Answered step by step

Verified Expert Solution

Question

1 Approved Answer

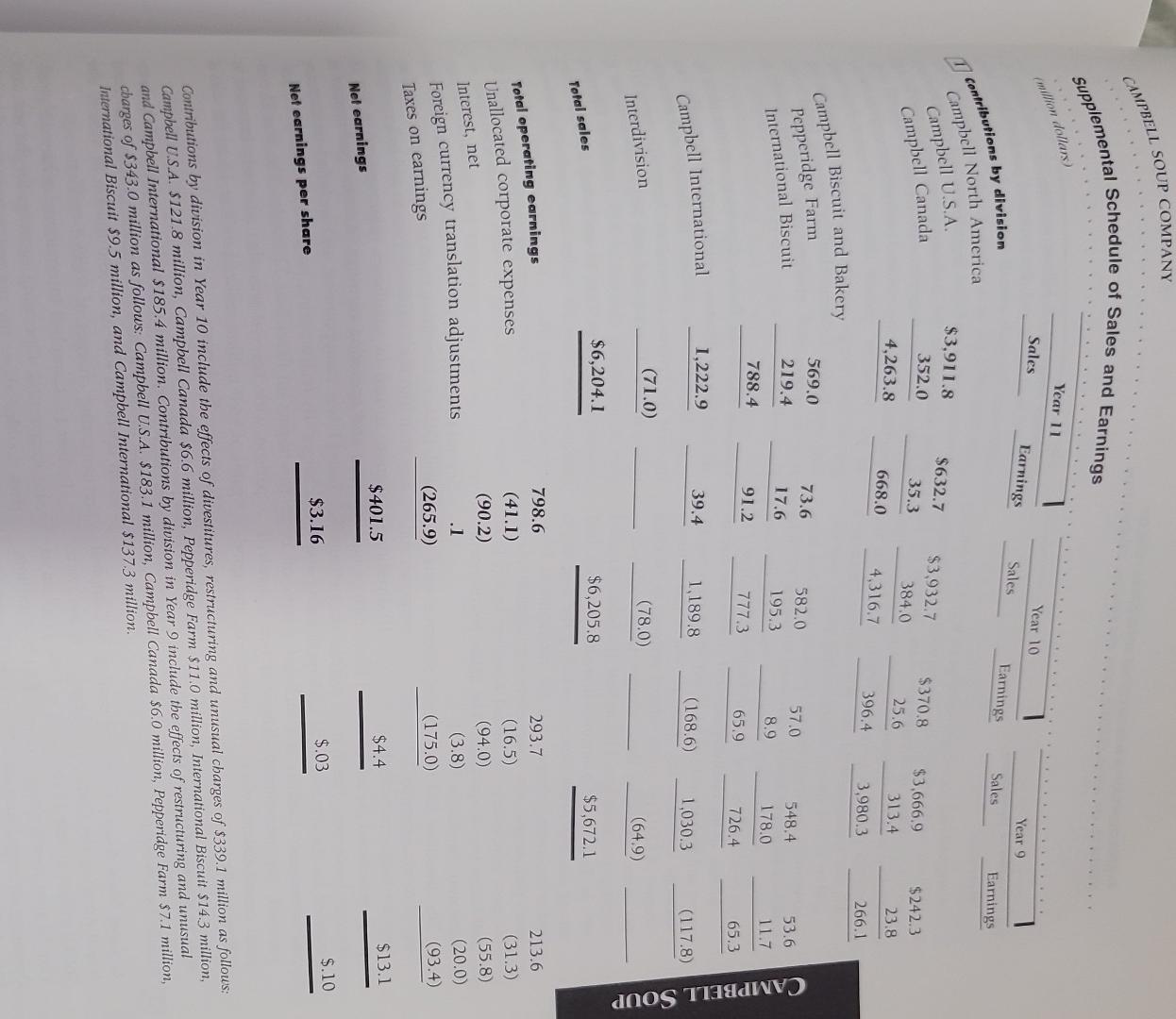

Conrributions by division in Year 10 include the effects of divestitures, restructuring and unusual charges of $339.1 million as follows: Campbell U.S.A. $121.8 million, Campbell

