Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help to do my Accounting Lab 7.. it connects to Lab 1, 4 and 6. I posted all the requirements please help me

I need help to do my Accounting Lab 7..

it connects to Lab 1, 4 and 6. I posted all the requirements please help me get all parts of Lab 7 done. Thank you!

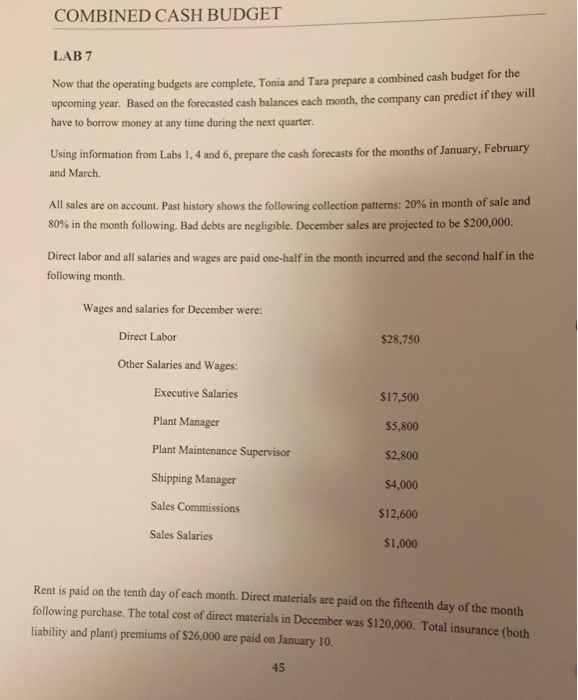

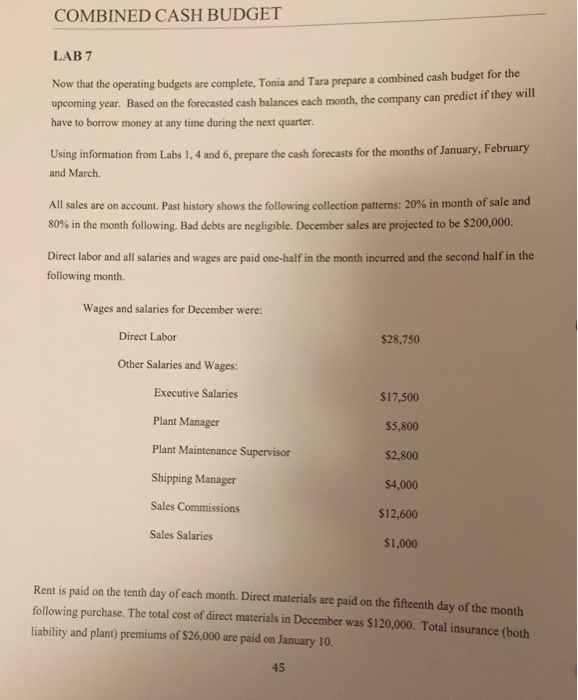

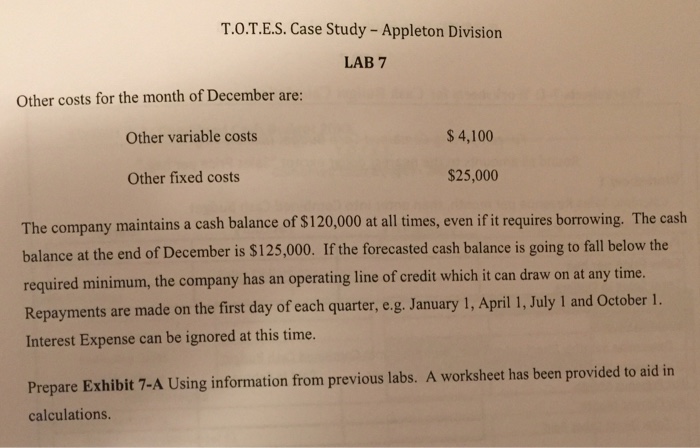

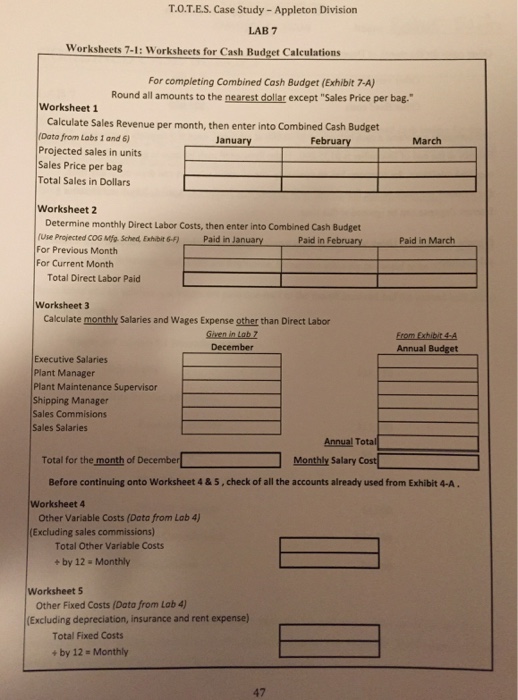

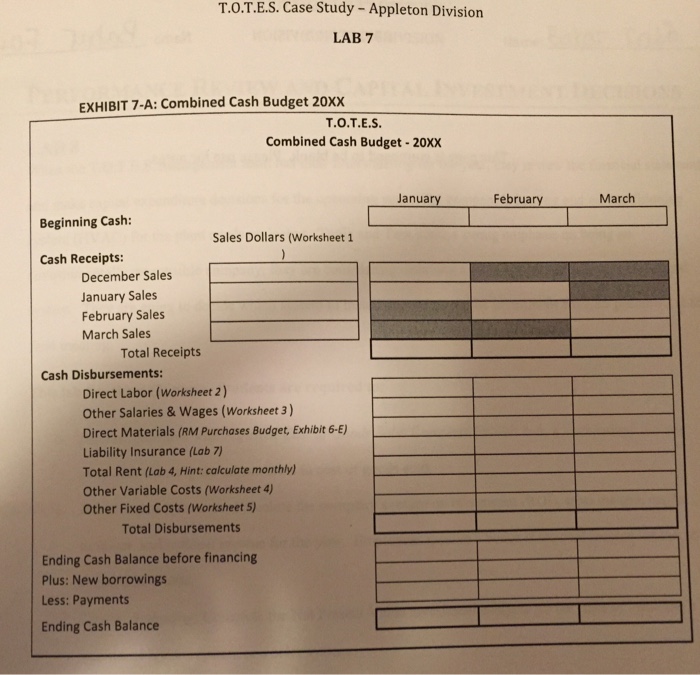

Here is Lab 7 that needs to be done...

