Answered step by step

Verified Expert Solution

Question

1 Approved Answer

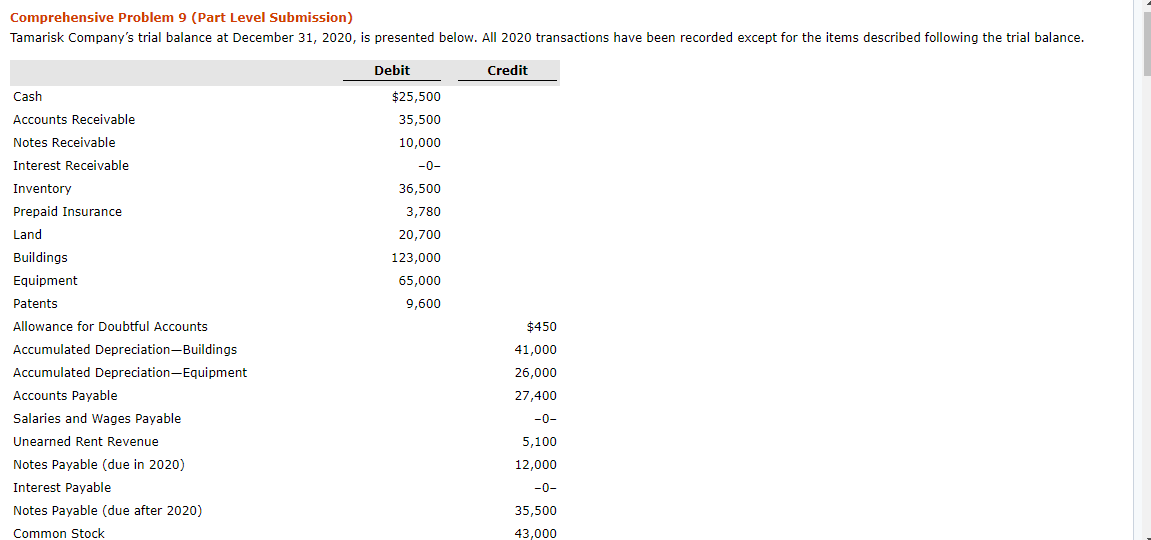

Comprehensive Problem 9 (Part Level Submission) Tamarisk Companys trial balance at December 31, 2020, is presented below. All 2020 transactions have been recorded except for

Comprehensive Problem 9 (Part Level Submission) Tamarisk Companys trial balance at December 31, 2020, is presented below. All 2020 transactions have been recorded except for the items described following the trial balance. Part 2

