Question: Use Home Depot's financial information in Appendix A. a. Compute ROI and EVA for the two most recent years reported. Use Net Earnings as

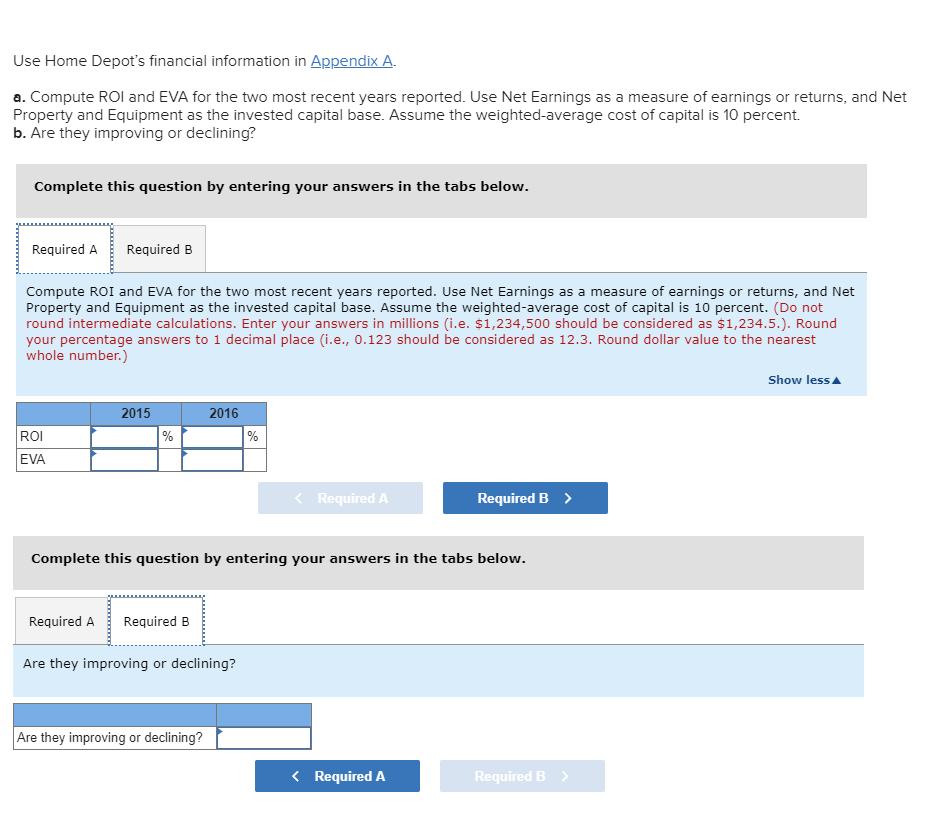

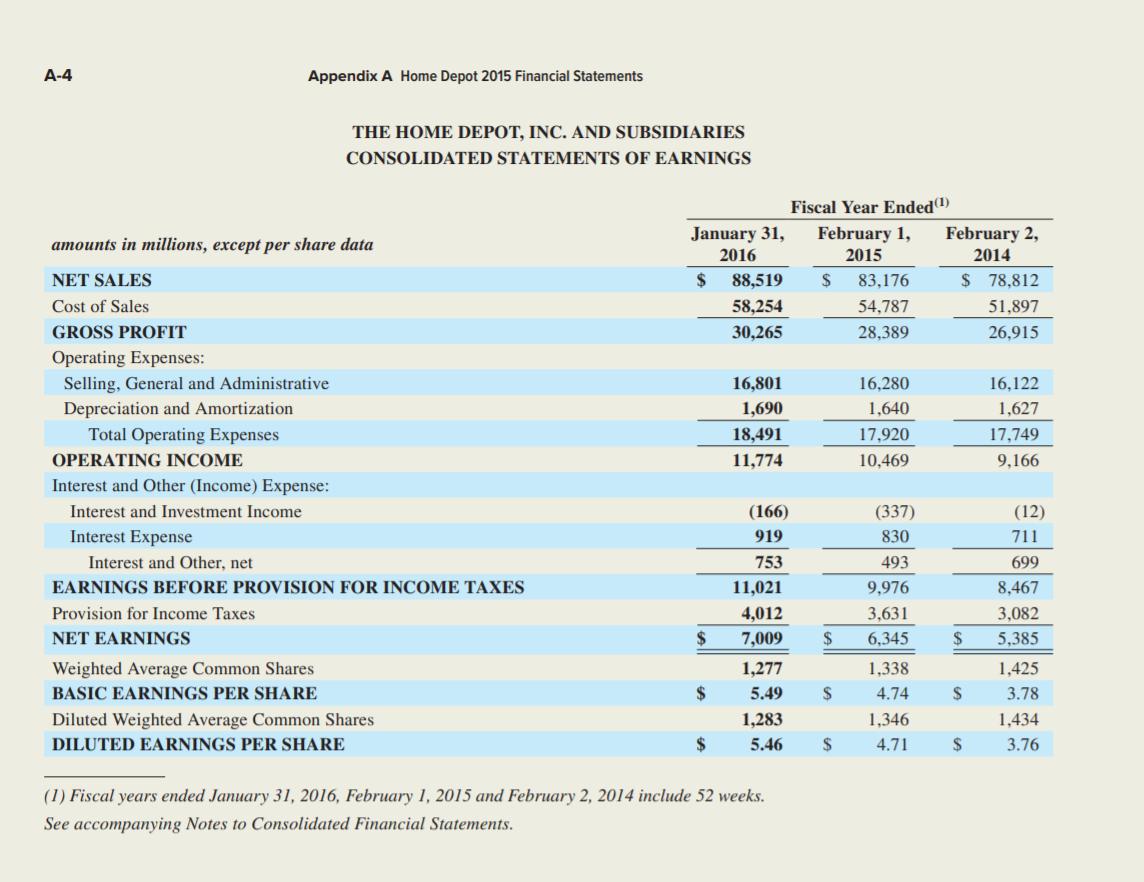

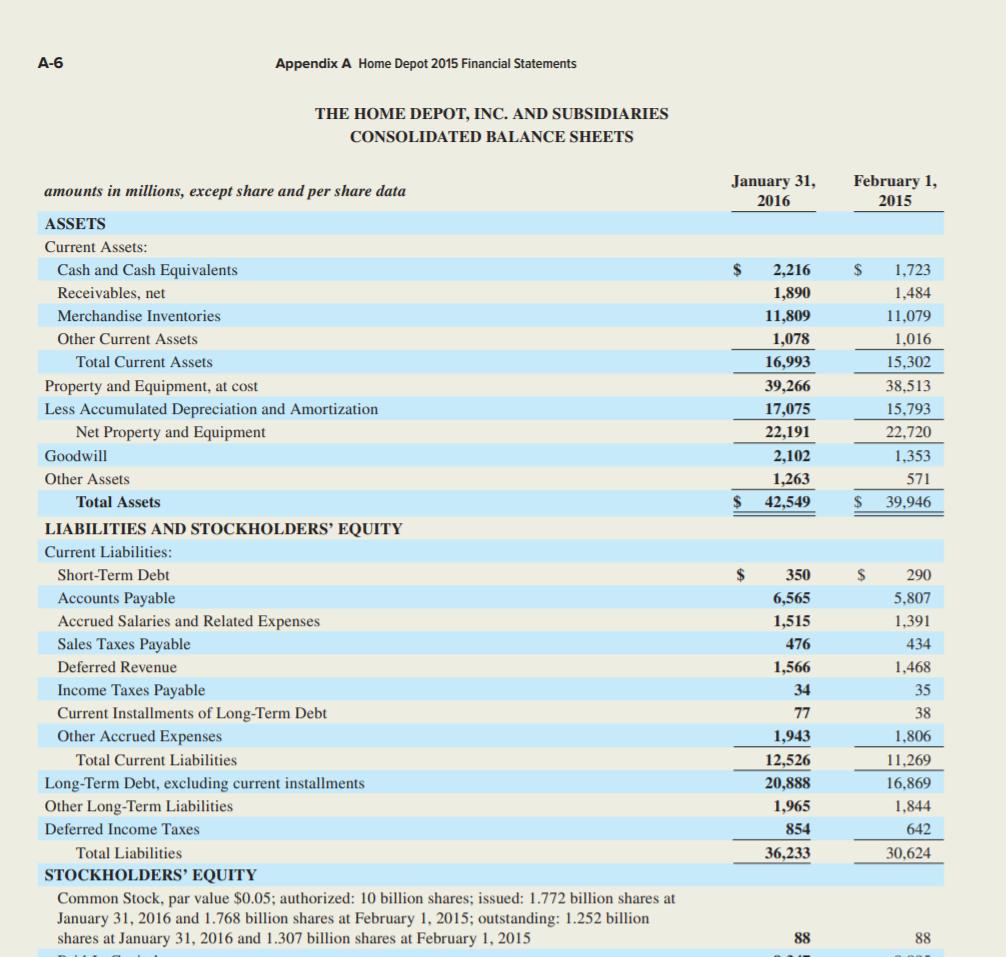

Use Home Depot's financial information in Appendix A. a. Compute ROI and EVA for the two most recent years reported. Use Net Earnings as a measure of earnings or returns, and Net Property and Equipment as the invested capital base. Assume the weighted-average cost of capital is 10 percent. b. Are they improving or declining? Complete this question by entering your answers in the tabs below. Required A Required B Compute ROI and EVA for the two most recent years reported. Use Net Earnings as a measure of earnings or returns, and Net Property and Equipment as the invested capital base. Assume the weighted-average cost of capital is 10 percent. (Do not round intermediate calculations. Enter your answers in millions (i.e. $i,234,500 should be considered as $1,234.5.). Round your percentage answers to 1 decimal place (i.e., 0.123 should be considered as 12.3. Round dollar value to the nearest whole number.) Show lessa 2015 2016 ROI % % EVA < Required A Required B > Complete this question by entering your answers in the tabs below. Required A Required B Are they improving or declining? Are they improving or