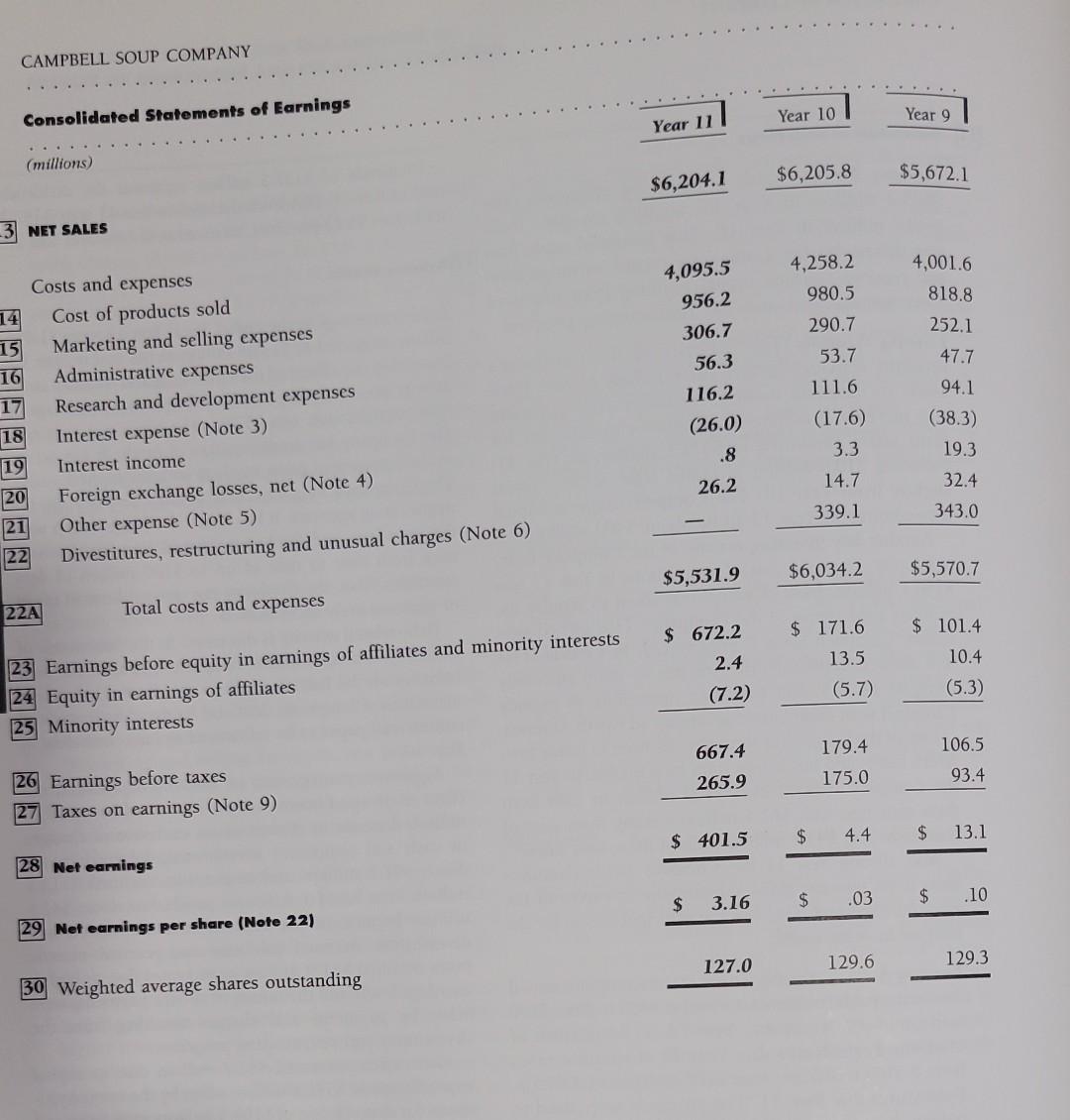

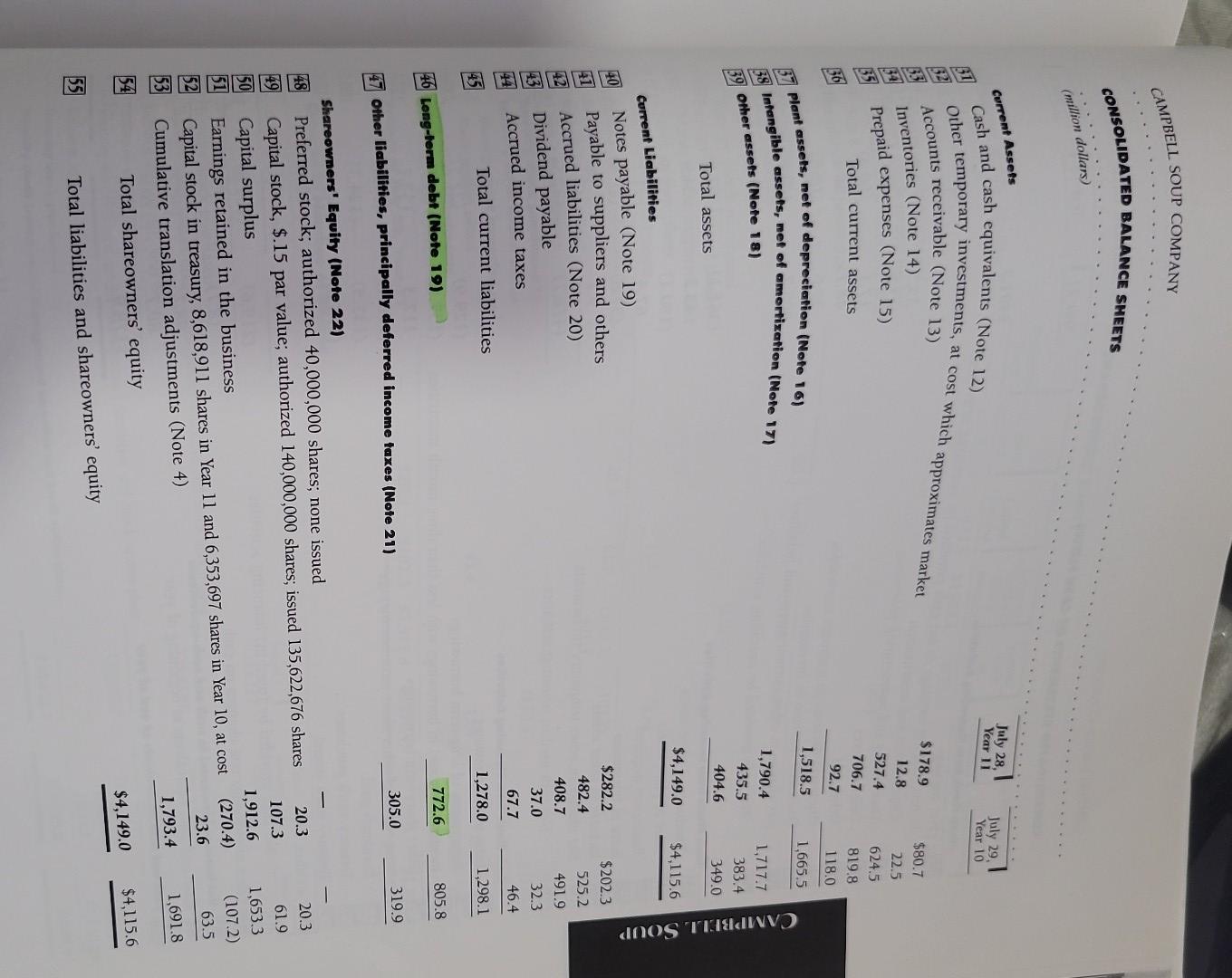

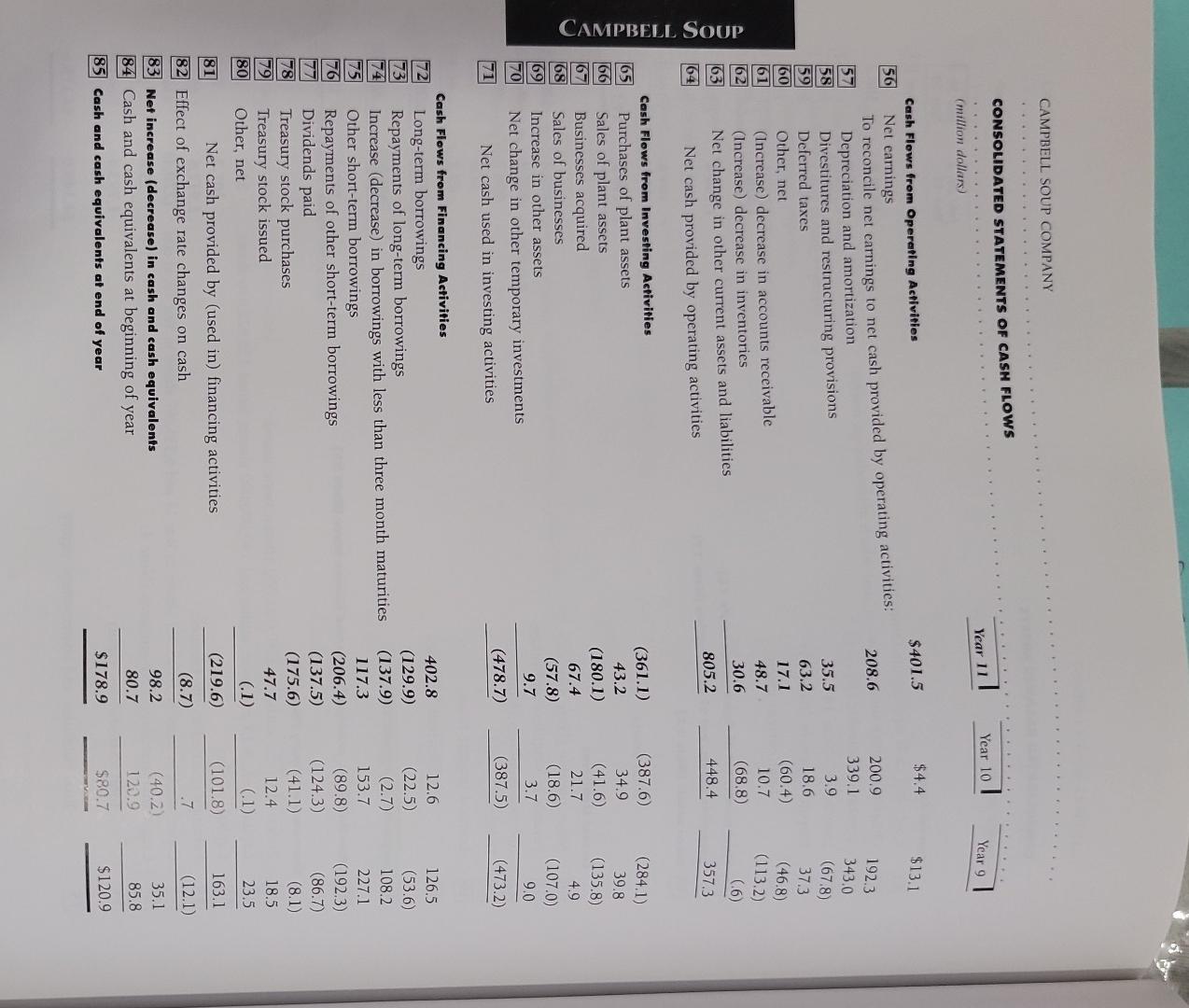

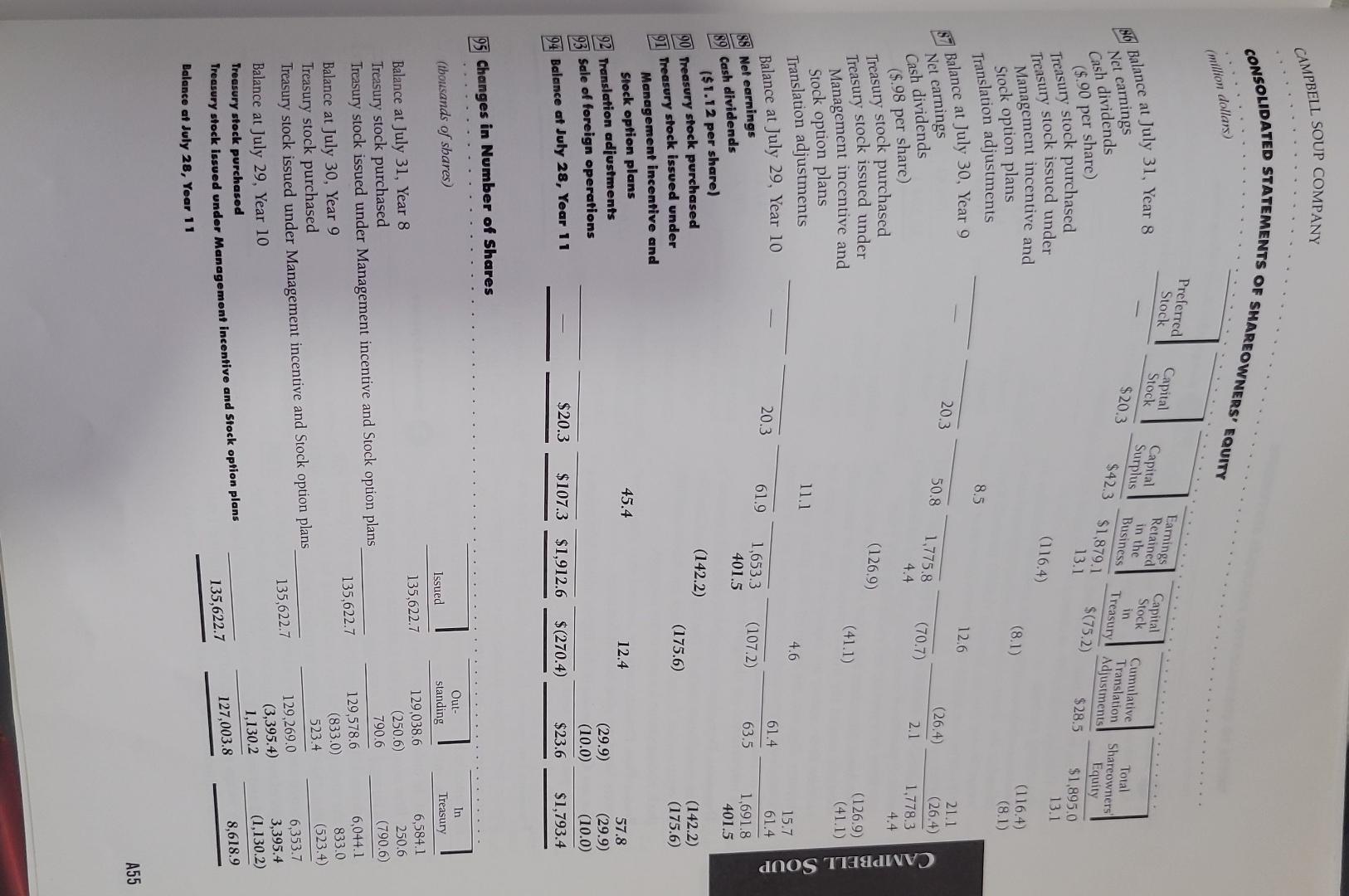

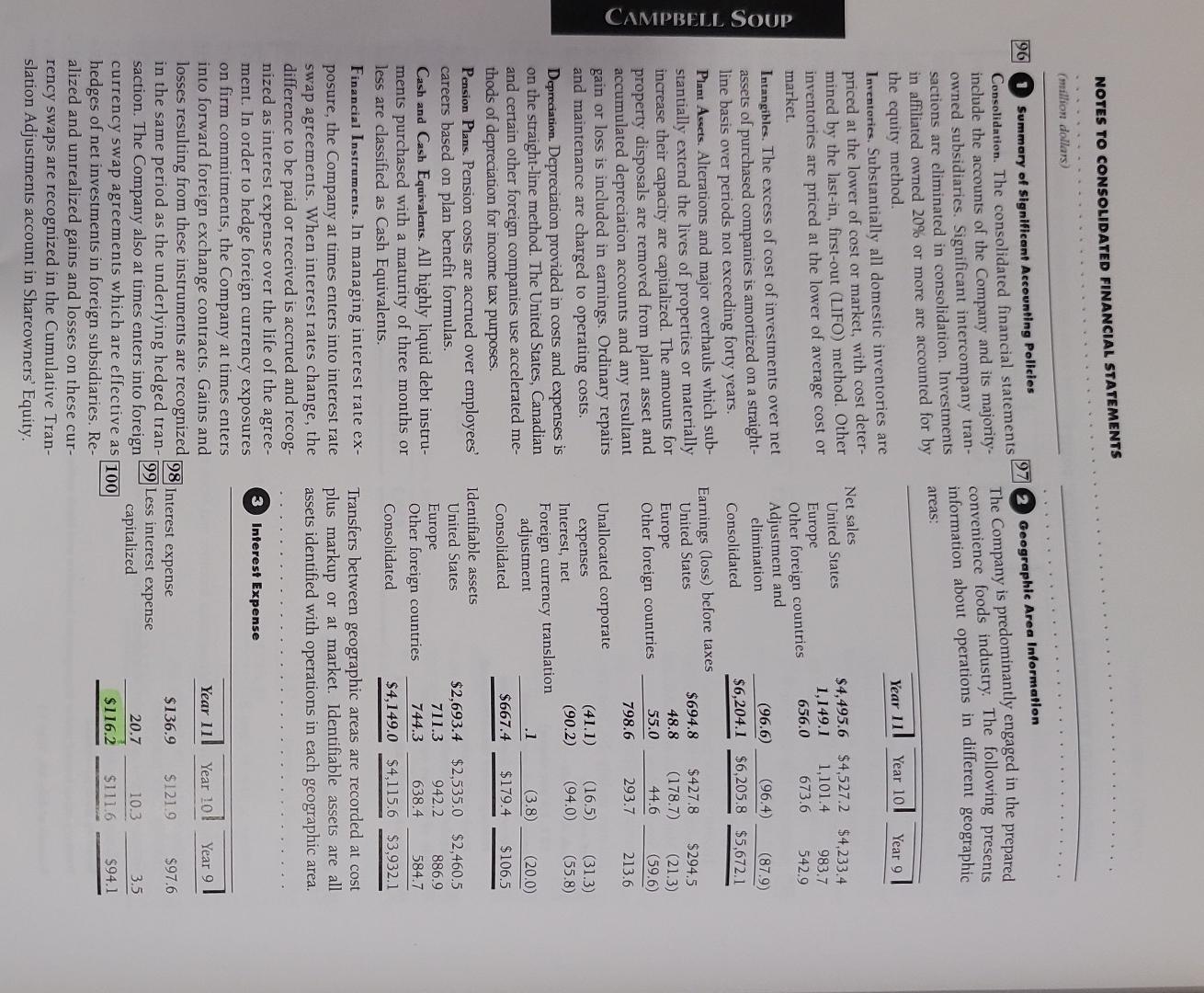

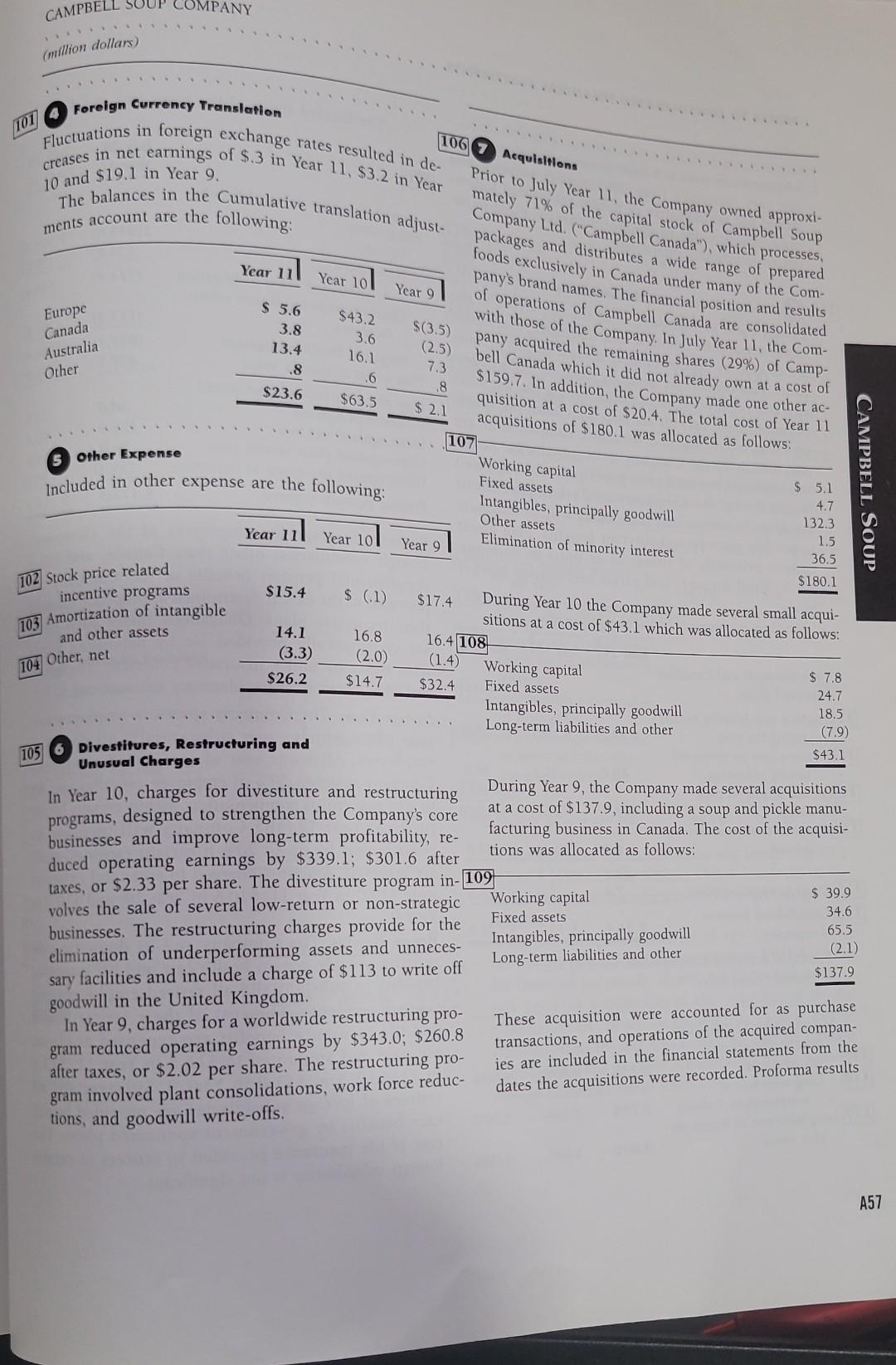

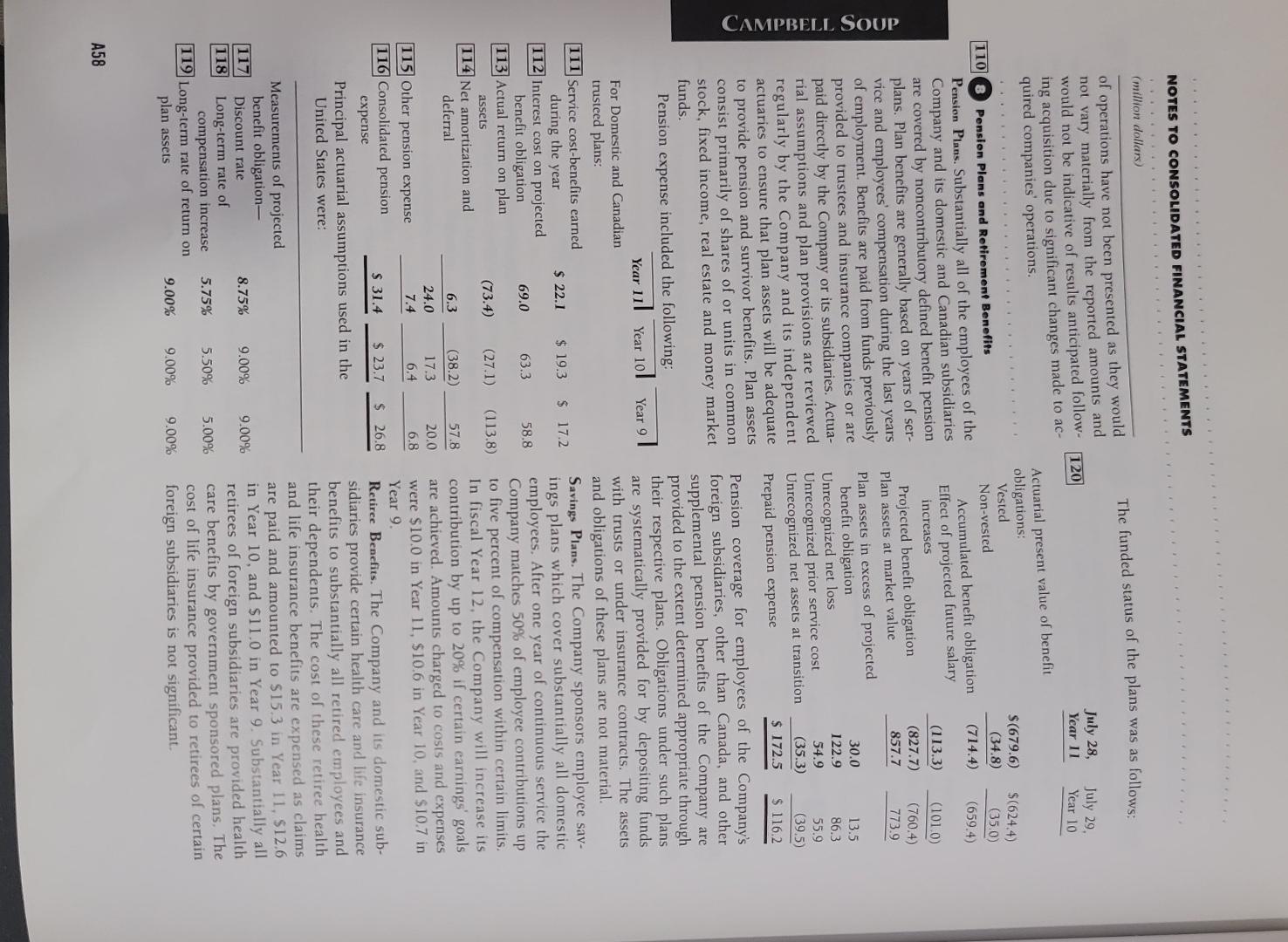

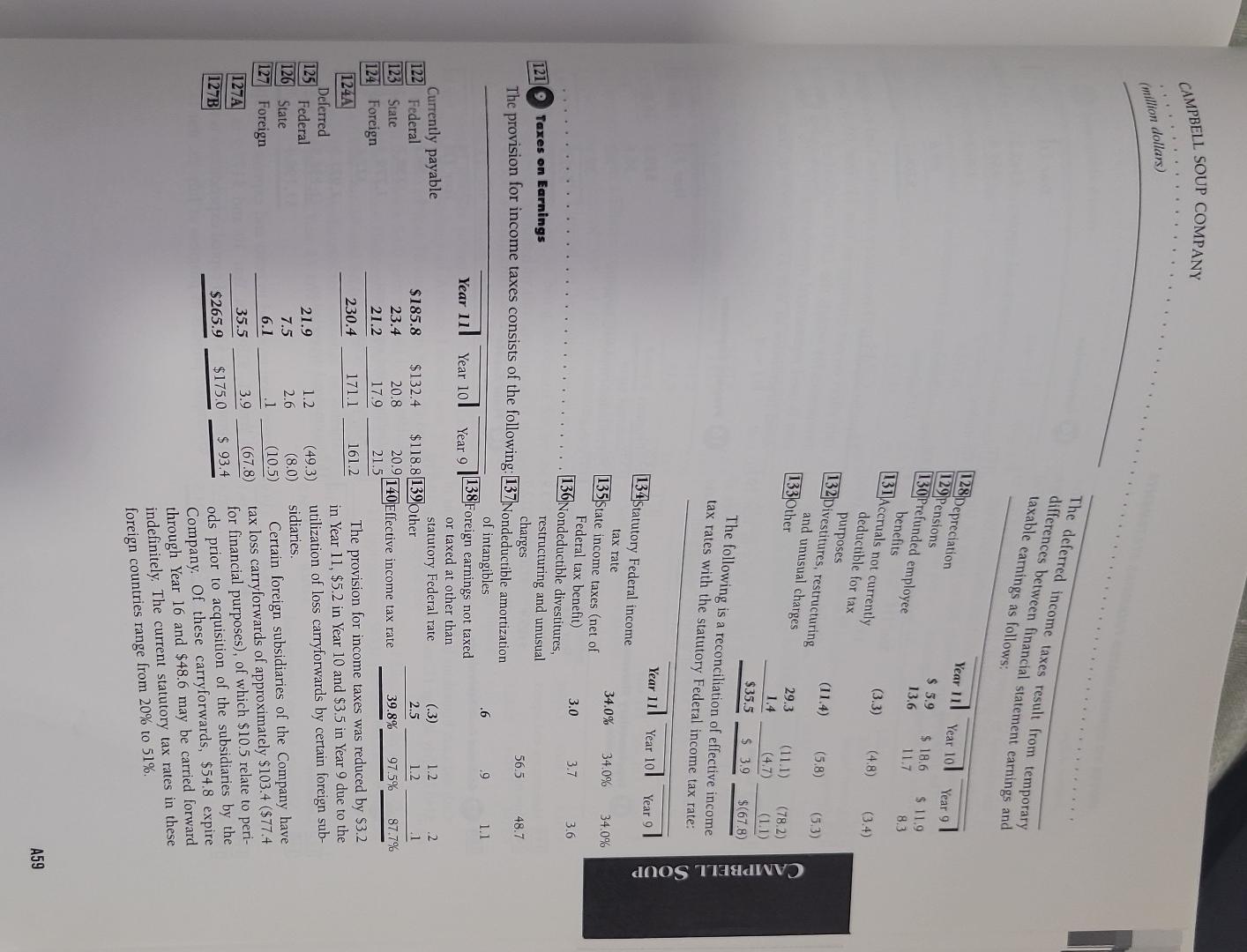

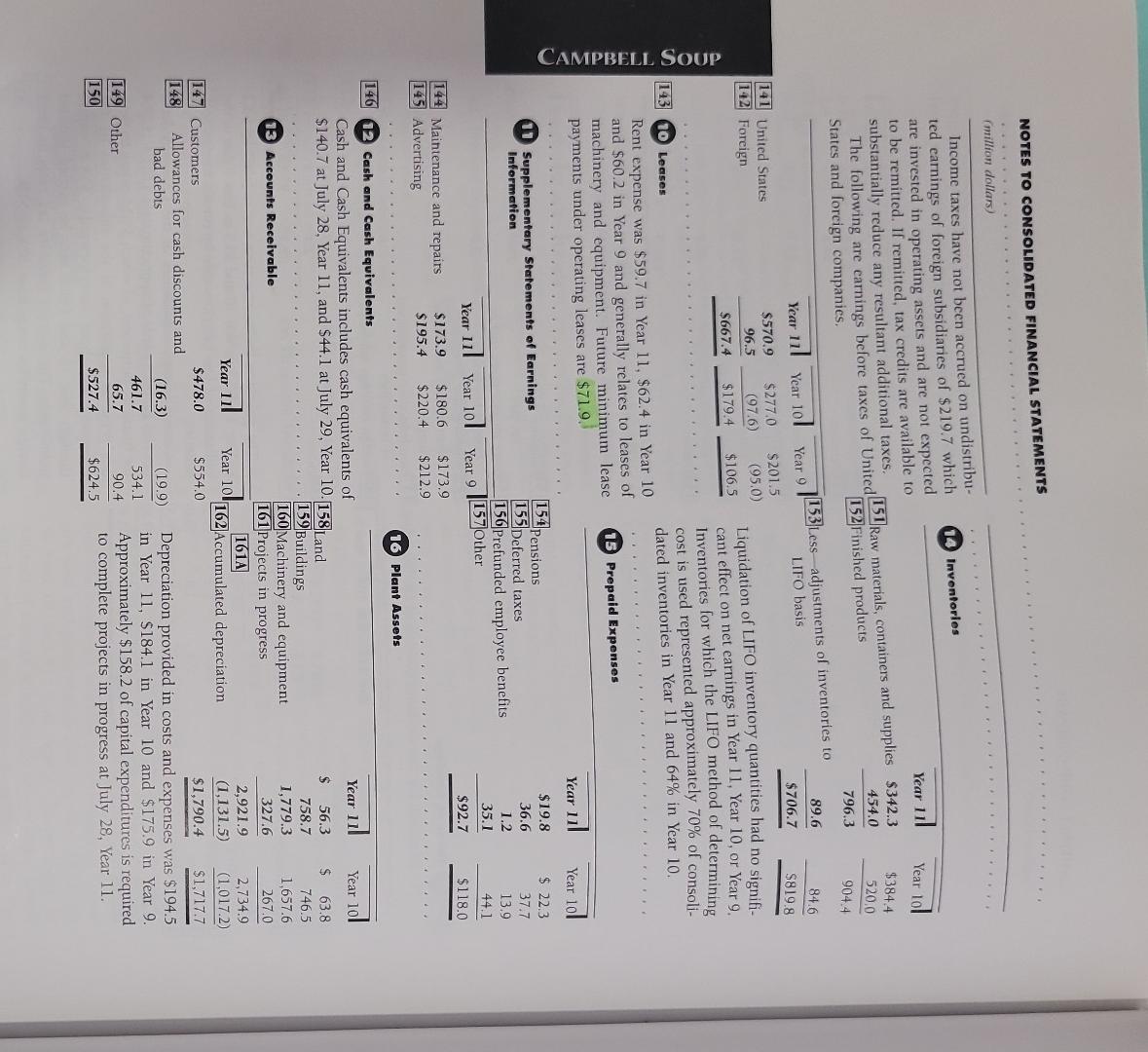

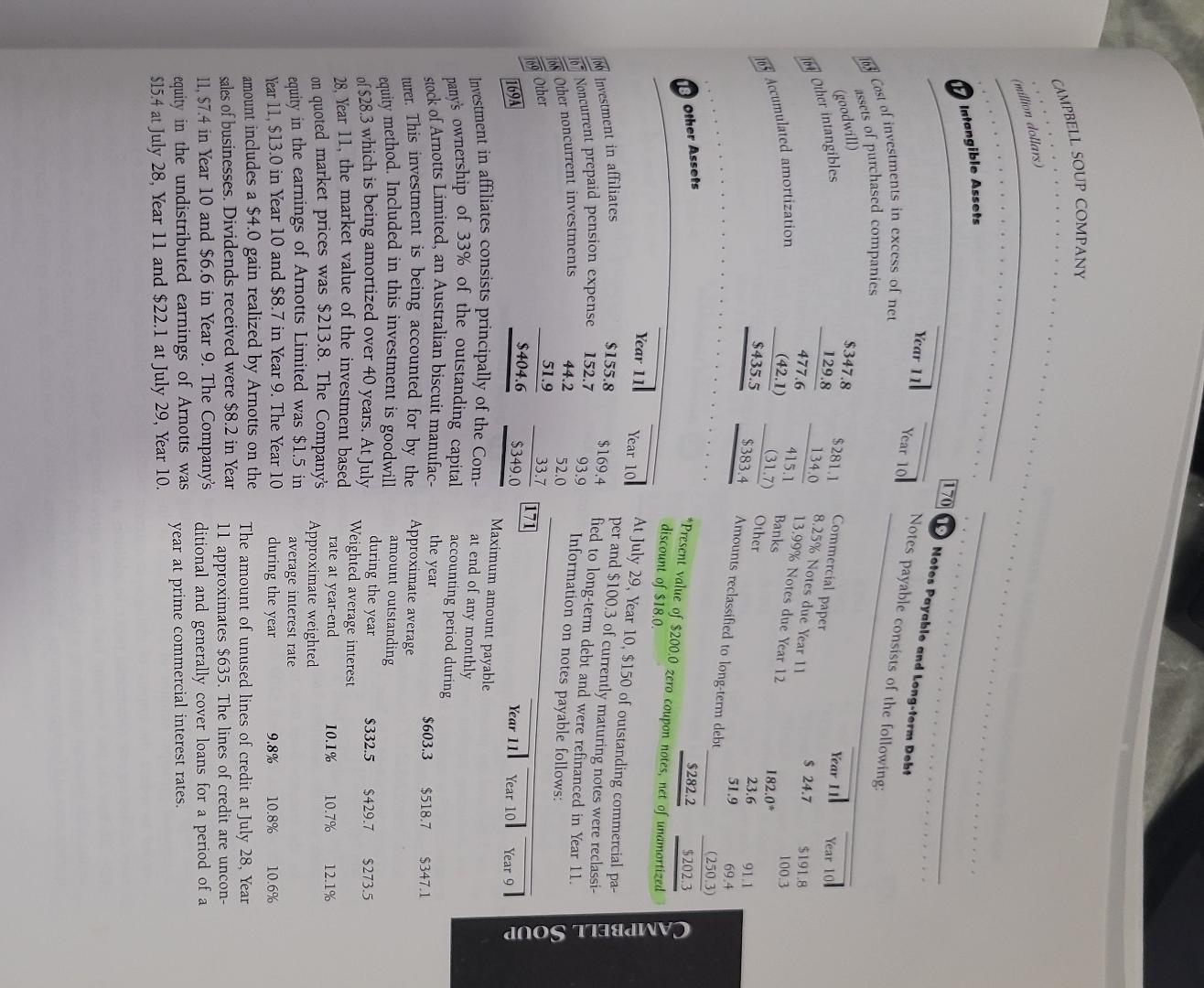

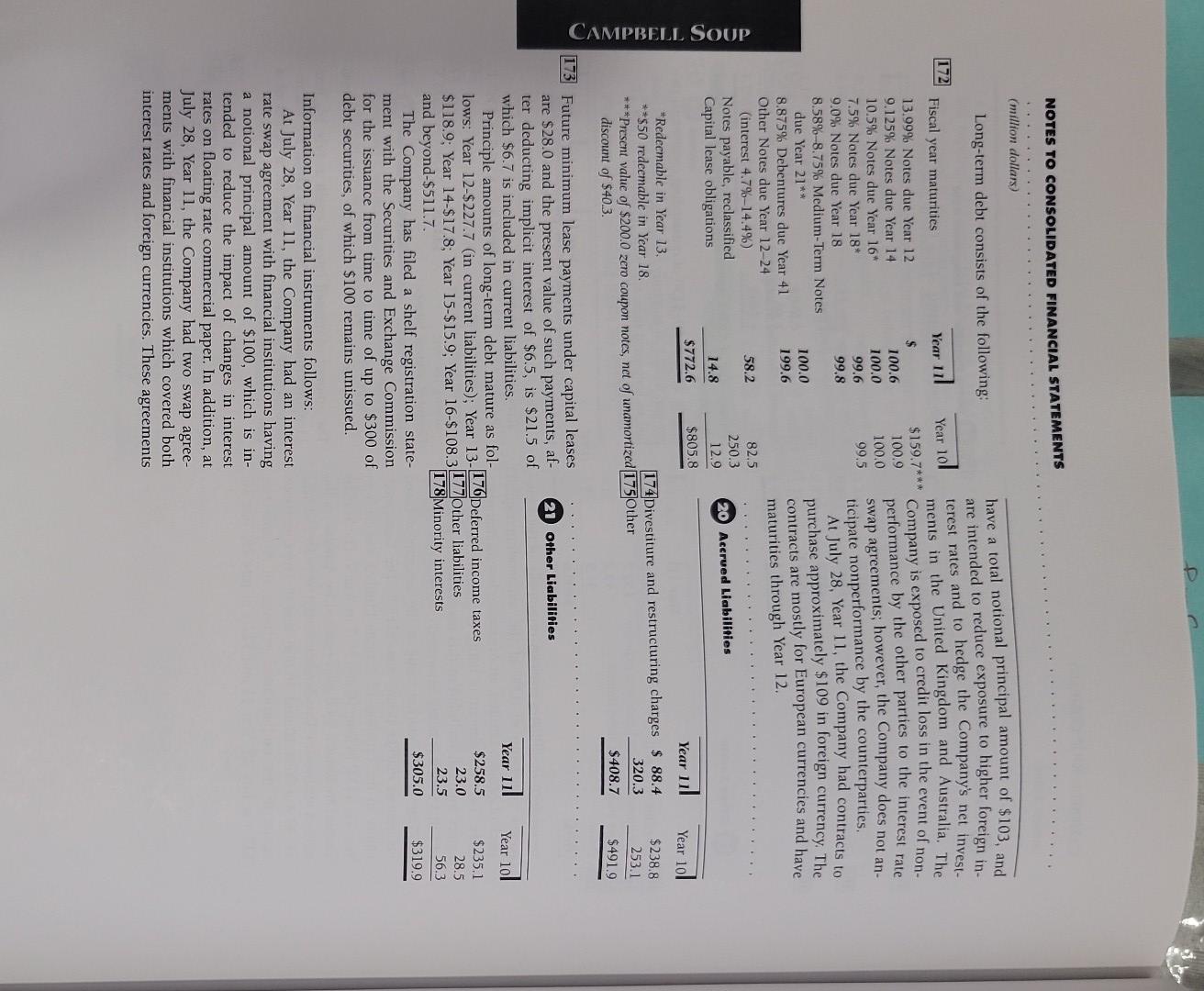

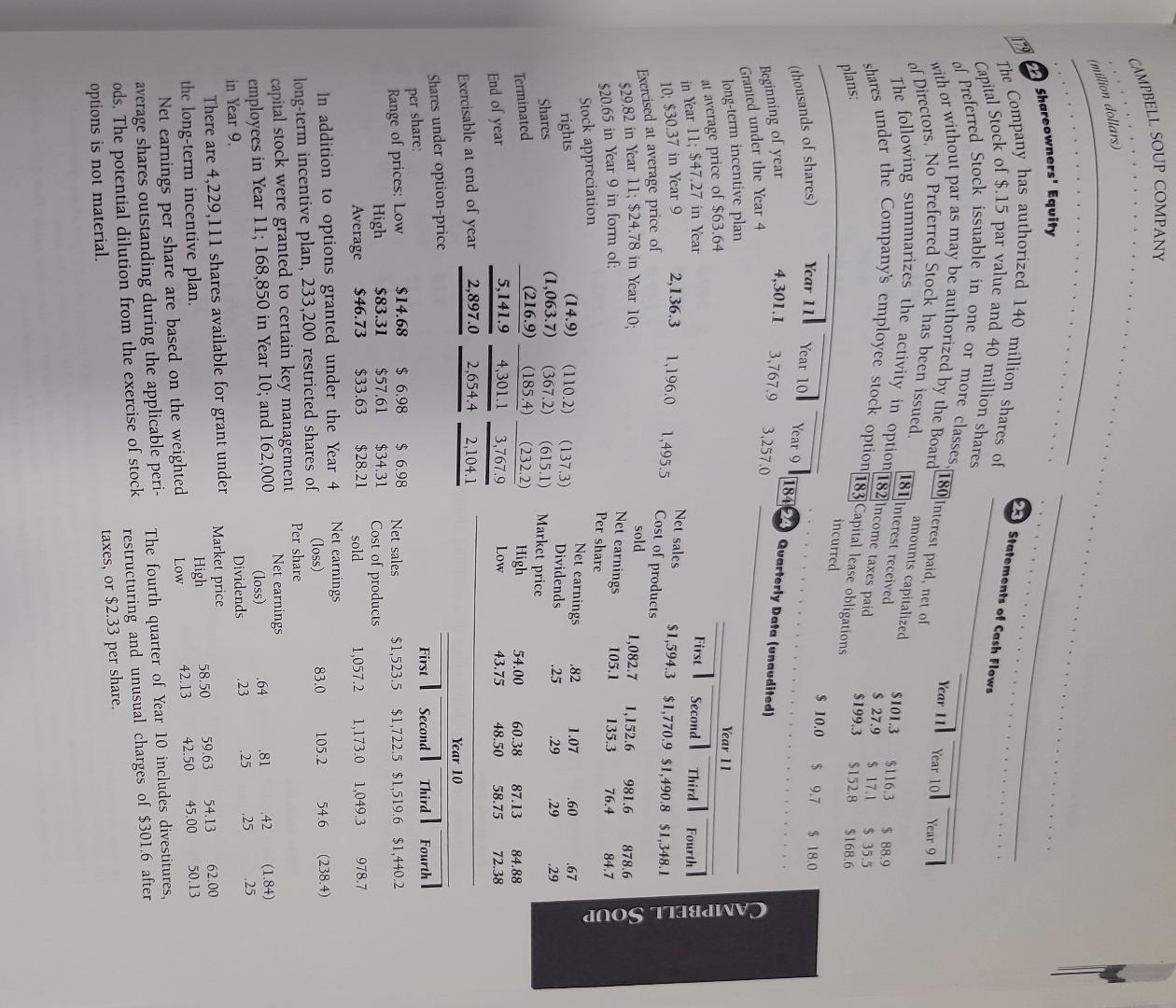

Conrributions by division in Year 10 include the effects of divestitures, restructuring and unusual charges of $339.1 million as follows: Campbell U.S.A. \$121.8 million, Campbell Canada \$6.6 million, Pepperidge Farm \$11.0 million, International Biscuit \$14.3 million, and Campbell International \$185.4 million. Contributions by division in Year 9 include the effects of restructuring and unusual charges of $343.0 million as follows: Campbell U.S.A. $183.1 million, Campbell Canada $6.0 million, Pepperidge Farm $7.1 million, Intemational Biscuit $9.5 million, and Campbell International $137.3 million. CAMPBELL SOUP COMPANY 3 NET SALE Costs and expenses 14 Cost of products sold Marketing and selling expenses Administrative expenses Research and development expenses Interest expense (Note 3) Interest income Foreign exchange losses, net (Note 4) $$5,531.9$5,570.7$6,034.2 22A Total costs and expenses 23 Earnings before equity in earnings of affiliates and minority interests $672.2$171.6$101.4 24 Equity in earnings of affiliates 25 Minority interests 26 Earnings before taxes 27 Taxes on earnings (Note 9) 28 Net earmings $401.5$4.4$13.1 29 Net earnings per share (Note 22) $\begin{tabular}{l} $.16$.10 \\ \hline \end{tabular} 30 Weighted average shares outstanding CONSOLUDATED BALANCE SHEETS (nitlion dollars) CAMPBELL SOUP COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS Year 11 Year 10 Year 9 (million dollars) Cash Flows from Operating Activitios 56 Net earnings To reconcile net earnings to net cash provided by operating activities Cash Flows from Investing Activities 65 Purchases of plant assets 66 Sales of plant assets 67 Businesses acquired 68 Sales of businesses 69 Increase in other assets 70 Net change in other temporary investments 71 Net cash used in investing activities \begin{tabular}{ccc} (361.1) & (387.6) & (284.1) \\ 43.2 & 34.9 & 39.8 \\ (180.1) & (41.6) & (135.8) \\ 67.4 & 21.7 & 4.9 \\ (57.8) & (18.6) & (107.0) \\ 9.7 & 3.7 & 9.0 \\ \hline (478.7) & (387.5) & (473.2) \\ \hline \end{tabular} cONSOLDATEO STATEMENTS OF SHAREOWm.- (million dollars) Consolidation. The consolidated financial statements 97 (2) Geographic Area Information (1) Summory of significent Accounting Policies include the accounts of the Company and its majority- The Company is predominantly engaged in the prepared owned subsidiaries. Significant intercompany tran- convenience foods industry. The following presents sactions are eliminated in consolidation. Investments information about operations in different geographic in affiliated owned 20% or more are accounted for by the equity method. Inventories. Substantially all domestic inventories are priced at the lower of cost or market, with cost determined by the last-in, first-out (LIFO) method. Other inventories are priced at the lower of average cost or market. Intangibles. The excess of cost of investments over net assets of purchased companies is amortized on a straightline basis over periods not exceeding forty years. Plant Assets. Alterations and major overhauls which substantially extend the lives of properties or materially increase their capacity are capitalized. The amounts for property disposals are removed from plant asset and accumulated depreciation accounts and any resultant gain or loss is included in earnings. Ordinary repairs and maintenance are charged to operating costs. Depreciation. Depreciation provided in costs and expenses is on the straight-line method. The United States, Canadian and certain other foreign companies use accelerated methods of depreciation for income tax purposes. Pension Plans. Pension costs are accrued over employees' careers based on plan benefit formulas. Cash and Cash Equivalents. All highly liquid debt