Answered step by step

Verified Expert Solution

Question

1 Approved Answer

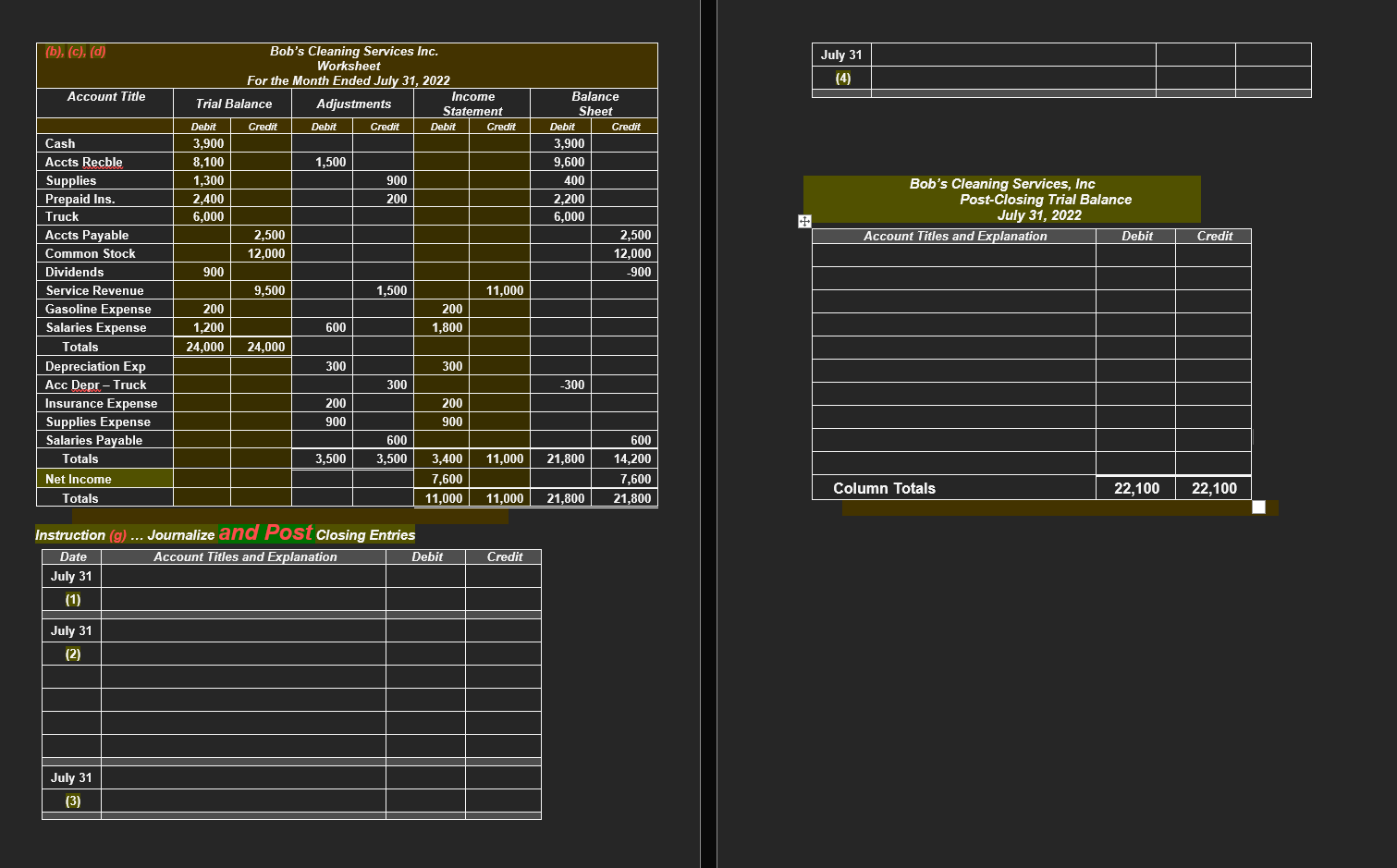

Comprehensive Problem ( Problem info and working papers ) Instruction ( g ) . . . Journalize and Post Closing Entries Bob opened Bob s

Comprehensive Problem Problem info and working papersInstruction g Journalize and Post Closing Entries

Bob opened Bobs Cleaning Services on July During July the company completed these transactions.

July Bob invested $ cash in the business

Purchased used truck for $ paying $ cash and the balance on account.

Purchased cleaning supplies for $ on account.

Paid $ cash on oneyear insurance policy effective July

Billed customers for $ for cleaning services.

Paid $ of amount owed on truck AND $ of the amount owed on cleaning supplies.

Paid $ for employee salaries.

Collected $ from customers previously billed on July

Billed customers $ for cleaning services.

Paid gasoline for the month on the truck, $

Declared and paid a $ cash dividend.

Use this Chart of Accounts: Cash; Account Receivable; Supplies; Prepaid Insurance; Truck; Accumulated DepreciationTruck; Accounts Payable; Salaries Payable; Common Stock; Retained Earnings; Dividends; Income Summary; Service Revenue; Supplies Expense; Gasoline Expense; Depreciation Expense; Insurance Expense; Salaries Expense.

Instructions:

c Unbilled and uncollected revenues for services performed at July were $

c Depreciation on the Truck for the month was $

c One month July of the year insurance policy was used up

c An inventory count shows that $ of cleaning supplies remains unused as of July

g Journalize AND POST the Closing entries.

h Prepare a PostClosing Trial Balance.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started