Answered step by step

Verified Expert Solution

Question

1 Approved Answer

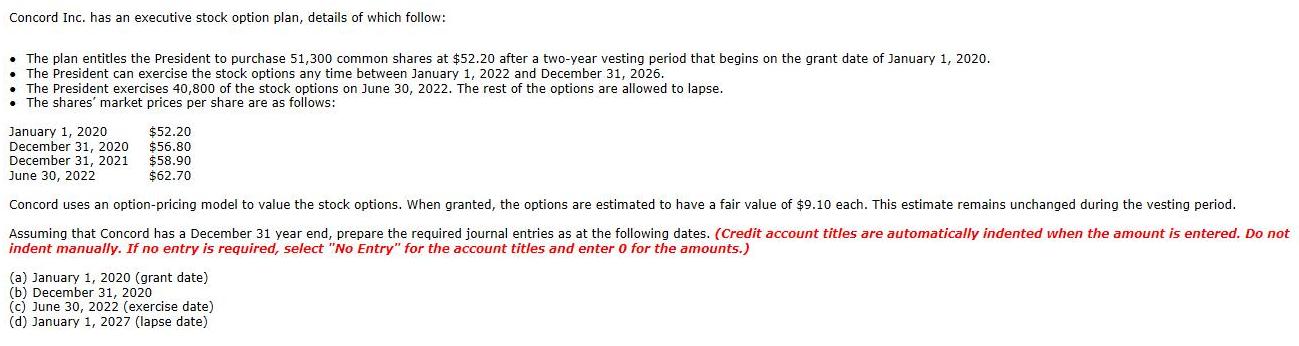

Concord Inc. has an executive stock option plan, details of which follow: The plan entitles the President to purchase 51,300 common shares at $52.20

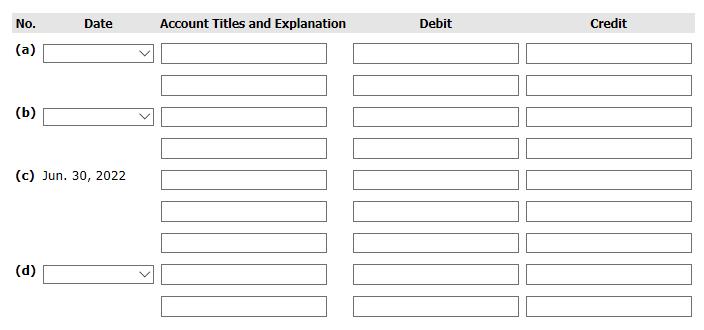

Concord Inc. has an executive stock option plan, details of which follow: The plan entitles the President to purchase 51,300 common shares at $52.20 after a two-year vesting period that begins on the grant date of January 1, 2020. The President can exercise the stock options any time between January 1, 2022 and December 31, 2026. The President exercises 40,800 of the stock options on June 30, 2022. The rest of the options are allowed to lapse. The shares' market prices per share are as follows: January 1, 2020 December 31, 2020 December 31, 2021 $52.20 $56.80 $58.90 $62.70 June 30, 2022 Concord uses an option-pricing model to value the stock options. When granted, the options are estimated to have a fair value of $9.10 each. This estimate remains unchanged during the vesting period. Assuming that Concord has a December 31 year end, prepare the required journal entries as at the following dates. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) (a) January 1, 2020 (grant date) (b) December 31, 2020 (c) June 30, 2022 (exercise date) (d) January 1, 2027 (lapse date) No. Date Account Titles and Explanation Debit Credit (a) (b) (c) Jun. 30, 2022 (d)

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION GIVEN DATA NO OF OPTIONS 51300 FAIR VALUE OF OPTIONS 910 PER OPTION TOTAL FAIR VALUE OF OPT...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

63627d24dfd4f_235713.pdf

180 KBs PDF File

63627d24dfd4f_235713.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started