instruments purchased with a maturity of three months or less are classified as Cash Equivalents. Financial Instruments. In managing interest rate ex- Transfers between geographic areas are recorded at cost posure, the Company at times enters into interest rate plus markup or at market. Identifiable assets are all swap agreements. When interest rates change, the assets identified with operations in each geographic area. difference to be paid or received is accrued and recognized as interest expense over the life of the agreement. In order to hedge foreign currency exposures on firm commitments, the Company at times enters into forward foreign exchange contracts. Gains and losses resulting from these instruments are recognized in the same period as the underlying hedged transaction. The Company also at times enters into foreign currency swap agreements which are effective as hedges of net investments in foreign subsidiaries. Realized and unrealized gains and losses on these currency swaps are recognized in the Cumulative Translation Adjustments account in Shareowners' Equity. 101 Fluctuations in foreign exchange rates resulted in de- 106 Acquisinions creases in net earnings of $.3 in Year 11,$3.2 in Ye- Prior to July Year 11, the Company owned approxi- 10 and $19.1 in Year 9 . The balances in the Cumulative translation adjust- Company Lid. ("Campbell stock of Campbell Soup Cockada"), which processes, ments account are the following: foodses and distributes a wide range of prepared pany's brand namely in Canada under many of the Comof operations of The financial position and results with those of of Campbell Canada are consolidated pany acquired the Company. In July Year 11 , the Combell Canada which remaining shares (29\%) of Camp\$159.7. In addition it did not already own at a cost of quisition at a cost of $20.4. The made one other acacquisitions of $180.1 w. The total cost of Year 11 (5) other Expense Included in other expense are the following: vuring Year 10 the Company made several small acquisitions at a cost of $43.1 which was allocated as follows: 105 (6) Divestifures, Restructuring and In Year 10 , charges for divestiture and restructuring During Year 9 , the Company made several acquisitions programs, designed to strengthen the Company's core at a cost of $137.9, including a soup and pickle manubusinesses and improve long-term profitability, re- facturing business in Canada. The cost of the acquisiduced operating earnings by $339.1;$301.6 after tions was allocated as follows: taxes, or $2.33 per share. The divestiture program in- 1 volves the sale of several low-return or non-strategic businesses. The restructuring charges provide for the elimination of underperforming assets and unnecessary facilities and include a charge of $113 to write off goodwill in the United Kingdom. In Year 9, charges for a worldwide restructuring pro- These acquisition were accounted for as purchase gram reduced operating earnings by $343.0;$260.8 transactions, and operations of the acquired companafter taxes, or $2.02 per share. The restructuring pro- ies are included in the financial statements from the gram involved plant consolidations, work force reduc- dates the acquisitions were recorded. Proforma results tions, and goodwill write-offs. (million dollans) of operations have not been presented as they would not vary matcrially from the reported amounts and would not be indicative of results anticipated following acquisition due to significant changes made to acquired companies' operations. (8) Pension Plans and Refirement Benefits Pension Plans. Substantially all of the employees of the Company and its domestic and Canadian subsidiaries are covered by noncontributory defined benefit pension plans. Plan benefits are generally based on years of service and employees' compensation during the last years of employment. Benefits are paid from funds previously provided to trustees and insurance companies or are paid directly by the Company or its subsidiaries. Actuarial assumptions and plan provisions are reviewed regularly by the Company and its independent actuaries to ensure that plan assets will be adequate to provide pension and survivor benefits. Plan assets consist primarily of shares of or