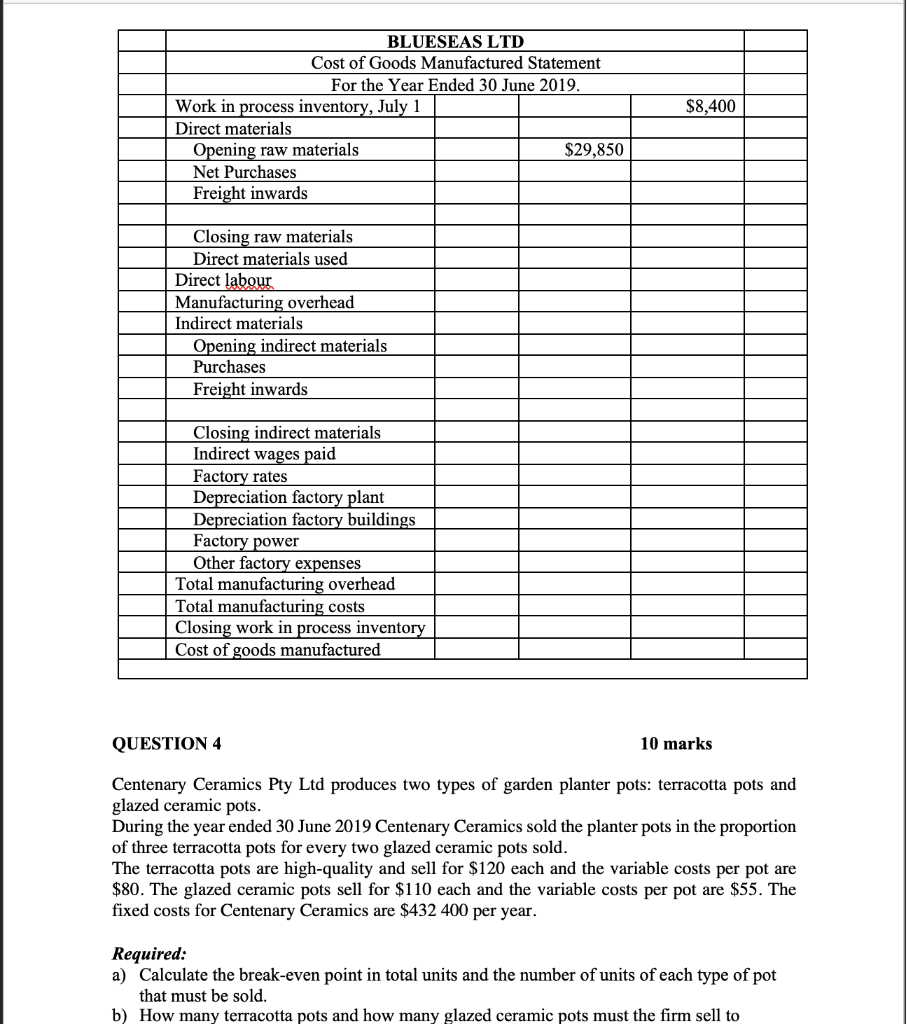

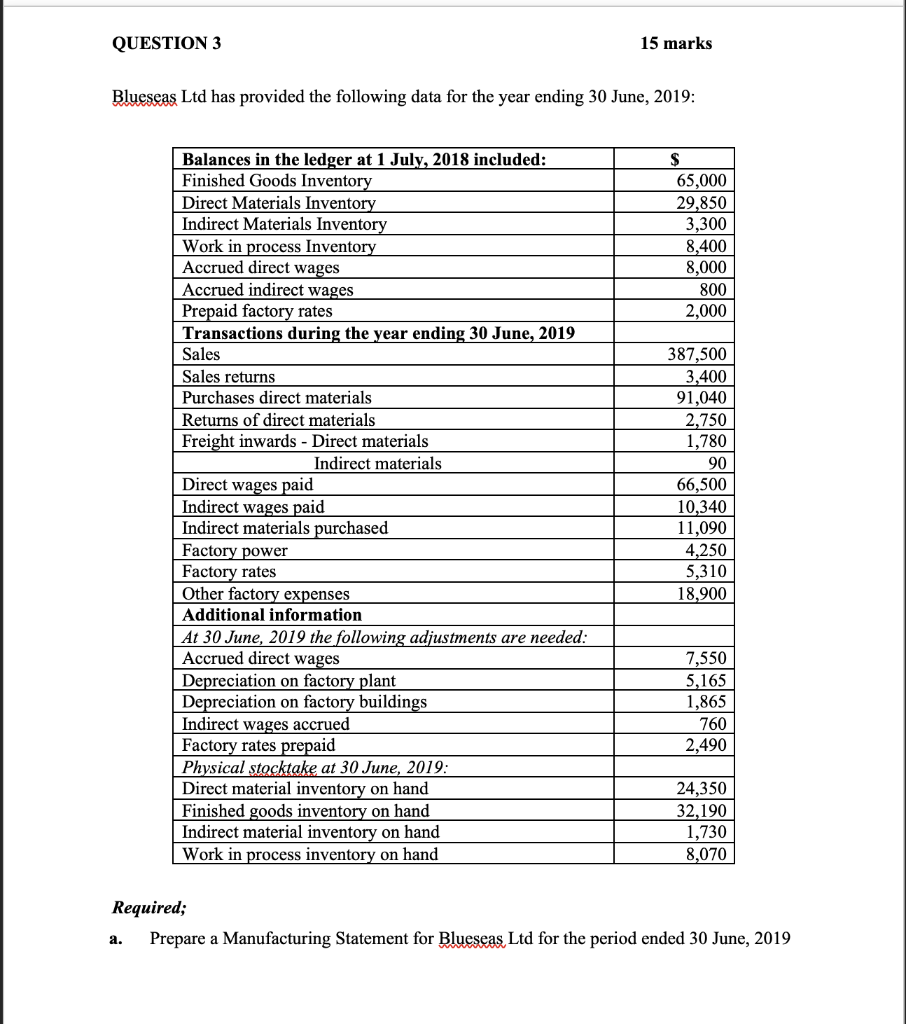

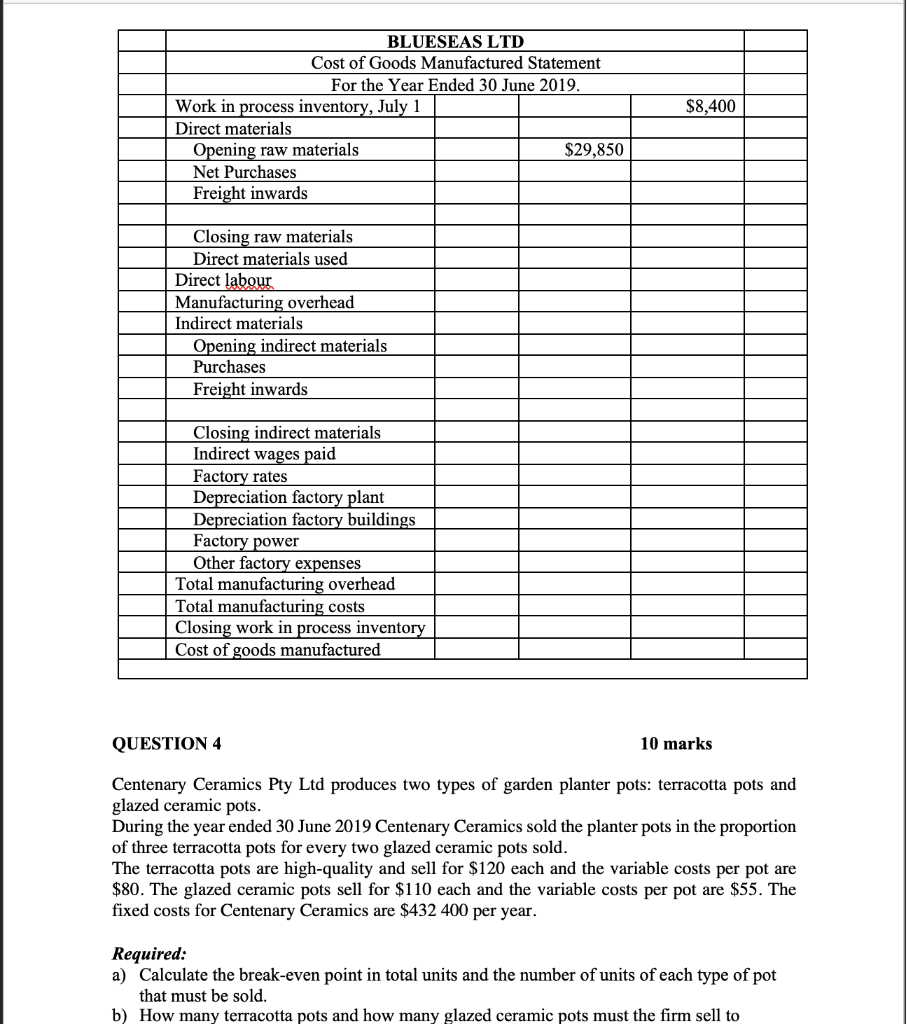

QUESTION 3 15 marks Blueseas Ltd has provided the following data for the year ending 30 June, 2019: $ 65,000 29,850 3,300 8,400 8,000 800 2,000 Balances in the ledger at 1 July, 2018 included: Finished Goods Inventory Direct Materials Inventory Indirect Materials Inventory Work in process Inventory Accrued direct wages Accrued indirect wages Prepaid factory rates Transactions during the year ending 30 June, 2019 Sales Sales returns Purchases direct materials Returns of direct materials Freight inwards - Direct materials Indirect materials Direct wages paid Indirect wages paid Indirect materials purchased Factory power Factory rates Other factory expenses Additional information At 30 June, 2019 the following adjustments are needed: Accrued direct wages Depreciation on factory plant