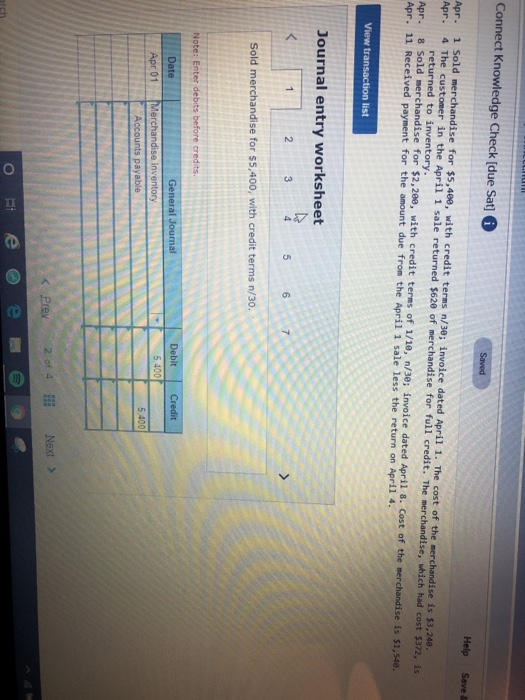

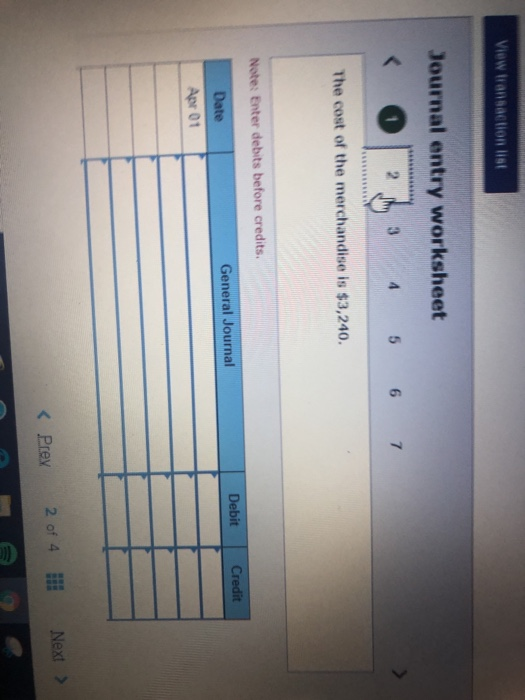

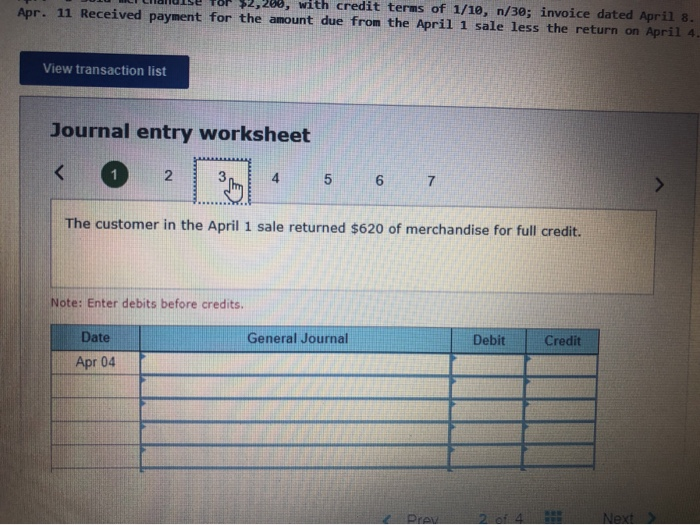

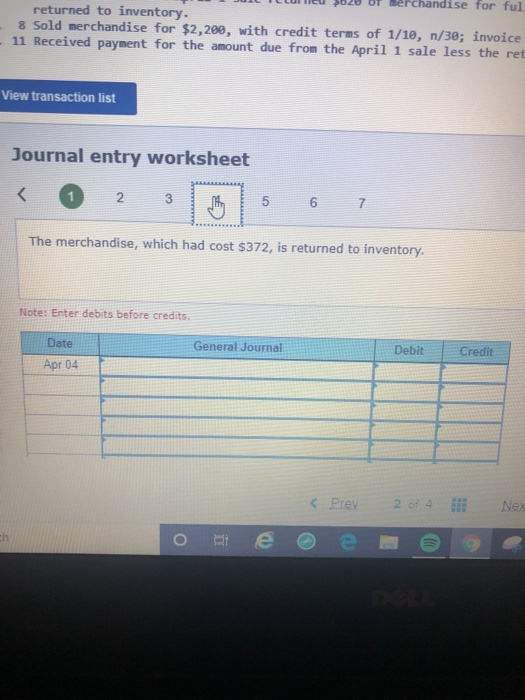

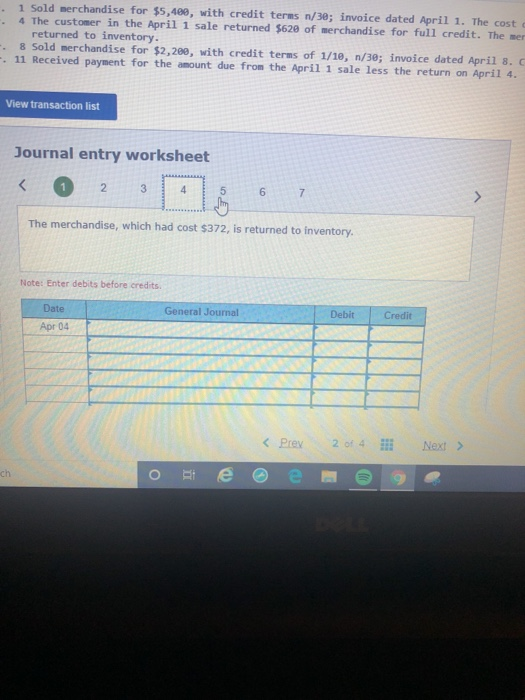

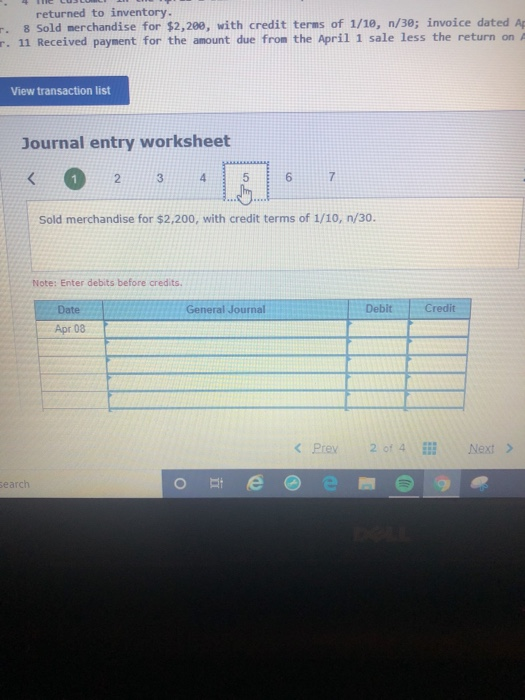

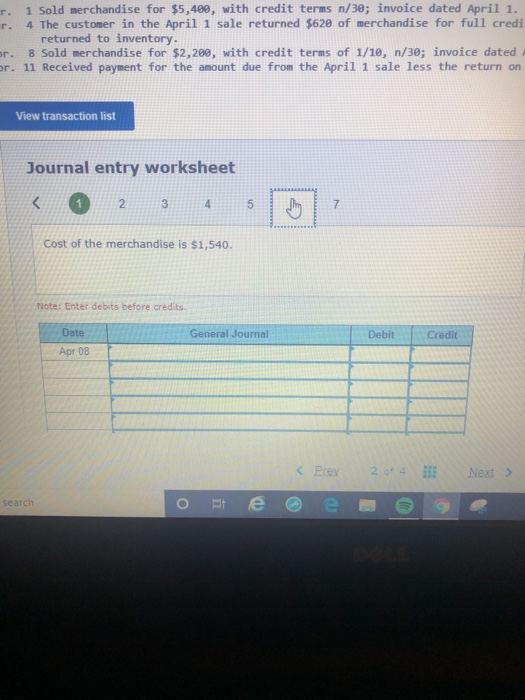

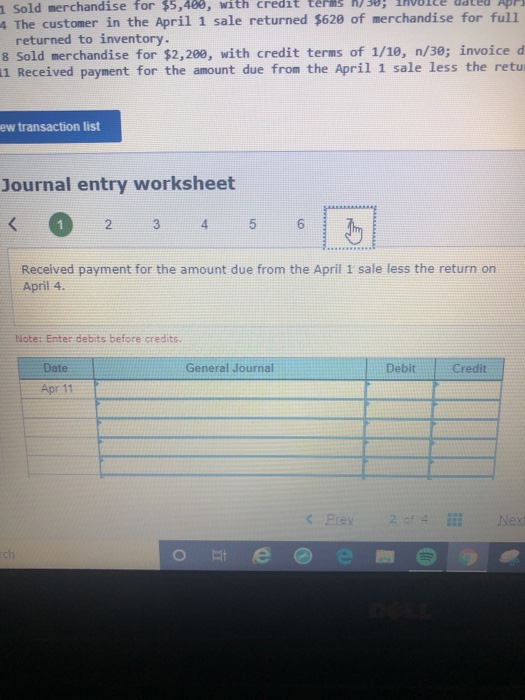

Connect Knowledge Check (due Sat] Saved Help Save & Apr. 1 Sold merchandise for $5,400, with credit terms n/30; invoice dated April 1. The cost of the merchandise Is 39,240 Apr. 4 The customer in the April 1 sale returned 5620 of merchandise for full credit. The merchandise, which had cost $372.is returned to inventory. Apr. 8 Sold merchandise for $2,280, with credit terms of 1/10, 1/30; invoice dated April 8. Cost of the merchandise Is 51,548 Apr. 11 Received payment for the amount due from the April 1 sale less the return on April 4. View transaction list Journal entry