units in common Pension coverage for employees of the Compan stock, fixed income, real estate and money market foreign subsidiaries, other than Canada, and oth supplemental pension benefits of the Company a funds. provided to the extent determined appropriate throu their respective plans. Obligations under such pla are systematically provided for by depositing fun with trusts or under insurance contracts. The ass and obligations of these plans are not material. Savings Plans. The Company sponsors employee st ings plans which cover substantially all domes employees. After one year of continuous service Company matches 50% of employee contributions to five percent of compensation within certain lim In fiscal Year 12, the Company will increase contribution by up to 20% if certain earnings' go are achieved. Amounts charged to costs and exper were $10.0 in Year 11,$10.6 in Year 10, and $10. Year 9. Retiree Benefits. The Company and its domestic s Principal actuarial assumptions used in the sidiaries provide certain health care and life insura benefits to substantially all retired employees United States were: their dependents. The cost of these retiree he The deferred income taxes result from temporary differences between financial statement earnings and taxable earnings as follows: tax rates wing is a reconciliation of effective income The provision for income taxes was reduced by $3.2 in Year 11,$5.2 in Year 10 and $3.5 in Year 9 due to the utilization of loss carryforwards by certain foreign subsidiaries. Certain foreign subsidiaries of the Company have tax loss carryforwards of approximately $103.4($77.4 for financial purposes), of which $10.5 relate to periods prior to acquisition of the subsidiaries by the Company. Of these carryforwards, $54.8 expire through Year 16 and $48.6 may be carried forward indefinitely. The current statutory tax rates in these foreign countries range from 20% to 51%. Income taxes have not been accrued on undistributed earnings of foreign subsidiaries of $219.7 which are invested in operating assets and are not expected to be remitted. If remitted, tax credits are available to substantially reduce any resultant additional taxes. The following are carnings before taxes of United 111 States and forcign companies. Liquidation of LIFO inventory quantities had no significant effect on net earnings in Year 11, Year 10 , or Year 9. Inventories for which the LIFO method of determining cost is used represented approximately 70% of consoli3 (10) Leases dated inventories in Year 11 and 64% in Year 10. Rent expense was $59.7 in Year 11,$62.4 in Year 10 and $60.2 in Year 9 and generally relates to leases of machinery and equipment. Future minimum lease payments under operating leases are $71.9. (11) Supplementary stetements of Earnings Information (12) Cash and Cash Equivalents Cash and Cash Equivalents includes cash equivalents of $140.7 at July 28 , Year 11 , and $44.1 at July 29 , Year 10 . (13) Accounts Receivable Depreciation provided in costs and expenses was $194.5 in Year 11,$184.1 in Year 10 and $175.9 in Year 9. Approximately $158.2 of capital expenditures is required to complete projects in progress at July 28 , Year 11. [170] Notos Poyablo and Long-torm Dobt Notes payable consists of the following. At July 29 , Year 10, $150 of outstanding commercial paper and $100.3 of currently maturing notes were reclassified to long-term debt and were refinanced in Year 11. Information on notes payable follows: Investment in affiliates consists principally of the Company's ownership of 33% of the outstanding capital stock of Arnotts Limited, an Australian biscuit manufacturer. This investment is being accounted for by the equity method. Included in this investment is goodwill of $28.3 which is being amortized over 40 years. At July 28. Year 11, the market value of the investment based on quoted market prices was \$213.8. The Company's equity in the earnings of Arnotts Limited was $1.5 in Year 11, $13.0 in Year 10 and $8.7 in Year 9. The Year 10 sales of businesses. Dividends received were $8.2 in Year The amount of unused lines of credit at July 28 , Year amount includes a $4.0 gain realized by Arnotts on the 11,57.4 in Year 10 and $6.6 in Year 9 . The Company's 11 