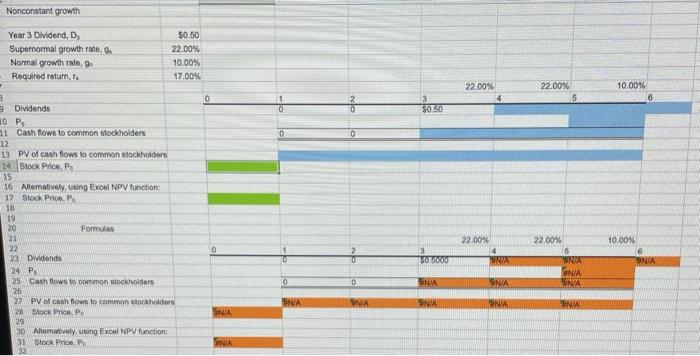

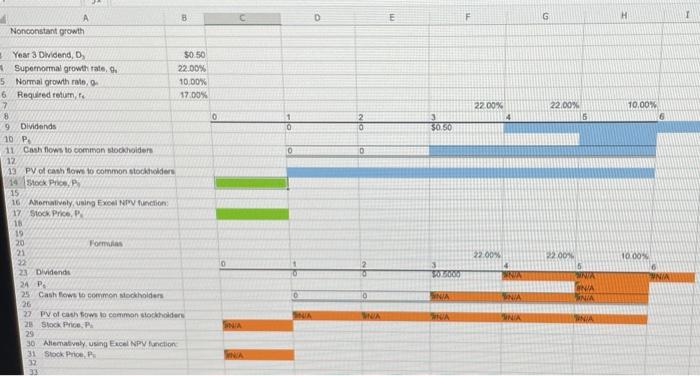

computech Corporation is expanding rapidly and currently needs to retain 28 of its camiegs; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $0.50 coming years from today. The dividend should grow rapidly at a rate of 22% per year during Years 4 and 5; but after Year S, growth should be a constant 10% per year. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet If the required return on Computech is 17%, what is the value of the stock today? Round your answer to the nearest cent. Do not round your intermediate calculations. Nonconstant growth Year 3 Dividend, D Supernormal growth rate, Normal growth rato, Required retur, $0.50 22.00% 10.00% 17.00% 22.00% 22.00% 10.00% 0 5 3 $0.50 0 3 Dividends 10 . 11 Cash flows to common stockholders 12 13 PV of cash flows to common stockholders 14 Stock Price. Po 15 16 Alteratively, using Exo NPV function 17 Stock Price 10 19 20 Formus 21 22 23. Dividende 24P 25 Cash flows to common stockholders 26 27 PV of onthow to common stockholders 28 Stock Price 29 30 Alternatively using Excel NPV function 31 Stock Price : 32 10.00% 0 22.00% 4 NA Sodou 22.00% 15 WNA ONIA MNA ONIA 0 0 SNA SNA NA NA WNIA WNIA WNIA NA NIA Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of 50,50 coming 3 years from today. The dividend should grow rapidly - at a rate of 224 per year - during Years 4 and s; but after Year S, growth should be a constant 10% per year. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet If the required return on Computech 175, what is the value of the stock today? Round your answer to the nearest cent. Do not round your intermediate calculations E G H Nonconstant growth 10.00% 22.00% 4 3 30760 22.00% 16 0 0 O Year 3 Dividend, 5050 Supernormal growth rate, 22.00% 5 Normal growth 10.00% 6 Required return 17.00% 7 8 0 9 Dividends 10 P 11 Cash flows to common stockholders 12 13 PV of cash flows to common stockholders 14 Sock PP 15 16 Anomalively using Exo NIV function 17 Stock Price. P. 18 19 20 Formu 23 0 23 Dividends 24P 25 Cash flows to common stockholders 26 27 PV of cash fows to common stockholders 20 Stock Price:P NA 29 30 Allemately Using Excel NPV Fanction 31 Stock ProP NA 32 33 2009 10.00% 3 3 SON 22.00% 4 SNA MNA NA 0 SNA NA WA ONIA