Question

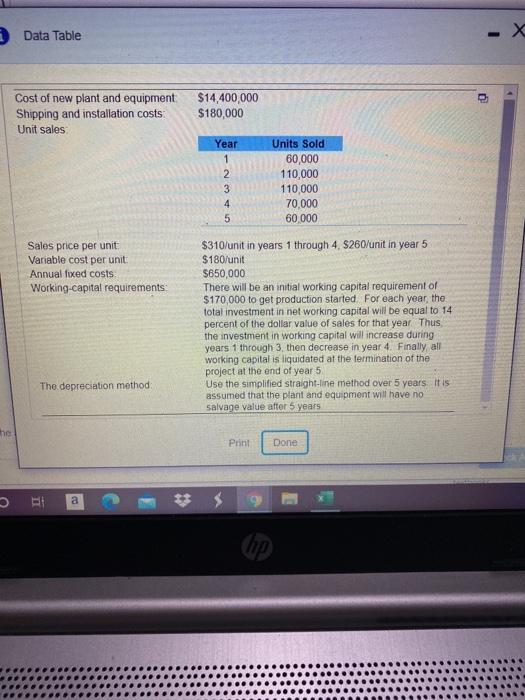

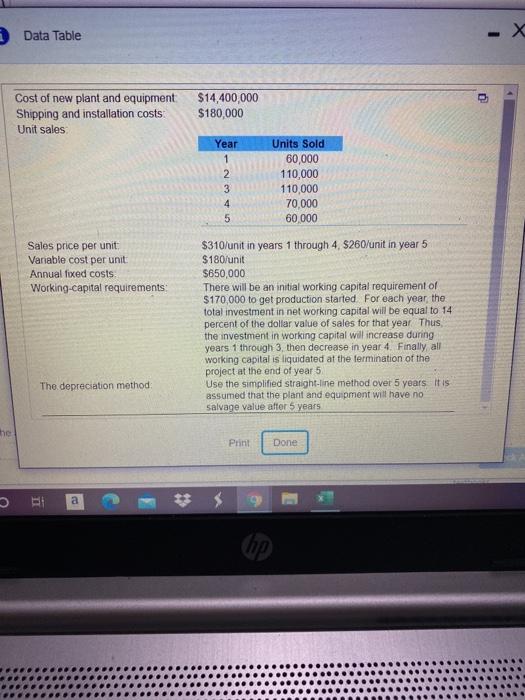

(Comprehensive problemcalculating project cash flows, NPV, PI, and IRR)Traid Winds Corporation, a firm in the 31 percent marginal tax bracket with a required rate of

(Comprehensive

problemcalculating

project cash flows, NPV, PI, and IRR)Traid Winds Corporation, a firm in the

31

percent marginal tax bracket with a required rate of return or discount rate of

10

percent, is considering a new project. This project involves the introduction of a new product. The project is expected to last

5

years and then, because this is somewhat of a fad product, it will be terminated. Given the following information,

LOADING...

,

determine the free cash flows associated with the project, the project's net present value, the profitability index, and the internal rate of return. Apply the appropriate decision criteria

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started