Answered step by step

Verified Expert Solution

Question

1 Approved Answer

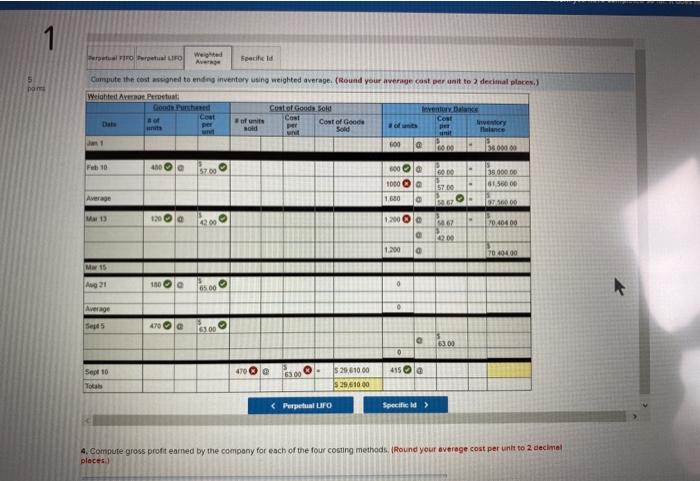

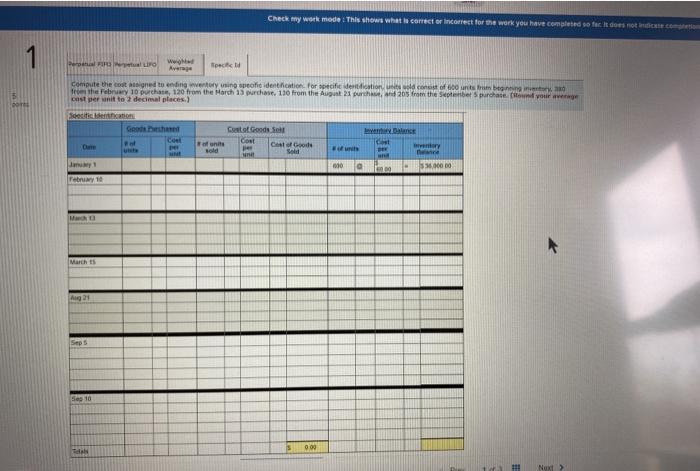

Compute the cost assigned to ending inventory using specific identification. For specific identification, units sold consist of 600 units from beginning inventory, 380 from the

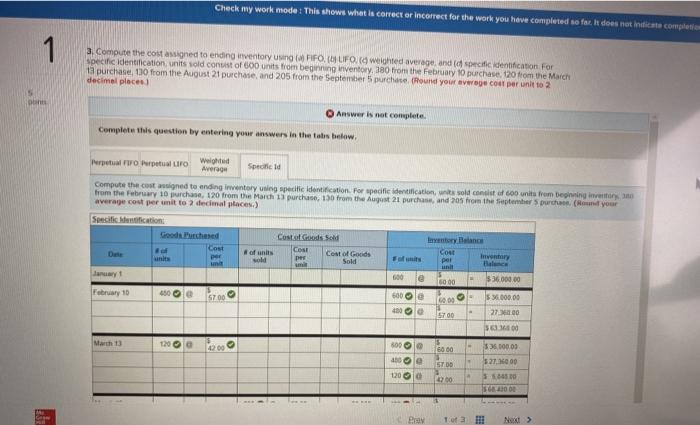

Compute the cost assigned to ending inventory using specific identification. For specific identification, units sold consist of 600 units from beginning inventory, 380 from the February 10 purchase, 120 from the March 13 purchase, 130 from the August 21 purchase, and 205 from the September 5 purchase. (Round your average cost per unit to 2 decimal places.)