approximates $635. The lines of credit are unconequity in the ditional and generally cover loans for a period of a S15.4 in the undistributed earnings of Arnotts was year at prime commercial interest rates. (million dollars) have a total notional principal amount of $103, and Long-term debt consists of the following: are intended to reduce exposure to higher foreign interest rates and to hedge the Company's net investments in the United Kingdom and Australia. The Company is exposed to credit loss in the event of nonperformance by the other parties to the interest rate swap agreements; however, the Company does not anticipate nonperformance by the counterparties. At July 28, Year 11, the Company had contracts to purchase approximately $109 in foreign currency. The contracts are mostly for European currencies and have maturities through Year 12 . 20 Acerued Liabilities "Redeemable in Year 13 , **\$50 redeemable in Year 18. ***Present value of $200.0 zero coupon notes, net of unamortized[ discount of $40.3. 173 Future minimum lease payments under capital leases are $28.0 and the present value of such payments, after deducting implicit interest of $6.5, is $21.5 of which $6.7 is included in current liabilities. Principle amounts of long-term debt mature as follows: Year 12-\$227.7 (in current liabilities); Year 13\$118.9; Year 14-\$17.8; Year 15-\$15.9; Year 16-\$108.3 and beyond- $511.7. The Company has filed a shelf registration statement with the Securities and Exchange Commission for the issuance from time to time of up to $300 of debt securities, of which $100 remains unissued. Information on financial instruments follows: At July 28, Year 11 , the Company had an interest rate swap agreement with financial institutions having a notional principal amount of $100, which is intended to reduce the impact of changes in interest rates on floating rate commercial paper. In addition, at July 28, Year 11 , the Company had two swap agreements with financial institutions which covered both interest rates and foreign currencies. These agreements (19) (2.) shareowners' Equiry The Company has authorized 140 million shares of Capital Stock of $.15 par value and 40 million shares of Preferred Stock issuable in one or more classes, [180 Interest paid, net of of Directors. No Preferred Stock has been issued. (a) at chares) Year11 Conrributions by division in Year 10 include the effects of divestitures, restructuring and unusual charges of $339.1 million as follows: Campbell U.S.A. \$121.8 million, Campbell Canada \$6.6 million, Pepperidge Farm \$11.0 million, International Biscuit \$14.3 million, and Campbell International \$185.4 million. Contributions by division in Year 9 include the effects of restructuring and unusual charges of $343.0 million as follows: Campbell U.S.A. $183.1 million, Campbell Canada $6.0 million, Pepperidge Farm $7.1 million, Intemational Biscuit $9.5 million, and Campbell International $137.3 million. CAMPBELL SOUP COMPANY 3 NET SALE Costs and expenses 14 Cost of products sold Marketing and selling expenses Administrative expenses Research and development expenses Interest expense (Note 3) Interest income Foreign exchange losses, net (Note 4) $$5,531.9$5,570.7$6,034.2 22A Total costs and expenses 23 Earnings before equity in earnings of affiliates and minority interests $672.2$171.6$101.4 24 Equity in earnings of affiliates 25 Minority interests 26 Earnings before taxes 27 Taxes on earnings (Note 9) 28 Net earmings $401.5$4.4$13.1 29 Net earnings per share (Note 22) $\begin{tabular}{l} $.16$.10 \\ \hline \end{tabular} 30 Weighted average shares outstanding CONSOLUDATED BALANCE SHEETS (nitlion dollars) CAMPBELL SOUP COMPANY CONSOLIDATED STATEMENTS OF CASH FLOWS Year 11 Year 10 Year 9 (million dollars) Cash Flows from Operating Activitios 56 Net earnings To reconcile net earnings to net cash provided by operating activities Cash Flows from Investing Activities 65 Purchases of plant assets 66 Sales of plant assets 67 Businesses acquired 68 Sales of businesses 69 Increase in other assets 70 Net change in other temporary investments 71 Net cash used in investing activities \begin{tabular}{ccc} (361.1) & (387.6) & (284.1) \\ 43.2 & 34.9 & 39.8 \\ (180.1) & (41.6) & (135.8) \\ 67.4 & 21.7 & 4.9 \\ (57.8) & (18.6) & (107.0) \\ 9.7 & 3.7 & 9.0 \\ \hline (478.7) & (387.5) & (473.2) \\ \hline \end{tabular} cONSOLDATEO STATEMENTS OF SHAREOWm.