Conduct a comparative analysis to assess Rafikis costs and delivery times against those of potential logistics service providers.

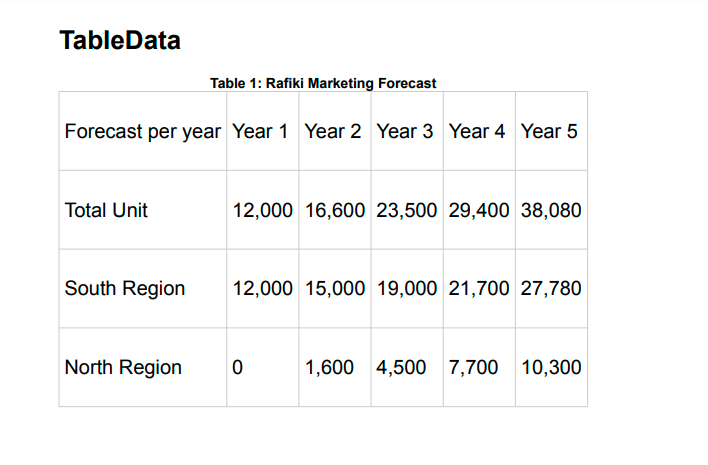

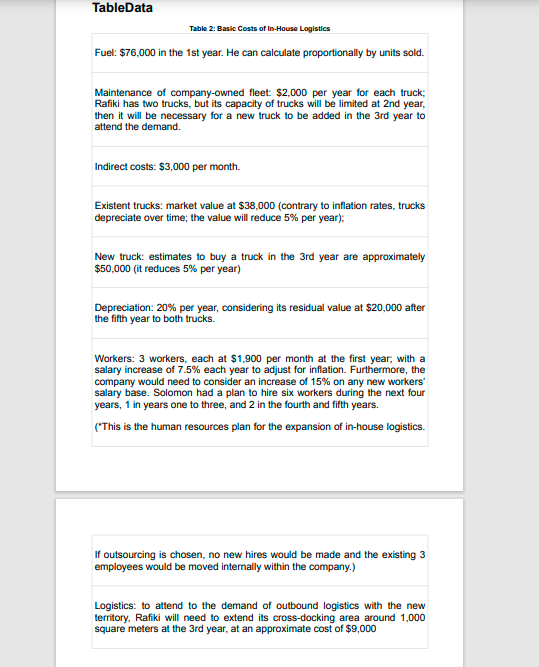

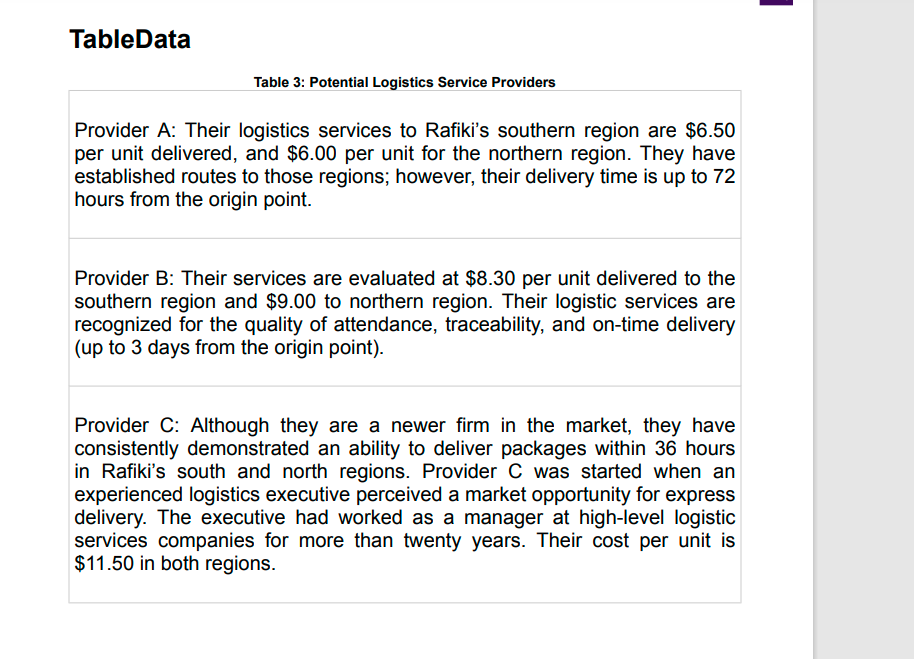

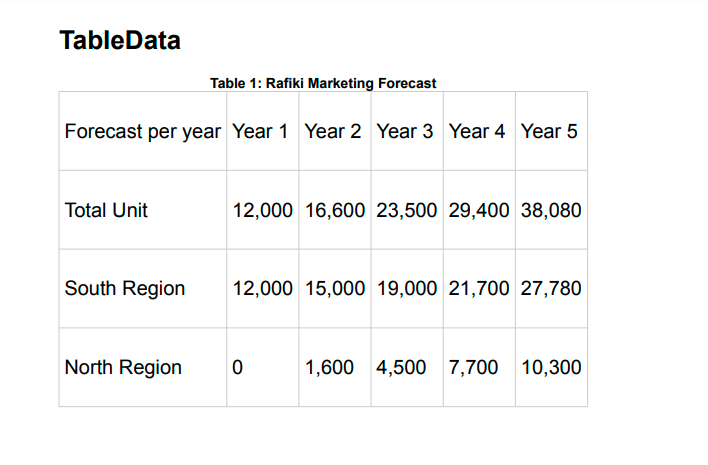

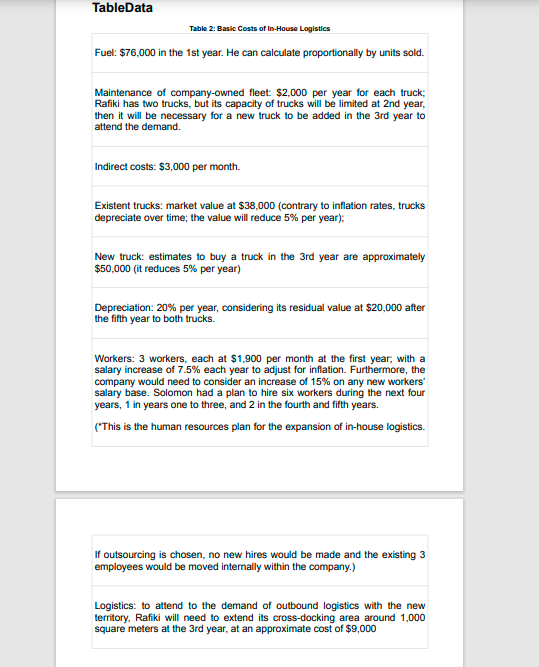

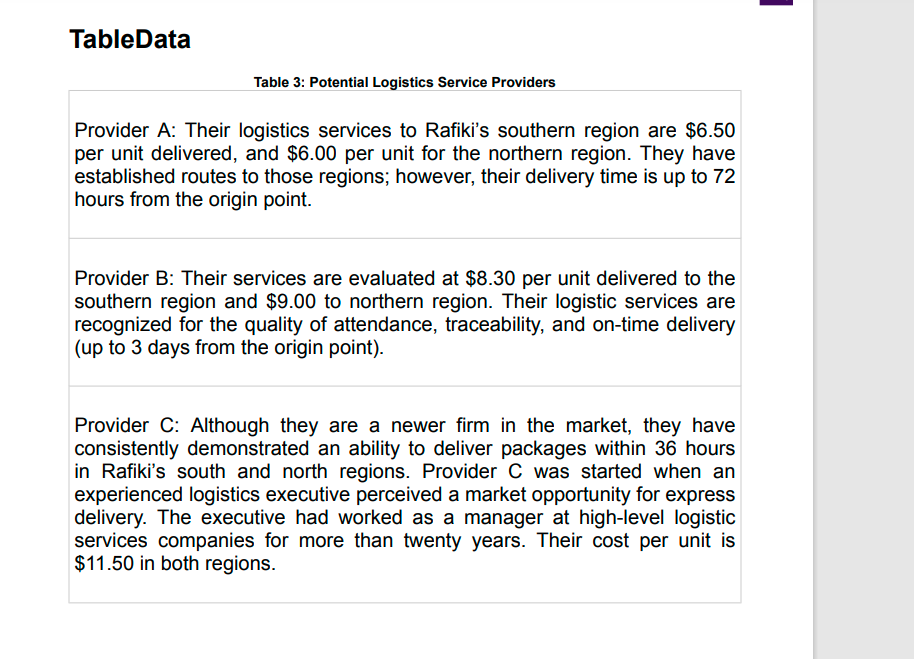

TableData Table 1: Rafiki Marketing Forecast Forecast per year Year 1 Year 2 Year 3 Year 4 Year 5 Total Unit 12,000 16,600 23,500 29,400 38,080 South Region 12,000 15,000 19,000 21,700 27,780 North Region 0 1,600 4,500 7,700 7,700 10,300 TableData Table 2: Basic Costs of In-House Logistics Fuel: $76,000 in the 1st year. He can calculate proportionally by units sold. Maintenance of company-owned fleet: $2,000 per year for each truck; Rafiki has two trucks, but its capacity of trucks will be limited at 2nd year, then it will be necessary for a new truck to be added in the 3rd year to attend the demand. Indirect costs: $3,000 per month. Existent trucks: market value at $38,000 (contrary to inflation rates, trucks depreciate over time; the value will reduce 5% per year); New truck: estimates to buy a truck in the 3rd year are approximately $50,000 (it reduces 5% per year) Depreciation: 20% per year, considering its residual value at $20,000 after the fifth year to both trucks. Workers: 3 workers, each at $1,900 per month at the first year, with a salary increase of 7.5% each year to adjust for inflation. Furthermore, the company would need to consider an increase of 15% on any new workers' salary base. Solomon had a plan to hire six workers during the next four years, 1 in years one to three, and 2 in the fourth and fifth years. ("This is the human resources plan for the expansion of in-house logistics. If outsourcing is chosen, no new hires would be made and the existing 3 employees would be moved internally within the company.) Logistics: to attend to the demand of outbound