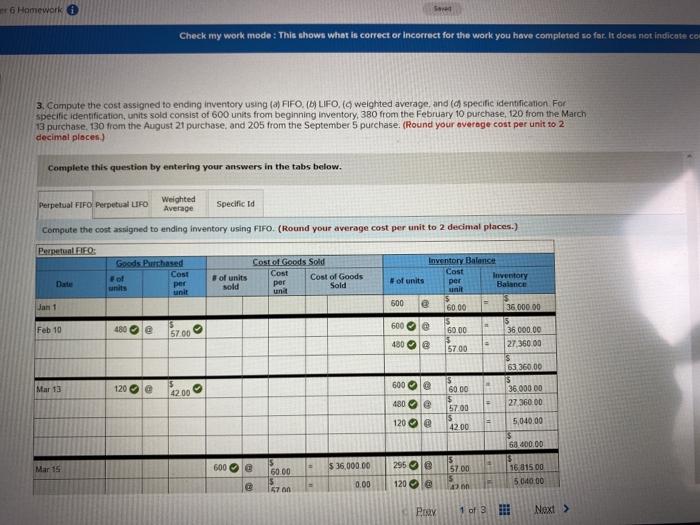

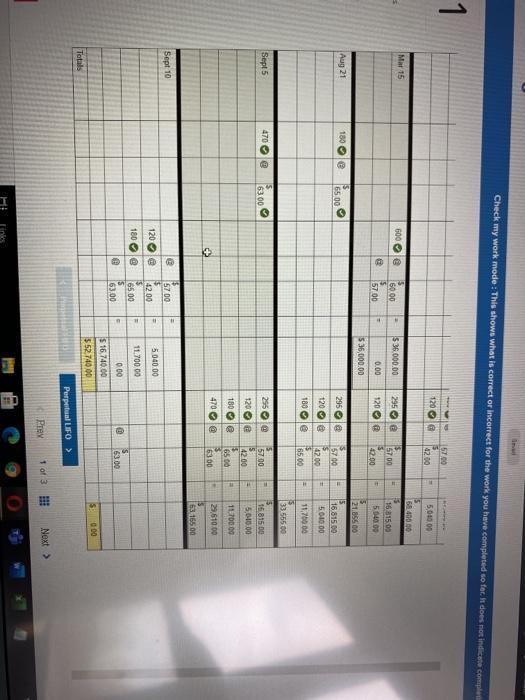

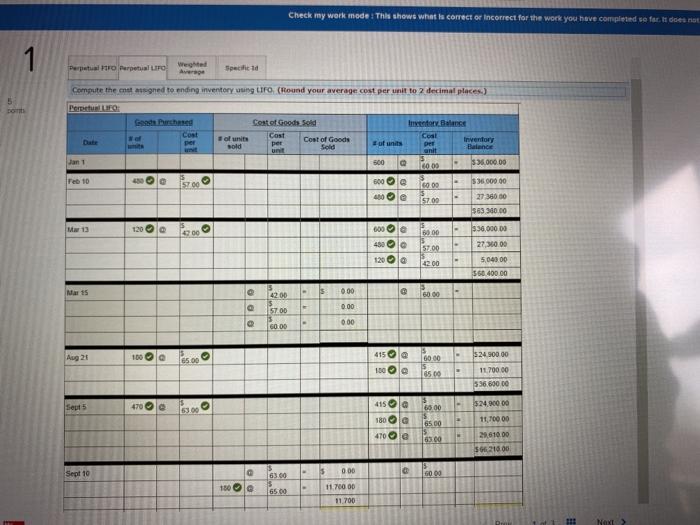

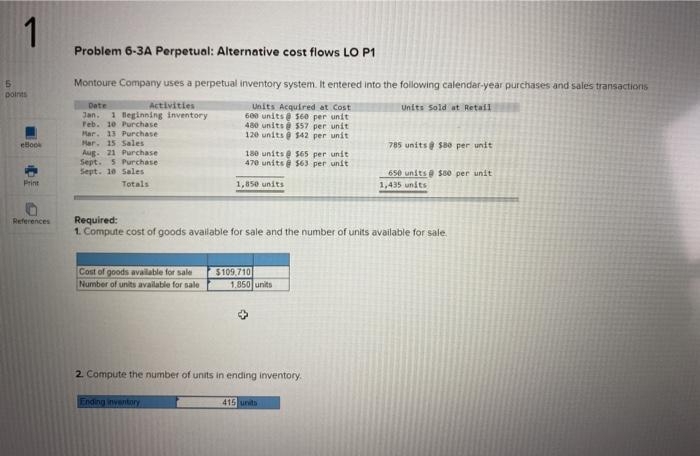

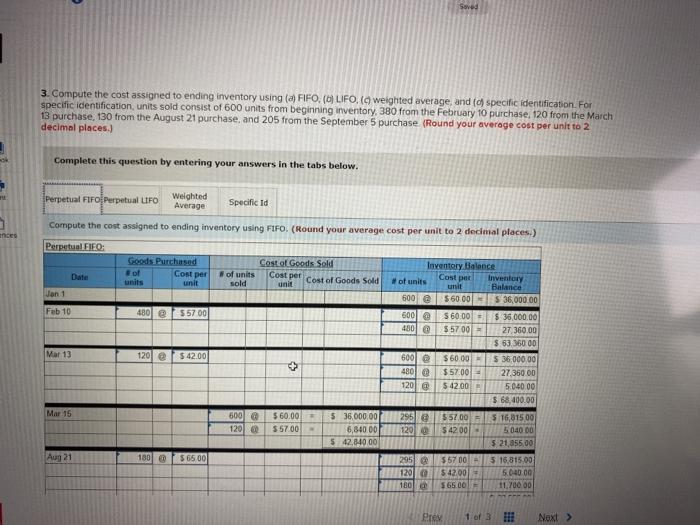

6 Homework Check my work mode: This shows what is correct or incorrect for the work you have completed so far, it does not indicate co 3. Compute the cost assigned to ending inventory using (a) FIFO (6) LIFO, (a weighted average, and (a specific identification For specific identification, units sold consist of 600 units from beginning inventory, 380 from the February 10 purchase, 120 from the March 13 purchase, 130 from the August 21 purchase, and 205 from the September 5 purchase. (Round your average cost per unit to 2 decimal places) Complete this question by entering your answers in the tabs below. Weighted Perpetual FIFO Perpetual LIFO Average Specific Id Compute the cost assigned to ending inventory using FIFO (Round your average cost per unit to 2 decimal places.) Perpetual FIFO: Goods Perchased Cost of Goods Sold Inventory Balance Cost Cost of of units Cost of Goods Cost per per Inventory sold per # of units Sold Balance unit unt Jan 1 500 @ 60.00 36 000.00 480 600 Feb 10 5700 . 60.00 57.00 36 000.00 27 360.00 480 e 63 360 00 Mar 13 120 la 600 l 42.00 $ 60 00 $ 57.00 480 @ 120 @ 42.00 36.00000 27 360.00 5,040.00 $ 68 600.00 $ 16 81500 504000 Mar 15 600 @ 295 Ole 60.00 $ 36,000.00 0.00 57.00 5 42. 16700 120 @ PLAY 1 of 3 Next > Check my work mode : This shows what is correct or incorrect for the work you have completed so far, it does not indicate complet 1 5700 120 le NE 5,000.00 42.00 Mar 15 600 $36.000.00 6000 5 5700 295e 120 e 5700 68 400.00 15 16215.00 504800 0.00 42.00 536,000.00 21.85500 Aug 21 180 e 6500 295 la 5700 16.815.00 501000 120 180@ 65.00 11,76000 3355500 Sept5 470@ 63.00 57.00 255 120 le 15.815.00 5,000.00 4200 180 le 6500 11.700.00 470 @ + 29,610.00 6300 53 155 00 Sept 10 5700 $ 4200 120 @ 5040.00 @ @ 180 11.700 00 @ 65.00 S 63.00 6300 000 $16.740.00 $ 52.740.00 5000 Totals Perpetual LIFO > Prey 1 of 3 Next > Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not 1 Perpaturo Perpetual LIFE Weged Specified Compute the cost mugned to ending inventory using UFO (Round your average cost per unit to 2 decimal places) 5 Perpetu Cost of Goods Sold Bo Cost Intro Balance Coal per Inventory Balance Cost per of units sold Cost of Goods Sold Euf units Jan 1 500 