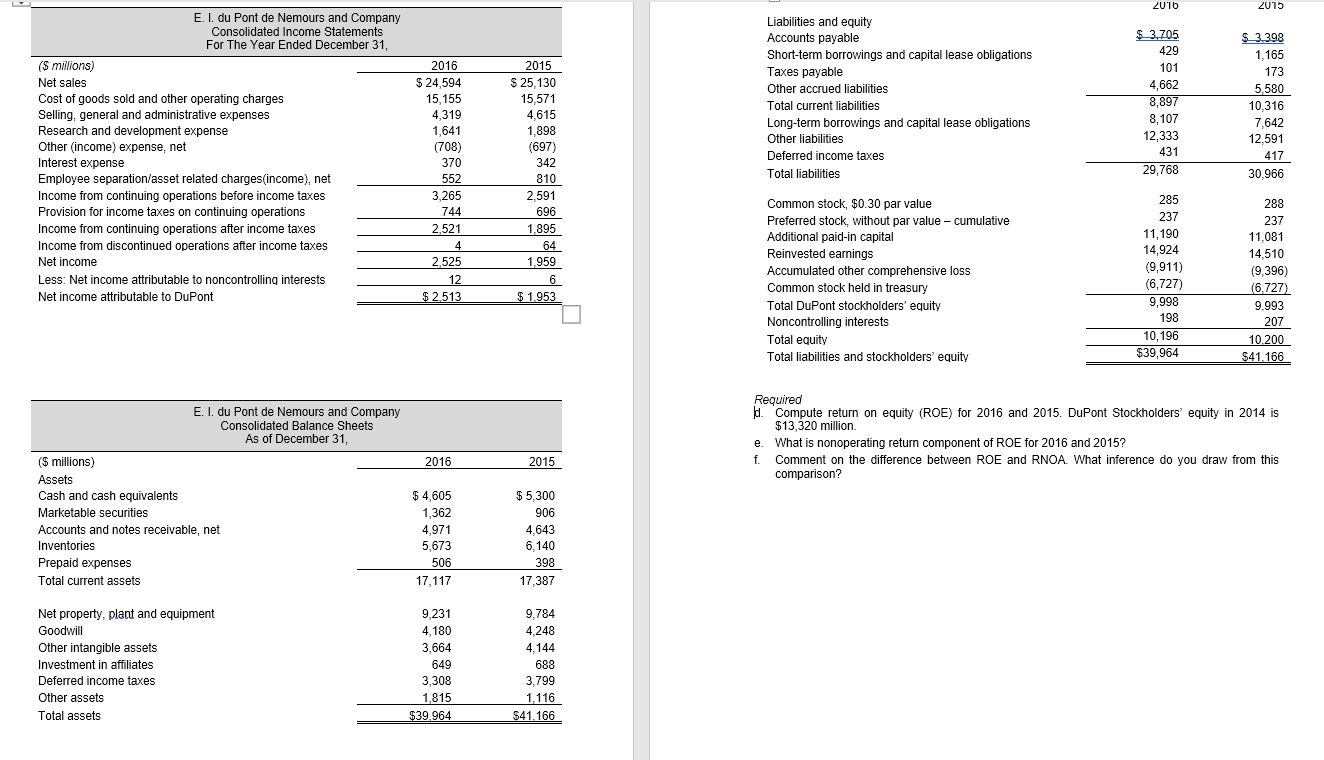

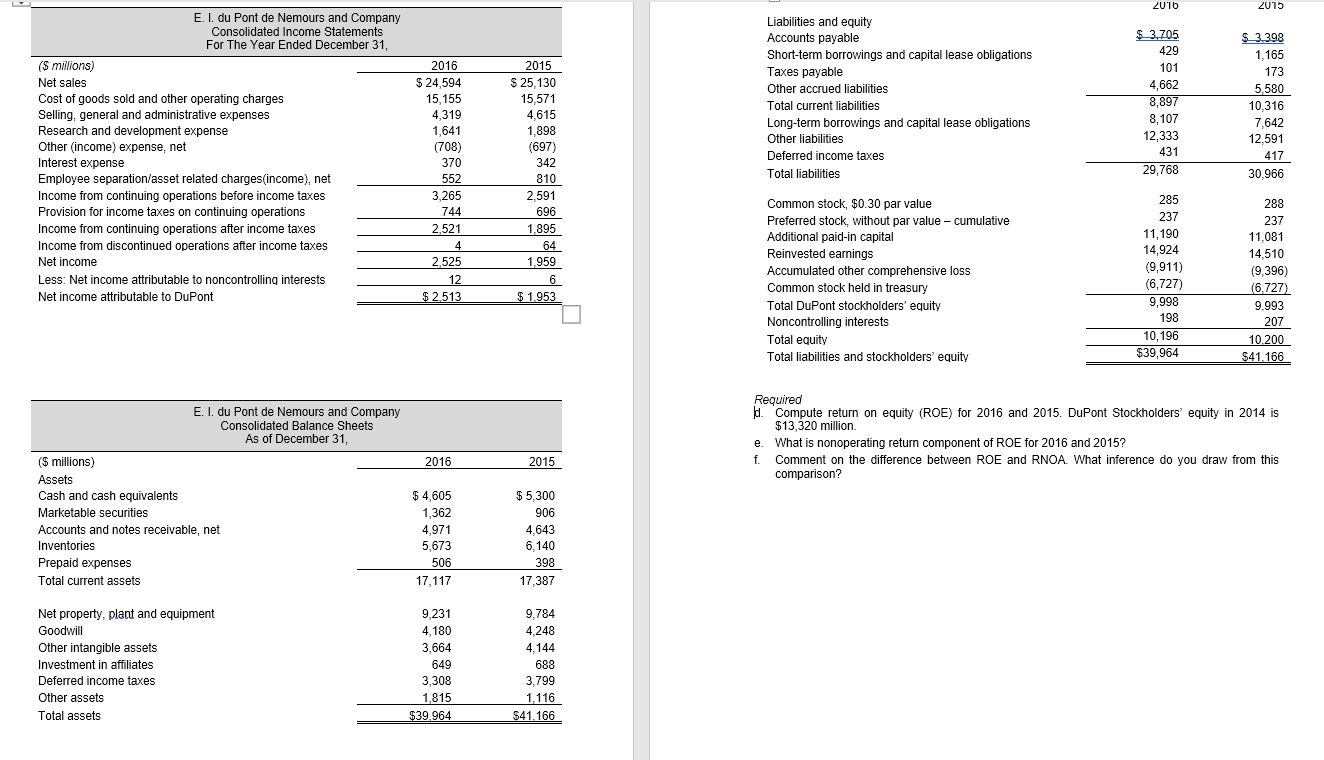

Compute return on equity (ROE) for 2016 and 2015. DuPont Stockholders equity in 2014 is $13,320 million.

e. What is nonoperating return component of ROE for 2016 and 2015?

f. Comment on the difference between ROE and RNOA. What inference do you draw from this comparison?

2016 2015 2015 E. I. du Pont de Nemours and Company Consolidated Income Statements For The Year Ended December 31, (5 millions) Net sales Cost of goods sold and other operating charges Selling, general and administrative expenses Research and development expense oth Other (income) expense, net Interest expense Employee separation/asset related charges(income), net Income from continuing operations before income taxes Provision for income taxes on continuing operations Income from continuing operations after income taxes Income from discontinued operations after income taxes Net income Less: Net income attributable to noncontrolling interests Net income attributable to DuPont Liabilities and equity Accounts payable Short-term borrowings and capital lease obligations Taxes payable Other accrued liabilities Total current liabilities Long-term borrowings and capital lease obligations Other liabilities Deferred income taxes Total liabilities $ 3.705 429 101 4,662 8,897 8,107 12,333 431 29,768 $_3.398 1,165 173 5.580 10,316 7,642 12,591 417 30,966 2016 $ 24,594 