worksheet 4 5 6 Sold merchandise for $5,400, with credit terms n/30. Note: Enter debits before credits Debit Credit Date Apr 01 General Journal Merchandise inventory Accounts payable 5.400 5.400 O e e TER View transaction is Journal entry worksheet 2 3 4 5 6 7 The cost of the merchandise is $3,240. Note: Enter debits before credits. Debit Credit Date General Journal Apr 01 - tor 24,200, with credit terms of 1/10, n/30: invoice dated April Apr. 11 Received payment for the amount due from the April 1 sale less the return on April View transaction list Journal entry worksheet returned to inventory. 8 Sold merchandise for $2,200, with credit terms of 1/10, n/30; invoice dated A - 11 Received payment for the amount due from the April 1 sale less the return on View transaction list Journal entry worksheet search r. 1 Sold merchandise for $5,400, with credit terms n/30; invoice dated April 1. r. 4 The customer in the April 1 sale returned $620 of merchandise for full credi returned to inventory. or. 8 Sold merchandise for $2,200, with credit terms of 1/10, n/30; invoice dated r. 11 Received payment for the amount due from the April 1 sale less the return on View transaction list Journal entry worksheet Cost of the merchandise is $1,540. Note: Enter debits before credits Date Apr 08 General Journal Debit Credit search Sold merchandise for $5,400, with credit 4 The customer in the April 1 sale returned $620 of merchandise for full returned to inventory. 8 Sold merchandise for $2,200, with credit terms of 1/10, n/30; invoiced 11 Received payment for the amount due from the April 1 sale less the retu ew transaction list Journal entry worksheet Received payment for the amount due from the April 1 sale less the return on April 4. Note: Enter debits before credits Date General Journal Debit Credit Apr 11 Nex