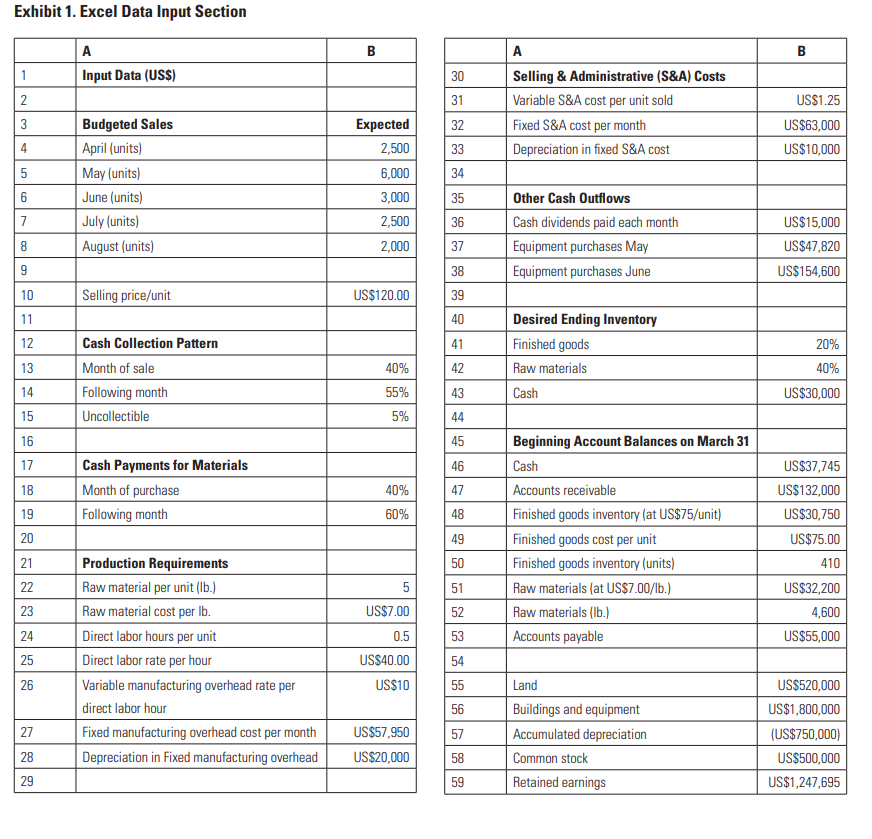

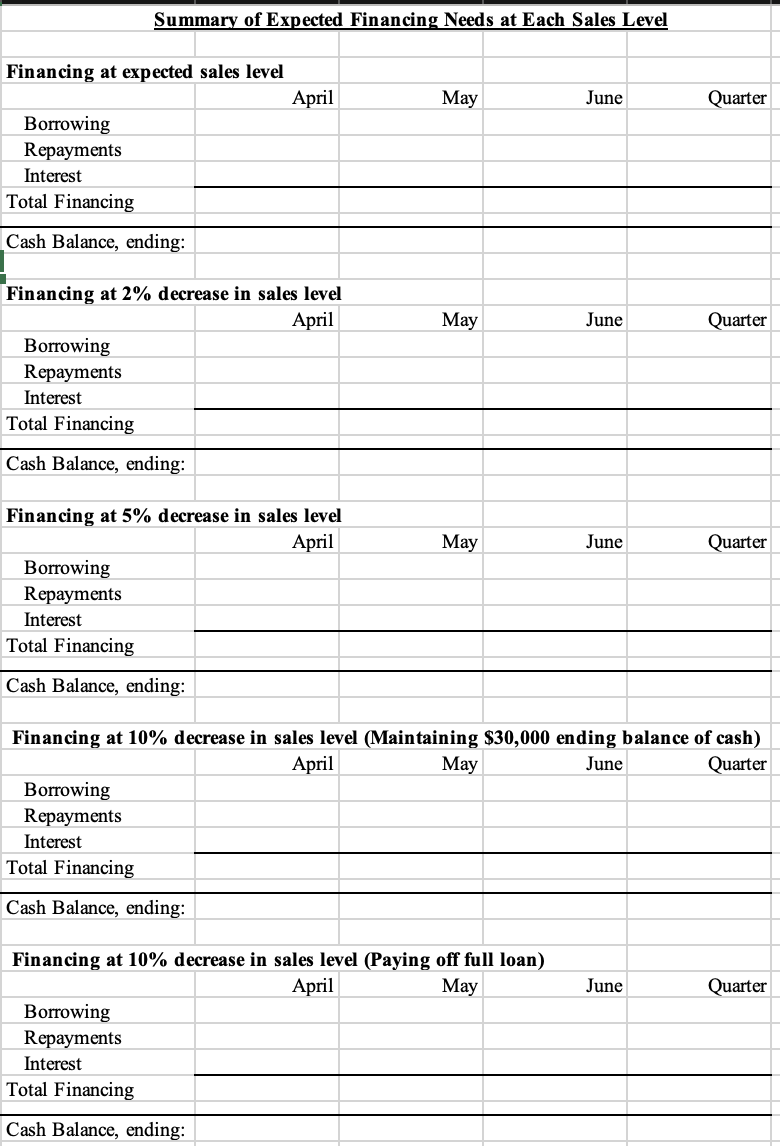

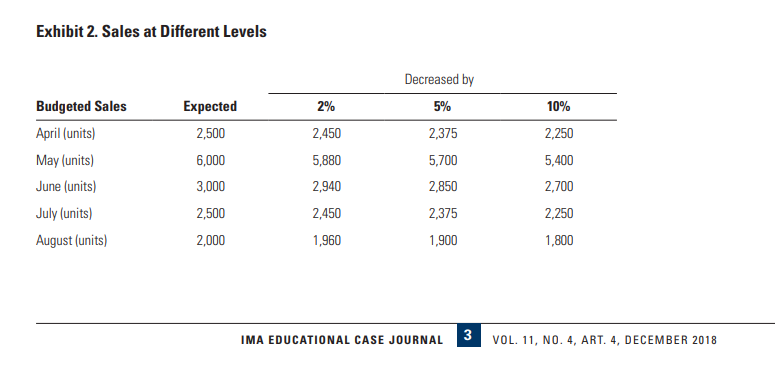

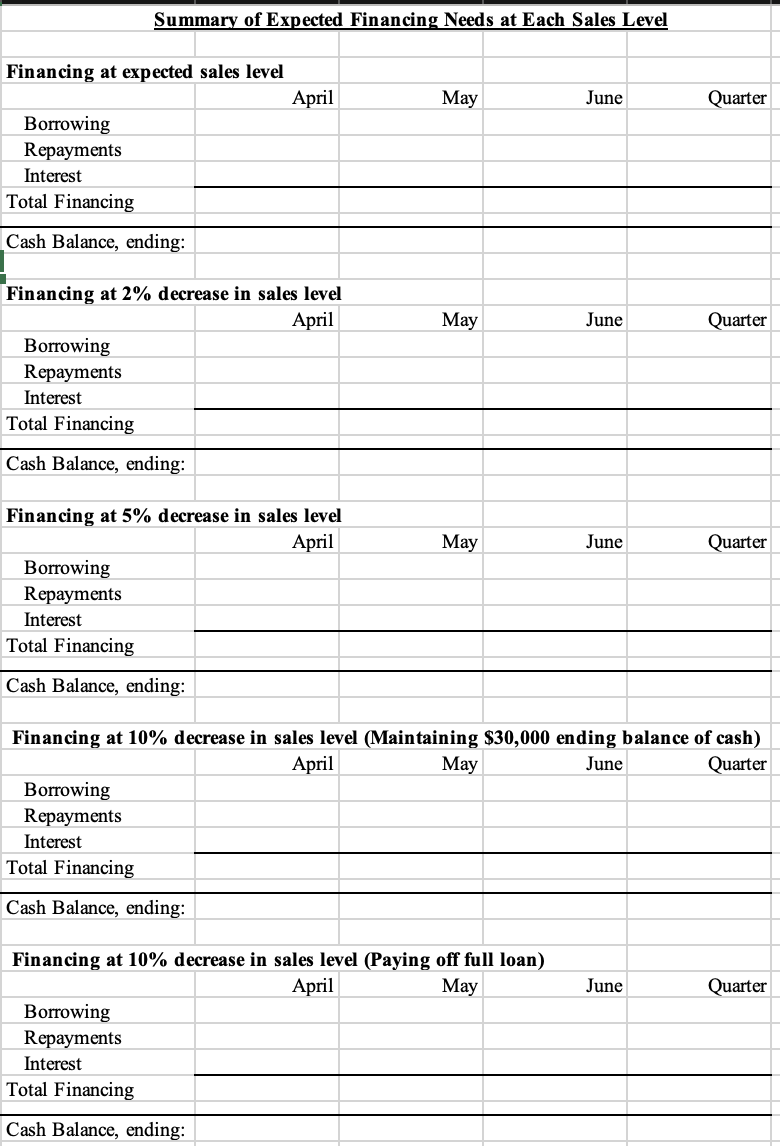

Conduct a sensitivity analysis, decreasing sales by 2%, 5%, and 10% for April through August. New sales levels are provided in (Excel sheet 2). Adjust the financing and cash needs at these new sales levels.

Conduct a sensitivity analysis, decreasing sales by 2%, 5%, and 10% for April through August. New sales levels are provided in (Excel sheet 2). Adjust the financing and cash needs at these new sales levels.

