Answered step by step

Verified Expert Solution

Question

1 Approved Answer

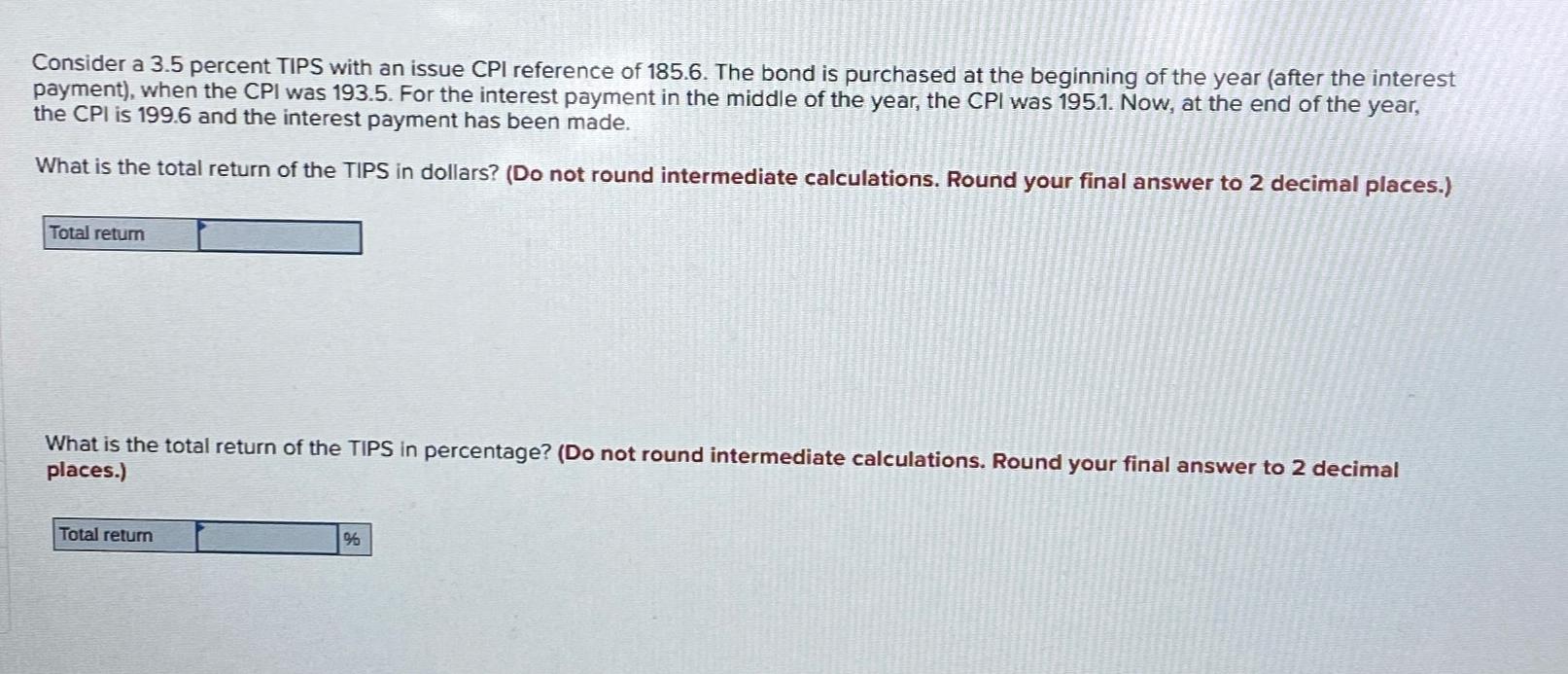

Consider a 3 . 5 percent TIPS with an issue CPI reference of 1 8 5 . 6 . The bond is purchased at the

Consider a percent TIPS with an issue CPI reference of The bond is purchased at the beginning of the year after the interest payment when the CPI was For the interest payment in the middle of the year, the CPI was Now, at the end of the year, the CPI is and the interest payment has been made.

What is the total return of the TIPS in dollars? Do not round intermediate calculations. Round your final answer to decimal places.

Total retum

What is the total return of the TIPS in percentage? Do not round intermediate calculations. Round your final answer to decimal places.

Total return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started