Q 6009 33.000.00 Feb 10 15700 $36.000.00 600 480 60.00 157.00 27 000 363 310.00 M 13 1200 4900 0 $30,000.00 600a 480 @ 120 60.00 57.00 27,300.00 12:00 5049.00 550.400.00 5 000 4200 60.00 OOO 0.00 157.00 G0.00 000 1000.00 Aug 21 415 0 60 60 100 100 Us 0 $24.90000 11.700.00 536.690 00 sept O O OOO 470 o 415 180 $24.900.00 65.00 65.00 470 11.10000 29.610.00 $216.00 5 Sept 10 000 6000 150 65.00 1170000 11.700 NAKE 1 metu FROLIFO Wed Specific nom Dumpute the cost signed to ending inventory using weighted average (Round your average cost per unit to 2 decimal places Weighted Amor Perpetual Good Pushed Contot Goods Bold henry DK ofit Cost (Ceat Cost of Good Inventory sold Sold Tence 800 ini Feb 10 6000 35 000 00 56000 1000 1.630 000 M 120a 200 12000 470.404.00 1.200 a 70.49400 M 15 Aug 21 180 16500 S5 470 la 16300 4700 4150 Sep 10 Total $25.610 00 $ 29,610.00 4. Compute gross profit earned by the company for each of the four costing methods, Round your average cost per unit to 2 decimal places) Check my work mode: This shows what la correct or incorrect for the work you have completed sofer does not nece 1 RO Ww. Ave Specific Compute the cost signed to ending wetery in profit identification for reife dedication of units from being from the 10 purchase, 120 from the March 13 purchase. 130 from the August 21 purch205 the be purchase your age cost per unit to 3 decimal places.) Section to God. So Cet of Good sold Solid De 10 reby 10 M March Seps 0.00 Nex 1 Problem 6-3A Perpetual: Alternative cost flows LO P1 Don Montoure Company uses a perpetual inventory system. It entered into the following calendar-year purchases and sales transactions Date Activities Units Acquired at Cost Jan. 1 beginning inventory units sold wt Retail 500 units 560 per unit Teb. 10 Purchase 480 units 557 per unit Mar. 13 Purchase 120 units $42 per unit Mar. 15 Sales 785 units & $8o per unit Aug 21 Purchase 180 units 365 per unit Sept. 5 Purchase 470 units 563 per unit Sept. 10 Sales 650 units @ $60 per unit Totals 1,850 units 1,435 units Boor Print References Required: 1. Compute cost of goods available for sale and the number of units available for sale Cost of goods available for sale Number of units available for sale $109.710 1.850 units 2. Compute the number of units in ending inventory Ending into 415 unit Saved 3. Compute the cost assigned to ending inventory using a FIFO (6) LIFO. (weighted average, and to