Depreciation on factory buildings Indirect wages accrued Factory rates prepaid Physical stocktake at 30 June, 2019: Direct material inventory on hand Finished goods inventory on hand Indirect material inventory on hand Work in process inventory on hand 387,500 3,400 91,040 2,750 1,780 90 66,500 10,340 11,090 4,250 5,310 18,900 7,550 5,165 1,865 760 2,490 24,350 32,190 1,730 8,070 Required; Prepare a Manufacturing Statement for Blueseas Ltd for the period ended 30 June, 2019 a. $8,400 BLUESEAS LTD Cost of Goods Manufactured Statement For the Year Ended 30 June 2019. Work in process inventory, July 1 Direct materials Opening raw materials $29,850 Net Purchases Freight inwards Closing raw materials Direct materials used Direct labour Manufacturing overhead Indirect materials Opening indirect materials Purchases Freight inwards Closing indirect materials Indirect wages paid Factory rates Depreciation factory plant Depreciation factory buildings Factory power Other factory expenses Total manufacturing overhead Total manufacturing costs Closing work in process inventory Cost of goods manufactured QUESTION 4 10 marks Centenary Ceramics Pty Ltd produces two types of garden planter pots: terracotta pots and glazed ceramic pots. During the year ended 30 June 2019 Centenary Ceramics sold the planter pots in the proportion of three terracotta pots for every two glazed ceramic pots sold. The terracotta pots are high-quality and sell for $120 each and the variable costs per pot are $80. The glazed ceramic pots sell for $110 each and the variable costs per pot are $55. The fixed costs for Centenary Ceramics are $432 400 per year. Required: a) Calculate the break-even point in total units and the number of units of each type of pot that must be sold. b) How many terracotta pots and how many glazed ceramic pots must the firm sell to