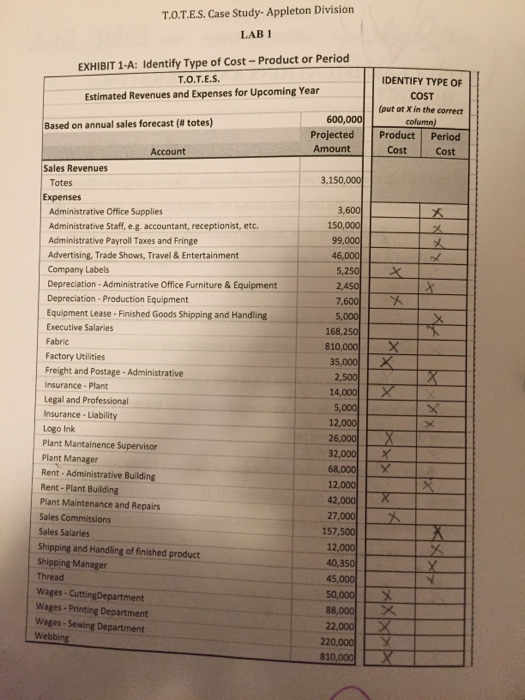

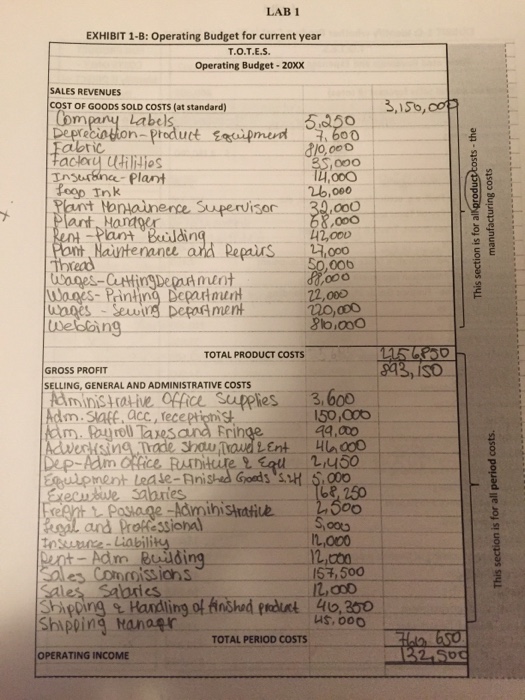

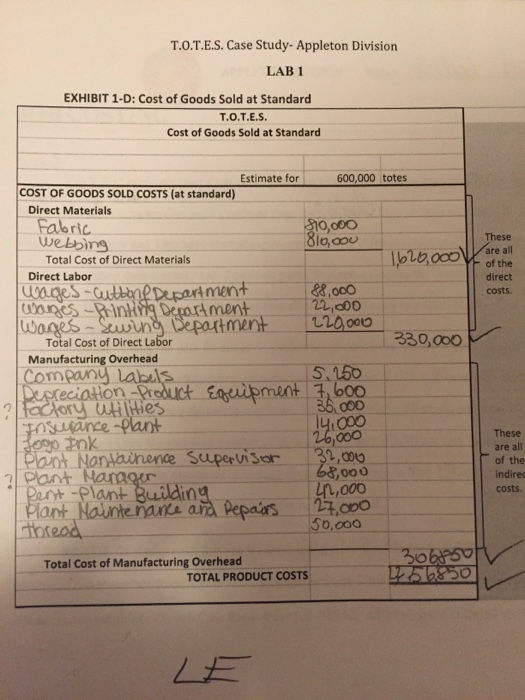

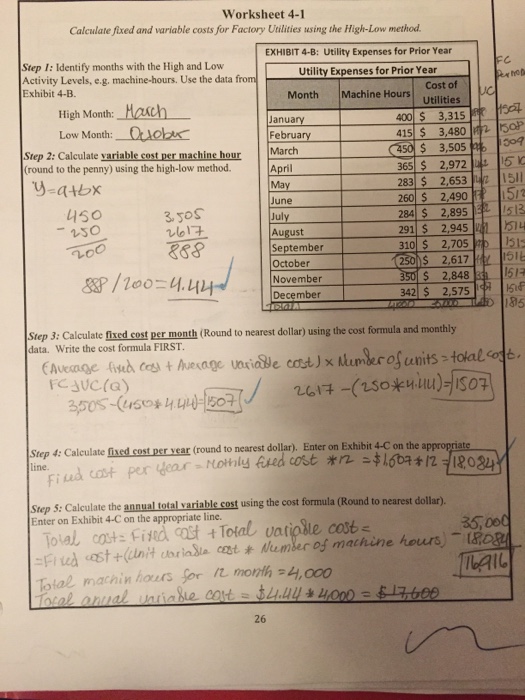