- (million dollars) Consolidation. The consolidated financial statements 97 (2) Geographic Area Information (1) Summory of significent Accounting Policies include the accounts of the Company and its majority- The Company is predominantly engaged in the prepared owned subsidiaries. Significant intercompany tran- convenience foods industry. The following presents sactions are eliminated in consolidation. Investments information about operations in different geographic in affiliated owned 20% or more are accounted for by the equity method. Inventories. Substantially all domestic inventories are priced at the lower of cost or market, with cost determined by the last-in, first-out (LIFO) method. Other inventories are priced at the lower of average cost or market. Intangibles. The excess of cost of investments over net assets of purchased companies is amortized on a straightline basis over periods not exceeding forty years. Plant Assets. Alterations and major overhauls which substantially extend the lives of properties or materially increase their capacity are capitalized. The amounts for property disposals are removed from plant asset and accumulated depreciation accounts and any resultant gain or loss is included in earnings. Ordinary repairs and maintenance are charged to operating costs. Depreciation. Depreciation provided in costs and expenses is on the straight-line method. The United States, Canadian and certain other foreign companies use accelerated methods of depreciation for income tax purposes. Pension Plans. Pension costs are accrued over employees' careers based on plan benefit formulas. Cash and Cash Equivalents. All highly liquid debt instruments purchased with a maturity of three months or less are classified as Cash Equivalents. Financial Instruments. In managing interest rate ex- Transfers between geographic areas are recorded at cost posure, the Company at times enters into interest rate plus markup or at market. Identifiable assets are all swap agreements. When interest rates change, the assets identified with operations in each geographic area. difference to be paid or received is accrued and recognized as interest expense over the life of the agreement. In order to hedge foreign currency exposures on firm commitments, the Company at times enters into forward foreign exchange contracts. Gains and losses resulting from these instruments are recognized in the same period as the underlying hedged transaction. The Company also at times enters into foreign currency swap agreements which are effective as hedges of net investments in foreign subsidiaries. Realized and unrealized gains and losses on these currency swaps are recognized in the Cumulative Translation Adjustments account in Shareowners' Equity. 101 Fluctuations in foreign exchange rates resulted in de- 106 Acquisinions creases in net earnings of $.3 in Year 11,$3.2 in Ye- Prior to July Year 11, the Company owned approxi- 10 and $19.1 in Year 9 . The balances in the Cumulative translation adjust- Company Lid. ("Campbell stock of Campbell Soup Cockada"), which processes, ments account are the following: foodses and distributes a wide range of prepared pany's brand namely in Canada under many of the Comof operations of The financial position and results with those of of Campbell Canada are consolidated pany acquired the Company. In July Year 11 , the Combell Canada which remaining shares (29\%) of Camp\$159.7. In addition it did not already own at a cost of quisition at a cost of $20.4. The made one other acacquisitions of $180.1 w. The total cost of Year 11 (5) other Expense Included in other expense are the following: vuring Year 10 the Company made several small acquisitions at a cost of $43.1 which was allocated as follows: 105 (6) Divestifures, Restructuring and In Year 10 , charges for divestiture and restructuring During Year 9 , the Company made several acquisitions programs, designed to strengthen the Company's core at a cost of $137.9, including a soup and pickle manubusinesses and improve long-term profitability, re- facturing business