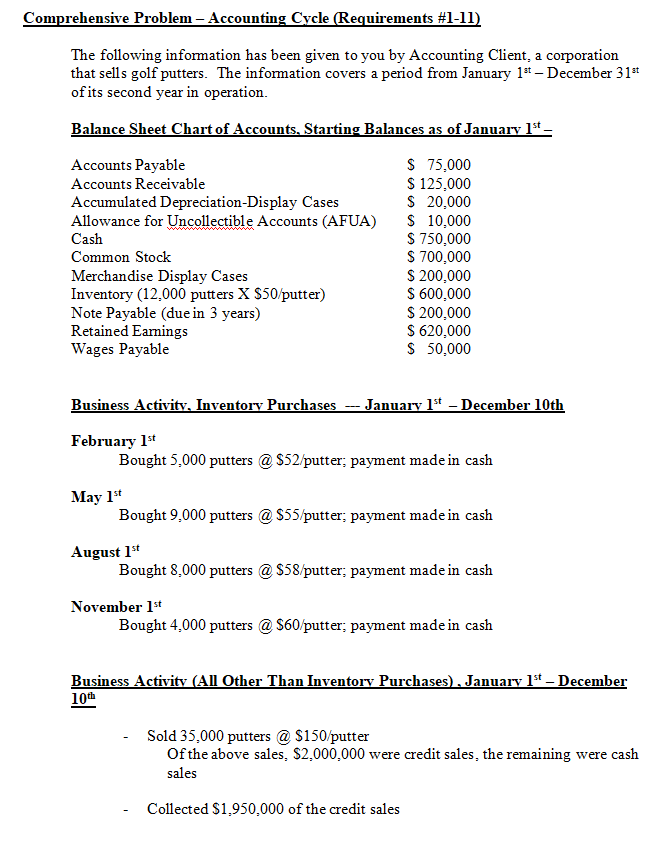

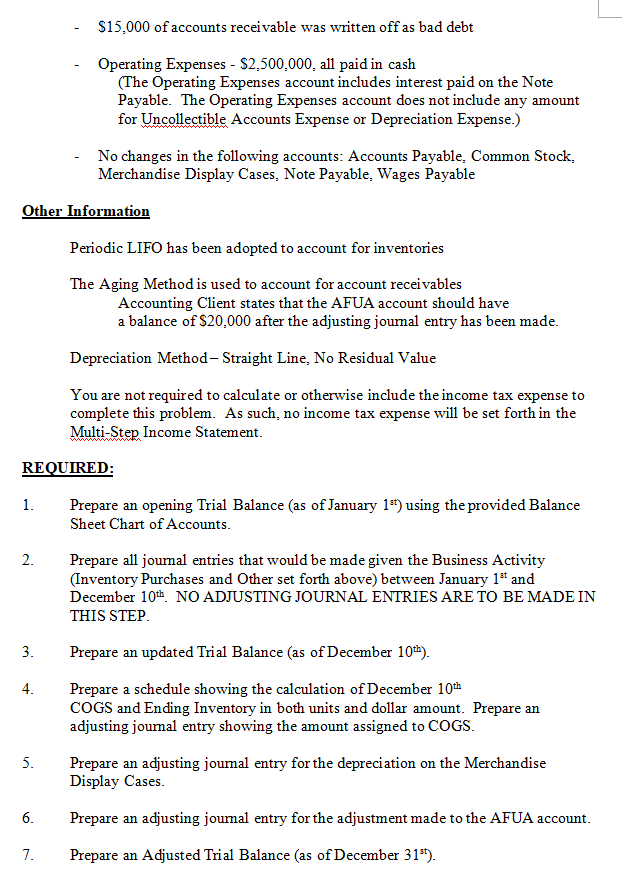

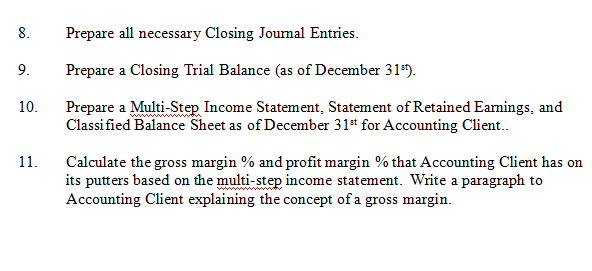

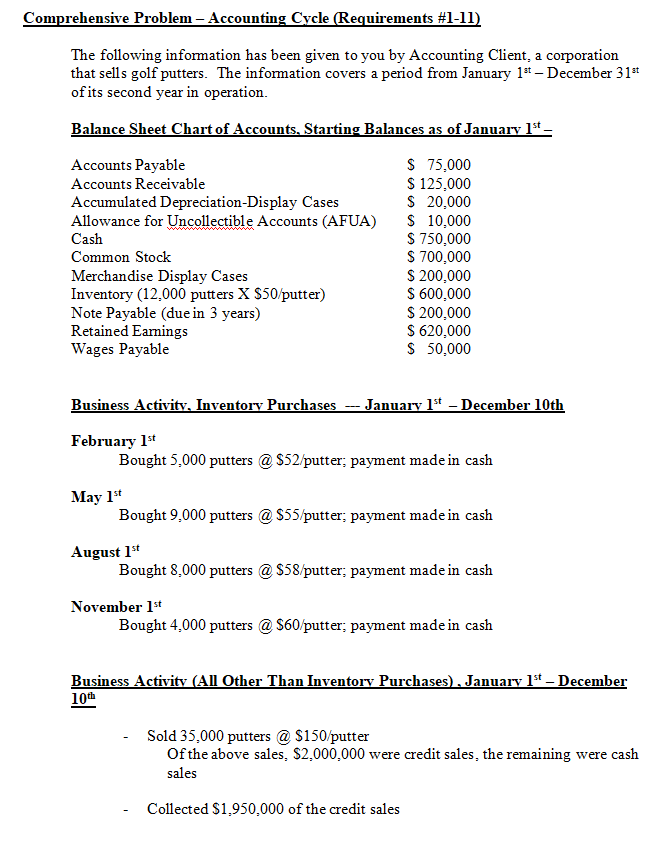

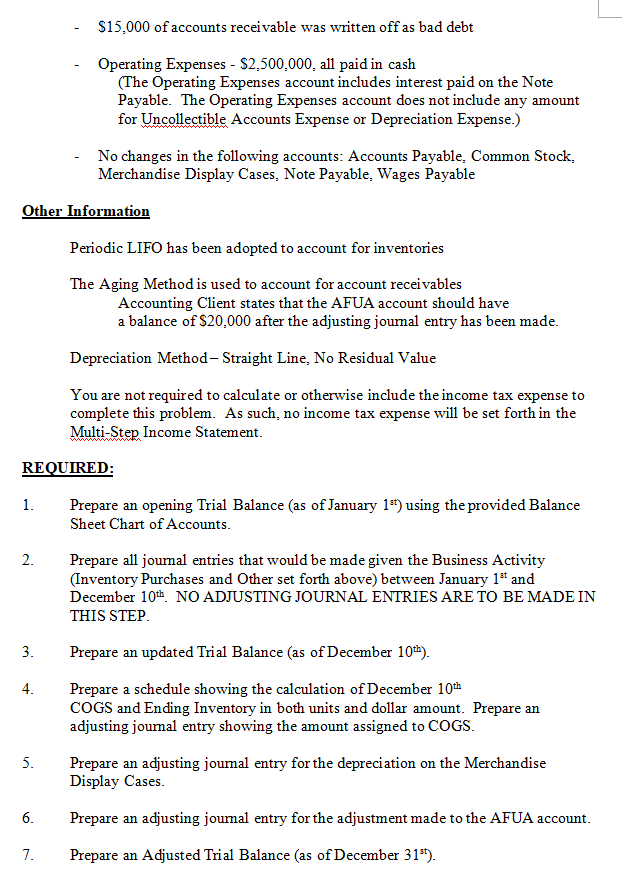

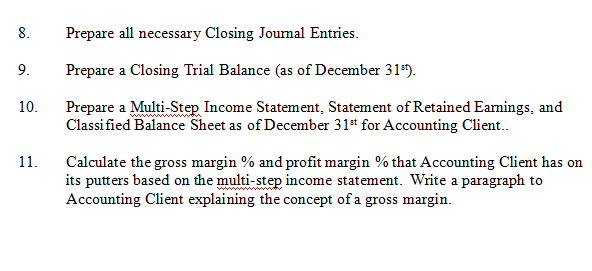

Comprehensive Problem - Accounting Cycle Requirements #1-11) The following information has been given to you by Accounting Client, a corporation that sells golf putters. The information covers a period from January 1st - December 31st of its second year in operation. Balance Sheet Chart of Accounts, Starting Balances as of January 1** - Accounts Payable Accounts Receivable Accumulated Depreciation-Display Cases Allowance for Uncollectible Accounts (AFUA) Cash Common Stock Merchandise Display Cases Inventory (12,000 putters X $50/putter) Note Payable (due in 3 years) Retained Earnings Wages Payable $ 75,000 S 125.000 $ 20.000 S 10,000 $ 750,000 $ 700,000 $ 200,000 $ 600,000 $ 200,000 S 620.000 S 50,000 Business Activity. Inventory Purchases --- January 1" - December 10th February 1st Bought 5,000 putters @ $52 putter; payment made in cash May 1st Bought 9,000 putters @ $55/putter; payment made in cash August 1st Bought 8,000 putters @ $58/putter; payment made in cash November 1st Bought 4,000 