declining? < Required A Required B > A-4 Appendix A Home Depot 2015 Financial Statements THE HOME DEPOT, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF EARNINGS Fiscal Year Ended January 31, February 1, February 2, amounts in millions, except per share data 2016 2015 2014 NET SALES $ 88,519 2$ 83,176 $ 78,812 Cost of Sales 58,254 54,787 51,897 GROSS PROFIT 30,265 28,389 26,915 Operating Expenses: Selling, General and Administrative Depreciation and Amortization 16,801 16,280 16,122 1,690 1,640 1,627 Total Operating Expenses 18,491 17,920 17,749 OPERATING INCOME 11,774 10,469 9,166 Interest and Other (Income) Expense: Interest and Investment Income (166) (337) (12) Interest Expense 919 830 711 Interest and Other, net 753 493 699 EARNINGS BEFORE PROVISION FOR INCOME TAXES 11,021 9,976 8,467 Provision for Income Taxes 4,012 3,631 3,082 NET EARNINGS 2$ 7,009 6,345 2$ 5,385 Weighted Average Common Shares 1,277 1,338 1,425 BASIC EARNINGS PER SHARE $ 5.49 4.74 3.78 Diluted Weighted Average Common Shares 1,283 1,346 1,434 DILUTED EARNINGS PER SHARE $ 5.46 $ 4.71 2$ 3.76 (1) Fiscal years ended January 31, 2016, February 1, 2015 and February 2, 2014 include 52 weeks. See accompanying Notes to Consolidated Financial Statements. A-6 Appendix A Home Depot 2015 Financial Statements THE HOME DEPOT, INC. AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS January 31, 2016 February 