specific identificationFor specific identification, units sold consist of 600 units from beginning inventory, 380 from the February 10 purchase, 120 from the March 13 purchase, 130 from the August 21 purchase, and 205 from the September 5 purchase (Round your average cost per unit to 2 decimal places.) Complete this question by entering your answers in the tabs below. ances Cost per Cost of Goods Sold Cost per 450 Perpetual Fifo Perpetual LIFO Weighted Average Specific Id Compute the cost assigned to ending inventory using FIFO. (Round your average cost per unit to 2 decimal places.) Perpetual FIFO: Goods Purchased Cost of Goods Sold Inventory Balance of Date Cost per of units unit Inventory sold unit # of units unit Balance Jan 1 600 e $ 6000 $ 36,000.00 Feb 10 480] $5700 600 560.00 $ 35,000.00 55700 27.360.00 $ 53,360 00 Mar 13 120 $42.00 6001 $60.00 5 36.000,00 4801 $57.00 27.360.00 120 $42.00 5.040.00 $ 68,400.00 Mar 15 500 $ 60.00 $36.000.00 295 @ $57.00 $ 16,81500 120 $57.00 6,840.00 120 5 4200 5040 00 $ 42,840.00 5 21,855,00 Aug 21 180 $ 65.00 295 557 00 5 16,815.00 120 $42.00 5.04000 180 56500 11.700.00 Prey 1 of 3 Next > Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate complete 1 3. Compute the cost assigned to ending inventory using FIFO, UFO, I weighted average and ld specific identification For specific identification units sold consist of 600 units from beginning inventory. 380 from the February 10 purchase, 120 from the March 13 purchase, 10 from the August 21 purchase, and 205 from the September 5 purchase Round your average couper unit 102 decimal places Answer is not complete Complete this question by entering your answers in the tabs below. Perpetual Perpetualuro Weighted Average Specified Compute the cost signed to ending inventory using specific Identification for specific identification, was sold cotto 600 units from beginning investor from the February 10 purchase, 120 from the March 13 purchase, 150 from the August 21 purch, and 705 from the September purchas Round your average cost per unit to a decimal places) Specification: Good Purchased Cost of Goods Sold antry Balance Cost COSI per Cou Cost of Goods sold per Sold por unit Hace nyt 600 $36.000.00 February 10 4500 5700 6000 e le $36.000.00 400 5700 2700 09 co - March 13 1200 le 6000 $35.000.00 STO le 1200 527 16000 500 300 7700 Tofa Next > Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started