Answered step by step

Verified Expert Solution

Question

1 Approved Answer

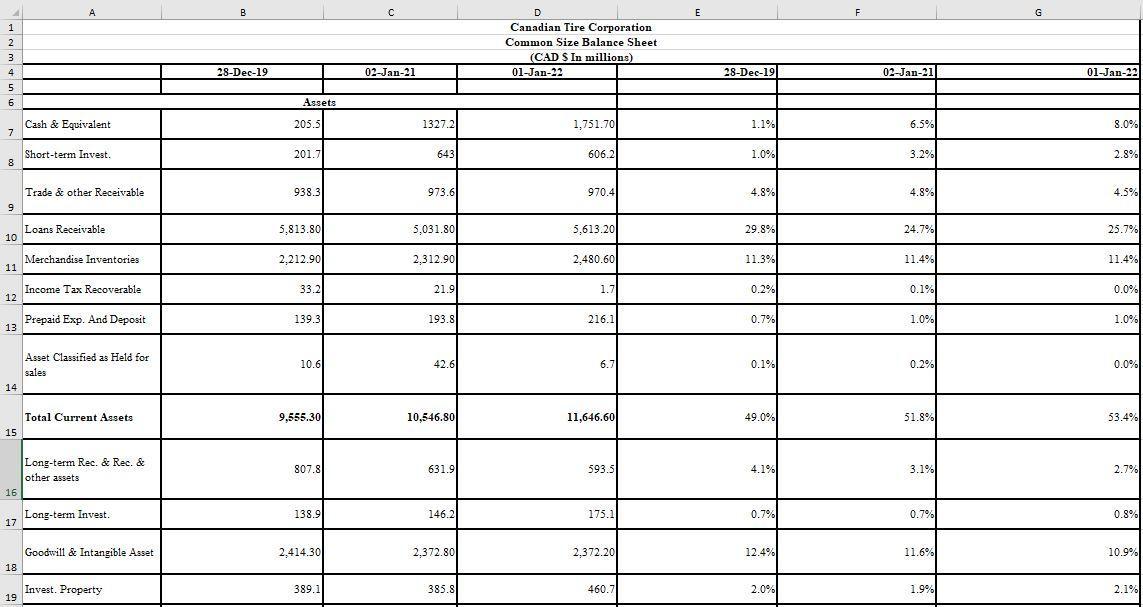

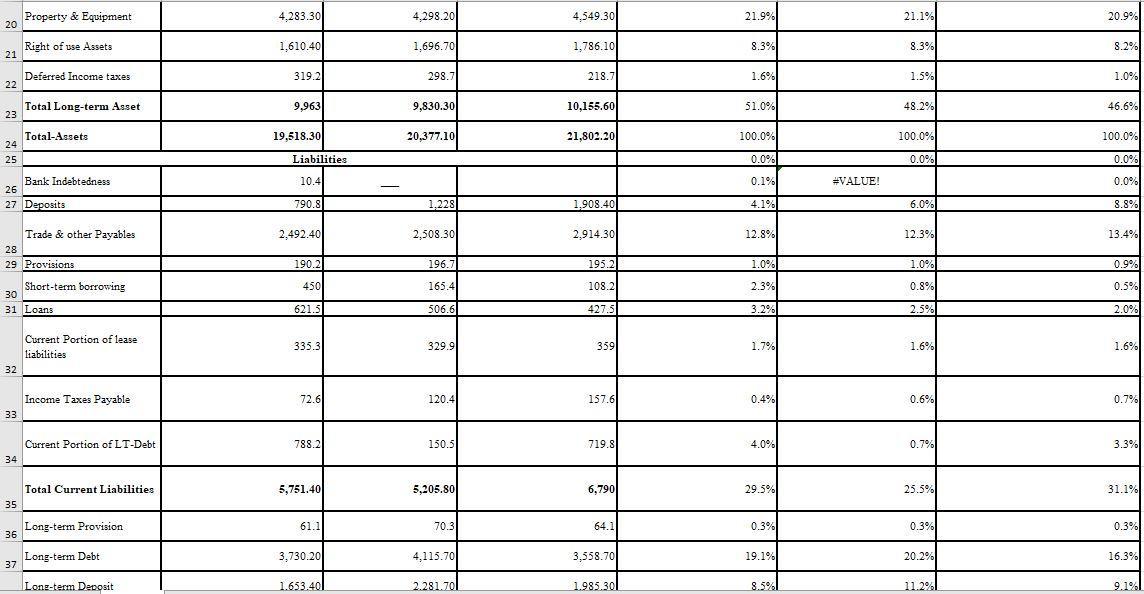