in Canada. The cost of the acquisiduced operating earnings by $339.1;$301.6 after tions was allocated as follows: taxes, or $2.33 per share. The divestiture program in- 1 volves the sale of several low-return or non-strategic businesses. The restructuring charges provide for the elimination of underperforming assets and unnecessary facilities and include a charge of $113 to write off goodwill in the United Kingdom. In Year 9, charges for a worldwide restructuring pro- These acquisition were accounted for as purchase gram reduced operating earnings by $343.0;$260.8 transactions, and operations of the acquired companafter taxes, or $2.02 per share. The restructuring pro- ies are included in the financial statements from the gram involved plant consolidations, work force reduc- dates the acquisitions were recorded. Proforma results tions, and goodwill write-offs. (million dollans) of operations have not been presented as they would not vary matcrially from the reported amounts and would not be indicative of results anticipated following acquisition due to significant changes made to acquired companies' operations. (8) Pension Plans and Refirement Benefits Pension Plans. Substantially all of the employees of the Company and its domestic and Canadian subsidiaries are covered by noncontributory defined benefit pension plans. Plan benefits are generally based on years of service and employees' compensation during the last years of employment. Benefits are paid from funds previously provided to trustees and insurance companies or are paid directly by the Company or its subsidiaries. Actuarial assumptions and plan provisions are reviewed regularly by the Company and its independent actuaries to ensure that plan assets will be adequate to provide pension and survivor benefits. Plan assets consist primarily of shares of or units in common Pension coverage for employees of the Compan stock, fixed income, real estate and money market foreign subsidiaries, other than Canada, and oth supplemental pension benefits of the Company a funds. provided to the extent determined appropriate throu their respective plans. Obligations under such pla are systematically provided for by depositing fun with trusts or under insurance contracts. The ass and obligations of these plans are not material. Savings Plans. The Company sponsors employee st ings plans which cover substantially all domes employees. After one year of continuous service Company matches 50% of employee contributions to five percent of compensation within certain lim In fiscal Year 12, the Company will increase contribution by up to 20% if certain earnings' go are achieved. Amounts charged to costs and exper were $10.0 in Year 11,$10.6 in Year 10, and $10. Year 9. Retiree Benefits. The Company and its domestic s Principal actuarial assumptions used in the sidiaries provide certain health care and life insura benefits to substantially all retired employees United States were: their dependents. The cost of these retiree he The deferred income taxes result from temporary differences between financial statement earnings and taxable earnings as follows: tax rates wing is a reconciliation of effective income The provision for income taxes was reduced by $3.2 in Year 11,$5.2 in Year 10 and $3.5 in Year 9 due to the utilization of loss carryforwards by certain foreign subsidiaries. Certain foreign subsidiaries of the Company have tax loss carryforwards of approximately $103.4($77.4 for financial purposes), of which $10.5 relate to periods prior to acquisition of the subsidiaries by the Company. Of these carryforwards, $54.8 expire through Year 16 and $48.6 may be carried forward indefinitely. The current statutory tax rates in these foreign countries range from 20% to 51%. Income taxes have not been accrued on undistributed earnings of foreign subsidiaries of $219.7 which are invested in operating assets and are not expected to be remitted. If remitted, tax credits are available to substantially reduce any resultant additional taxes. The following are carnings before taxes of United 111 States and forcign companies. Liquidation of LIFO inventory quantities had no significant effect on net earnings in Year 11, Year 10 , or Year 9. Inventories for which