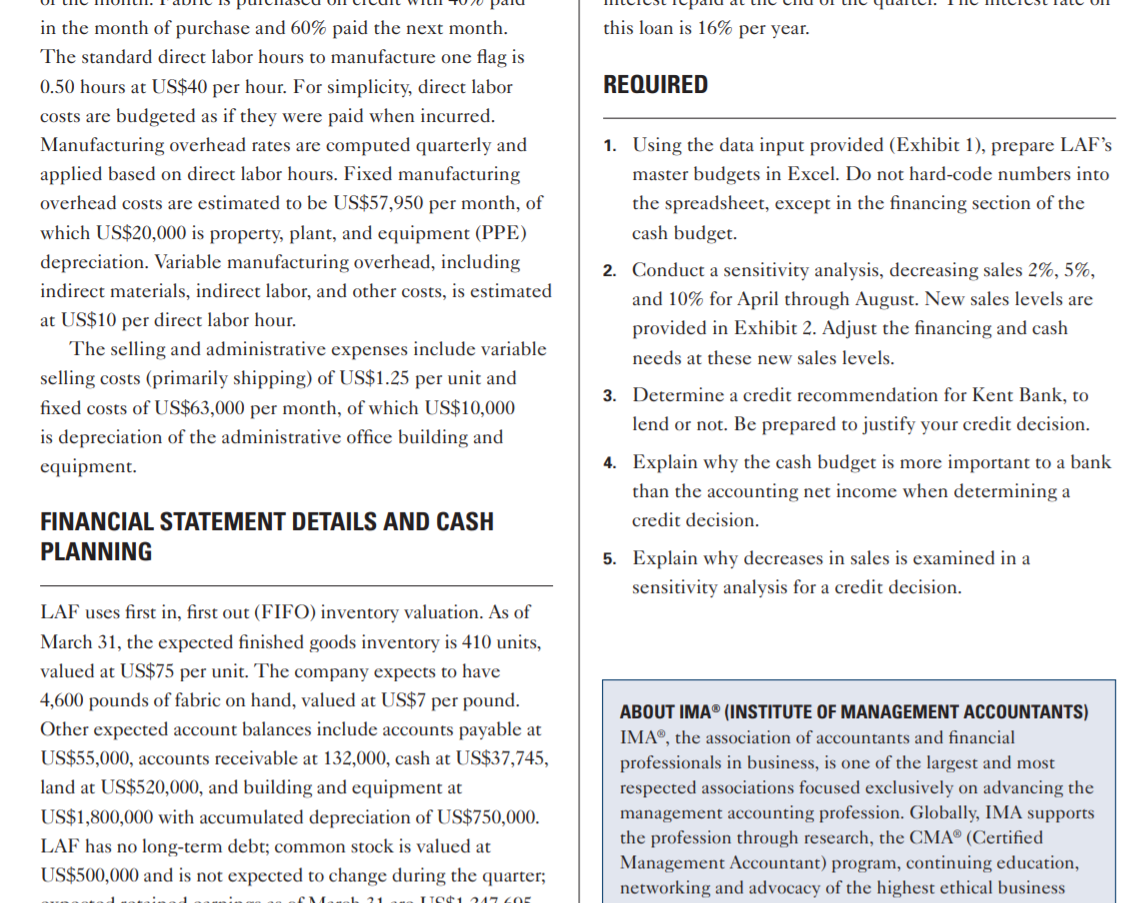

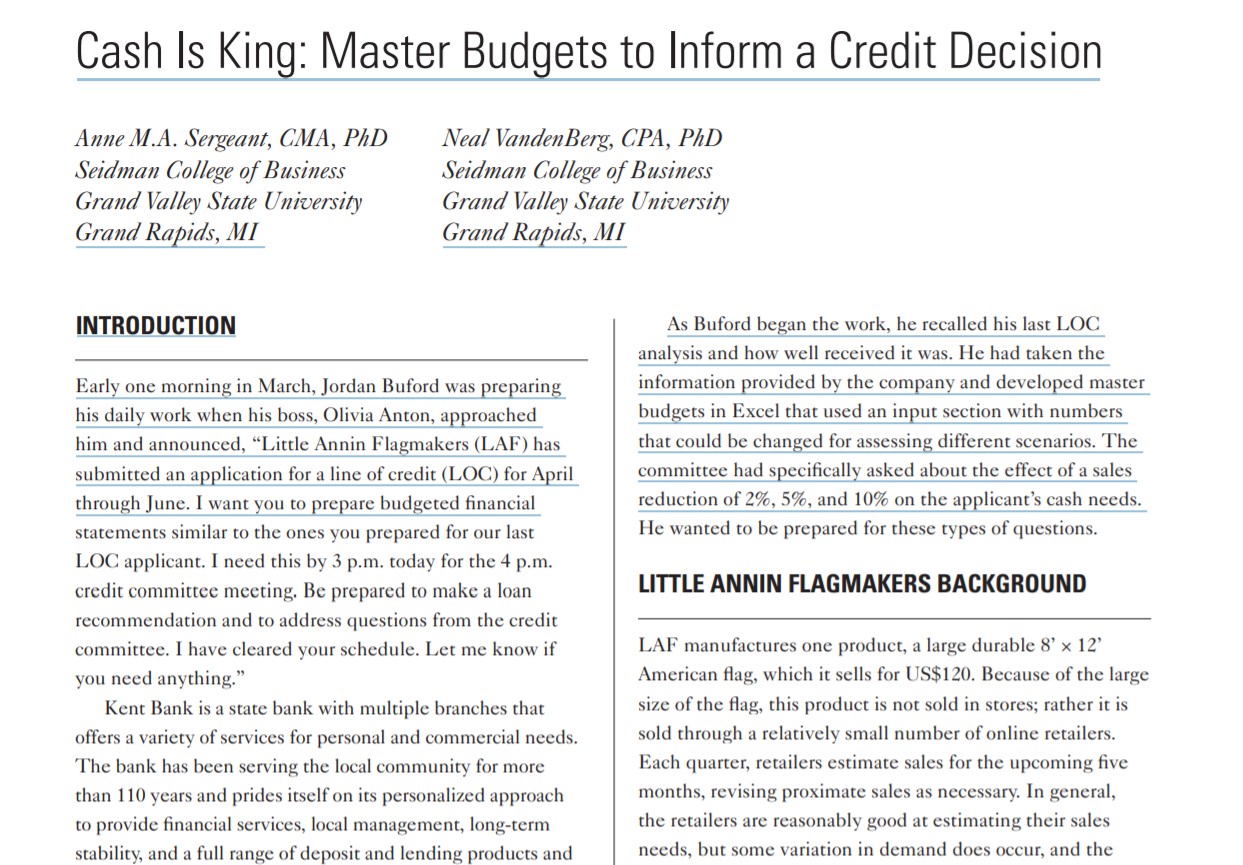

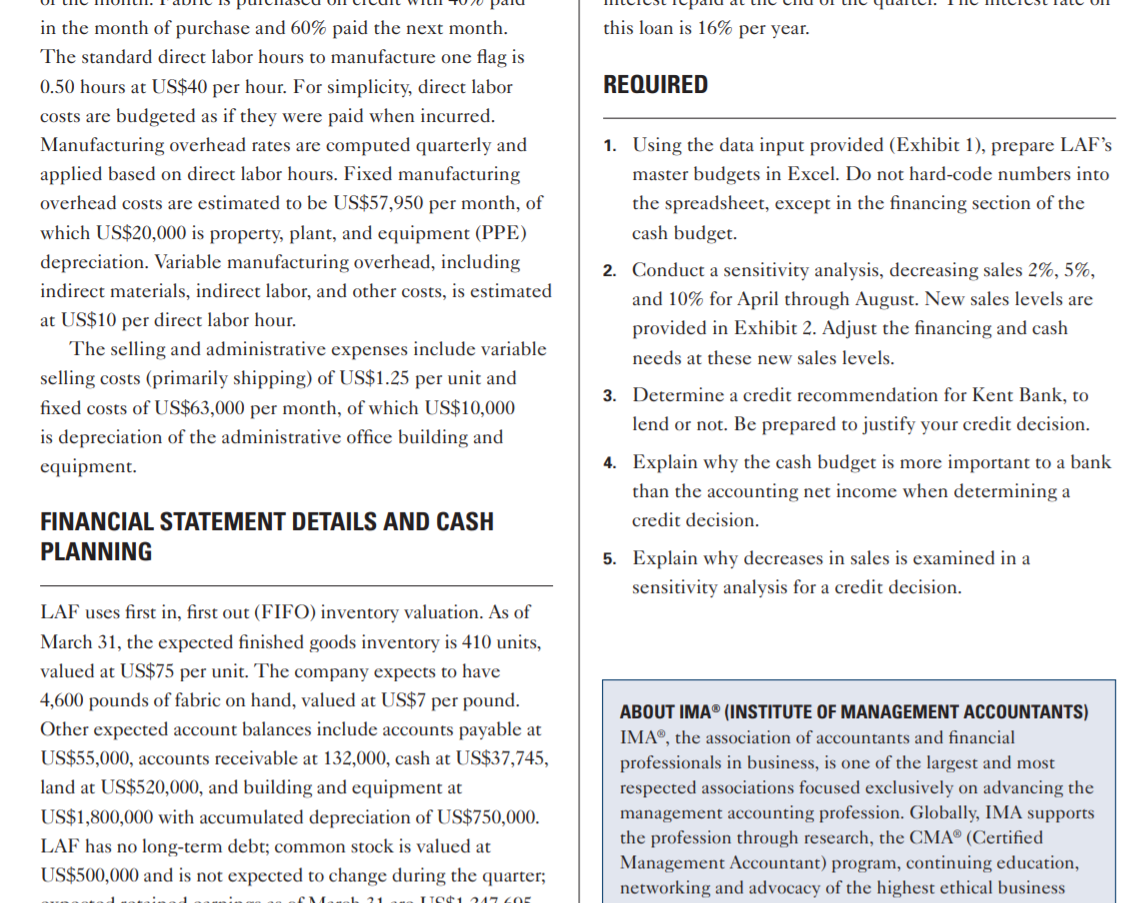

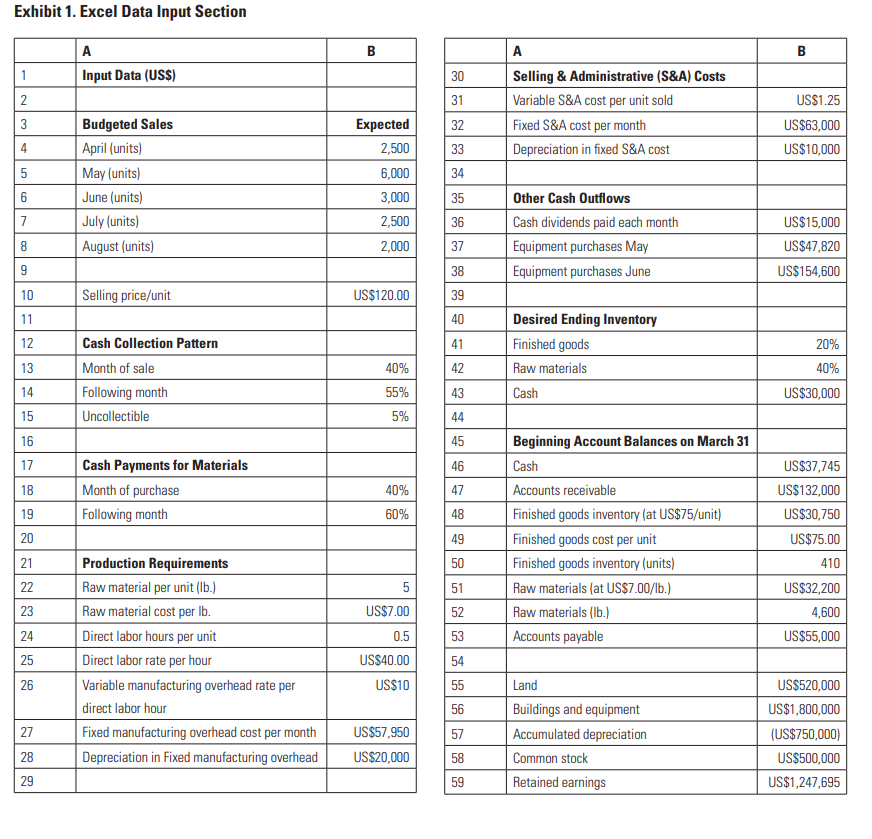

Exhibit 2. Sales at Different Levels Cash Is King: Master Budgets to Inform a Credit Decision INTRODUCTION Early one morning in March, Jordan Buford was preparing his daily work when his boss, Olivia Anton, approached him and announced, "Little Annin Flagmakers (LAF) has submitted an application for a line of credit (LOC) for April through June. I want you to prepare budgeted financial LOC applicant. I need this by 3 p.m. today for the 4 p.m. credit committee meeting. Be prepared to make a loan recommendation and to address questions from the credit committee. I have cleared your schedule. Let me know if you need anything." Kent Bank is a state bank with multiple branches that offers a variety of services for personal and commercial need The bank has been serving the local community for more than 110 years and prides itself on its personalized approach to provide financial services, local management, long-term As Buford began the work, he recalled his last LOC analysis and how well received it was. He had taken the formation provided by the company and developed master budgets in Excel that used an input section with numbers that could be changed for assessing different scenarios. The committee had specifically asked about the effect of a sales reduction of 2%,5%, and 10% on the applicant's cash need He wanted to be prepared for these types of questions. LITTLE ANNIN FLAGMAKERS BACKGROUND LAF manufactures one product, a large durable 8 ' 12 ' American flag, which it sells for US $120. Because of the large size of the flag, this product is not sold in stores; rather it is sold through a relatively small number of online retailers. Each quarter, retailers estimate sales for the upcoming five months, revising proximate sales as necessary. In general, the retailers are reasonably good at estimating their sales needs, but some variation in demand does occur, and the Cash Is King: Master Budgets to Inform a Credit Decision INTRODUCTION Early one morning in March, Jordan Buford was preparing his daily work when his boss, Olivia Anton, approached him and announced, "Little Annin Flagmakers (LAF) has submitted an application for a line of credit (LOC) for April through June. I want you to prepare budgeted financial LOC applicant. I need this by 3 p.m. today for the 4 p.m. credit committee meeting. Be prepared to make a loan recommendation and to address questions from the credit committee. I have cleared your schedule. Let me know if you need anything." Kent Bank is a state bank with multiple branches that offers a variety of services for personal and commercial need The bank has been serving the local community for more than 110 years and prides itself on its personalized approach to provide financial services, local management, long-term As Buford began the work, he recalled his last LOC analysis and how well received it was. He had taken the formation provided by the company and developed master budgets in Excel that used an input section with numbers