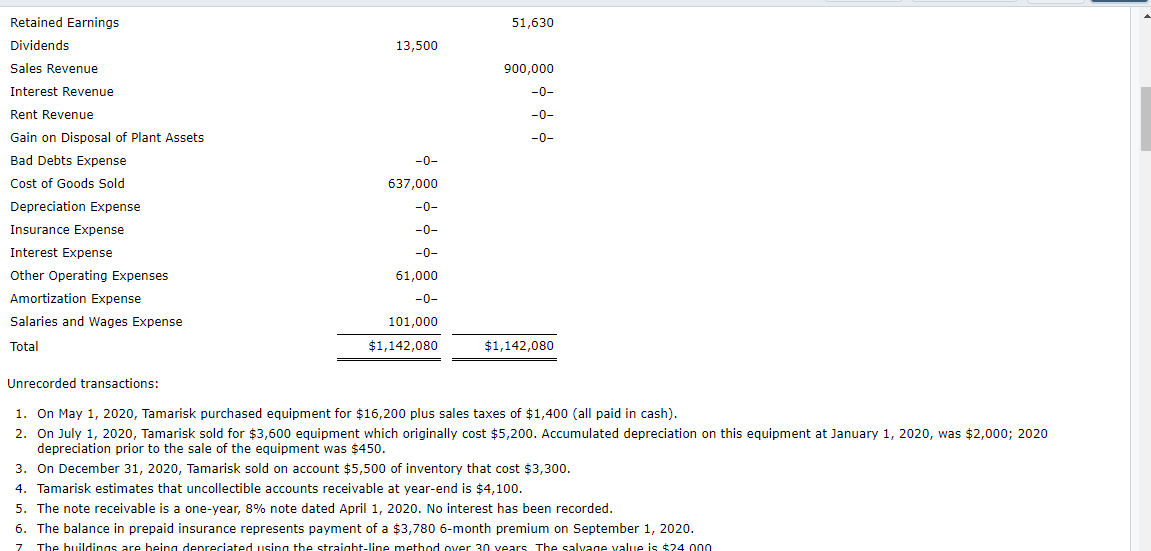

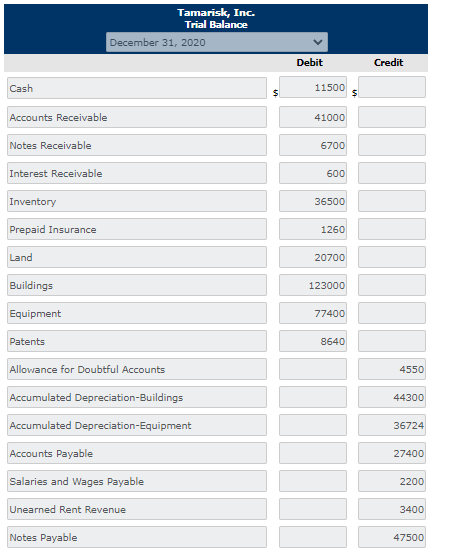

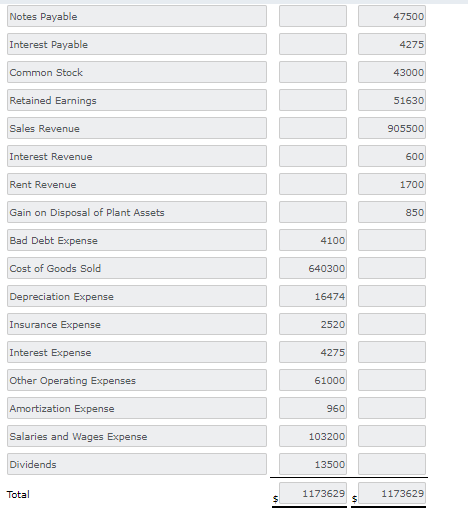

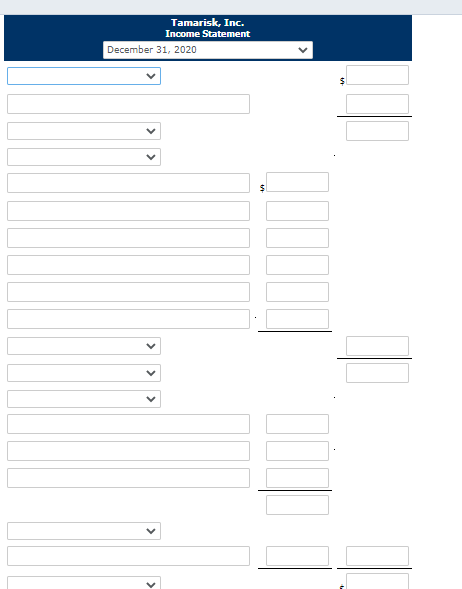

Comprehensive Problem 9 (Part Level Submission) Tamarisk Company's trial balance at December 31, 2020, is presented below. All 2020 transactions have been recorded except for the items described following the trial balance. Debit Credit $25,500 35,500 10,000 -0- Cash Accounts Receivable Notes Receivable Interest Receivable Inventory Prepaid Insurance Land Buildings Equipment 36,500 3,780 20,700 123,000 65,000 9,600 $450 41,000 26,000 27,400 Patents Allowance for Doubtful Accounts Accumulated Depreciation-Buildings Accumulated Depreciation-Equipment Accounts Payable Salaries and Wages Payable Unearned Rent Revenue Notes Payable (due in 2020) Interest Payable Notes Payable (due after 2020) Common Stock -0- 5,100 12,000 -0- 35,500 43,000 51,630 Retained Earnings Dividends 13,500 Sales Revenue 900,000 -0- -0- -0- Interest Revenue Rent Revenue Gain on Disposal of Plant Assets Bad Debts Expense Cost of Goods Sold Depreciation Expense Insurance Expense Interest Expense Other Operating Expenses Amortization Expense Salaries and Wages Expense -0- 637,000 -0- -0- -0- 61,000 -0- 101,000 $1,142,080 Total $1,142,080 Unrecorded transactions: 1. On May 1, 2020, Tamarisk purchased equipment for $16,200 plus sales taxes of $1,400 (all paid in cash). 2. On July 1, 2020, Tamarisk sold for $3,600 equipment which originally cost $5,200. Accumulated depreciation on this equipment at January 1, 2020, was $2,000; 2020 depreciation prior to the sale of the equipment was $450. 3. On December 31, 2020, Tamarisk sold on account $5,500 of inventory that cost $3,300. 4. Tamarisk estimates that uncollectible accounts receivable at year-end is $4,100. 5. The note receivable is a one-year, 8% note dated April 1, 2020. No interest has been recorded. 6. The balance in prepaid insurance represents payment of a $3,780 6-month premium on September 1, 2020. 7 The buildings are being depreciated using the straight-line method over 30 years. The salvane value is $24 000 Tamarisk, Inc. Trial Balance December 31, 2020 Debit Credit Cash 11500 $ Accounts Receivable 41000 Notes Receivable 6700 Interest Receivable 600 Inventory 36500 Prepaid Insurance 1260 Land 20700 Buildings 123000 Equipment 77400 Patents 8640 Allowance for Doubtful Accounts 4550 44300 Accumulated Depreciation Buildings Accumulated Depreciation Equipment 36724 Accounts Payable 27400 Salaries and Wages Payable 2200 Unearned Rent Revenue 3400 Notes Payable 47500 Notes Payable 47500 Interest Payable 4275 Common Stock 43000 Retained Earnings 51630 Sales Revenue 905500 Interest Revenue 600 Rent Revenue 1700 Gain on Disposal of Plant Assets 850 Bad Debt Expense 4100 Cost of Goods Sold 640300 Depreciation Expense 16474 Insurance Expense 2520 Interest Expense 4275 Other Operating Expenses 61000 Amortization Expense 960 Salaries and Wages Expense 103200 Dividends 13500 Total 1173629 1173629 $ S Tamarisk, Inc. Income Statement December 31, 2020 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started