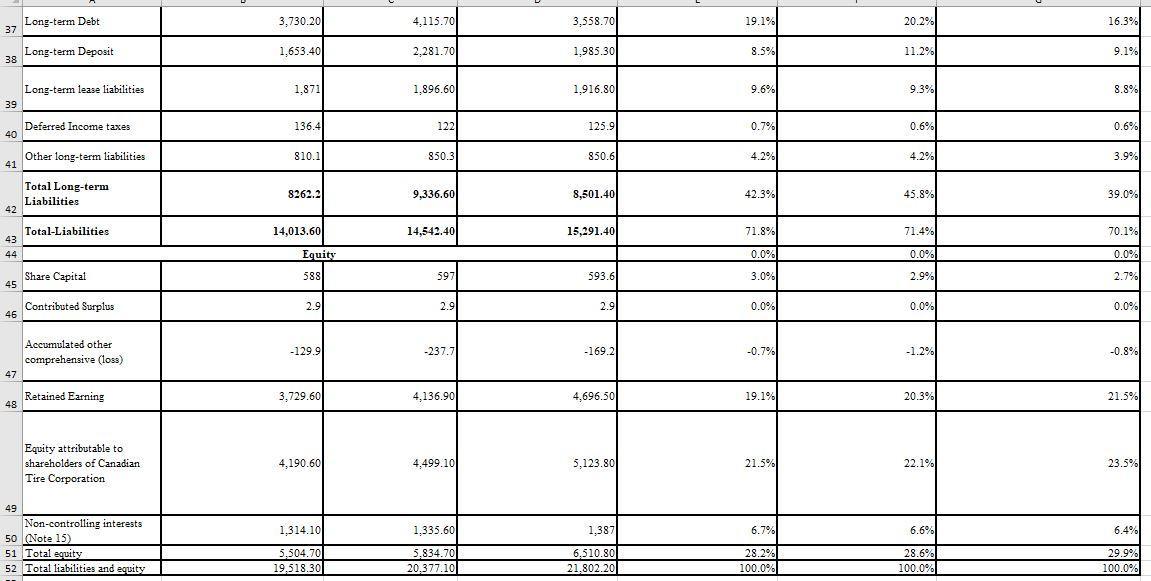

Compute the following for Canadian Tire Corporation for 2021 and 2022 1. Accounts Receivable Turnover 2. Days Sales Outstanding 3. Inventory Turnover 4. Days

