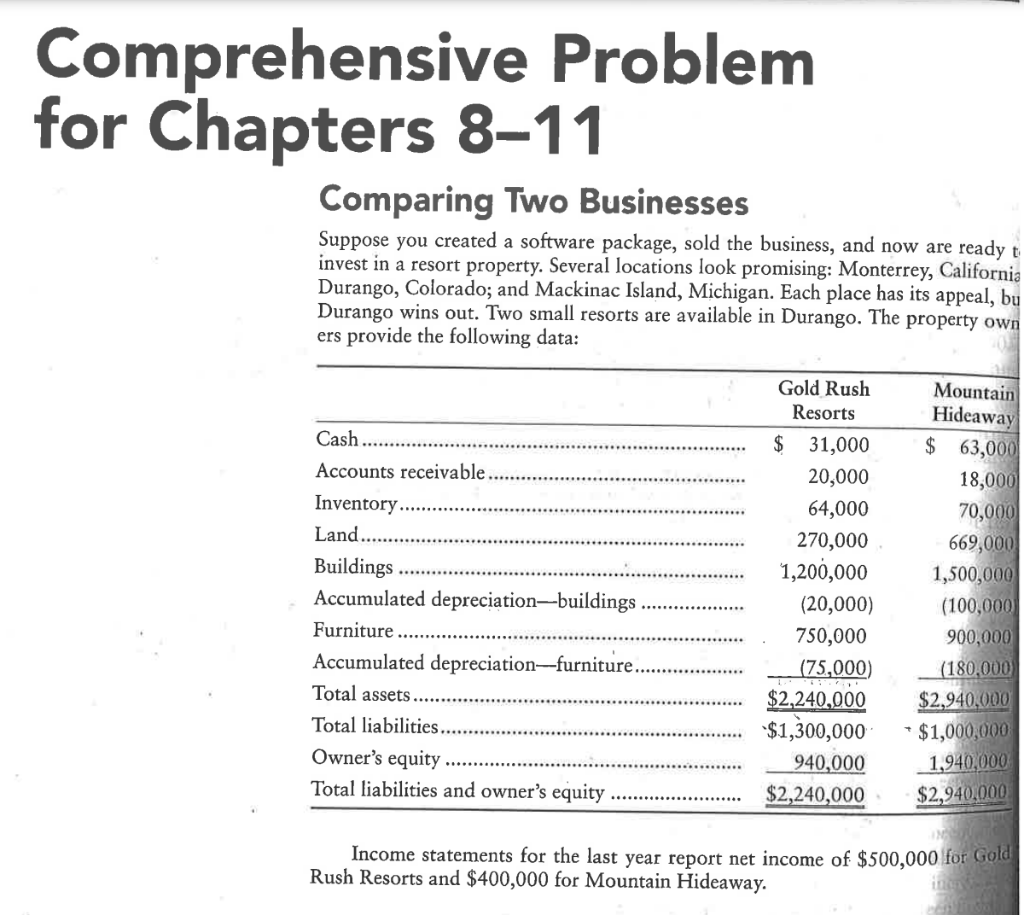

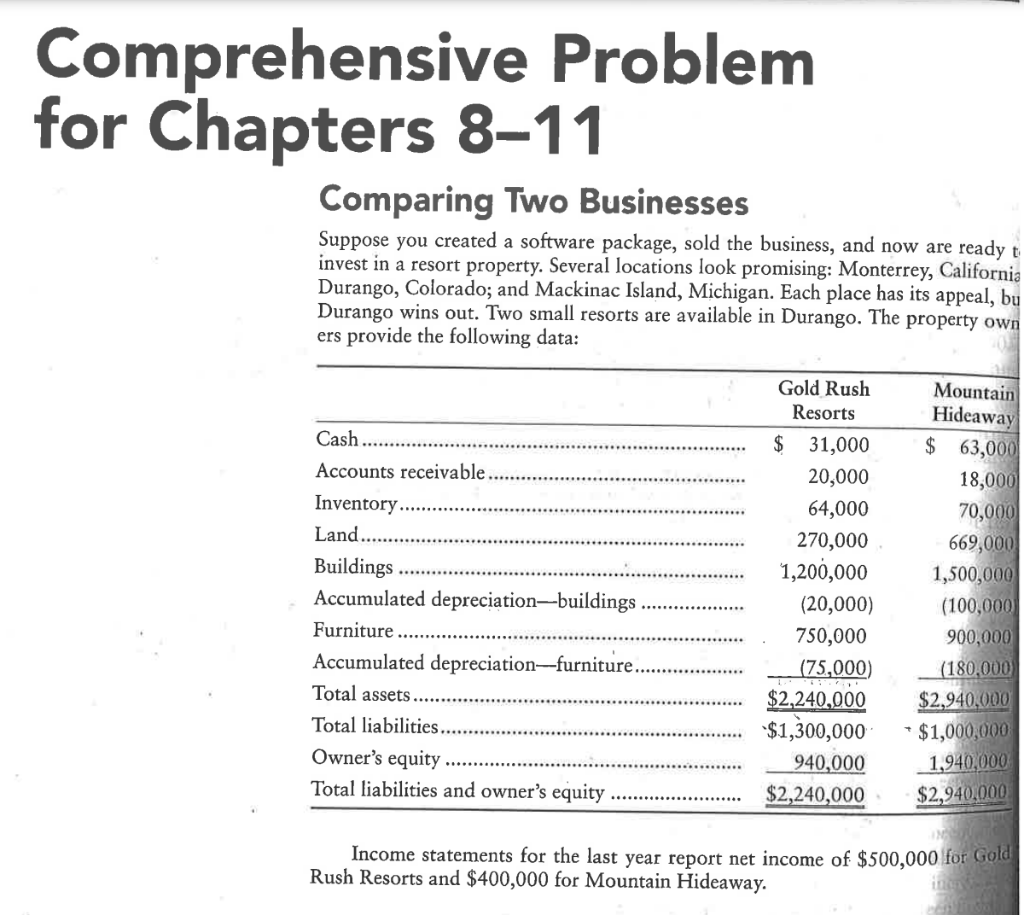

Comprehensive Problem for Chapters 811 Comparing Two Businesses Suppose you created a software package, sold the business, and now are ready t invest in a resort property. Several locations look promising: Monterrey, California Durango, Colorado; and Mackinac Island, Michigan. Each place has its appeal, bu Durango wins out. Two small resorts are available in Durango. The property own ers provide the following data: Gold Rush Resorts Cash. Accounts receivable. Inventory Land. Buildings Accumulated depreciation--buildings Furniture .... Accumulated depreciation-furniture. Total assets .... Total liabilities..... Owner's equity Total liabilities and owner's equity $ 31,000 20,000 64,000 270,000 1,200,000 (20,000) 750,000 (75,000) $2,240,000 $1,300,000 940,000 $2,240,000 Mountain Hideaway $ 63,000 18,000 70,000 669,000 1,500,000 (100,000 900,000 (180,000 $2,940,000 $1,000,000 1,940,000 $2,940,000 Income statements for the last year report net income of $500,000 for Gold Rush Resorts and $400,000 for Mountain Hideaway. Inventories Gold Rush Resorts uses the FIFO inventory method, and Mountain Hideaway uses LIFO. If Gold Rush had used LIFO, its ending inventory would have been $7,000 lower. (pp. 320-321) Plant Assets Gold Rush Resorts uses the straight-line depreciation method and an estimated use- ful life of 40 years for buildings and 10 years for furniture. Estimated residual values are $400,000 for buildings and $0 for furniture. Gold Rush's buildings old. (p. 512) ates buildings over 30 years. The furniture, also 1 year old, is being depreciated over Mountain Hideaway uses the double-declining-balance method and depreci- 10 years. (p. 514) are 1 year Accounts Receivable Gold Rush Resorts uses the direct write-off method for uncollectible receivables. Mountain Hideaway uses the allowance method. The Gold Rush owner estimates apter 11 Cie that $2,000 of the company's receivables are doubtful. Mountain Hideaway receiv- ables are already reported at net realizable value. (pp. 460, 464) Requirements 1. To compare the two resorts, convert Gold Rush Resorts' net income to the accounting methods and the estimated useful lives used by Mountain Hideaway. 2. Compare the two resorts' net incomes after you have revised Gold Rush's fig- ures. Which resort looked better at the outset? Which looks better when they are placed on equal footing