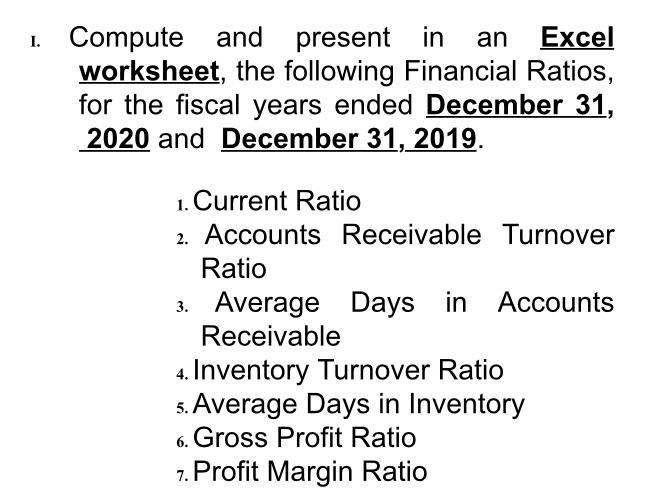

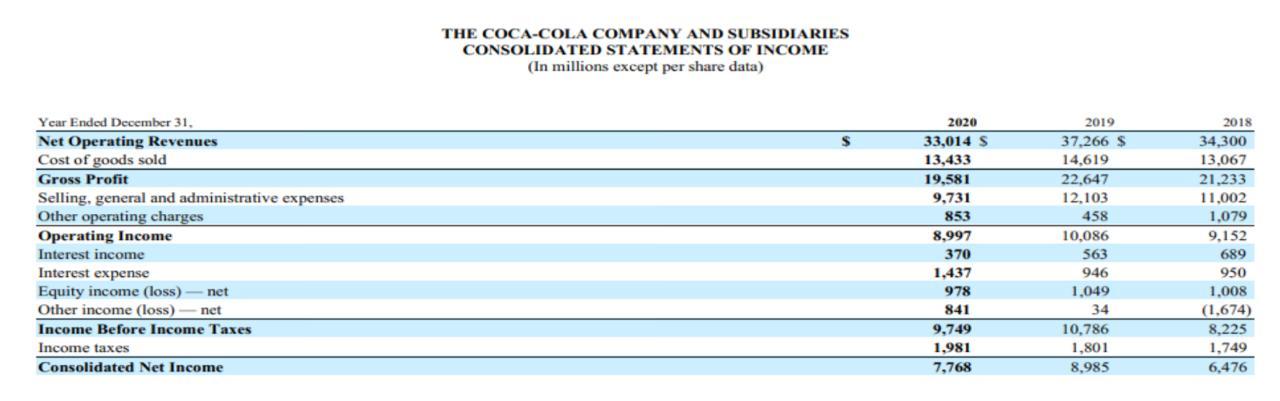

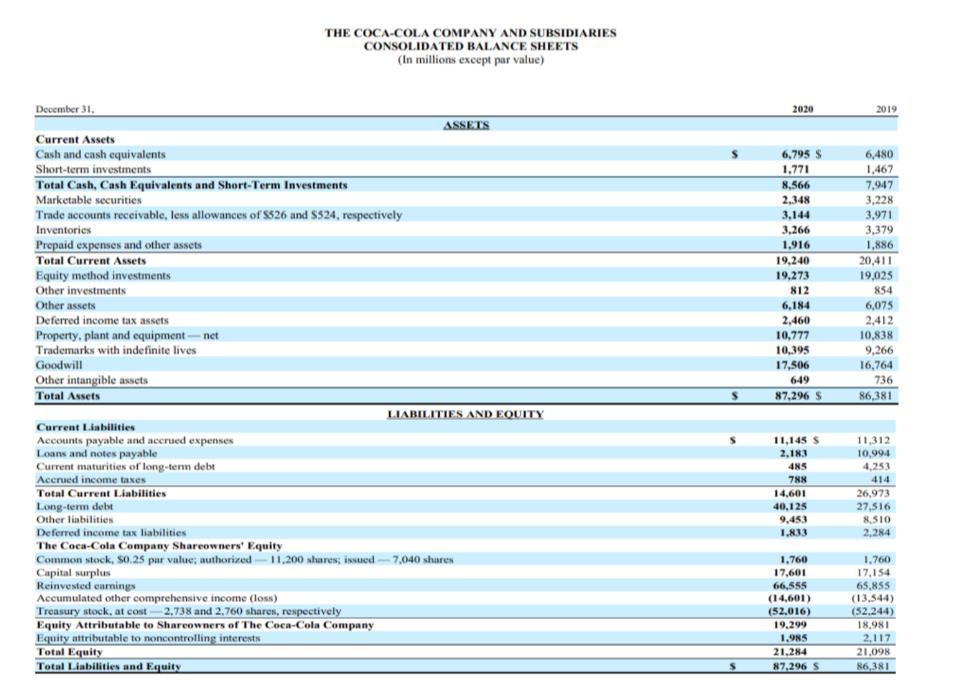

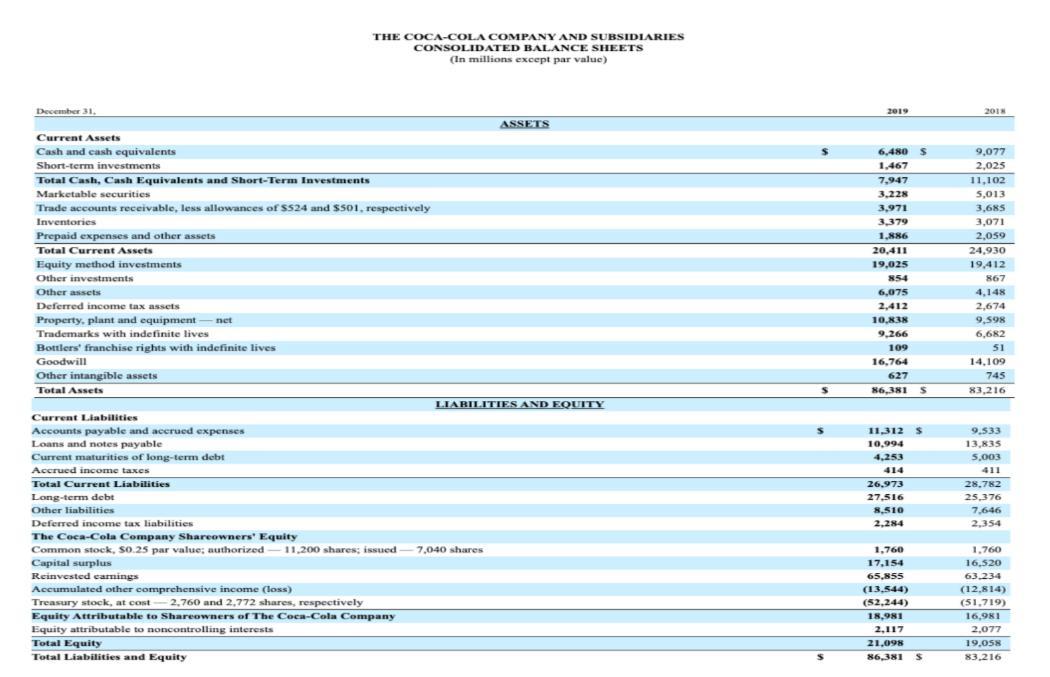

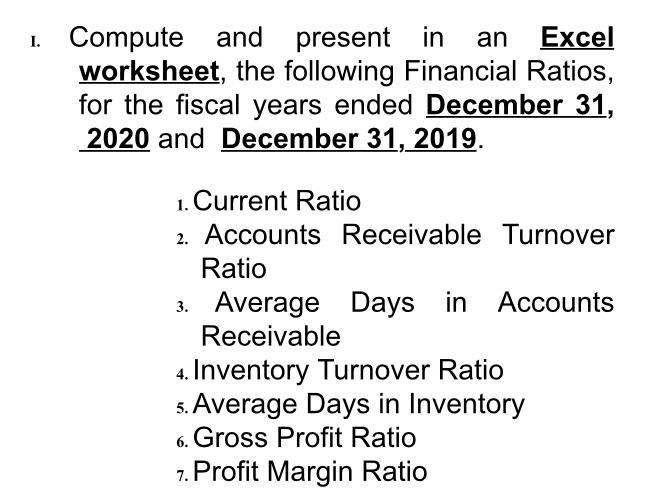

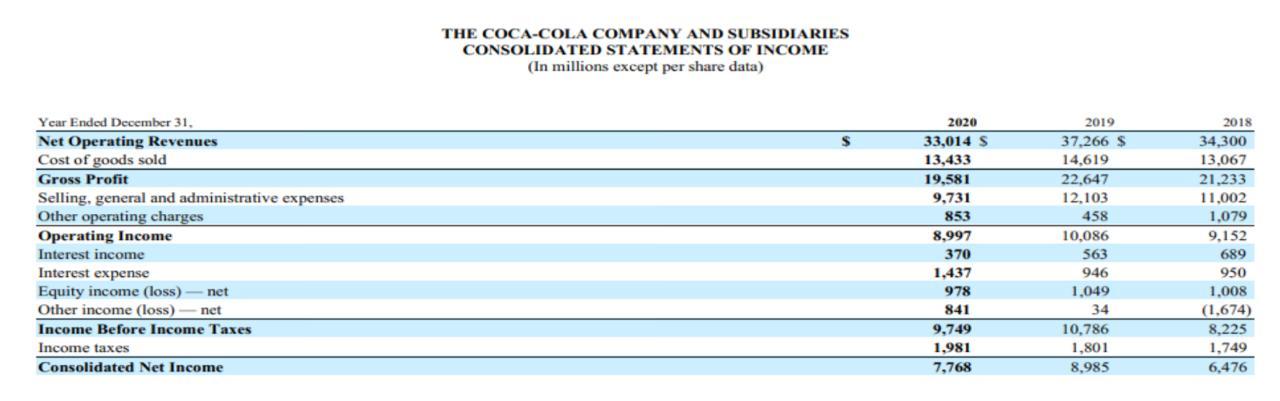

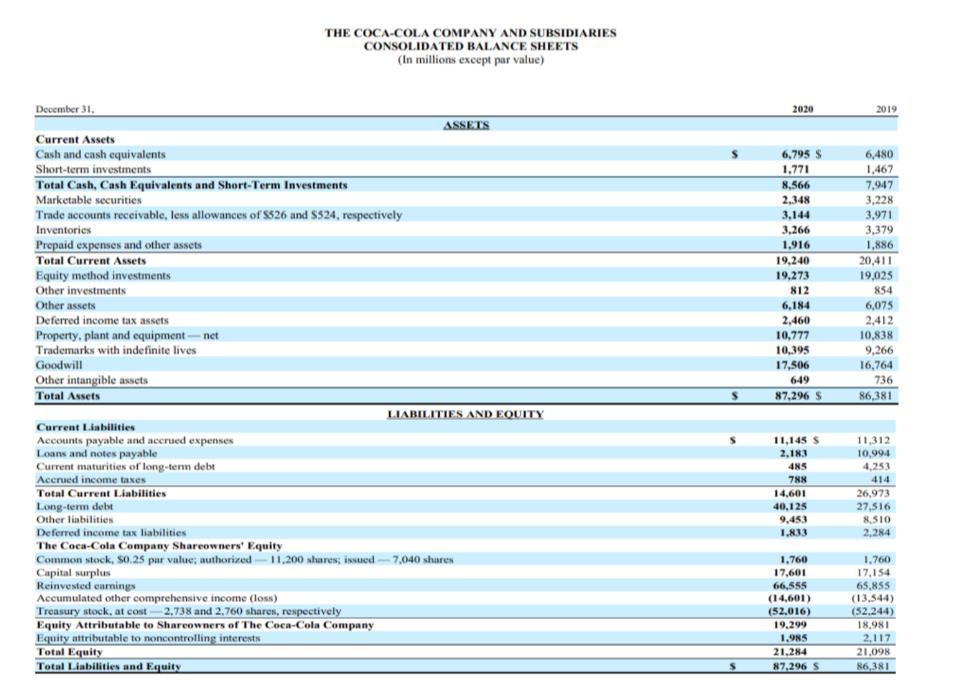

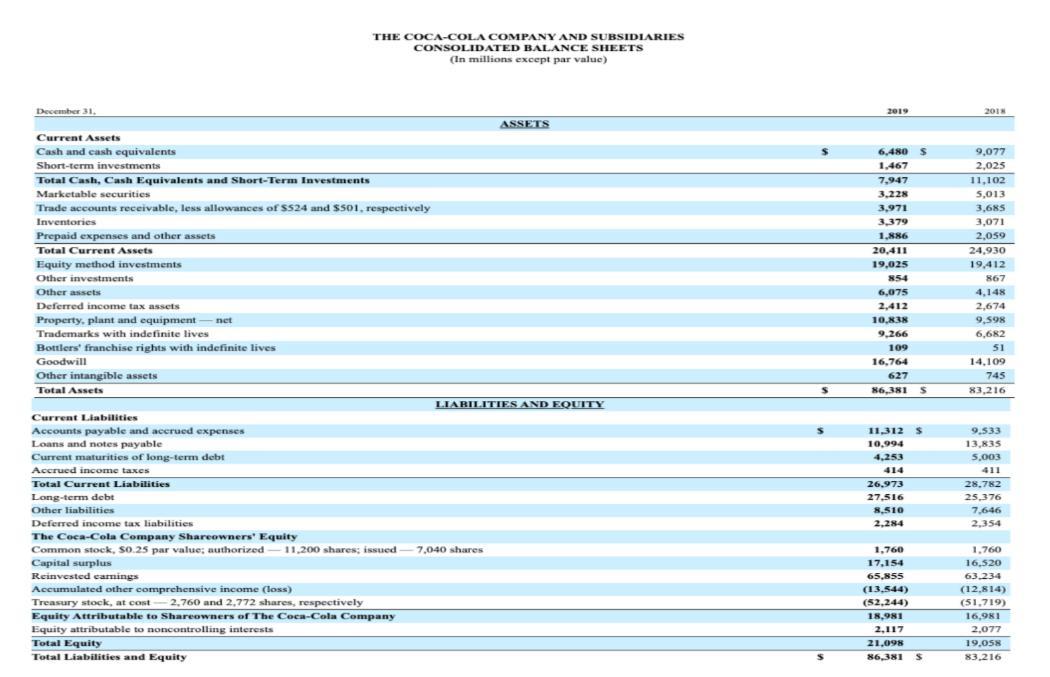

Compute and present in an Excel worksheet, the following Financial Ratios, for the fiscal years ended December 31, 2020 and December 31, 2019. 1. Current Ratio 2. Accounts Receivable Turnover Ratio 3. Average Days in Accounts Receivable 4. Inventory Turnover Ratio 5. Average Days in Inventory Gross Profit Ratio 7. Profit Margin Ratio THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (In millions except per share data) $ Year Ended December 31, Net Operating Revenues Cost of goods sold Gross Profit Selling, general and administrative expenses Other operating charges Operating Income Interest income Interest expense Equity income (loss) - net Other income (loss) net Income Before Income Taxes Income taxes Consolidated Net Income 2020 33,014 s 13,433 19,581 