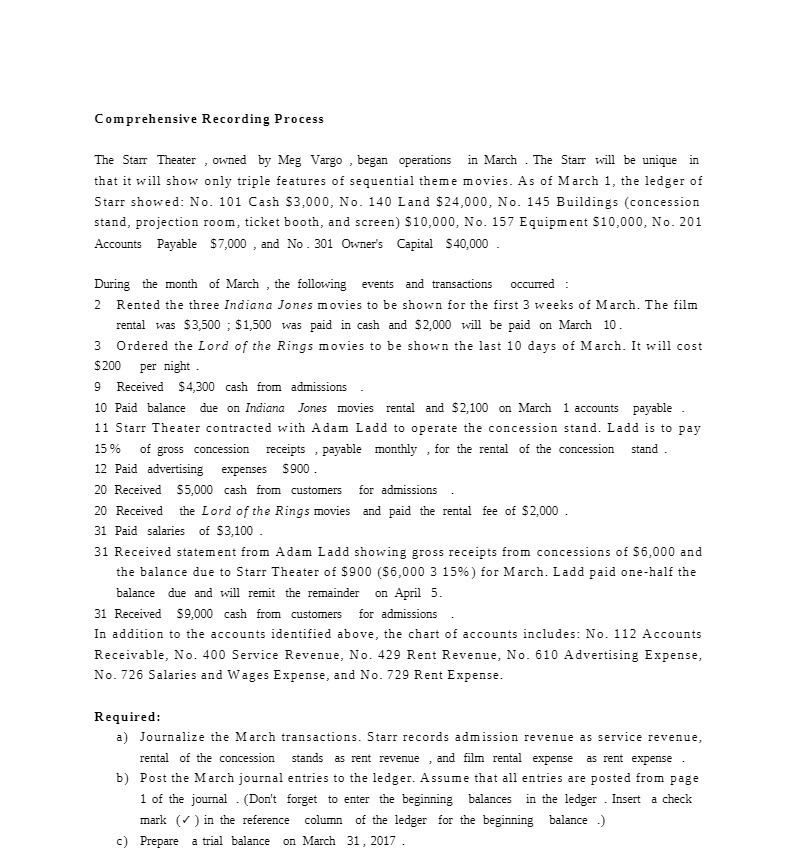

Comprehensive Recording Process The Starr Theater , owned by Meg Vargo , began operations in March . The Starr will be unique in that it will show only triple features of sequential theme movies. As of March 1, the ledger of Starr showed: No. 101 Cash $3,000, No. 140 Land $24,000, No. 145 Buildings (concession stand, projection room, ticket booth, and screen) $10,000, No. 157 Equipment $10,000, No. 201 Accounts Payable $7,000 , and No . 301 Owner's Capital $40,000 During the month of March , the following events and transactions occurred : 2 Rented the three Indiana Jones movies to be shown for the first 3 weeks of March. The film rental was $3,500 ; $1,500 was paid in cash and $2,000 will be paid on March 10. 3 Ordered the Lord of the Rings movies to be shown the last 10 days of March. It will cost $200 per night . 9 Received $4,300 cash from admissions 10 Paid balance due on Indiana Jones movies rental and $2,100 on March 1 accounts payable 11 Starr Theater contracted with Adam Ladd to operate the concession stand. Ladd is to pay 6 of gross concession receipts , payable monthly , for the rental of the concession stand 12 Paid advertising expenses $900 . 20 Received $5,000 cash from customers for admissions 20 Received the Lord of the Rings movies and paid the rental fee of $2,000 . 31 Paid salaries of $3,100 31 Received statement from Adam Ladd showing gross receipts from concessions of $6,000 and the balance due to Starr Theater of $900 ($6,000 3 15% ) for March. Ladd paid one-half the balance due and will remit the remainder on April 5. 31 Received $9,000 cash from customers for admissions In addition to the accounts identified above, the chart of accounts includes: No. 112 Accounts Receivable, No. 400 Service Revenue, No. 429 Rent Revenue, No. 610 Advertising Expense, No. 726 Salaries and Wages Expense, and No. 729 Rent Expense. Required: a) Journalize the March transactions. Starr records admission revenue as service revenue, rental of the concession stands as rent revenue , and film rental expense as rent expense b) Post the March journal entries to the ledger. Assume that all entries are posted from page 1 of the journal . (Don't forget to enter the beginning balances in the ledger . Insert a check mark ( ) in the reference column of the ledger for the beginning balance .) c) Prepare a trial balance on March 31 , 2017