Answered step by step

Verified Expert Solution

Question

1 Approved Answer

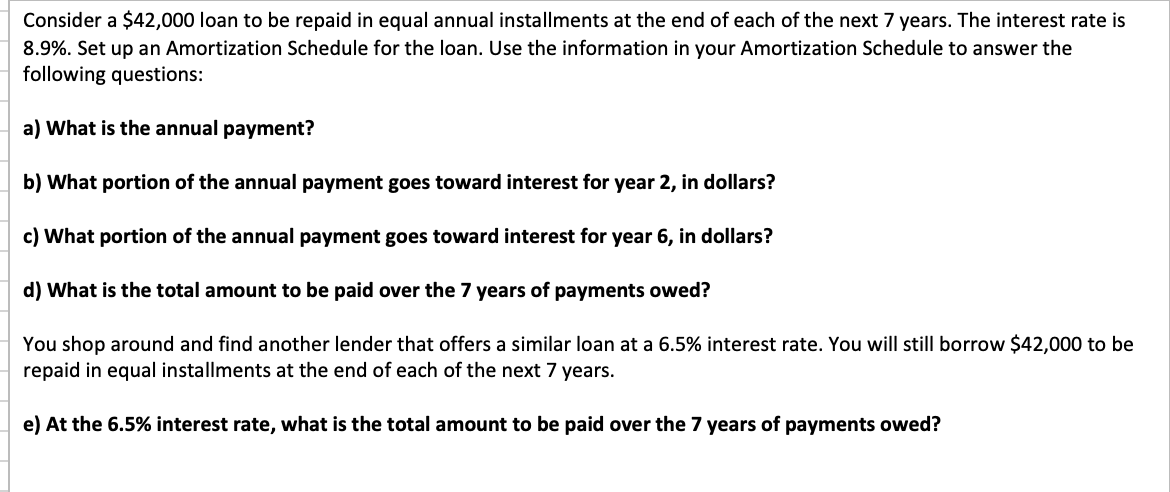

Consider a $ 4 2 , 0 0 0 loan to be repaid in equal annual installments at the end of each of the next

Consider a $ loan to be repaid in equal annual installments at the end of each of the next years. The interest rate is

Set up an Amortization Schedule for the loan. Use the information in your Amortization Schedule to answer the

following questions:

a What is the annual payment?

b What portion of the annual payment goes toward interest for year in dollars?

c What portion of the annual payment goes toward interest for year in dollars?

d What is the total amount to be paid over the years of payments owed?

You shop around and find another lender that offers a similar loan at a interest rate. You will still borrow $ to be

repaid in equal installments at the end of each of the next years.

e At the interest rate, what is the total amount to be paid over the years of payments owed?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started