Here is Lab 1 all completed

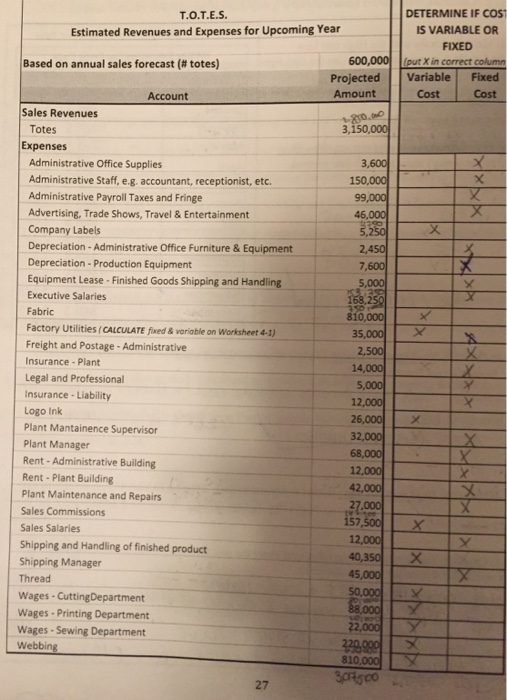

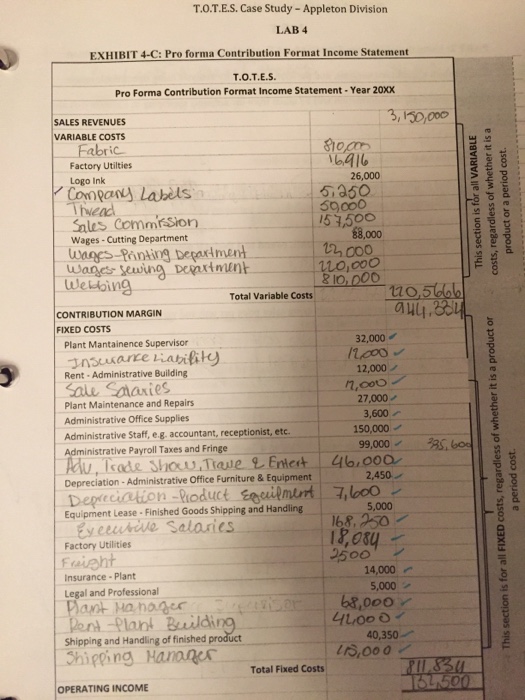

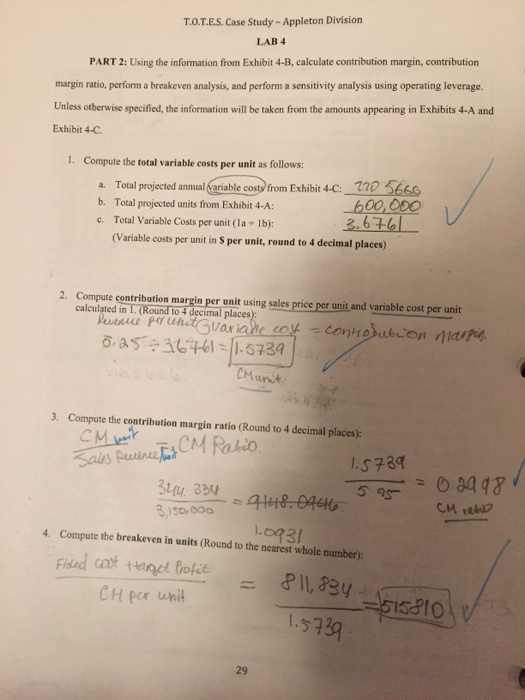

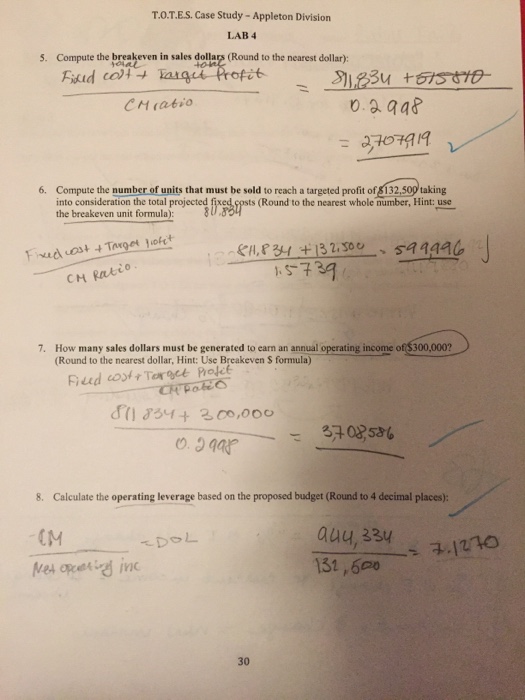