1, amounts in millions, except share and per share data 2015 ASSETS Current Assets: Cash and Cash Equivalents 2$ 2,216 %2$ 1,723 Receivables, net 1,890 1,484 Merchandise Inventories 11,809 11,079 Other Current Assets 1,078 1,016 Total Current Assets 16,993 15,302 Property and Equipment, at cost Less Accumulated Depreciation and Amortization 39,266 38,513 17,075 15,793 Net Property and Equipment 22,191 22,720 Goodwill 2,102 1,353 Other Assets 1,263 571 Total Assets %24 42,549 %2$ 39,946 LIABILITIES AND STOCKHOLDERS' EQUITY Current Liabilities: Short-Term Debt 350 290 5,807 Accounts Payable Accrued Salaries and Related Expenses 6,565 1,515 1,391 Sales Taxes Payable 476 434 Deferred Revenue 1,566 1,468 Income Taxes Payable 34 35 Current Installments of Long-Term Debt Other Accrued Expenses 77 38 1,943 1,806 Total Current Liabilities 12,526 11,269 Long-Term Debt, excluding current installments Other Long-Term Liabilities 20,888 16,869 1,965 1,844 Deferred Income Taxes 854 642 Total Liabilities 36,233 30,624 STOCKHOLDERS' EQUITY Common Stock, par value $0.05; authorized: 10 billion shares; issued: 1.772 billion shares at January 31, 2016 and 1.768 billion shares at February 1, 2015; outstanding: 1.252 billion shares at January 31, 2016 and 1.307 billion shares at February 1, 2015 88 88

Step by Step Solution

3.44 Rating (144 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts