Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Comprehensive Problem (Algo) LO 11-1, 11-2, 11-3, 11-4 Rooney Modems, Inc. acquired a subsidiary named Anywhere, Inc. (AI). AI manufactures a wireless modem that enables

Comprehensive Problem (Algo) LO 11-1, 11-2, 11-3, 11-4

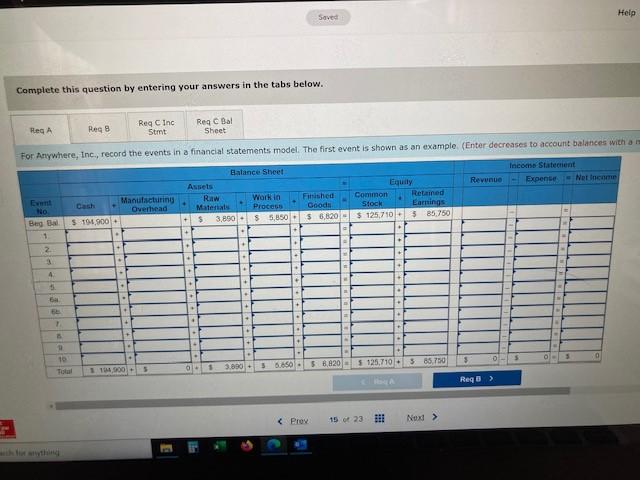

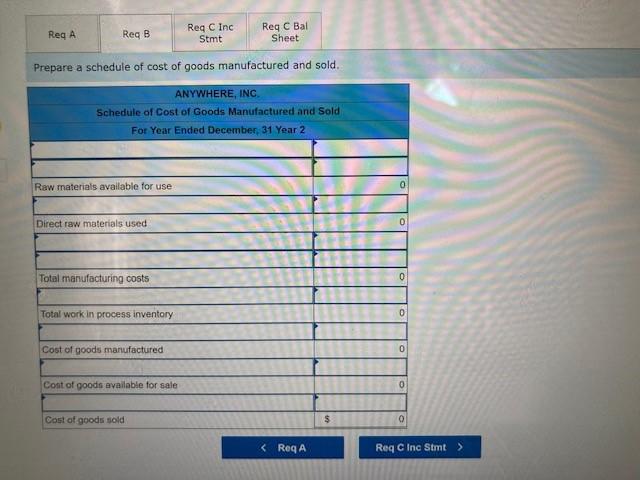

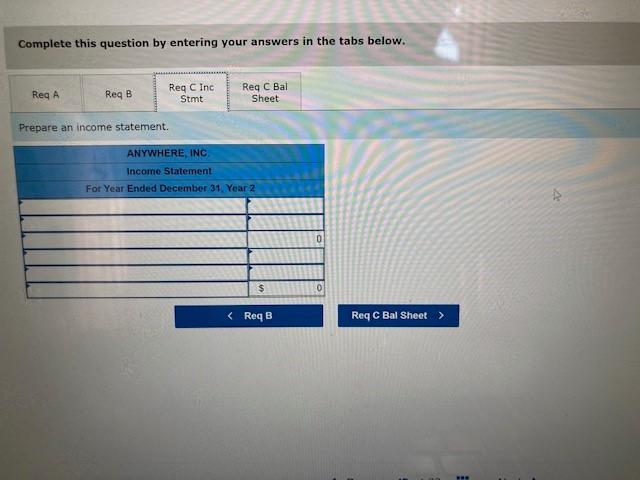

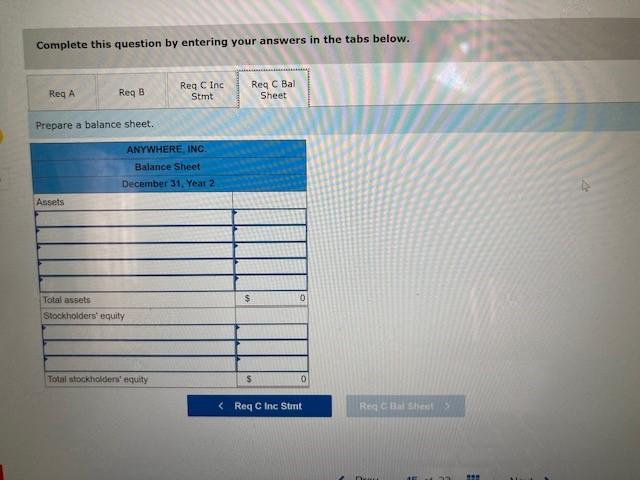

Rooney Modems, Inc. acquired a subsidiary named Anywhere, Inc. (AI). AI manufactures a wireless modem that enables users to access the Internet through cell phones. The following trial balance was drawn from the accounts of the subsidiary.

| Cash | $ | 194,900 | ||||||

| Raw materials inventory | 3,890 | |||||||

| Work in process inventory | 5,850 | |||||||

| Finished goods inventory | 6,820 | |||||||

| Common stock | $ | 125,710 | ||||||

| Retained earnings | 85,750 | |||||||

| Totals | $ | 211,460 | $ | 211,460 | ||||

The subsidiary completed the following transactions during Year 2.

- Paid $58,470 cash for direct raw materials.

- Transferred $48,730 of direct raw materials to work in process.

- Paid production employees $77,970 cash.

- Applied $51,640 of manufacturing overhead costs to work in process.

- Completed work on products that cost $158,810.

- Sold products that cost $139,320 for $177,330 cash. Record the recognition of revenue in a row labeled 6a and the cost of goods sold in a row labeled 6b.

- Paid $19,490 cash for selling and administrative expenses.

- Actual overhead costs paid in cash amounted to $53,580.

- Closed the Manufacturing Overhead account. The amount of over- or underapplied overhead was insignificant (immaterial).

- Made a $4,850 cash distribution to the owners.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started