that could be changed for assessing different scenarios. The committee had specifically asked about the effect of a sales reduction of 2%,5%, and 10% on the applicant's cash need He wanted to be prepared for these types of questions. LITTLE ANNIN FLAGMAKERS BACKGROUND LAF manufactures one product, a large durable 8 ' 12 ' American flag, which it sells for US $120. Because of the large size of the flag, this product is not sold in stores; rather it is sold through a relatively small number of online retailers. Each quarter, retailers estimate sales for the upcoming five months, revising proximate sales as necessary. In general, the retailers are reasonably good at estimating their sales needs, but some variation in demand does occur, and the in the month of purchase and 60% paid the next month. The standard direct labor hours to manufacture one flag is 0.50 hours at US $40 per hour. For simplicity, direct labor costs are budgeted as if they were paid when incurred. Manufacturing overhead rates are computed quarterly and applied based on direct labor hours. Fixed manufacturing overhead costs are estimated to be US $57,950 per month, of which US $20,000 is property, plant, and equipment (PPE) depreciation. Variable manufacturing overhead, including indirect materials, indirect labor, and other costs, is estimated at US $10 per direct labor hour. The selling and administrative expenses include variable selling costs (primarily shipping) of US $1.25 per unit and fixed costs of US $63,000 per month, of which US $10,000 is depreciation of the administrative office building and equipment. FINANCIAL STATEMENT DETAILS AND CASH PLANNING LAF uses first in, first out (FIFO) inventory valuation. As of March 31, the expected finished goods inventory is 410 units, valued at US $75 per unit. The company expects to have 4,600 pounds of fabric on hand, valued at US $7 per pound. Other expected account balances include accounts payable at US $55,000, accounts receivable at 132,000 , cash at US $37,745, land at US $520,000, and building and equipment at US $1,800,000 with accumulated depreciation of US $750,000. LAF has no long-term debt; common stock is valued at US $500,000 and is not expected to change during the quarter; this loan is 16% per year. REQUIRED 1. Using the data input provided (Exhibit 1), prepare LAF's master budgets in Excel. Do not hard-code numbers into the spreadsheet, except in the financing section of the cash budget. 2. Conduct a sensitivity analysis, decreasing sales 2%,5%, and 10% for April through August. New sales levels are provided in Exhibit 2. Adjust the financing and cash needs at these new sales levels. 3. Determine a credit recommendation for Kent Bank, to lend or not. Be prepared to justify your credit decision. 4. Explain why the cash budget is more important to a bank than the accounting net income when determining a credit decision. 