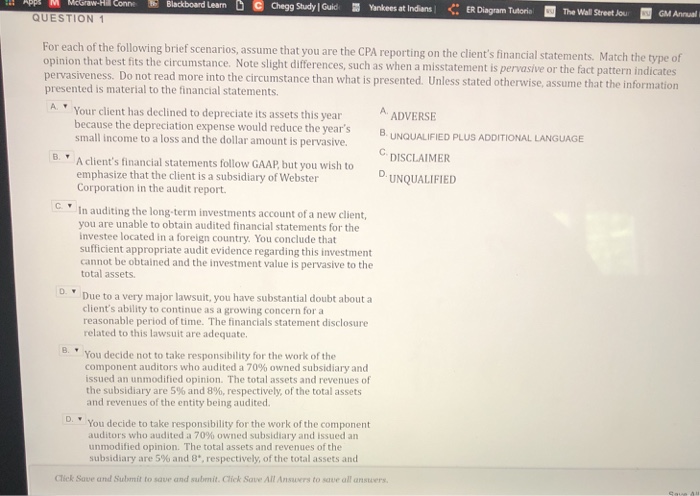

ConneBlackboard LearnC Chegg Study GuidYankees at Indians ER Diagram TutorieThe Wall Street Jour GM Anua QUESTION 1 For each of the following brief scenarios, assume that you are the CPA reporting on the client's financial statements. Match the type of opinion that best fits the circumstance. Note slight differences, such as when a misstatement is pervasive or the fact pattern indicates pervasiveness. Do not read more into the circumstance than what is presented. Unless stated otherwise, assume that the information presented is material to the financial statements. Your client has declined to depreciate its assets this year because the depreciation expense would reduce the year's B. UNQUALIFIED PLUS ADDITIONAL LANGUAGE A. ADVERSE small income to a loss and the dollar amount is pervasive. C. B. DISCLAIMER A client's financial statements follow GAAP, but you wish to emphasize that the client is a subsidiary of Webster Corporation in the audit report. UNQUALIFIED C. In auditing the long-term investments account of a new client, you are unable to obtain audited financial statements for the investee located in a foreign country. You conclude that sufficient appropriate audit evidence regarding this investment cannot be obtained and the investment value is pervasive to the total assets 0 Due to a very major lawsuit, you have substantial doubt about a client's ability to continue as a growing concern for a reasonable period of time. The financials statement disclosure related to this lawsuit are adequate. B. You decide not to take responsibility for the work of the component auditors who audited a 70% owned subsidiary and issued an unmodified opinion. The total assets and revenues of the subsidiary are 5% and 8%, respectively, of the total assets and revenues of the entity being audited You decide to take responsibility for the work of the component auditors who audited a 70% owned subsidiary and issued an unmodified opinion. The total assets and revenues of the subsidiary are 5% and 8*, respectively, of the total assets and Click Save and Sulbmit to saue and submit. Click Save All Answers to save all ansuers