Answered step by step

Verified Expert Solution

Question

1 Approved Answer

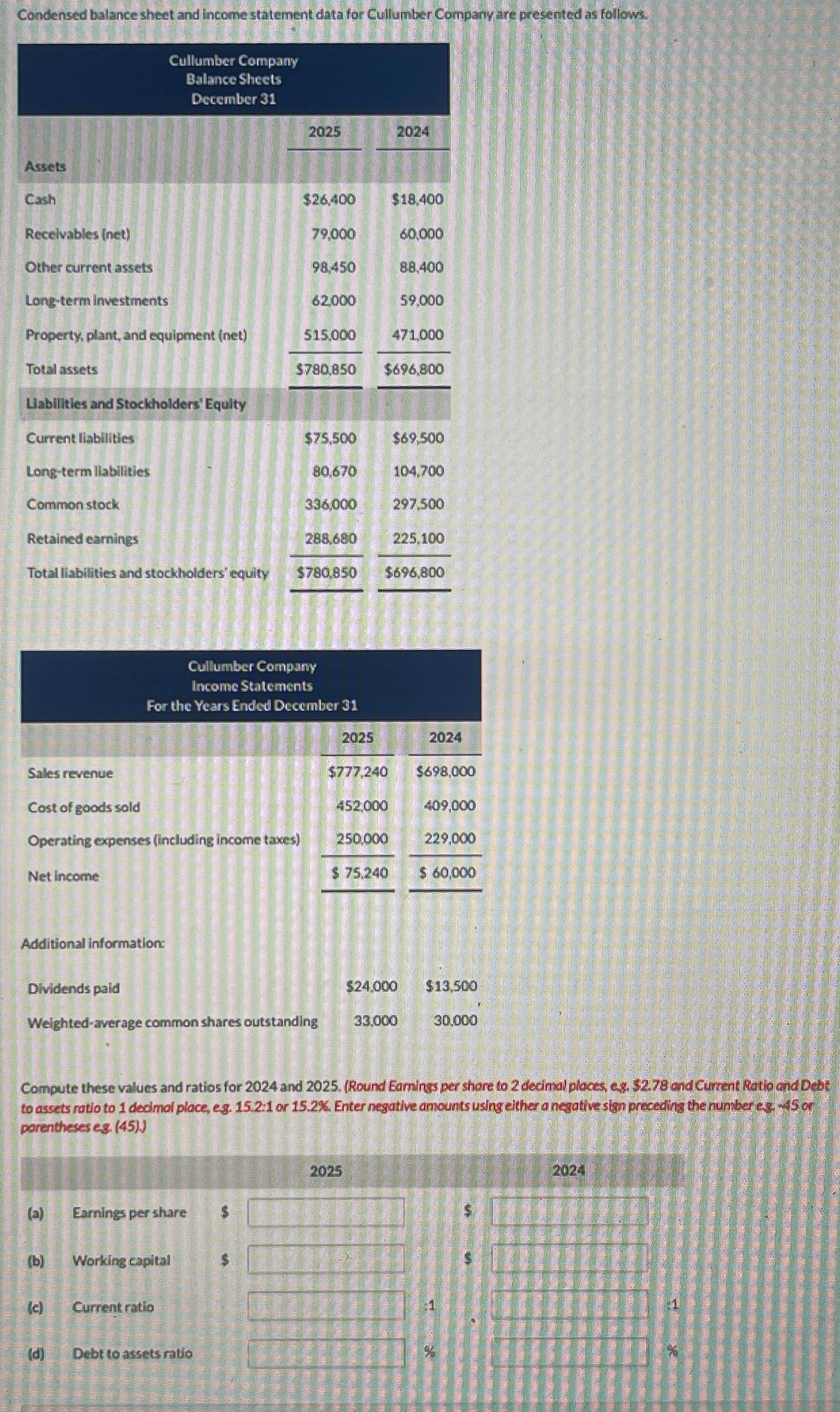

Condensed balance sheet and income statement data for Cullumber Company are presented as follows. Cullumber Company Balance Sheets Assets Cash December 31 2025 2024

Condensed balance sheet and income statement data for Cullumber Company are presented as follows. Cullumber Company Balance Sheets Assets Cash December 31 2025 2024 $26,400 $18,400 Receivables (net) 79,000 60,000 Other current assets 98,450 88,400 Long-term investments 62,000 59,000 Property, plant, and equipment (net) $15,000 471,000 Total assets $780.850 $696,800 Liabilities and Stockholders' Equity Current liabilities $75,500 $69,500 Long-term liabilities 80.670 104,700 Common stock 336,000 297,500 Retained earnings 288,680 225,100 Total liabilities and stockholders equity $780.850 $696.800 Cullumber Company Income Statements For the Years Ended December 31 2025 2024 Sales revenue $777,240 $698,000 Cost of goods sold 452.000 409,000 Operating expenses (including income taxes) 250,000 229,000 Net income 75.240 $ 60,000 Additional information: Dividends paid $24.000 $13.500 Weighted-average common shares outstanding 33.000 30.000 Compute these values and ratios for 2024 and 2025. (Round Earnings per share to 2 decimal places, eg. $2.78 and Current Ratio and Debt to assets ratio to 1 decimal place, eg. 15.2:1 or 15.2%. Enter negative amounts using either a negative sin preceding the number ex-45 or parentheses eg. (45)) (a) Earnings per share $ (b) Working capital (c) Current ratio 2025 $ (d) Debt to assets ratio % 2024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started