Answered step by step

Verified Expert Solution

Question

1 Approved Answer

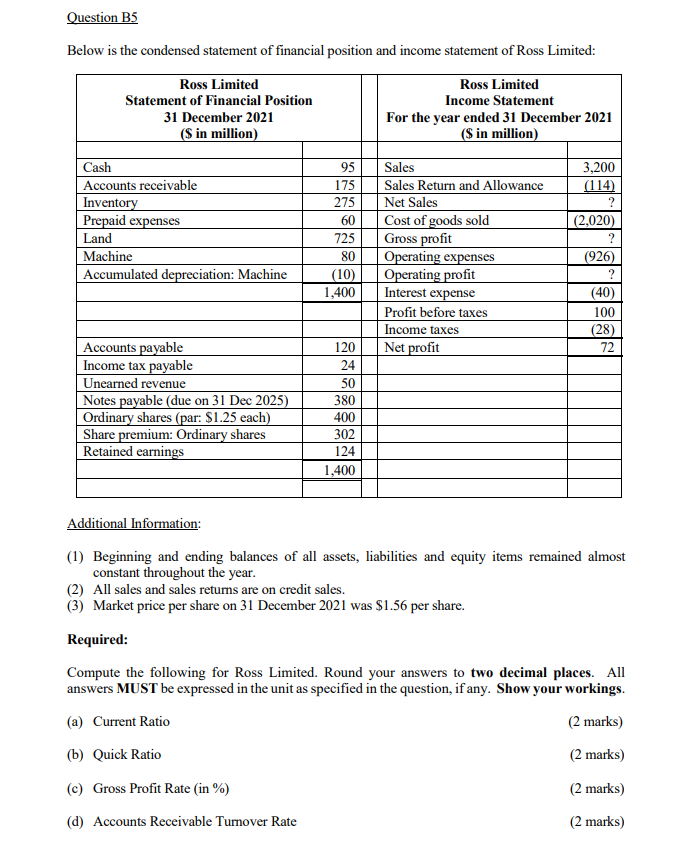

Compute the following for Ross Limited. Round your answers to two decimal places. All answers MUST be expressed in the unit as specified in the

Compute the following for Ross Limited. Round your answers to two decimal places. All answers MUST be expressed in the unit as specified in the question, if any. Show your workings.

(a) Current Ratio (2 marks)

(b) Quick Ratio (2 marks)

(c) Gross Profit Rate (in %) (2 marks)

(d) Accounts Receivable Turnover Rate (2 marks)

(e) Debt Ratio (in %) (2 marks)

(f) Return on Equity (%) (2 marks)

(g) Price-Earnings Ratio (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started