9,731 853 8,997 370 1,437 978 841 9,749 1,981 7,768 2019 37,266 $ 14,619 22.647 12.103 458 10,086 563 946 1.049 34 10,786 1,801 8,985 2018 34,300 13,067 21.233 11.002 1,079 9.152 689 950 1.008 (1.674) 8,225 1,749 6,476 THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In millions except par value) 2020 2019 6,795 $ 1.771 8,566 2,348 3,144 3.266 1,916 19,240 19,273 812 6,184 2.460 10,777 10,395 17,506 649 87.296 S 6,480 1,467 7,947 3,228 3.971 3,379 1,886 20,411 19.025 December 31, ASSETS Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of SS26 and S$24, respectively Inventories Prepaid expenses and other assets Total Current Assets Equity method investments Other investments Other assets Deferred income tax assets Property, plant and equipment-net Trademarks with indefinite lives Goodwill Other intangible assets Total Assets LIABILITIES AND EQUITY Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other liabilities Deferred income tax liabilities The Coca-Cola Company Shareowners' Equity Common stock, S0.25 par value; authorized 11,200 shares; issued-7.040 shares Capital surplus Reinvested earnings Accumulated other comprehensive income (loss) Treasury stock, at cost 2,738 and 2.760 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity 854 6,075 2,412 10,838 9,266 16,764 736 86,381 S 11,145 S 2.183 4NS 7NN 14,601 40,125 9,453 1.833 11,312 10,994 4,253 414 26,973 27,516 8.510 2,284 1.760 17.601 66,555 (14,601) (52,016) 19,299 1.985 21,284 87,296 S 1.760 17,154 65,855 (13.544) (52.244) 18,981 2,117 21.098 86,381 s THE COCA-COLA COMPANY AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In millions except par value) 2019 2011 December 31. ASSETS Current Assets Cash and cash equivalents Short-term investments Total Cash, Cash Equivalents and Short-Term Investments Marketable securities Trade accounts receivable, less allowances of SS24 and $501, respectively Inventories Prepaid expenses and other assets Total Current Assets Equity method investments Other investments Other assets Deferred income tax assets Property, plant and equipment -net Trademarks with indefinite lives Bottlers' franchise rights with indefinite lives Goodwill Other intangible assets Total Assets LIABILITIES AND EQUITY Current Liabilities Accounts payable and accrued expenses Loans and notes payable Current maturities of long-term debt Accrued income taxes Total Current Liabilities Long-term debt Other liabilities Deferred income tax liabilities The Coca-Cola Company Shareowners' Equity Common stock, S0.25 par value; authorized - 11.200 shares: issued 7,040 shares Capital surplus Reinvested earnings Accumulated other comprehensive income (less) Treasury stock, at cost-2.760 and 2.772 shares, respectively Equity Attributable to Shareowners of The Coca-Cola Company Equity attributable to noncontrolling interests Total Equity Total Liabilities and Equity 6.480 $ 1,467 7,947 3.228 3,971 3.379 1.886 20,411 19.025 854 6,075 2,412 10,838 9,266 109 16,764 627 86,3815 9,077 2,025 11.102 5,013 3,685 3,071 2,059 24,930 19,412 867 4,148 2,674 9,598 6,602 51 14,109 745 83,216 $ 11.312 10,994 4.253 414 26.973 27,516 8.510 2.284 9,533 13,835 5.003 411 28.782 25,376 7.646 2,354 1.760 17.154 65,855 (13.544) (52.244) 18,981 2.117 21.098 86,381 1.760 16.520 63.234 (12.814) (51,719) 16,981 2.077 19.05 83,216