the LIFO method of determining cost is used represented approximately 70% of consoli3 (10) Leases dated inventories in Year 11 and 64% in Year 10. Rent expense was $59.7 in Year 11,$62.4 in Year 10 and $60.2 in Year 9 and generally relates to leases of machinery and equipment. Future minimum lease payments under operating leases are $71.9. (11) Supplementary stetements of Earnings Information (12) Cash and Cash Equivalents Cash and Cash Equivalents includes cash equivalents of $140.7 at July 28 , Year 11 , and $44.1 at July 29 , Year 10 . (13) Accounts Receivable Depreciation provided in costs and expenses was $194.5 in Year 11,$184.1 in Year 10 and $175.9 in Year 9. Approximately $158.2 of capital expenditures is required to complete projects in progress at July 28 , Year 11. [170] Notos Poyablo and Long-torm Dobt Notes payable consists of the following. At July 29 , Year 10, $150 of outstanding commercial paper and $100.3 of currently maturing notes were reclassified to long-term debt and were refinanced in Year 11. Information on notes payable follows: Investment in affiliates consists principally of the Company's ownership of 33% of the outstanding capital stock of Arnotts Limited, an Australian biscuit manufacturer. This investment is being accounted for by the equity method. Included in this investment is goodwill of $28.3 which is being amortized over 40 years. At July 28. Year 11, the market value of the investment based on quoted market prices was \$213.8. The Company's equity in the earnings of Arnotts Limited was $1.5 in Year 11, $13.0 in Year 10 and $8.7 in Year 9. The Year 10 sales of businesses. Dividends received were $8.2 in Year The amount of unused lines of credit at July 28 , Year amount includes a $4.0 gain realized by Arnotts on the 11,57.4 in Year 10 and $6.6 in Year 9 . The Company's 11 approximates $635. The lines of credit are unconequity in the ditional and generally cover loans for a period of a S15.4 in the undistributed earnings of Arnotts was year at prime commercial interest rates. (million dollars) have a total notional principal amount of $103, and Long-term debt consists of the following: are intended to reduce exposure to higher foreign interest rates and to hedge the Company's net investments in the United Kingdom and Australia. The Company is exposed to credit loss in the event of nonperformance by the other parties to the interest rate swap agreements; however, the Company does not anticipate nonperformance by the counterparties. At July 28, Year 11, the Company had contracts to purchase approximately $109 in foreign currency. The contracts are mostly for European currencies and have maturities through Year 12 . 20 Acerued Liabilities "Redeemable in Year 13 , **\$50 redeemable in Year 18. ***Present value of $200.0 zero coupon notes, net of unamortized[ discount of $40.3. 173 Future minimum lease payments under capital leases are $28.0 and the present value of such payments, after deducting implicit interest of $6.5, is $21.5 of which $6.7 is included in current liabilities. Principle amounts of long-term debt mature as follows: Year 12-\$227.7 (in current liabilities); Year 13\$118.9; Year 14-\$17.8; Year 15-\$15.9; Year 16-\$108.3 and beyond- $511.7. The Company has filed a shelf registration statement with the Securities and Exchange Commission for the issuance from time to time of up to $300 of debt securities, of which $100 remains unissued. Information on financial instruments follows: At July 28, Year 11 , the Company had an interest rate swap agreement with financial institutions having a notional principal amount of $100, which is intended to reduce the impact of changes in interest rates on floating rate commercial paper. In addition, at July 28, Year 11 , the Company had two swap agreements with financial institutions which covered both interest rates and foreign currencies. These agreements (19) (2.) shareowners' Equiry The Company has authorized 140 million shares of Capital Stock of $.15 par value and 40 million shares of Preferred Stock issuable in one or more classes, [180 Interest paid, net of of Directors. No Preferred Stock has been issued. (a) at chares) Year11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started