Question

Consider a 2-year forward contract to buy 1 million shares of a non-dividend paying stock. The current stock price is $80 per share, the

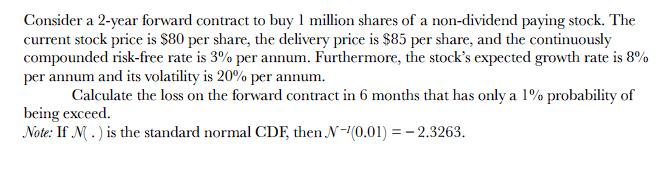

Consider a 2-year forward contract to buy 1 million shares of a non-dividend paying stock. The current stock price is $80 per share, the delivery price is $85 per share, and the continuously compounded risk-free rate is 3% per annum. Furthermore, the stock's expected growth rate is 8% per annum and its volatility is 20% per annum. Calculate the loss on the forward contract in 6 months that has only a 1% probability of being exceed. Note: If N.) is the standard normal CDF, then N-(0.01) = -2.3263.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the loss on the forward contract that has only a 1 probability of being exceeded in 6 m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Accounting

Authors: Paul M. Fischer, William J. Tayler, Rita H. Cheng

11th edition

538480289, 978-0538480284

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App