putters @ $60/putter; payment made in cash Business Activity (All Other Than Inventory Purchases). January 1s* December 10th - Sold 35,000 putters a $150/putter Of the above sales, $2,000,000 were credit sales, the remaining were cash sales - Collected $1,950,000 of the credit sales - $15,000 of accounts receivable was written off as bad debt - Operating Expenses - $2.500.000, all paid in cash (The Operating Expenses account includes interest paid on the Note Payable. The Operating Expenses account does not include any amount for Uncollectible Accounts Expense or Depreciation Expense.) - No changes in the following accounts: Accounts Payable, Common Stock, Merchandise Display Cases, Note Payable, Wages Payable Other Information Periodic LIFO has been adopted to account for inventories The Aging Method is used to account for account receivables Accounting Client states that the AFUA account should have a balance of $20,000 after the adjusting journal entry has been made. Depreciation Method - Straight Line, No Residual Value You are not required to calculate or otherwise include the income tax expense to complete this problem. As such, no income tax expense will be set forth in the Multi-Step Income Statement. REQUIRED: 1. Prepare an opening Trial Balance (as of January 18t) using the provided Balance Sheet Chart of Accounts. Prepare all journal entries that would be made given the Business Activity (Inventory Purchases and Other set forth above) between January 19 and December 10th NO ADJUSTING JOURNAL ENTRIES ARE TO BE MADE IN THIS STEP 3. Prepare an updated Trial Balance (as of December 10th). Prepare a schedule showing the calculation of December 10th COGS and Ending Inventory in both units and dollar amount. Prepare an adjusting journal entry showing the amount assigned to COGS. 5. Prepare an adjusting journal entry for the depreciation on the Merchandise Display Cases. Prepare an adjusting journal entry for the adjustment made to the AFUA account. 7. Prepare an Adjusted Trial Balance (as of December 31"). - 8. Prepare all necessary Closing Journal Entries. 9. Prepare a Closing Trial Balance (as of December 31'). 10. Prepare a Multi-Step Income Statement. Statement of Retained Earnings, and Classified Balance Sheet as of December 31st for Accounting Client.. 11. Calculate the gross margin % and profit margin % that Accounting Client has on its putters based on the multi-step income statement. Write a paragraph to Accounting Client explaining the concept of a gross margin