Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ConD Rice Products Ltd. has the possibility to embark on an exciting overseas investment. To aa e $90,000 in exploratory expenses have been incurred

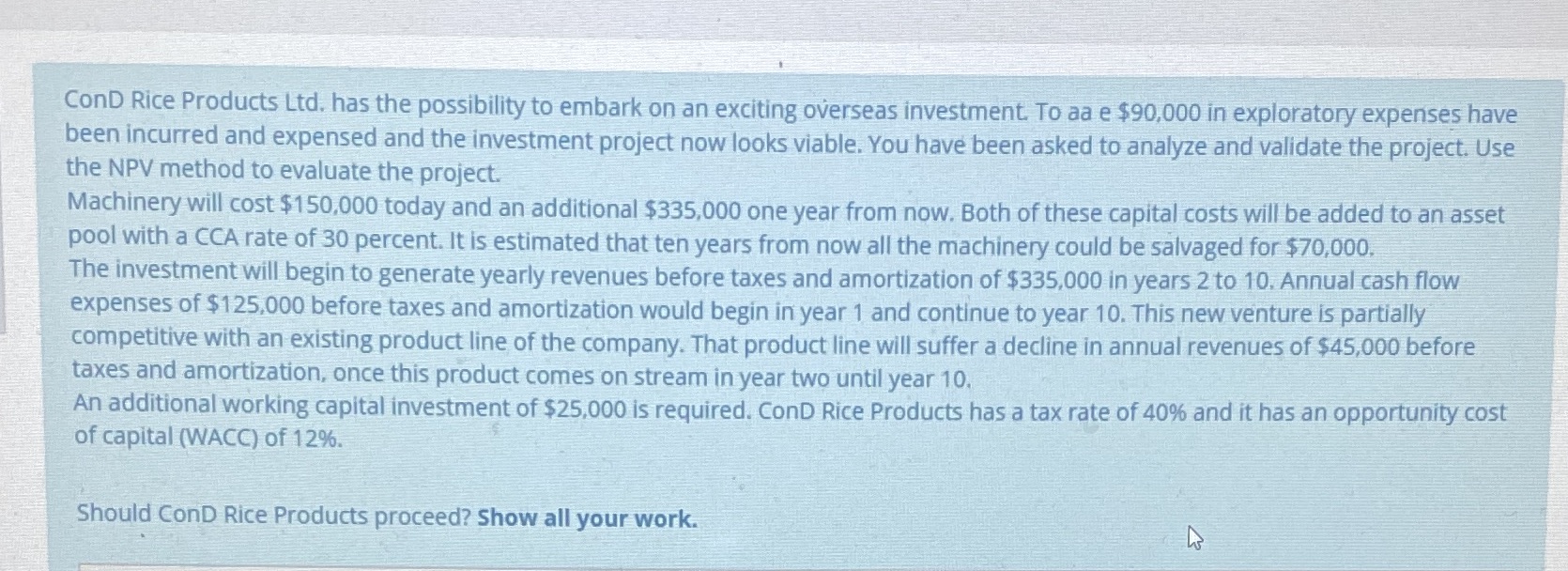

ConD Rice Products Ltd. has the possibility to embark on an exciting overseas investment. To aa e $90,000 in exploratory expenses have been incurred and expensed and the investment project now looks viable. You have been asked to analyze and validate the project. Use the NPV method to evaluate the project. Machinery will cost $150,000 today and an additional $335,000 one year from now. Both of these capital costs will be added to an asset pool with a CCA rate of 30 percent. It is estimated that ten years from now all the machinery could be salvaged for $70,000. The investment will begin to generate yearly revenues before taxes and amortization of $335,000 in years 2 to 10. Annual cash flow expenses of $125,000 before taxes and amortization would begin in year 1 and continue to year 10. This new venture is partially competitive with an existing product line of the company. That product line will suffer a decline in annual revenues of $45,000 before taxes and amortization, once this product comes on stream in year two until year 10. An additional working capital investment of $25,000 is required. ConD Rice Products has a tax rate of 40% and it has an opportunity cost of capital (WACC) of 12%. Should ConD Rice Products proceed? Show all your work.

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the overseas investment using the Net Present Value NPV method well discount all cash fl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started