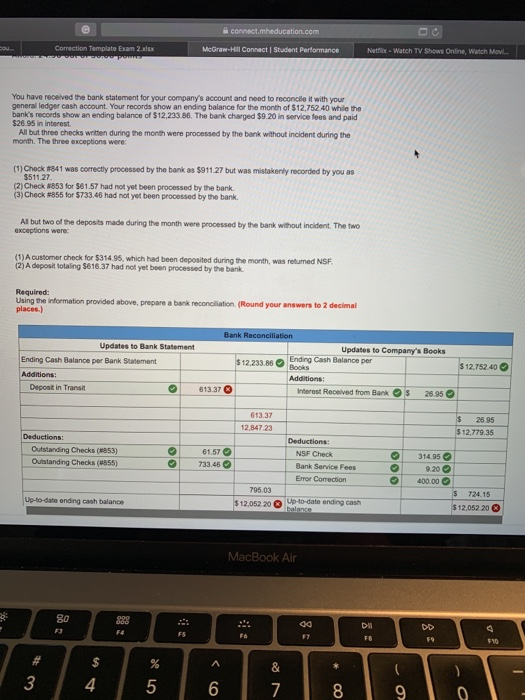

Connect.mheducation.com rrection Template Exam 2 x McGraw-Hill Connect Student Performance Netflix - Watch TV Shows Online, Watch Movie You have received the bank statement for your company's account and need to reconcile it with your general ledger cash account. Your records show an ending balance for the month of $12,752 40 While the bank's records show an ending balance of $12,233 86. The bank charged $9.20 in service fees and paid $26.95 In interest. All but three checks written during the month were processed by the bank without incident during the month. There exceptions were: (1) Check 841 was correctly processed by the bank as $911 27 but was mistakenly recorded by you as $511 27. (2) Check #853 for $61.57 had not yet been processed by the bank 131 Check 855 for 5733.45 had not yet been processed by the bank All but two of the deposits made during the month were processed by the bank without incident. The two exceptions were (1) Acustomer check for $314.95, which had been deposited during the month, was retumed NSF (2) A deposit totaling 561637 had not yet been processed by the bank Required: Using the information provided above, prepare a bank reconciliation (Round your answers to 2 decimal places) Updates to Bank Statement Bank Reconciliation Updates to Company's Books $ 12.233.86 Ending Cash Balance per 06 Nooks Additions rest Received from Bank $ 28.95 Ending Cash Balance per Bank Statement Additions Depost in Trans $12.792.40 613.37 12.847 23 Deductions: Outstanding Checks (85) Outstanding Checks (855) Deductions NSF Check 61.57 Bank Service Fees 314.95 9.20 400.00 Error Correction 72415 $12,052 20 Up a nding cash balance 12.052 20 to date ending a MacBook Air Connect.mheducation.com rrection Template Exam 2 x McGraw-Hill Connect Student Performance Netflix - Watch TV Shows Online, Watch Movie You have received the bank statement for your company's account and need to reconcile it with your general ledger cash account. Your records show an ending balance for the month of $12,752 40 While the bank's records show an ending balance of $12,233 86. The bank charged $9.20 in service fees and paid $26.95 In interest. All but three checks written during the month were processed by the bank without incident during the month. There exceptions were: (1) Check 841 was correctly processed by the bank as $911 27 but was mistakenly recorded by you as $511 27. (2) Check #853 for $61.57 had not yet been processed by the bank 131 Check 855 for 5733.45 had not yet been processed by the bank All but two of the deposits made during the month were processed by the bank without incident. The two exceptions were (1) Acustomer check for $314.95, which had been deposited during the month, was retumed NSF (2) A deposit totaling 561637 had not yet been processed by the bank Required: Using the information provided above, prepare a bank reconciliation (Round your answers to 2 decimal places) Updates to Bank Statement Bank Reconciliation Updates to Company's Books $ 12.233.86 Ending Cash Balance per 06 Nooks Additions rest Received from Bank $ 28.95 Ending Cash Balance per Bank Statement Additions Depost in Trans $12.792.40 613.37 12.847 23 Deductions: Outstanding Checks (85) Outstanding Checks (855) Deductions NSF Check 61.57 Bank Service Fees 314.95 9.20 400.00 Error Correction 72415 $12,052 20 Up a nding cash balance 12.052 20 to date ending a MacBook Air