logistics with the new territory, Rafiki will need to extend its cross-docking area around 1,000 square meters at the 3rd year, at an approximate cost of $9,000 TableData Table 3: Potential Logistics Service Providers Provider A: Their logistics services to Rafiki's southern region are $6.50 per unit delivered, and $6.00 per unit for the northern region. They have established routes to those regions; however, their delivery time is up to 72 hours from the origin point. Provider B: Their services are evaluated at $8.30 per unit delivered to the southern region and $9.00 to northern region. Their logistic services are recognized for the quality of attendance, traceability, and on-time delivery (up to 3 days from the origin point). Provider C: Although they are a newer firm in the market, they have consistently demonstrated an ability to deliver packages within 36 hours in Rafiki's south and north regions. Provider C was started when an experienced logistics executive perceived a market opportunity for express delivery. The executive had worked as a manager at high-level logistic services companies for more than twenty years. Their cost per unit is $11.50 in both regions. TableData Table 1: Rafiki Marketing Forecast Forecast per year Year 1 Year 2 Year 3 Year 4 Year 5 Total Unit 12,000 16,600 23,500 29,400 38,080 South Region 12,000 15,000 19,000 21,700 27,780 North Region 0 1,600 4,500 7,700 7,700 10,300 TableData Table 2: Basic Costs of In-House Logistics Fuel: $76,000 in the 1st year. He can calculate proportionally by units sold. Maintenance of company-owned fleet: $2,000 per year for each truck; Rafiki has two trucks, but its capacity of trucks will be limited at 2nd year, then it will be necessary for a new truck to be added in the 3rd year to attend the demand. Indirect costs: $3,000 per month. Existent trucks: market value at $38,000 (contrary to inflation rates, trucks depreciate over time; the value will reduce 5% per year); New truck: estimates