Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a European call option with an exercise price (i.e. strike price) of $4 and six months to expiry. The underlying share is currently

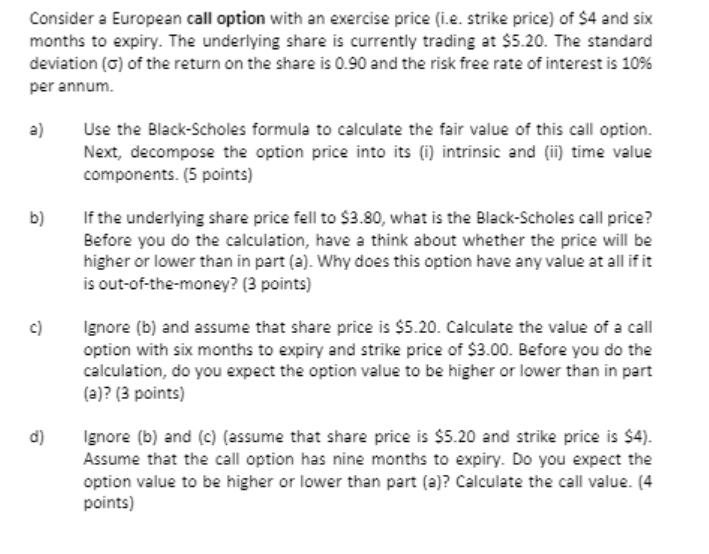

Consider a European call option with an exercise price (i.e. strike price) of $4 and six months to expiry. The underlying share is currently trading at $5.20. The standard deviation (a) of the return on the share is 0.90 and the risk free rate of interest is 10% per annum. a) b) c) d) Use the Black-Scholes formula to calculate the fair value of this call option. Next, decompose the option price into its (i) intrinsic and (ii) time value components. (5 points) If the underlying share price fell to $3.80, what is the Black-Scholes call price? Before you do the calculation, have a think about whether the price will be higher or lower than in part (a). Why does this option have any value at all if it is out-of-the-money? (3 points) Ignore (b) and assume that share price is $5.20. Calculate the value of a call option with six months to expiry and strike price of $3.00. Before you do the calculation, do you expect the option value to be higher or lower than in part (a)? (3 points) Ignore (b) and (c) (assume that share price is $5.20 and strike price is $4). Assume that the call option has nine months to expiry. Do you expect the option value to be higher or lower than part (a)? Calculate the call value. (4 points)

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The BlackScholes model is a widely used mathematical model for pricing options It takes into account several factors includingthe current price of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started