15,155 240 4,319 1,641 (708) 370 552 3,265 744 2,521 4 2,525 12 $ 2,513 $ 25,130 15,571 4,615 1,898 000 icon (697) 242 342 040 810 2,591 696 1,895 64 1,959 6 $ 1.953 Common stock, $0.30 par value Preferred stock, without par value - cumulative Additional paid-in capital Reinvested earnings Accumulated other comprehensive loss Common stock held in treasury Total DuPont stockholders' equity Noncontrolling interests Total equity Total liabilities and stockholders' equity 285 237 11,190 14,924 (9,911) (6,727) 9,998 198 10.196 $39,964 288 237 11,081 14,510 (9,396) (6.727) 9.993 207 10.200 $41.166 E. I. du Pont de Nemours and Company Consolidated Balance Sheets As of December 31, Required d. Compute return on equity (ROE) for 2016 and 2015. DuPont Stockholders' equity in 2014 is $13,320 million. What is nonoperating return component of ROE for 2016 and 2015? f. Comment on the difference between ROE and RNOA What inference do you draw from this comparison? e 2016 2015 ($ millions) Assets Cash and cash equivalents Marketable securities Accounts and notes receivable, net Inventories Prepaid expenses Total current assets $ 4,605 1,362 4,971 5,673 506 17,117 $5,300 906 4.643 6,140 398 17,387 Net property, plant and equipment Goodwill Other intangible assets Investment in affiliates Deferred income taxes Other assets Total assets 9,231 4,180 3,664 649 3,308 1,815 $39,964 9,784 4.248 4.144 688 3,799 1,116 $41.166 $