Question

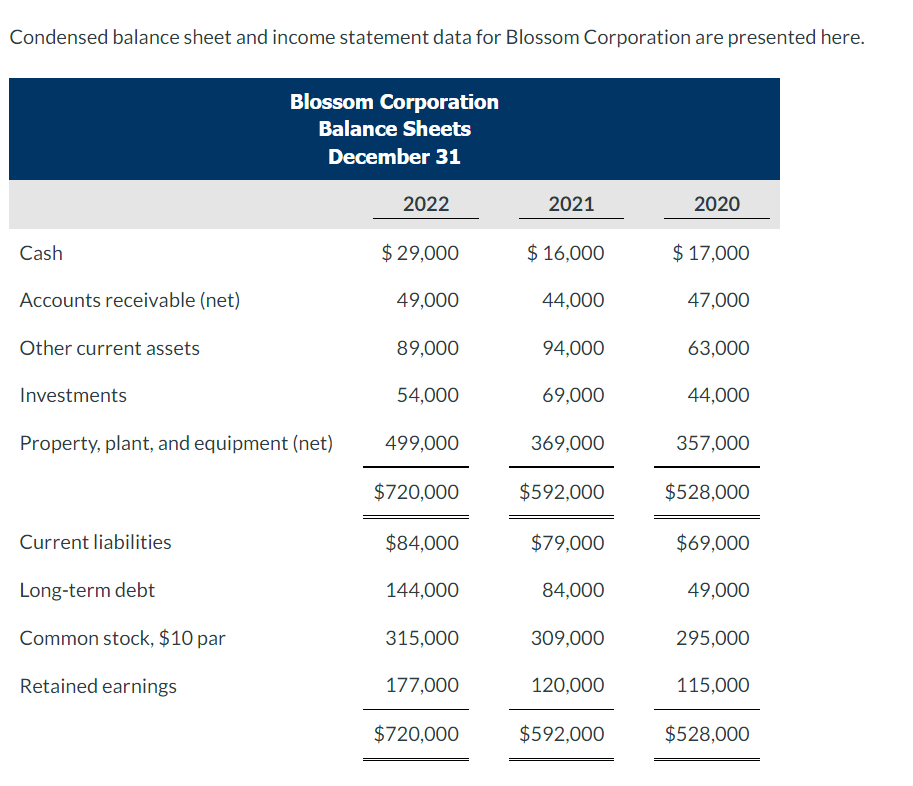

Condensed balance sheet and income statement data for Blossom Corporation are presented here. Blossom Corporation Balance Sheets December 31 2022 2021 2020 Cash $ 29,000

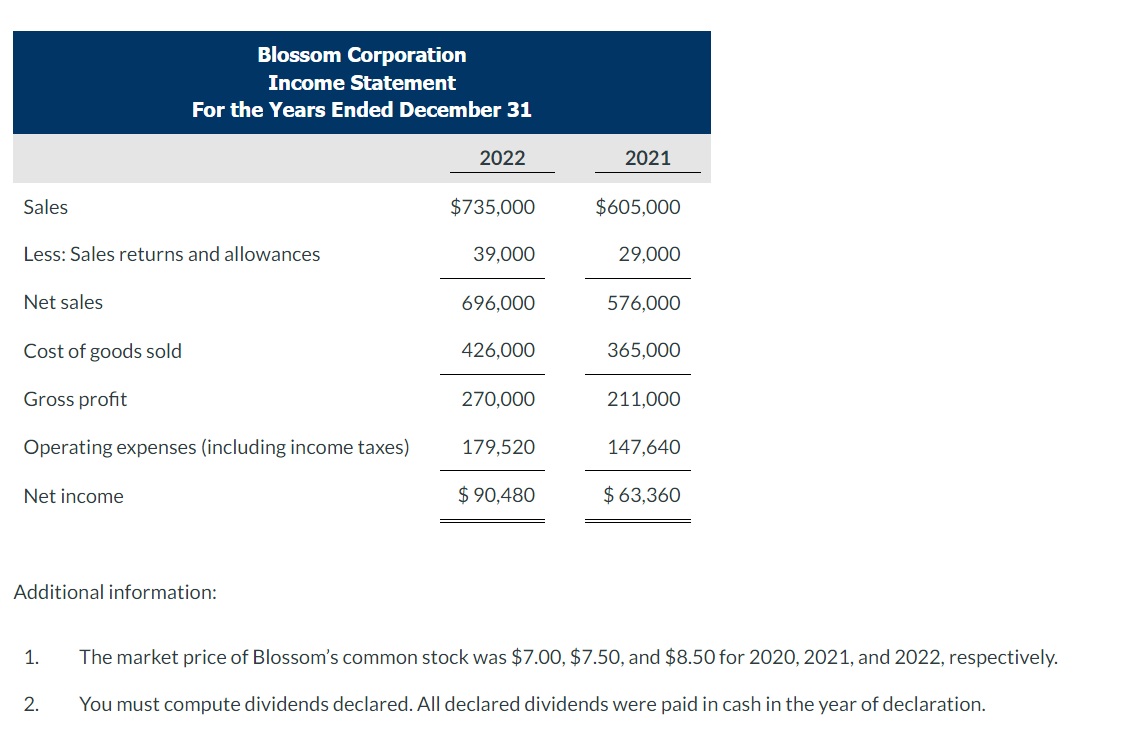

Condensed balance sheet and income statement data for Blossom Corporation are presented here. Blossom Corporation Balance Sheets December 31 2022 2021 2020 Cash $ 29,000 $ 16,000 $ 17,000 Accounts receivable (net) 49,000 44,000 47,000 Other current assets 89,000 94,000 63,000 Investments 54,000 69,000 44,000 Property, plant, and equipment (net) 499,000 369,000 357,000 $720,000 $592,000 $528,000 Current liabilities $84,000 $79,000 $69,000 Long-term debt 144,000 84,000 49,000 Common stock, $10 par 315,000 309,000 295,000 Retained earnings 177,000 120,000 115,000 $720,000 $592,000 $528,000 Blossom Corporation Income Statement For the Years Ended December 31 2022 2021 Sales $735,000 $605,000 Less: Sales returns and allowances 39,000 29,000 Net sales 696,000 576,000 Cost of goods sold 426,000 365,000 Gross profit 270,000 211,000 Operating expenses (including income taxes) 179,520 147,640 Net income $ 90,480 $ 63,360 Additional information: 1. The market price of Blossoms common stock was $7.00, $7.50, and $8.50 for 2020, 2021, and 2022, respectively. 2. You must compute dividends declared. All declared dividends were paid in cash in the year of declaration.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started