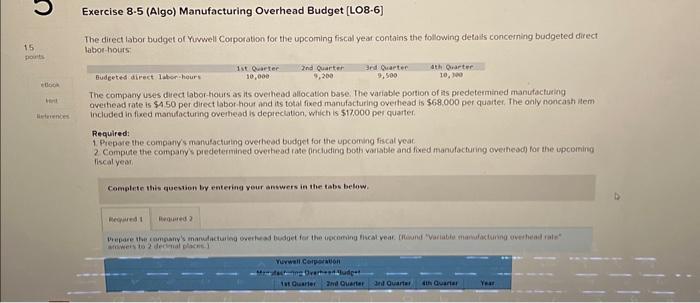

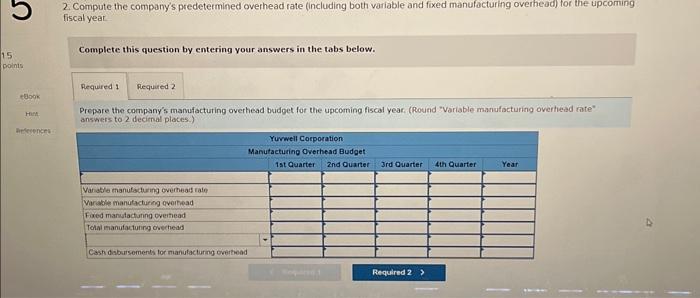

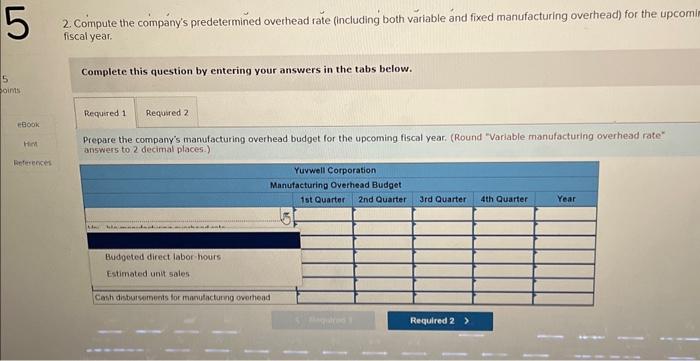

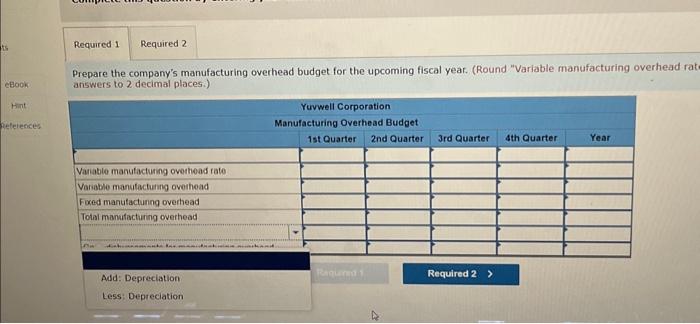

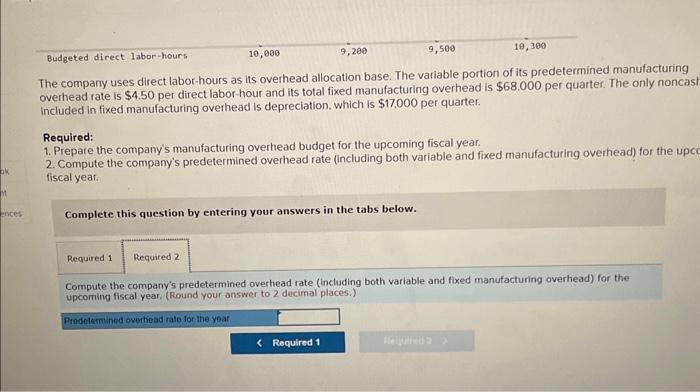

Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming iscal year Complete this question by entering your answers in the tabs below. Prepare the company's mamufacturing overhead budpet for the upcoming fiscal year, (Round "Variable manufacturing overhead rate" anshers to 2 decirnal ploces.) The company uses direct labor-hours as its overhead allocation base. The variable portion of its predetermined manufacturing overhead rate is $4.50 per direct labor-hour and its total fixed manufacturing overhead is $68.000 per quarter. The only nonca included in fixed manufacturing overhead is depreciation, which is $17,000 per quarter. Required: 1. Prepare the company's manufacturing overhead budget for the upcoming fiscal year. 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the up fiscal year. Complete this question by entering your answers in the tabs below. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcoming fiscal year, (Round your answer to 2 decimal places.) 2. Compute the company's predetermined overhead rate (including both variable and fixed manufacturing overhead) for the upcom fiscal year. Complete this question by entering your answers in the tabs below. Prepare the company's manufacturing overhead budget for the upcoming fiscal year. (Round "Variable manufacturing overhead rate* answers to 2 decimal places.) Exercise 8-5 (Algo) Manufacturing Overhead Budget [LO8-6) The direct labor budget of Yuwwell Corporation for the upcoming fiscal year contains the following detais concerning budgeted direct labor-hours The company uses direct labor-fiours as its overhead allocation base, The variable portion of as predetermined manutacturing avestiead rate is $450 per direct labor-hour and its totat fixed manufacturing overthead is $6.8,000 per quaiter, The only noncash ilem incladed in fled manulacturing ovethead is depieclation, which is $17,000 per quarter Required: Required: 1. Prepore the companys manutactioting overthead budget for the upcoming fiscal yeat 2 Compute the compary piedetermined orethead rate (including both valable and fised manufocturing oveaheodf for the upcoining fiscal year Mowersing deranal posis)