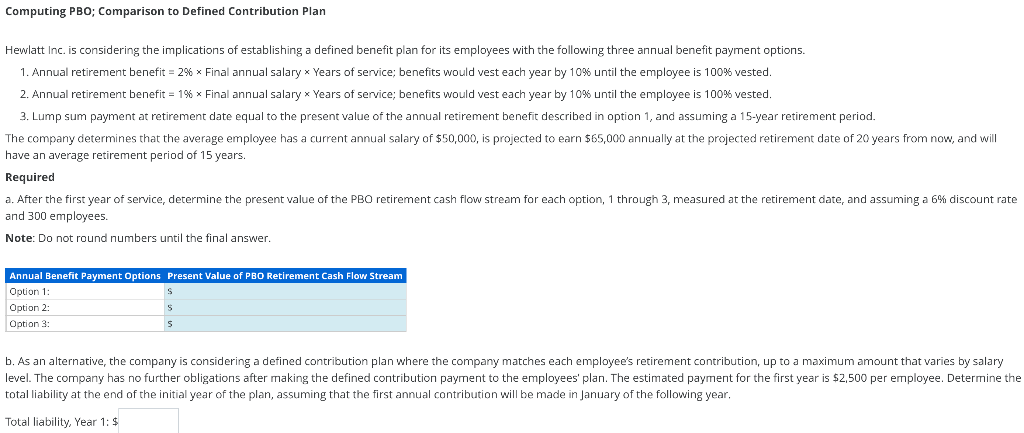

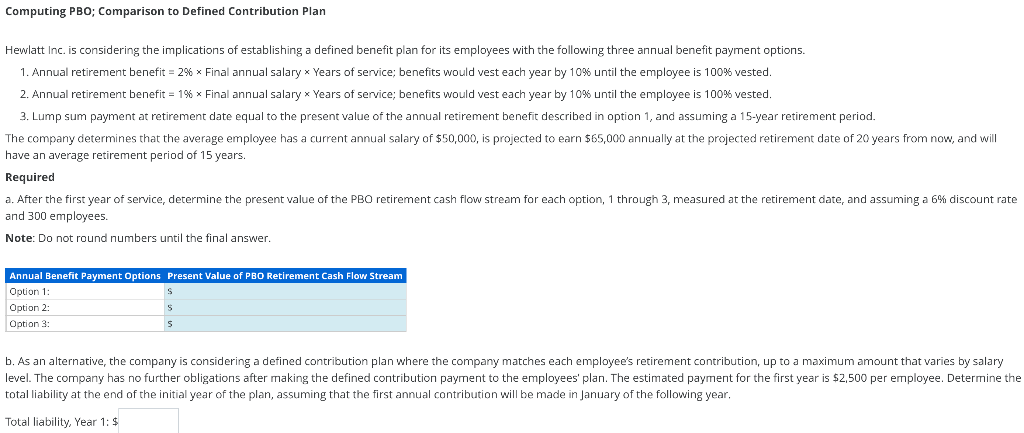

Computing PBO; Comparison to Defined Contribution Plan Hewlatt Inc. is considering the implications of establishing a defined benefit plan for its employees with the following three annual benefit payment options. 1. Annual retirement benefit =2% Final annual salary Years of service; benefits would vest each year by 10% until the employee is 100% vested. 2. Annual retirement benefit =1% Final annual salary Years of service; benefits would vest each year by 1096 until the employee is 100 og vested. 3. Lump sum payment at retirement date equal to the present value of the annual retirement benefic described in option 1 , and assuming a 15 -year retirement period. The company determines that the average employee has a current annual salary of $50,000, is projected to earn $65,000 annually at the projected retirement date of 20 years from now, and will have an average retirement period of 15 years. Required a. After the first year of service, determine the present value of the PBO retirement cash flow stream for each option, 1 through 3 , measured at the retirement date, and assuming a 6% discount rate and 300 employees. Note: Do not round numbers until the final answer. b. As an alternative, the company is considering a detined contribution plan where the company matches each employee's retirement contribution, up to a maximum amount that varies by salary level. The company has no further obligations after making the defined contribution payment to the employees' plan. The estimated payment for the first year is $2,500 per employee. Determine the total liability at the end of the initial year of the plan, assuming that the first annual contribution will be made in January of the following year. Total liability, Year 1: Computing PBO; Comparison to Defined Contribution Plan Hewlatt Inc. is considering the implications of establishing a defined benefit plan for its employees with the following three annual benefit payment options. 1. Annual retirement benefit =2% Final annual salary Years of service; benefits would vest each year by 10% until the employee is 100% vested. 2. Annual retirement benefit =1% Final annual salary Years of service; benefits would vest each year by 1096 until the employee is 100 og vested. 3. Lump sum payment at retirement date equal to the present value of the annual retirement benefic described in option 1 , and assuming a 15 -year retirement period. The company determines that the average employee has a current annual salary of $50,000, is projected to earn $65,000 annually at the projected retirement date of 20 years from now, and will have an average retirement period of 15 years. Required a. After the first year of service, determine the present value of the PBO retirement cash flow stream for each option, 1 through 3 , measured at the retirement date, and assuming a 6% discount rate and 300 employees. Note: Do not round numbers until the final answer. b. As an alternative, the company is considering a detined contribution plan where the company matches each employee's retirement contribution, up to a maximum amount that varies by salary level. The company has no further obligations after making the defined contribution payment to the employees' plan. The estimated payment for the first year is $2,500 per employee. Determine the total liability at the end of the initial year of the plan, assuming that the first annual contribution will be made in January of the following year. Total liability, Year 1