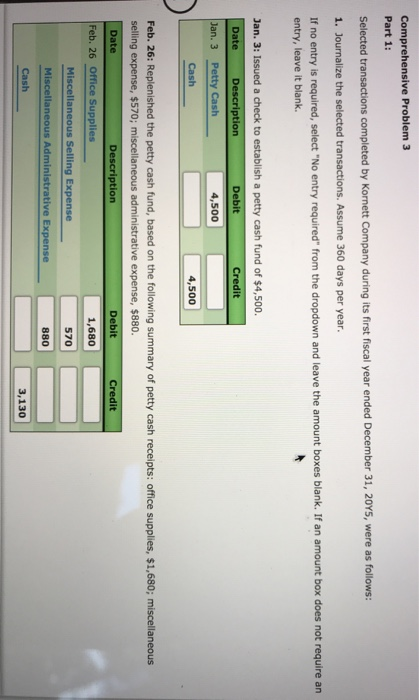

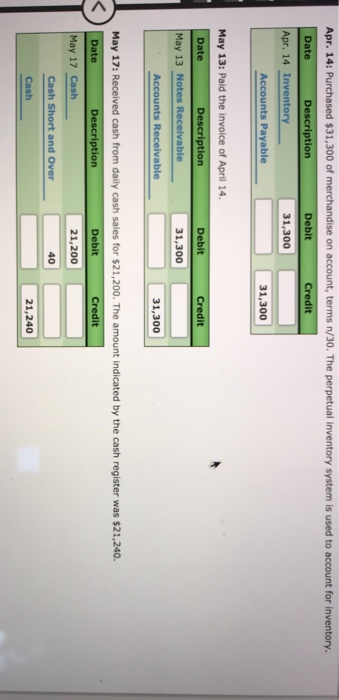

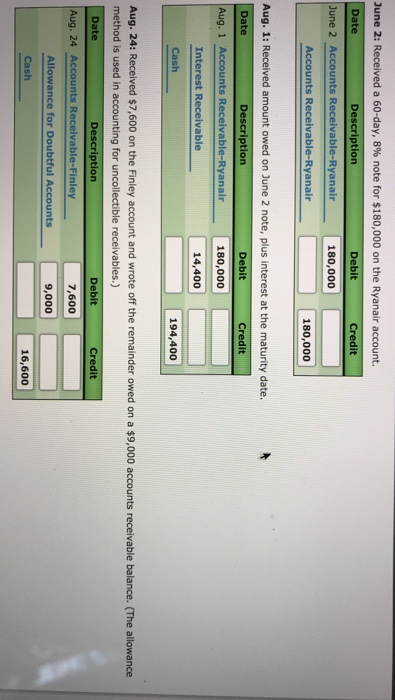

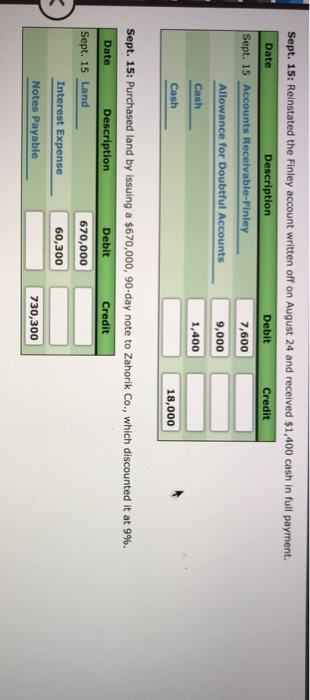

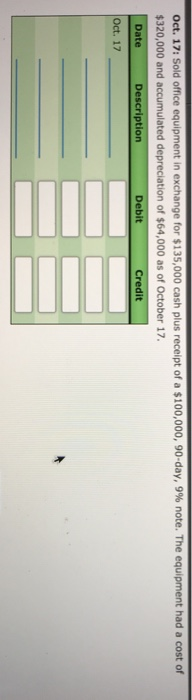

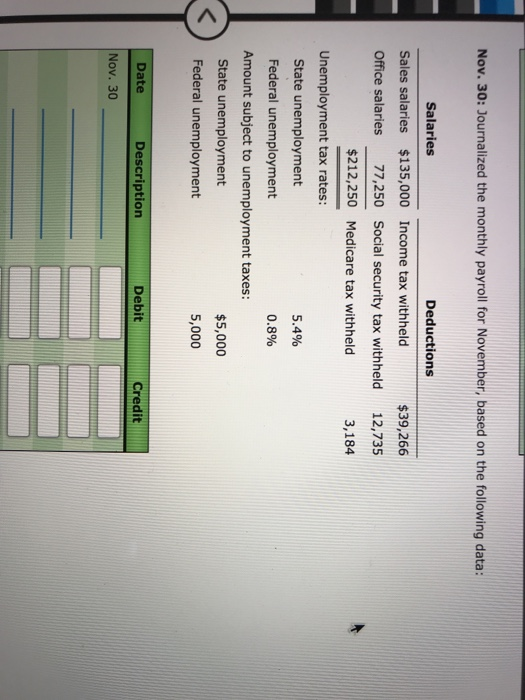

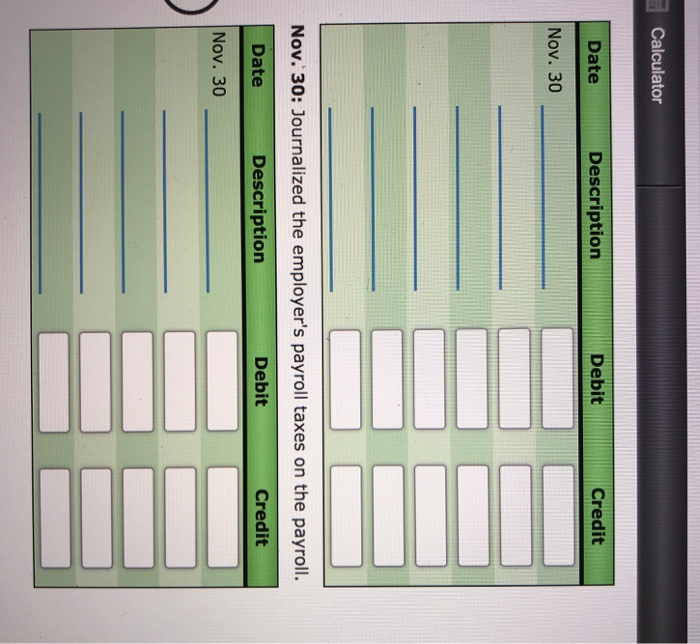

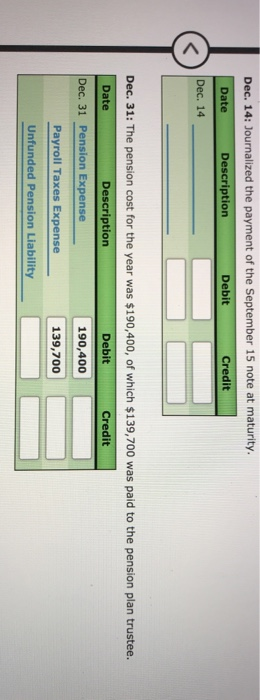

Comprehensive Problem 3 Part 1: Selected transactions completed by Kornett Company during its first fiscal year ended December 31, 2045, were as follows: 1. Journalize the selected transactions. Assume 360 days per year. If no entry is required, select "No entry required" from the dropdown and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. Jan. 3: Issued a check to establish a petty cash fund of $4,500. Date Description Debit Credit Jan. 3 Petty Cash 4,500 Cash 4,500 Feb. 26: Replenished the petty cash fund, based on the following summary of petty cash receipts: office supplies, $1,680; miscellaneous selling expense, $570; miscellaneous administrative expense, $880. Date Description Debit Credit Feb. 26 Office Supplies 1,680 Cred Miscellaneous Selling Expense 570 Miscellaneous Administrative Expense 880 Cash 3,130 Apr. 14: Purchased $31,300 of merchandise on account, terms n/30. The perpetual inventory system is used to account for inventory. Date Description Debit Credit Apr. 14 Inventory 31,300 Accounts Payable 31,300 Credit May 13: Paid the invoice of April 14. Date Description May 13 Notes Receivable Accounts Receivable Debit 31,300 31,300 May 17: Received cash from daily cash sales for $21,200. The amount indicated by the cash register was $21,240. Description Debit Credit Date May 17 Cash 21,200 Cash Short and Over 40 Cash 21,240 June 2: Received a 60-day, 8% note for $180,000 on the Ryanair account. Date Description Debit Credit June 2 Accounts Receivable-Ryanair 180,000 Accounts Receivable-Ryanair 180,000 Aug. 1: Received amount owed on June 2 note, plus interest at the maturity date. Date Description Debit Credit Aug. 1 Accounts