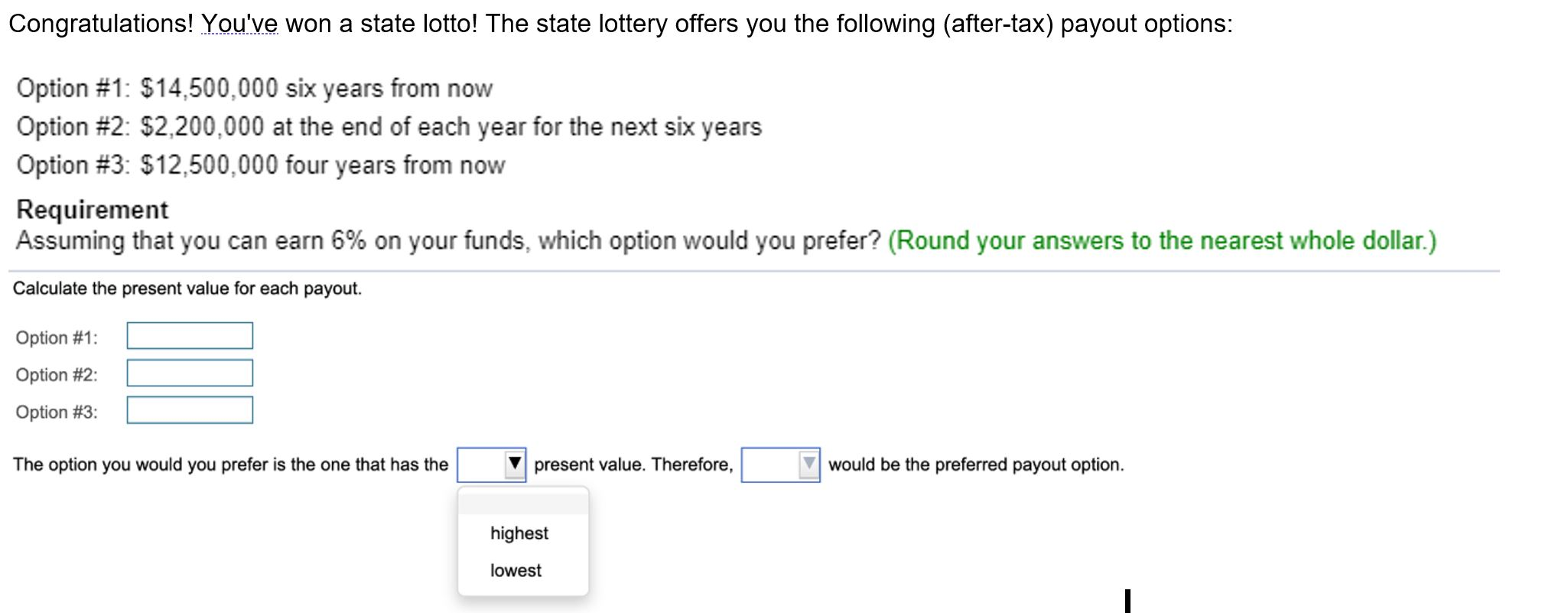

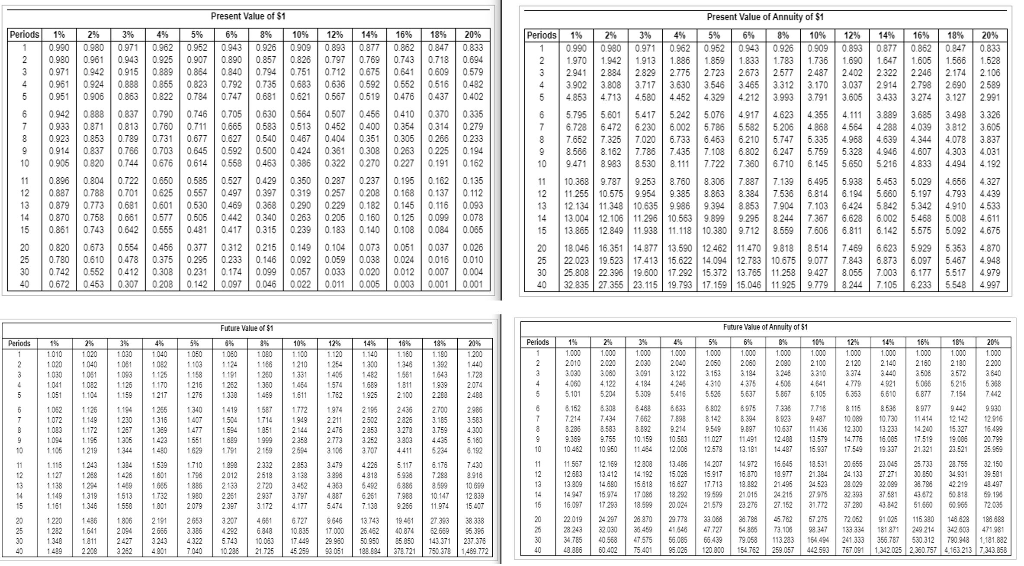

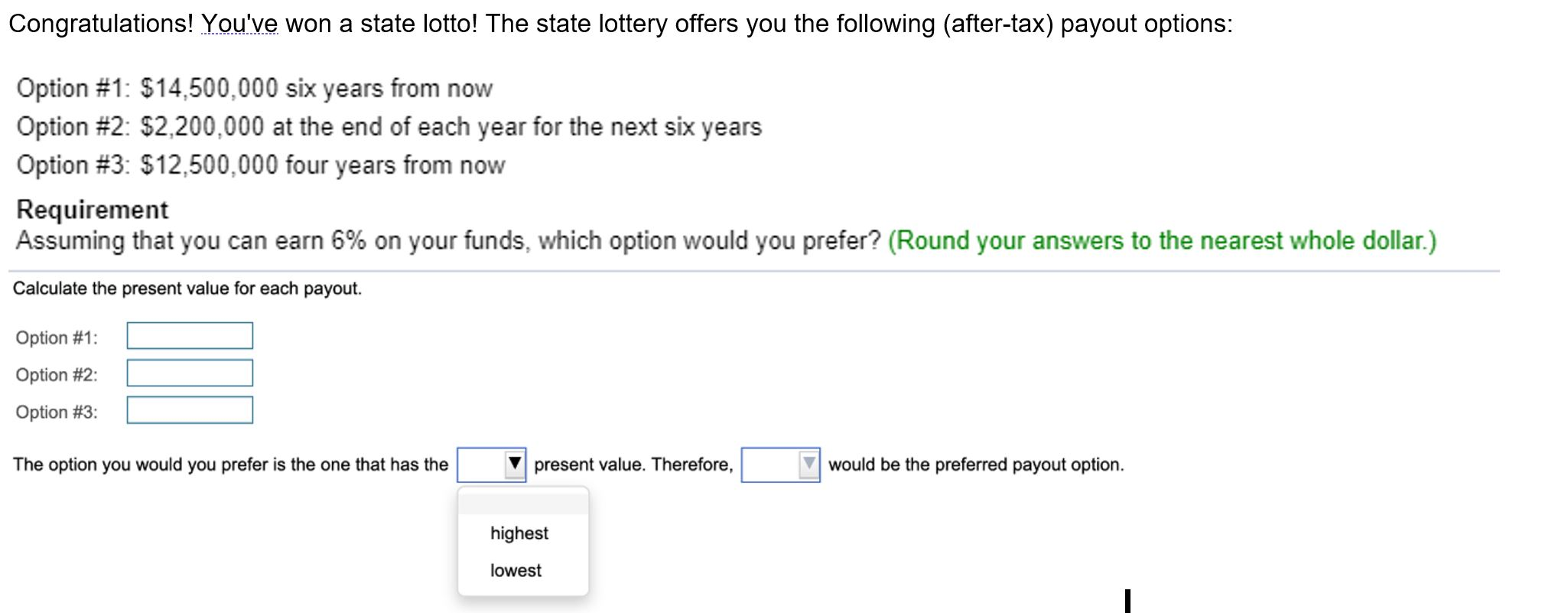

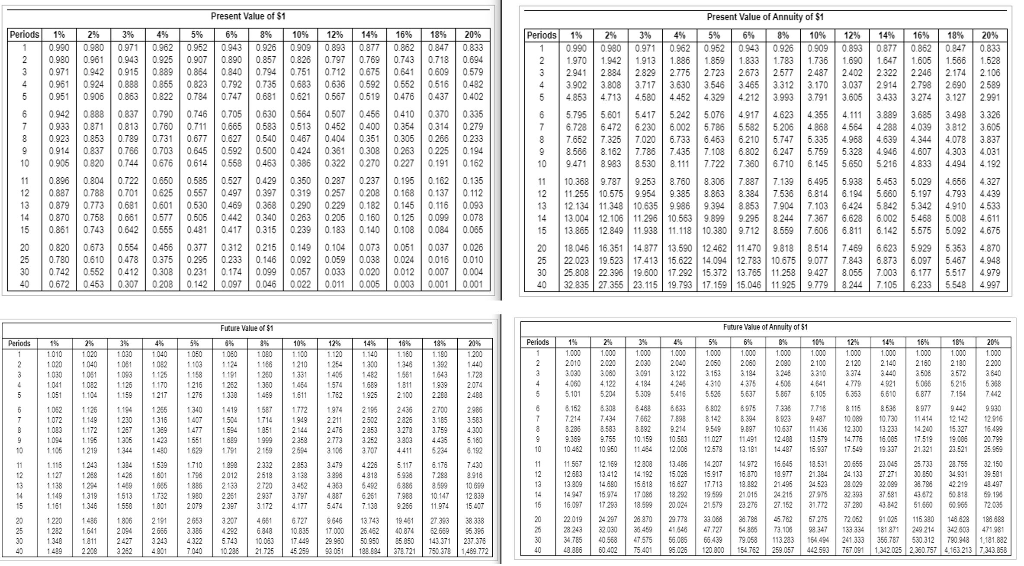

Congratulations! You've won a state lotto! The state lottery offers you the following (after-tax) payout options: Option #1: $14,500,000 six years from now Option #2: $2,200,000 at the end of each year for the next six years Option #3: $12,500,000 four years from now Requirement Assuming that you can earn 6% on your funds, which option would you prefer? (Round your answers to the nearest whole dollar.) Calculate the present value for each payout. Option #1: Option #2: Option #3: The option you would you prefer is the one that has the present value. Therefore, would be the preferred payout option. highest lowest Present Value of $1 . . 1. . . . 