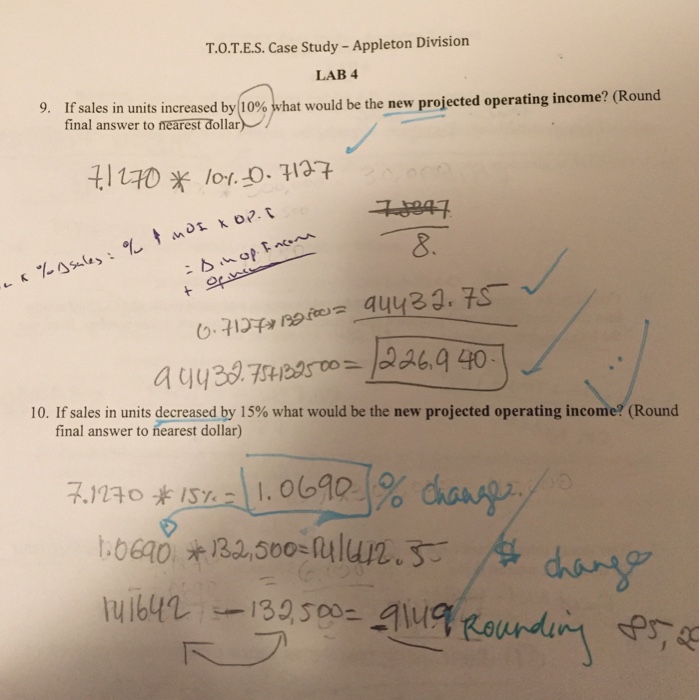

Here is Lab 4 all completed

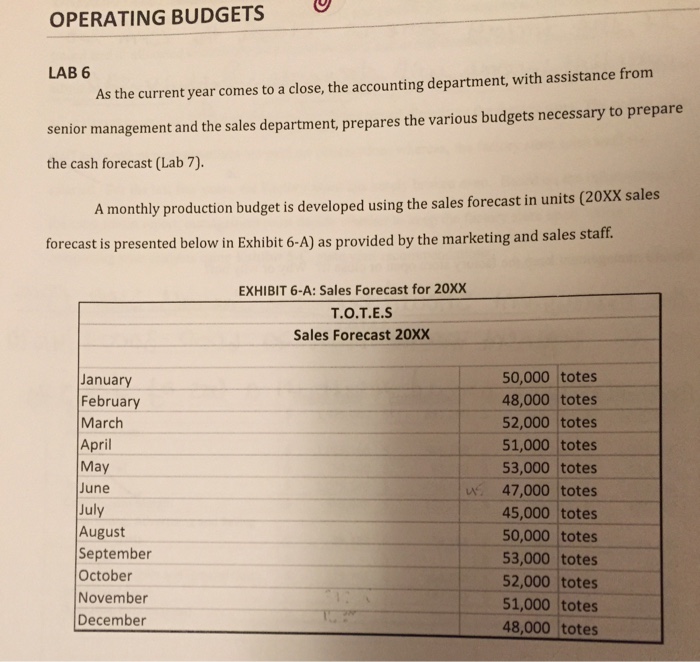

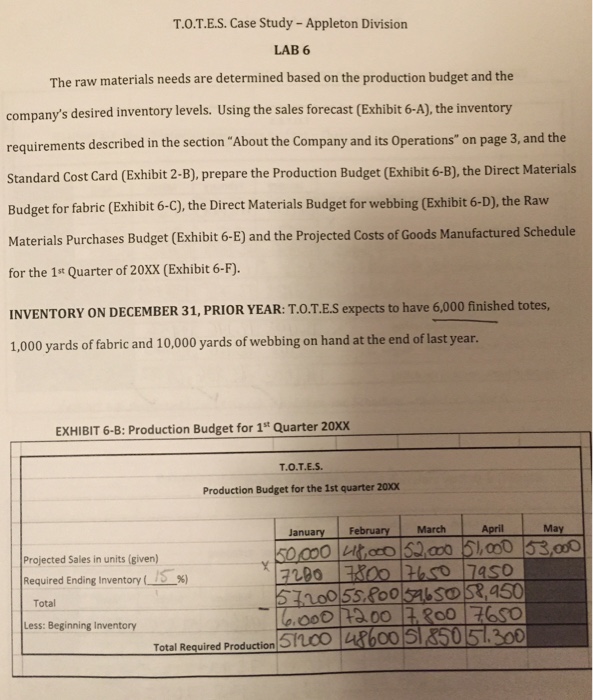