5. Explain why decreases in sales is examined in a sensitivity analysis for a credit decision. ABOUT IMA (INSTITUTE OF MANAGEMENT ACCOUNTANTS) IMA , the association of accountants and financial professionals in business, is one of the largest and most respected associations focused exclusively on advancing the management accounting profession. Globally, IMA supports the profession through research, the CMA (Certified Management Accountant) program, continuing education, networking and advocacy of the highest ethical business Exhibit 1. Excel Data Input Section Exhibit 2. Sales at Different Levels in the month of purchase and 60% paid the next month. The standard direct labor hours to manufacture one flag is 0.50 hours at US $40 per hour. For simplicity, direct labor costs are budgeted as if they were paid when incurred. Manufacturing overhead rates are computed quarterly and applied based on direct labor hours. Fixed manufacturing overhead costs are estimated to be US $57,950 per month, of which US $20,000 is property, plant, and equipment (PPE) depreciation. Variable manufacturing overhead, including indirect materials, indirect labor, and other costs, is estimated at US $10 per direct labor hour. The selling and administrative expenses include variable selling costs (primarily shipping) of US $1.25 per unit and fixed costs of US $63,000 per month, of which US $10,000 is depreciation of the administrative office building and equipment. FINANCIAL STATEMENT DETAILS AND CASH PLANNING LAF uses first in, first out (FIFO) inventory valuation. As of March 31, the expected finished goods inventory is 410 units, valued at US $75 per unit. The company expects to have 4,600 pounds of fabric on hand, valued at US $7 per pound. Other expected account balances include accounts payable at US $55,000, accounts receivable at 132,000 , cash at US $37,745, land at US $520,000, and building and equipment at US $1,800,000 with accumulated depreciation of US $750,000. LAF has no long-term debt; common stock is valued at US $500,000 and is not expected to change during the quarter; this loan is 16% per year. REQUIRED 1. Using the data input provided (Exhibit 1), prepare LAF's master budgets in Excel. Do not hard-code numbers into the spreadsheet, except in the financing section of the cash budget. 2. Conduct a sensitivity analysis, decreasing sales 2%,5%, and 10% for April through August. New sales levels are provided in Exhibit 2. Adjust the financing and cash needs at these new sales levels. 3. Determine a credit recommendation for Kent Bank, to lend or not. Be prepared to justify your credit decision. 4. Explain why the cash budget is more important to a bank than the accounting net income when determining a credit decision. 5. Explain why decreases in sales is examined in a sensitivity analysis for a credit decision. ABOUT IMA (INSTITUTE OF MANAGEMENT ACCOUNTANTS) IMA , the association of accountants and financial professionals in business, is one of the largest and most respected associations focused exclusively on advancing the management accounting profession. Globally, IMA supports the profession through research, the CMA (Certified Management Accountant) program, continuing education, networking and advocacy of the highest ethical business Exhibit 1. Excel Data Input Section Exhibit 2. Sales at Different Levels Cash Is King: Master Budgets to Inform a Credit Decision INTRODUCTION Early one