110, 112 : | 0942 | 0915 | ? | 0.864 1 0.840 | 0.794 | 0751 | 0712 | 0.07 0.641 | 0.609 98 | 2 | 3 | 4 | 2 | 3 | | 5 | 6 | 2 | 3 | 19 | 24. 1 1 1 1 1 1 1 | . 0.923 | 0.853 | 0.789 | 0731 | .677 | 0.027 | 0.640 | o467 | 0.404 | o351 | o306 10 26s Toy 0.914 | o837 | 0.766 | 2.703 | 0.645 | 0.592 | 0.500 | 0424 | 0.381 | o 308 | 0.263 | 0 225 | 0.19 | 0906 | 0820 | 0.744 | 0676 | 0614 | 0558 | 0.453 | o386 | 0322 | 27 | 22 | 0.191 un o ooo oooooooooooooo Present Value of Annuity of 11%, 12, 13, 14, 15% 16% 18% 10% 1 125 5 173 1736 1 1680 | 1647 1.606 | 2 941 | 2 834 2329 | 2775 | 2723 | 2.673 2577 | 2 437 2402 2 322 1224 1 1 1 1 1 1 1 0 1 312 | 170 13037 | 2014 | 2790 1 2 690 1 1 1 1 1 1 1 1 1 1 1 1 1 1 1 | | | | | | | | | | 49 | 1.652 | 326 | 1020 | 25 26 | 8.500 | 162 | 7.7% | 7.435 | 7.108 | 802 | 6.247 | 5.769 | 5.323 | 4.946 | 4.607 | 4 303 | 9471 | 3 983 | 8.530 | 8.11 | 1.722 | 7.360 | 6.710 | 6.145 | 5.650 | 5216 | 4833 | 4 494 | 