Compute the following for Canadian Tire Corporation for 2021 and 2022 1. Accounts Receivable Turnover 2. Days Sales Outstanding 3. Inventory Turnover 4. Days Inventory Outstanding 5. Accounts Payable Turnover 6. Days Payables Outstanding 7. Cash Conversion Cycle 1 2 min 60 3 4 5 7 8 9 10 11 12 13 14 15 16 17 18 19 A Cash & Equivalent Short-term Invest. Trade & other Receivable Loans Receivable Merchandise Inventories Income Tax Recoverable Prepaid Exp. And Deposit Asset Classified as Held for sales Total Current Assets Long-term Rec. & Rec. & other assets Long-term Invest. Goodwill & Intangible Asset Invest. Property B 28-Dec-19 Assets 205.5 201.7 938.3 5,813.80 2,212.90 33.2 139.3 10.6 9,555.30 807.8 138.9 2,414.30 389.1 02-Jan-21 1327.2 643 973.6 5,031.80 2,312.90 21.9 193.8 42.6 10,546.80 631.9 146.2 2,372.80 385.8 D Canadian Tire Corporation Common Size Balance Sheet (CAD S In millions) 01-Jan-22 1,751.70 606.2 970.4 5,613.20 2,480.60 1.7 216.1 6.7 11,646.60 593.5 175.1 2,372.20 460.7 E 28-Dec-19 1.1% 1.0% 4.8% 29.8% 11.3% 0.2% 0.7% 0.1% 49.0% 4.1% 0.7% 12.4% 2.0% F 02-Jan-21 6.5% 3.2% 4.8% 24.7% 11.4% 0.1% 1.0% 0.2% 51.8% 3.1% 0.7% 11.6% 1.9% G 01-Jan-22 8.0% 2.8% 4.5% 25.7% 11.4% 0.0% 1.0% 0.0% 53.4% 2.7% 0.8% 10.9% 2.1% 20 21 22 23 24 25 32 26 27 Deposits 33 34 Property & Equipment Right of use Assets Deferred Income taxes 28 29 Provisions 35 Total Long-term Asset 36 Total-Assets 30 31 Loans 37 Bank Indebtedness Trade & other Payables. Short-term borrowing Current Portion of lease liabilities Income Taxes Payable Current Portion of LT-Debt Total Current Liabilities Long-term Provision Long-term Debt Long-term Deposit 4,283.30 1.610.40 319.2 9.963 19.518.30 Liabilities 10.4 790.8 2,492.40 190.2 450 621.5 335.3 72.6 788.2 5,751.40 61.1 3,730.20 1.653.40 - 4.298.20 1.696.70 298.7 9.830.30 20,377.10 1,228 2,508.30 196.7 165.4 506.6 329.9 120.4 150.5 5.205.80 70.3 4,115.70 2.281.70 4,549.30 1.786.10 218.7 10,155.60 21,802.20 1,908.40 2,914.30 195.2 108.2 427.5 359 157.6 719.8 6,790 64.1 3,558.70 1.985.301 21.9% 8.3% 1.6% 51.0% 100.0% 0.0% 0.1% 4.1% 12.8% 1.0% 2.3% 3.2% 1.7% 0.4% 4.0% 29.5% 0.3% 19.1% 8.5% #VALUE! 21.1% 8.3% 1.5% 48.2% 100.0% 0.0% 6.0% 12.3% 1.0% 0.8% 2.5% 1.6 % 0.6% 0.7% 25.5% 0.3% 20.2% 11.2% 20.9% 8.2% 1.0% 46.6% 100.0% 0.0% 0.0% 8.8% 13.4% 0.9% 0.5% 2.0% 1.6% 0.7% 3.3% 31.1% 0.3% 16.3% 9.1% 37 38 39 40 41 42 43 44 45 46 47 48 49 Long-term Debt Long-term Deposit Long-term lease liabilities Deferred Income taxes Other long-term liabilities Total Long-term Liabilities Total-Liabilities Share Capital Contributed Surplus Accumulated other comprehensive (loss) Retained Earning Equity attributable to shareholders of Canadian Tire Corporation Non-controlling interests 50 (Note 15) 51 Total equity 52 Total liabilities and equity 3,730.20 1.653.40 1,871 136.4 810.1 8262.2 14,013.60 Equity 588 2.9 -129.9 3,729.60 4,190.60 1,314.10 5.504.70 19,518.30 4.115.70 2,281.70 1,896.60 122 850.3 9,336.60 14,542.40 597 2.9 -237.7 4,136.90 4,499.10 1,335.60 5.834.70 20,377.10 3,558.70 1,985.30 1,916.80 125.9 850.6 8,501.40 15,291.40 593.6 2.9 -169.2 4,696.50 5,123.80 1,387 6,510.80 21,802.20 19.1% 8.5% 9.6% 0.7% 4.2% 42.3% 71.8% 0.0% 3.0% 0.0% -0.7% 19.1% 21.5% 6.7% 28.2% 100.0% 20.2% 11.2% 9.3% 0.6% 4.2% 45.8% 71.4% 0.0% 2.9% 0.0% -1.2% 20.3% 22.1% 6.6% 28.6% 100.0% 16.3% 9.1% 8.8% 0.6% 3.9% 39.0% 70.1% 0.0% 2.7% 0.0% -0.8% 21.5% 23.5% 6.4% 29.9% 100.0%

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To compute the financial ratios for Canadian Tire Corporation for 2021 and 2022 we would need the relevant financial statements for those years Unfortunately I dont have access to realtime financial d...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started