morning in March, Jordan Buford was preparing his daily work when his boss, Olivia Anton, approached him and announced, "Little Annin Flagmakers (LAF) has submitted an application for a line of credit (LOC) for April through June. I want you to prepare budgeted financial LOC applicant. I need this by 3 p.m. today for the 4 p.m. credit committee meeting. Be prepared to make a loan recommendation and to address questions from the credit committee. I have cleared your schedule. Let me know if you need anything." Kent Bank is a state bank with multiple branches that offers a variety of services for personal and commercial need The bank has been serving the local community for more than 110 years and prides itself on its personalized approach to provide financial services, local management, long-term As Buford began the work, he recalled his last LOC analysis and how well received it was. He had taken the formation provided by the company and developed master budgets in Excel that used an input section with numbers that could be changed for assessing different scenarios. The committee had specifically asked about the effect of a sales reduction of 2%,5%, and 10% on the applicant's cash need He wanted to be prepared for these types of questions. LITTLE ANNIN FLAGMAKERS BACKGROUND LAF manufactures one product, a large durable 8 ' 12 ' American flag, which it sells for US $120. Because of the large size of the flag, this product is not sold in stores; rather it is sold through a relatively small number of online retailers. Each quarter, retailers estimate sales for the upcoming five months, revising proximate sales as necessary. In general, the retailers are reasonably good at estimating their sales needs, but some variation in demand does occur, and the Cash Is King: Master Budgets to Inform a Credit Decision INTRODUCTION Early one morning in March, Jordan Buford was preparing his daily work when his boss, Olivia Anton, approached him and announced, "Little Annin Flagmakers (LAF) has submitted an application for a line of credit (LOC) for April through June. I want you to prepare budgeted financial LOC applicant. I need this by 3 p.m. today for the 4 p.m. credit committee meeting. Be prepared to make a loan recommendation and to address questions from the credit committee. I have cleared your schedule. Let me know if you need anything." Kent Bank is a state bank with multiple branches that offers a variety of services for personal and commercial need The bank has been serving the local community for more than 110 years and prides itself on its personalized approach to provide financial services, local management, long-term As Buford began the work, he recalled his last LOC analysis and how well received it was. He had taken the formation provided by the company and developed master budgets in Excel that used an input section with numbers that could be changed for assessing different scenarios. The committee had specifically asked about the effect of a sales reduction of 2%,5%, and 10% on the applicant's cash need He wanted to be prepared for these types of questions. LITTLE ANNIN FLAGMAKERS BACKGROUND LAF manufactures one