4 192 | 10.368 | 9.787 | 9 263 | 8.760 | 8.306 | 7.887 | 7.139 | 6.496 | 5.933 | 5.452 5.029 | 4.666 | 1 | | | | | | | | | | | | 13 004 | 12 106 | 11 205 | 10.56 | | 9 205 | 8 244 | 7 367 | 628 | 5 002 | 5 468 | | 2011 | 13.365 | 12.349 | 11 933 | 11.113 | 1038 | 9712 8.559 | 1.606 | 6.811 | 6.142 | 5.575 | 5.092 | 4.675 20 | 18.045 | 16.351 | 14.877 | 13.590 | 12 462 | 11470 | 9.818 | 8.514 | 7 469 | .623 | 5.929 5. 363 | 4 870 5.46 1943 2032 235 213 I 15 | 19 17.1se | 45 46 | 11925 | 770 I a 24 | 1105 | 6 233 . B un | 14 | 0.861 | 2.743 | 1.642 | 0555 | 0431 | 0417 | o315 | 0 239 | 183 | 0.140 | | o.os 0.820 | 0.673 | 0.654 | 0.456 | 0.377 | 0312 | 0216 | 0.149 | 0104 | | oost | o037 | 25 10.780 1 0.610 10.473 1 0.375 0.291 0233 10.146 19.092 10.059 12.038 10.024 | 2016 | 0.01 72 | o453 | | 142 | oo97 | opa6 | oo22 | oo11 | ooos | 1 : Future Value of Annuity of Periods 16