Answered step by step

Verified Expert Solution

Question

1 Approved Answer

comput net cash flow from financing activities Ann opened an Office Cleaning Service company on January 1, 2020. During 2020 she had the following transactions.

comput net cash flow from financing activities

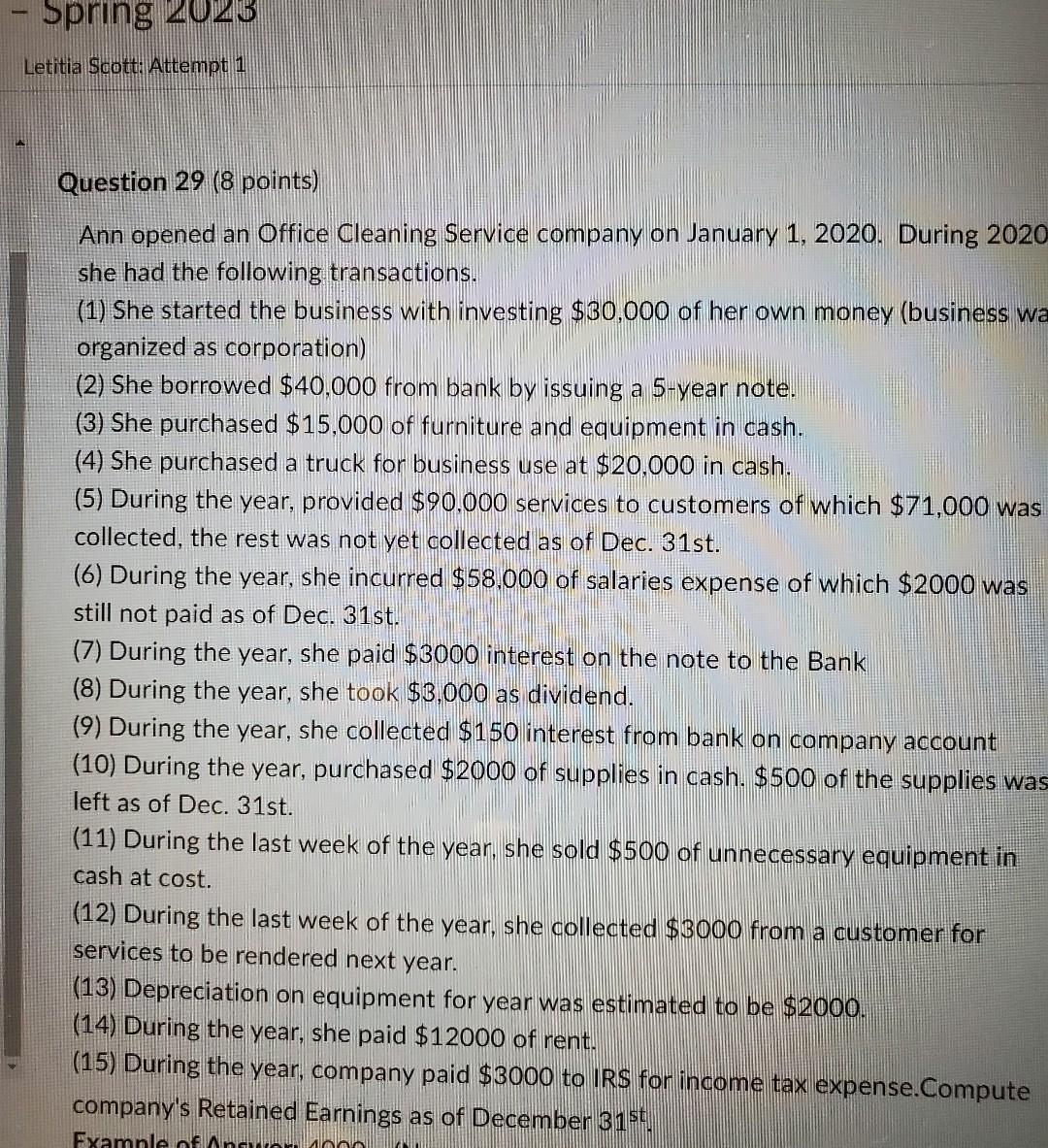

Ann opened an Office Cleaning Service company on January 1, 2020. During 2020 she had the following transactions. (1) She started the business with investing $30,000 of her own money (business wa organized as corporation) (2) She borrowed $40,000 from bank by issuing a 5-year note. (3) She purchased $15,000 of furniture and equipment in cash. (4) She purchased a truck for business use at $20,000 in cash. (5) During the year, provided $90,000 services to customers of which $71,000 was collected, the rest was not yet collected as of Dec. 31st. (6) During the year, she incurred $58.000 of salaries expense of which $2000 was still not paid as of Dec. 31 st. (7) During the year, she paid $3000 interest on the note to the Bank (8) During the year, she took $3,000 as dividend. (9) During the year, she collected $150 interest from bank on company account (10) During the year, purchased $2000 of supplies in cash. $500 of the supplies was left as of Dec. 31st. (11) During the last week of the year, she sold $500 of unnecessary equipment in cash at cost. (12) During the last week of the year, she collected $3000 from a customer for services to be rendered next year. (13) Depreciation on equipment for year was estimated to be $2000. (14) During the year, she paid $12000 of rent. (15) During the year, company paid $3000 to IRS for income tax expense.Compute company's Retained Earnings as of December 3115t. Ann opened an Office Cleaning Service company on January 1, 2020. During 2020 she had the following transactions. (1) She started the business with investing $30,000 of her own money (business wa organized as corporation) (2) She borrowed $40,000 from bank by issuing a 5-year note. (3) She purchased $15,000 of furniture and equipment in cash. (4) She purchased a truck for business use at $20,000 in cash. (5) During the year, provided $90,000 services to customers of which $71,000 was collected, the rest was not yet collected as of Dec. 31st. (6) During the year, she incurred $58.000 of salaries expense of which $2000 was still not paid as of Dec. 31 st. (7) During the year, she paid $3000 interest on the note to the Bank (8) During the year, she took $3,000 as dividend. (9) During the year, she collected $150 interest from bank on company account (10) During the year, purchased $2000 of supplies in cash. $500 of the supplies was left as of Dec. 31st. (11) During the last week of the year, she sold $500 of unnecessary equipment in cash at cost. (12) During the last week of the year, she collected $3000 from a customer for services to be rendered next year. (13) Depreciation on equipment for year was estimated to be $2000. (14) During the year, she paid $12000 of rent. (15) During the year, company paid $3000 to IRS for income tax expense.Compute company's Retained Earnings as of December 3115tStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started