product, a large durable 8 ' 12 ' American flag, which it sells for US $120. Because of the large size of the flag, this product is not sold in stores; rather it is sold through a relatively small number of online retailers. Each quarter, retailers estimate sales for the upcoming five months, revising proximate sales as necessary. In general, the retailers are reasonably good at estimating their sales needs, but some variation in demand does occur, and the in the month of purchase and 60% paid the next month. The standard direct labor hours to manufacture one flag is 0.50 hours at US $40 per hour. For simplicity, direct labor costs are budgeted as if they were paid when incurred. Manufacturing overhead rates are computed quarterly and applied based on direct labor hours. Fixed manufacturing overhead costs are estimated to be US $57,950 per month, of which US $20,000 is property, plant, and equipment (PPE) depreciation. Variable manufacturing overhead, including indirect materials, indirect labor, and other costs, is estimated at US $10 per direct labor hour. The selling and administrative expenses include variable selling costs (primarily shipping) of US $1.25 per unit and fixed costs of US $63,000 per month, of which US $10,000 is depreciation of the administrative office building and equipment. FINANCIAL STATEMENT DETAILS AND CASH PLANNING LAF uses first in, first out (FIFO) inventory valuation. As of March 31, the expected finished goods inventory is 410 units, valued at US $75 per unit. The company expects to have 4,600 pounds of fabric on hand, valued at US $7 per pound. Other expected account balances include accounts payable at US $55,000, accounts receivable at 132,000 , cash at US $37,745, land at US $520,000, and building and equipment at US $1,800,000 with accumulated depreciation of US $750,000. LAF has no long-term debt; common stock is valued at US $500,000 and is not expected to change during the quarter; this loan is 16% per year. REQUIRED 1. Using the data input provided (Exhibit 1), prepare LAF's master budgets in Excel. Do not hard-code numbers into the spreadsheet, except in the financing section of the cash budget. 2. Conduct a sensitivity analysis, decreasing sales 2%,5%, and 10% for April through August. New sales levels are provided in Exhibit 2. Adjust the financing and cash needs at these new sales levels. 3. Determine a credit recommendation for Kent Bank, to lend or not. Be prepared to justify your credit decision. 4. Explain why the cash budget is more important to a bank than the accounting net income when determining a credit decision. 5. Explain why decreases in sales is examined in a sensitivity analysis for a credit decision. ABOUT IMA (INSTITUTE OF MANAGEMENT ACCOUNTANTS) IMA , the association of accountants and financial professionals in business, is one of the largest and most respected associations focused exclusively on advancing the management accounting profession. Globally, IMA supports the profession through research, the CMA (Certified Management Accountant) program, continuing education, networking and advocacy of the highest ethical business Exhibit 1. Excel Data Input