to buy a truck in the 3rd year are approximately $50,000 (it reduces 5% per year) Depreciation: 20% per year, considering its residual value at $20,000 after the fifth year to both trucks. Workers: 3 workers, each at $1,900 per month at the first year, with a salary increase of 7.5% each year to adjust for inflation. Furthermore, the company would need to consider an increase of 15% on any new workers' salary base. Solomon had a plan to hire six workers during the next four years, 1 in years one to three, and 2 in the fourth and fifth years. ("This is the human resources plan for the expansion of in-house logistics. If outsourcing is chosen, no new hires would be made and the existing 3 employees would be moved internally within the company.) Logistics: to attend to the demand of outbound logistics with the new territory, Rafiki will need to extend its cross-docking area around 1,000 square meters at the 3rd year, at an approximate cost of $9,000 TableData Table 3: Potential Logistics Service Providers Provider A: Their logistics services to Rafiki's southern region are $6.50 per unit delivered, and $6.00 per unit for the northern region. They have established routes to those regions; however, their delivery time is up to 72 hours from the origin point. Provider B: Their services are evaluated at $8.30 per unit delivered to the southern region and $9.00 to northern region. Their logistic services are recognized for the quality of attendance, traceability, and on-time delivery (up to 3 days from the origin point). Provider C: Although they are a newer firm in the market, they have consistently demonstrated an ability to deliver packages within 36 hours in Rafiki's south and north regions. Provider C was started when an experienced logistics executive perceived a market opportunity for express delivery. The executive had worked as a manager at high-level logistic services companies for more than twenty years. Their cost per unit is $11.50 in both regions