Answered step by step

Verified Expert Solution

Question

1 Approved Answer

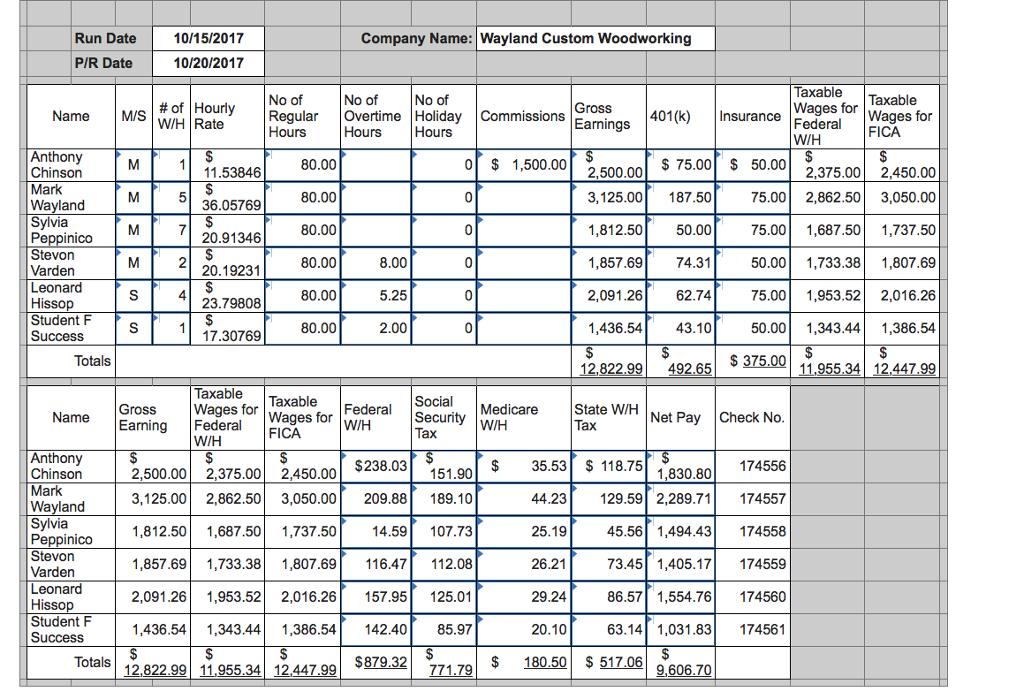

Compute SUTA and FUTA semimonthly payroll taxes general journal entry for this pay period. Show all calculations. Include both debits only. FUTA is .006 on

Compute SUTA and FUTA semimonthly payroll taxes general journal entry for this pay period. Show all calculations. Include both debits only.

FUTA is .006 on 1st 7k of wages.

SUTA is 2.6% on 1st 33,100.

Run Date 10/15/2017 Company Name: Wayland Custom Woodworking P/R Date 10/20/2017 Taxable Name M/S # of Hourly W/H Rate No of Regular Hours No of No of Overtime Holiday Commissions Hours Hours Taxable Gross Earnings 401(k) Insurance Wages for Federal Wages for FICA W/H Anthony $ $ $ $ M 1 80.00 0 $ 1,500.00 $ 75.00 $ 50.00 Chinson 11.53846 2,500.00 2,375.00 2,450.00 Mark $ M 5 80.00 0 3,125.00 187.50 Wayland 75.00 2,862.50 3,050.00 36.05769 Sylvia T $ M 7 80.00 0 Peppinico 1,812.50 50.00 75.00 1,687.50 1,737.50 20.91346 Stevon $ M 2 80.00 8.00 0 1,857.69 74.31 50.00 1,733.38 1,807.69 Varden 20.19231 Leonard $ S 4 80.00 5.25 0 2,091.26 62.74 75.00 1,953.52 2,016.26 Hissop 23.79808 Student F $ S 1 80.00 2.00 1,436.54 43.10 50.00 1,343.44 1,386.54 Success 17.30769 $ $ $ $ Totals $ 375.00 12,822.99 492.65 11,955.34 12,447.99 Gross Taxable Wages for Taxable Social Name Earning Federal Wages for FICA Federal W/H Security Tax Medicare W/H State W/H Tax Net Pay Check No. W/H Anthony $ $ $ $238.03 Chinson 2,500.00 2,375.00 2,450.00 Mark 3,125.00 2,862.50 3,050.00 $ 151.90 209.88 189.10 $ 35.53 $118.75 $ 1,830.80 174556 44.23 129.59 2,289.71 174557 Wayland Sylvia 1,812.50 1,687.50 1,737.50 14.59 107.73 25.19 45.56 1,494.43 174558 Peppinico Stevon 1,857.69 1,733.38 1,807.69 116.47 112.08 26.21 73.45 1,405.17 174559 Varden Leonard 2,091.26 1,953.52 2,016.26 157.95 125.01 29.24 86.57 1,554.76 174560 Hissop Student F 1,436.54 1,343.44 1,386.54 142.40 85.97 20.10 Success $ Totals $ $ 12,822.99 11,955.34 12,447.99 $ $879.32 $ 180.50 $ 517.06 771.79 63.14 1,031.83 174561 $ 9,606.70

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started