Question

Compute, Disaggregate, and Interpret ROE and RNOA Headquartered in Calgary, Alberta, Husky Energy Inc. is a publicly traded, integrated energy company. Selected fiscal year balance

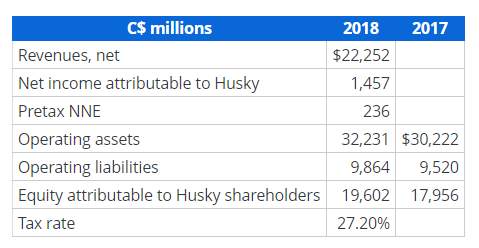

Compute, Disaggregate, and Interpret ROE and RNOA Headquartered in Calgary, Alberta, Husky Energy Inc. is a publicly traded, integrated energy company. Selected fiscal year balance sheet and income statement information for Husky Energy follow (Canadian $ millions).

a. Compute the 2018 return on equity (ROE) and the 2018 return on net operating assets (RNOA). Note: Round percentages to two decimal places (for example, enter 6.66% for 6.6555%).

2018 Return on equity: [answer] % 2018 Return on net operating assets: [answer] %

b. Disaggregate RNOA into net operating profit margin (NOPM) and net operating asset turnover (NOAT). Note: For NOPM and RNOA, round percentages to two decimal places (for example, enter 6.66% for 6.6555%). Note: For NOAT, round amount to three decimal places (for example, enter 6.776 for 6.77555).

| NOPM | x | NOAT | = | RNOA |

| Answer%

| x | Answer%

| = | Answer%

|

c. Compute the percentage of RNOA to ROE, and compute Huskys nonoperating return for 2018. Note: Round percentages to two decimal places (for example, enter 6.66% for 6.6555%).

Percentage of RNOA to ROE: [answer]% Nonoperating return: [answer]%

C$ millions 2018 2017 Revenues, net $22,252 Net income attributable to Husky 1,457 Pretax NNE 236 Operating assets 32,231 $30,222 Operating liabilities 9,864 9,520 Equity attributable to Husky shareholders 19,602 17,956 Tax rate 27.20%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started