Section Exhibit 2. Sales at Different Levels in the month of purchase and 60% paid the next month. The standard direct labor hours to manufacture one flag is 0.50 hours at US $40 per hour. For simplicity, direct labor costs are budgeted as if they were paid when incurred. Manufacturing overhead rates are computed quarterly and applied based on direct labor hours. Fixed manufacturing overhead costs are estimated to be US $57,950 per month, of which US $20,000 is property, plant, and equipment (PPE) depreciation. Variable manufacturing overhead, including indirect materials, indirect labor, and other costs, is estimated at US $10 per direct labor hour. The selling and administrative expenses include variable selling costs (primarily shipping) of US $1.25 per unit and fixed costs of US $63,000 per month, of which US $10,000 is depreciation of the administrative office building and equipment. FINANCIAL STATEMENT DETAILS AND CASH PLANNING LAF uses first in, first out (FIFO) inventory valuation. As of March 31, the expected finished goods inventory is 410 units, valued at US $75 per unit. The company expects to have 4,600 pounds of fabric on hand, valued at US $7 per pound. Other expected account balances include accounts payable at US $55,000, accounts receivable at 132,000 , cash at US $37,745, land at US $520,000, and building and equipment at US $1,800,000 with accumulated depreciation of US $750,000. LAF has no long-term debt; common stock is valued at US $500,000 and is not expected to change during the quarter; this loan is 16% per year. REQUIRED 1. Using the data input provided (Exhibit 1), prepare LAF's master budgets in Excel. Do not hard-code numbers into the spreadsheet, except in the financing section of the cash budget. 2. Conduct a sensitivity analysis, decreasing sales 2%,5%, and 10% for April through August. New sales levels are provided in Exhibit 2. Adjust the financing and cash needs at these new sales levels. 3. Determine a credit recommendation for Kent Bank, to lend or not. Be prepared to justify your credit decision. 4. Explain why the cash budget is more important to a bank than the accounting net income when determining a credit decision. 5. Explain why decreases in sales is examined in a sensitivity analysis for a credit decision. ABOUT IMA (INSTITUTE OF MANAGEMENT ACCOUNTANTS) IMA , the association of accountants and financial professionals in business, is one of the largest and most respected associations focused exclusively on advancing the management accounting profession. Globally, IMA supports the profession through research, the CMA (Certified Management Accountant) program, continuing education, networking and advocacy of the highest ethical business Exhibit 1. Excel Data Input

Conduct a sensitivity analysis, decreasing sales by 2%, 5%, and 10% for April through August. New sales levels are provided in (Excel sheet 2). Adjust the financing and cash needs at these new sales levels.

Conduct a sensitivity analysis, decreasing sales by 2%, 5%, and 10% for April through August. New sales levels are provided in (Excel sheet 2). Adjust the financing and cash needs at these new sales levels.