Answered step by step

Verified Expert Solution

Question

1 Approved Answer

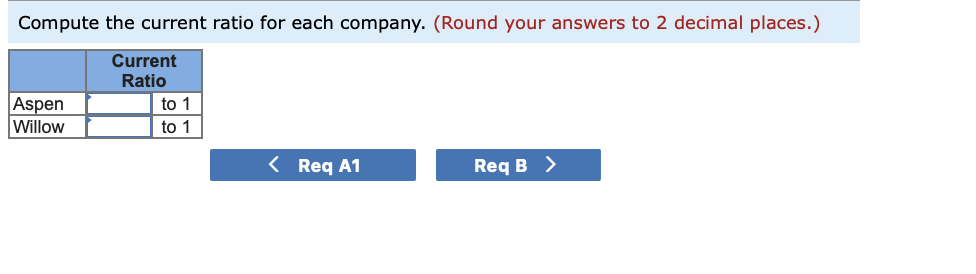

Compute the current ratio for each company. (Round your answers to 2 decimal places.) Complete this question by entering your answers in the tabs below.

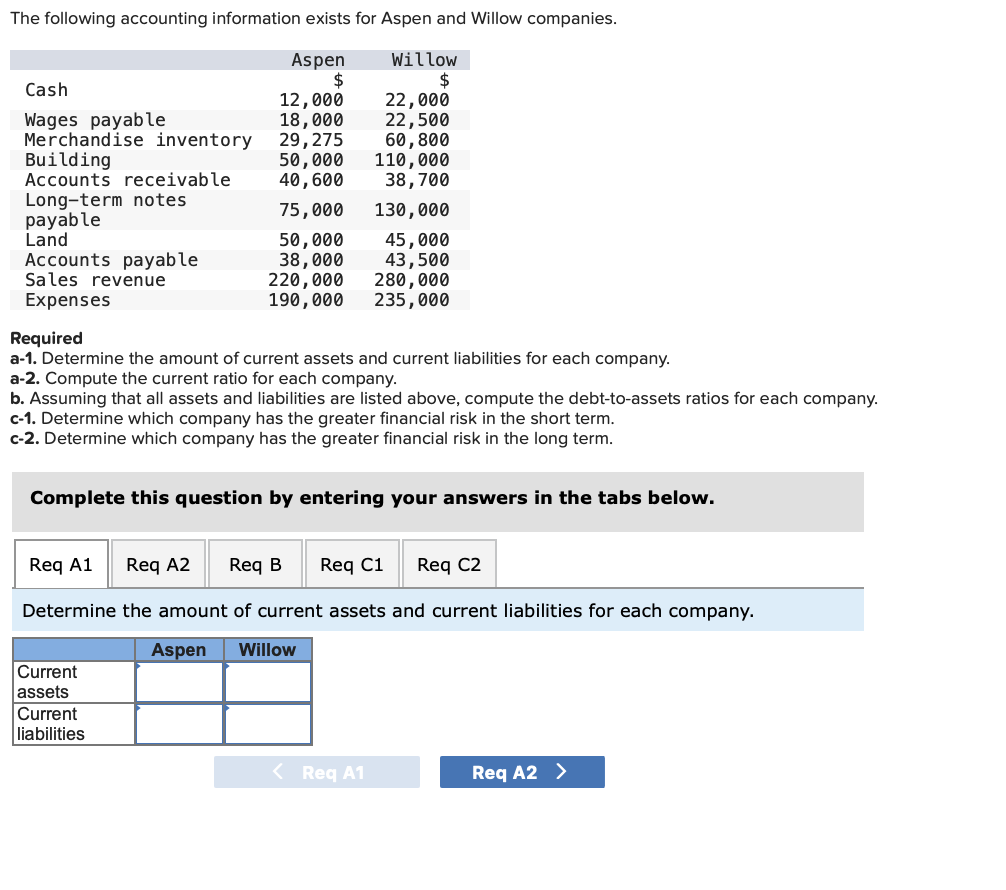

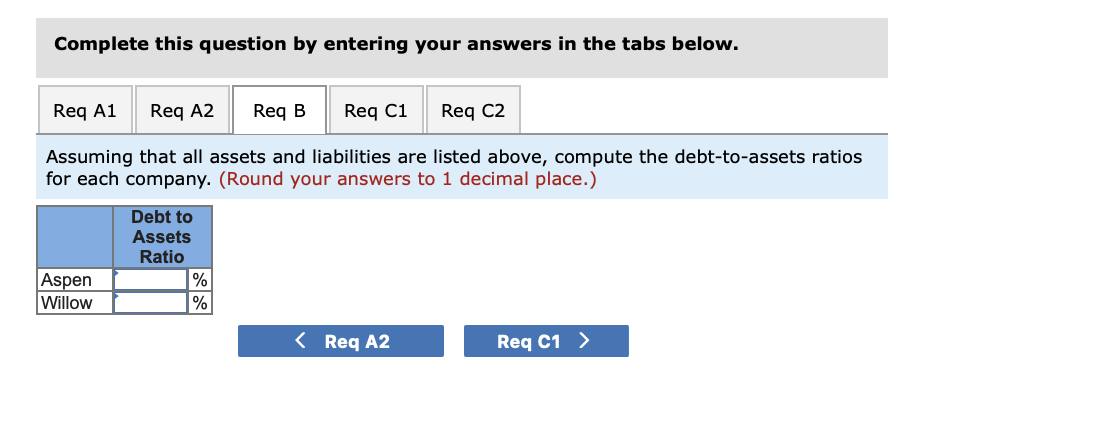

Compute the current ratio for each company. (Round your answers to 2 decimal places.) Complete this question by entering your answers in the tabs below. Assuming that all assets and liabilities are listed above, compute the debt-to-assets ratios for each company. (Round your answers to 1 decimal place.) The following accounting information exists for Aspen and Willow companies. Required a-1. Determine the amount of current assets and current liabilities for each company. a-2. Compute the current ratio for each company. b. Assuming that all assets and liabilities are listed above, compute the debt-to-assets ratios for each company c-1. Determine which company has the greater financial risk in the short term. c-2. Determine which company has the greater financial risk in the long term. Complete this question by entering your answers in the tabs below. Determine the amount of current assets and current liabilities for each company

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started