Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Concord Company has two divisions, Rice and Pine. Rice produces an item that Pine could use in its production. Pine currently is purchasing 13,000 units

Concord Company has two divisions, Rice and Pine. Rice produces an item that Pine could use in its production. Pine currently is purchasing 13,000 units from an outside supplier for $14 per unit. Rice is currently operating at less than its full capacity of 501,000 units and has variable costs of $8.00 per unit. The full cost to manufacture the unit is $10. Rice currently sells 451,000 units at a selling price of $16 per unit.

Required:

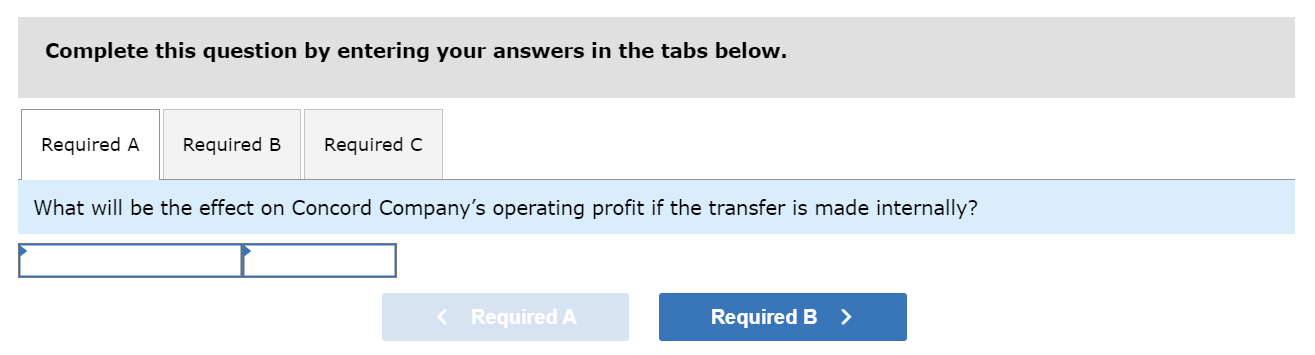

- What will be the effect on Concord Companys operating profit if the transfer is made internally?

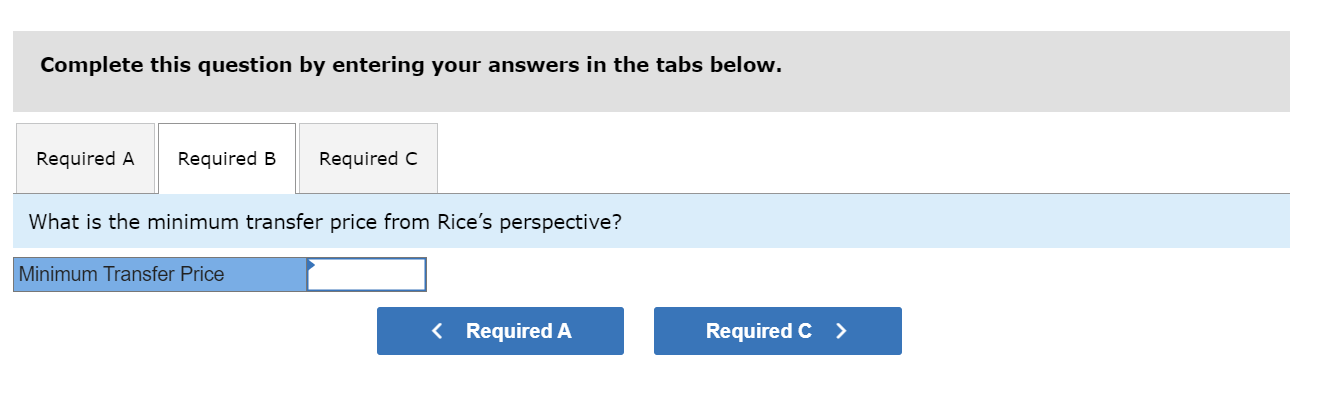

- What is the minimum transfer price from Rices perspective?

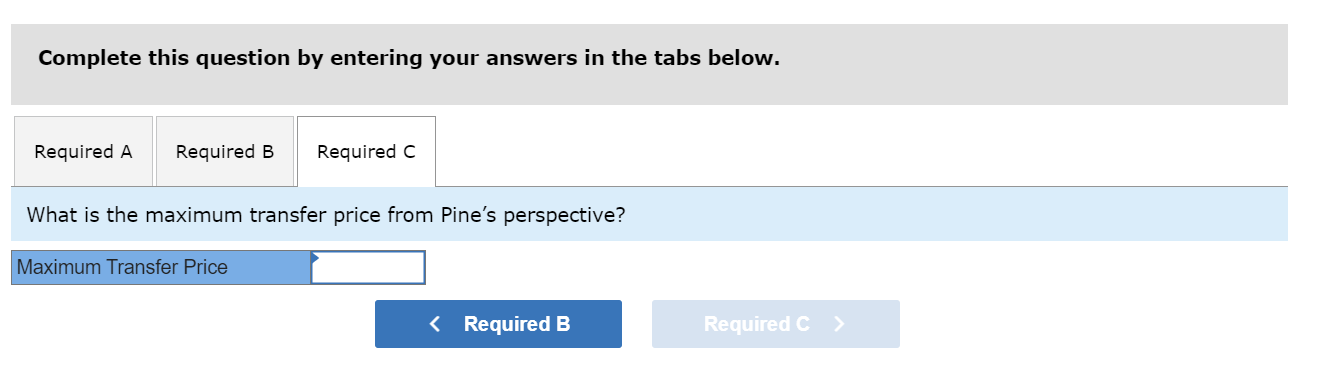

- What is the maximum transfer price from Pines perspective?

Complete this question by entering your answers in the tabs below. What will be the effect on Concord Company's operating profit if the transfer is made internally? Complete this question by entering your answers in the tabs below. What is the minimum transfer price from Rice's perspective? Complete this question by entering your answers in the tabs below. What is the maximum transfer price from Pine's perspective

Complete this question by entering your answers in the tabs below. What will be the effect on Concord Company's operating profit if the transfer is made internally? Complete this question by entering your answers in the tabs below. What is the minimum transfer price from Rice's perspective? Complete this question by entering your answers in the tabs below. What is the maximum transfer price from Pine's perspective Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started