Receivable-Ryanair 180,000 Interest Receivable 14,400 Cash 194,400 Aug. 24: Received $7,600 on the Finley account and wrote off the remainder owed on a $9,000 accounts receivable balance. (The allowance method is used in accounting for uncollectible receivables.) Date Description Debit Credit Aug. 24 Accounts Receivable-Finley 7,600 Allowance for Doubtful Accounts 9,000 Cash 16,600 Sept. 15: Reinstated the Finley account written off on August 24 and received $1,400 cash in full payment. Date Description Debit Credit Sept. 15 Accounts Receivable-Finley 7,600 Allowance for Doubtful Accounts 9,000 Cash 1,400 Cash 18,000 Sept. 15: Purchased land by issuing a $670,000, 90-day note to Zahorik Co., which discounted it at 9%. Date Description Debit Credit Sept. 15 Land 670,000 Interest Expense 60,300 Notes Payable 730,300 Oct. 17: Sold office equipment in exchange for $135,000 cash plus receipt of a $100,000, 90-day, 9% note. The equipment had a cost of $320,000 and accumulated depreciation of $64,000 as of October 17. Date Description Debit Credit Oct. 17 Nov. 30: Journalized the monthly payroll for November, based on the following data: $39,266 12,735 3,184 Salaries Deductions Sales salaries $135,000 Income tax withheld Office salaries 77,250 Social security tax withheld $212,250 Medicare tax withheld Unemployment tax rates: State unemployment 5.4% Federal unemployment 0.8% Amount subject to unemployment taxes: State unemployment $5,000 Federal unemployment 5,000 Description Debit Credit Date Nov. 30 Calculator Date Description Debit Credit Nov. 30 Nov. 30: Journalized the employer's payroll taxes on the payroll. Date Description Debit Credit Nov. 30 Dec. 14: Journalized the payment of the September 15 note at maturity. Date Description Debit Credit Dec. 14 Dec. 31: The pension cost for the year was $190,400, of which $139,700 was paid to the pension plan trustee. Date Description Debit Credit Dec. 31 Pension Expense 190,400 Payroll Taxes Expense 139,700 Unfunded Pension Liability