Answered step by step

Verified Expert Solution

Question

1 Approved Answer

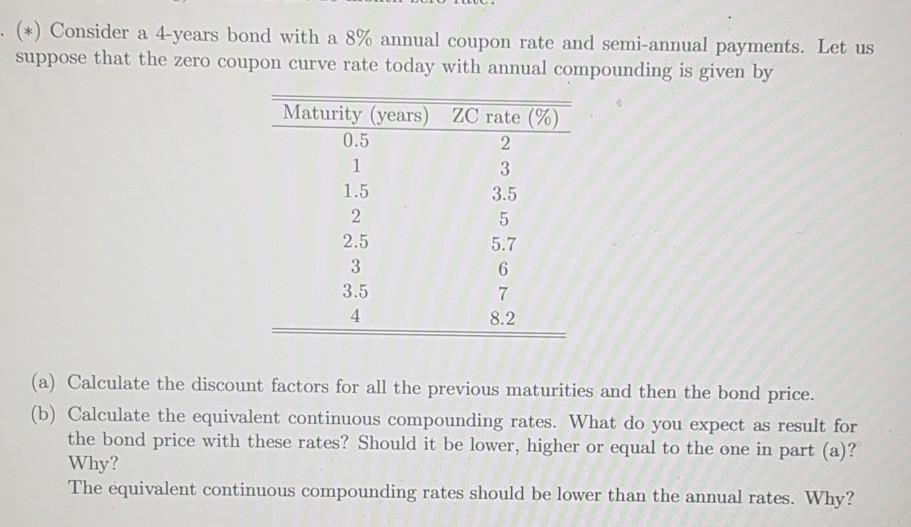

(*) Consider a 4-years bond with a 8% annual coupon rate and semi-annual payments. Let us suppose that the zero coupon curve rate today with

(*) Consider a 4-years bond with a 8% annual coupon rate and semi-annual payments. Let us suppose that the zero coupon curve rate today with annual compounding is given by Maturity (years) ZC rate (%) 0.5 2 1 3 1.5 3.5 2 5 2.5 5.7 3 6 3.5 7 4 8.2 (a) Calculate the discount factors for all the previous maturities and then the bond price. (b) Calculate the equivalent continuous compounding rates. What do you expect as result for the bond price with these rates? Should it be lower, higher or equal to the one in part (a)? Why? The equivalent continuous compounding rates should be lower than the annual rates. Why

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started