Answered step by step

Verified Expert Solution

Question

1 Approved Answer

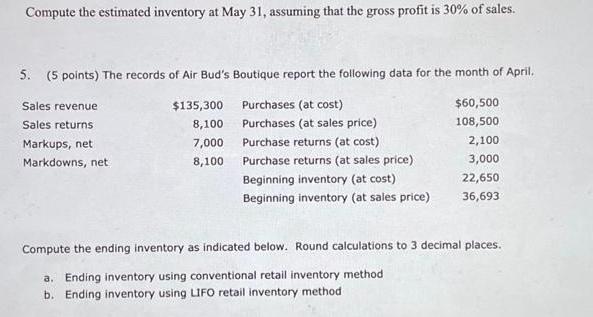

Compute the estimated inventory at May 31, assuming that the gross profit is 30% of sales. 5. (5 points) The records of Air Bud's

Compute the estimated inventory at May 31, assuming that the gross profit is 30% of sales. 5. (5 points) The records of Air Bud's Boutique report the following data for the month of April. Purchases (at cost) Sales revenue $135,300 $60,500 Sales returns 8,100 Purchases (at sales price) 108,500 Markups, net 7,000 Purchase returns (at cost) 2,100 Markdowns, net 8,100 Purchase returns (at sales price) 3,000 Beginning inventory (at cost) 22,650 Beginning inventory (at sales price) 36,693 Compute the ending inventory as indicated below. Round calculations to 3 decimal places. a. Ending inventory using conventional retail inventory method b. Ending inventory using LIFO retail inventory method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To compute the ending inventory using the conventional retail inventory method youll subtract ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started