Answered step by step

Verified Expert Solution

Question

1 Approved Answer

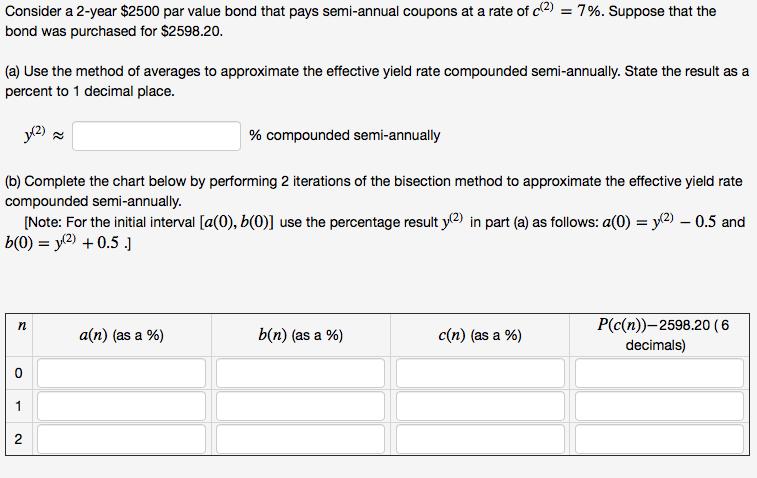

Consider a 2-year $2500 par value bond that pays semi-annual coupons at a rate of c() = 7%. Suppose that the bond was purchased

![(c) Use the last line in the table above to find the bracket [a(3), b(3)] and the midpoint c(3) to](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/05/645ddc7816c4d_1683872889053.jpg)

Consider a 2-year $2500 par value bond that pays semi-annual coupons at a rate of c() = 7%. Suppose that the bond was purchased for $2598.20. (a) Use the method of averages to approximate the effective yield rate compounded semi-annually. State the result as a percent to 1 decimal place. y() (b) Complete the chart below by performing 2 iterations of the bisection method to approximate the effective yield rate compounded semi-annually. [Note: For the initial interval [a(0), b(0)] use the percentage result y(2) in part (a) as follows: a(0) = y(2) - 0.5 and b(0) = y(2) +0.5.] n O 1 2 % compounded semi-annually a(n) (as a %) b(n) (as a %) c(n) (as a %) P(c(n))-2598.20 (6 decimals) (c) Use the last line in the table above to find the bracket [a(3), b(3)] and the midpoint c(3) to approximate the effective yield rate compounded semi-annually. State the final result as a percent to 4 decimal places. (2) c(3) = % compounded semi-annually

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To solve part a of the question we can use the method of averages to approximate the effective yield rate We have a 2year 2500 par value bond that pays semiannual coupons at a rate of c2 7 The bond wa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started