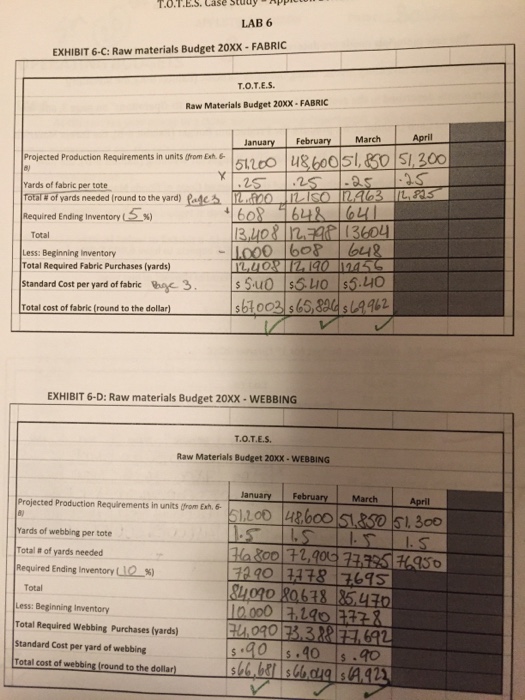

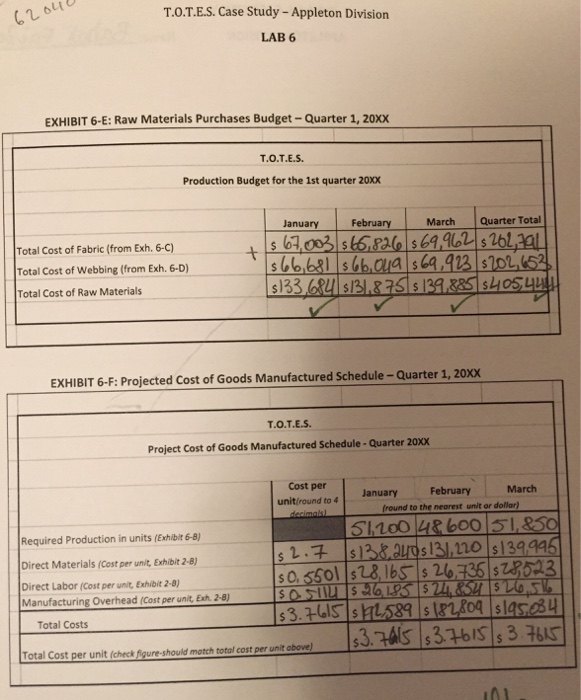

And here is Lab 6 all completed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started