Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a do-it-yourself pension fund based on regular savings invested in a bank account, attracting an annual interest rate of 4%. You plan to retire

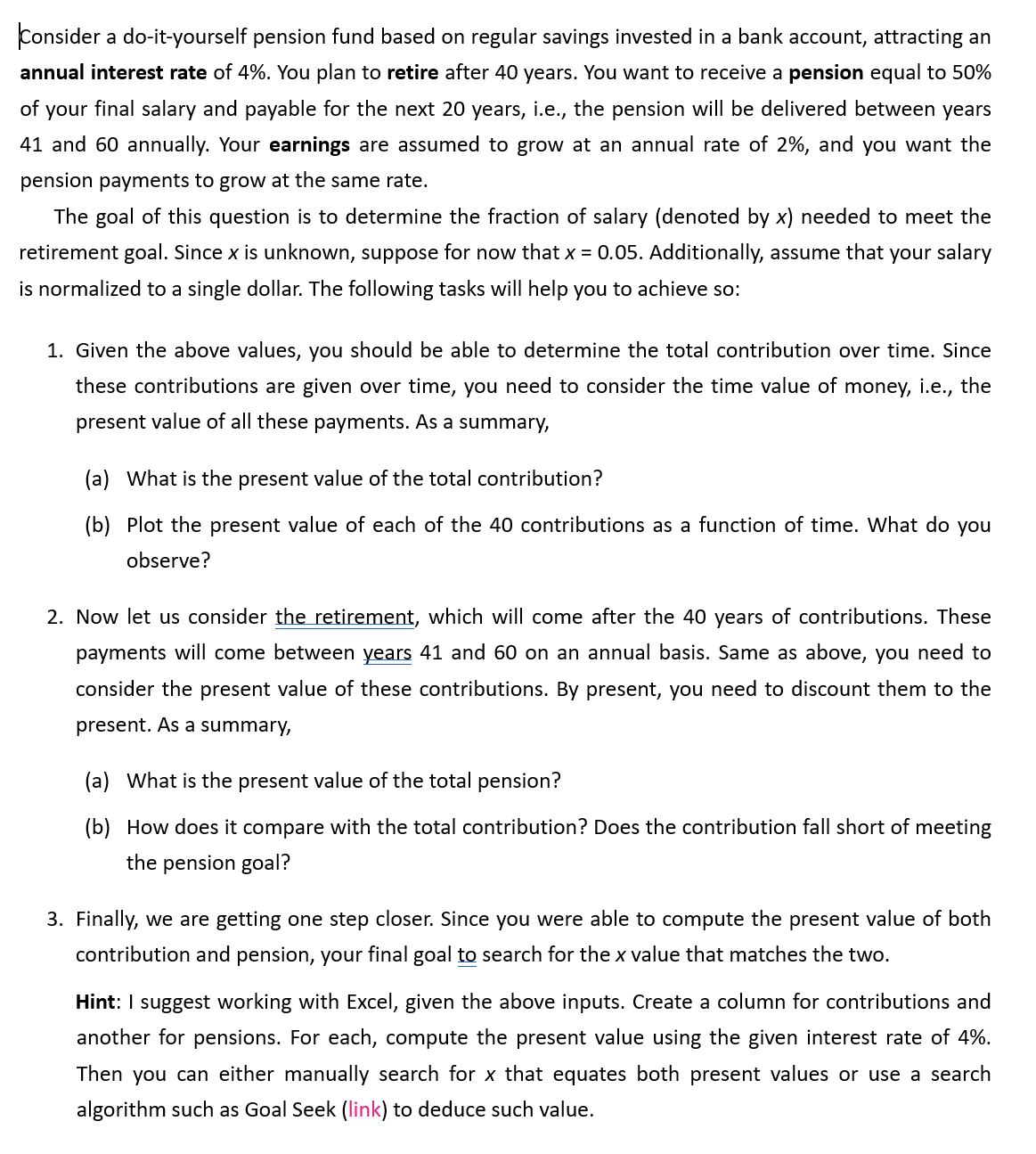

Consider a do-it-yourself pension fund based on regular savings invested in a bank account, attracting an annual interest rate of 4%. You plan to retire after 40 years. You want to receive a pension equal to 50% of your final salary and payable for the next 20 years, i.e., the pension will be delivered between years 41 and 60 annually. Your earnings are assumed to grow at an annual rate of 2%, and you want the pension payments to grow at the same rate. The goal of this question is to determine the fraction of salary (denoted by x ) needed to meet the retirement goal. Since x is unknown, suppose for now that x=0.05. Additionally, assume that your salary is normalized to a single dollar. The following tasks will help you to achieve so: 1. Given the above values, you should be able to determine the total contribution over time. Since these contributions are given over time, you need to consider the time value of money, i.e., the present value of all these payments. As a summary, (a) What is the present value of the total contribution? (b) Plot the present value of each of the 40 contributions as a function of time. What do you observe? 2. Now let us consider the retirement, which will come after the 40 years of contributions. These payments will come between years 41 and 60 on an annual basis. Same as above, you need to consider the present value of these contributions. By present, you need to discount them to the present. As a summary, (a) What is the present value of the total pension? (b) How does it compare with the total contribution? Does the contribution fall short of meeting the pension goal? 3. Finally, we are getting one step closer. Since you were able to compute the present value of both contribution and pension, your final goal to search for the x value that matches the two. Hint: I suggest working with Excel, given the above inputs. Create a column for contributions and another for pensions. For each, compute the present value using the given interest rate of 4%. Then you can either manually search for x that equates both present values or use a search algorithm such as Goal Seek (link) to deduce such value

Consider a do-it-yourself pension fund based on regular savings invested in a bank account, attracting an annual interest rate of 4%. You plan to retire after 40 years. You want to receive a pension equal to 50% of your final salary and payable for the next 20 years, i.e., the pension will be delivered between years 41 and 60 annually. Your earnings are assumed to grow at an annual rate of 2%, and you want the pension payments to grow at the same rate. The goal of this question is to determine the fraction of salary (denoted by x ) needed to meet the retirement goal. Since x is unknown, suppose for now that x=0.05. Additionally, assume that your salary is normalized to a single dollar. The following tasks will help you to achieve so: 1. Given the above values, you should be able to determine the total contribution over time. Since these contributions are given over time, you need to consider the time value of money, i.e., the present value of all these payments. As a summary, (a) What is the present value of the total contribution? (b) Plot the present value of each of the 40 contributions as a function of time. What do you observe? 2. Now let us consider the retirement, which will come after the 40 years of contributions. These payments will come between years 41 and 60 on an annual basis. Same as above, you need to consider the present value of these contributions. By present, you need to discount them to the present. As a summary, (a) What is the present value of the total pension? (b) How does it compare with the total contribution? Does the contribution fall short of meeting the pension goal? 3. Finally, we are getting one step closer. Since you were able to compute the present value of both contribution and pension, your final goal to search for the x value that matches the two. Hint: I suggest working with Excel, given the above inputs. Create a column for contributions and another for pensions. For each, compute the present value using the given interest rate of 4%. Then you can either manually search for x that equates both present values or use a search algorithm such as Goal Seek (link) to deduce such value Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started