Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hardy Boys Mining Company purchased a piece of land for $5,000,000 with the intention of mining granite from the site. Hardy Boys paid $80,000

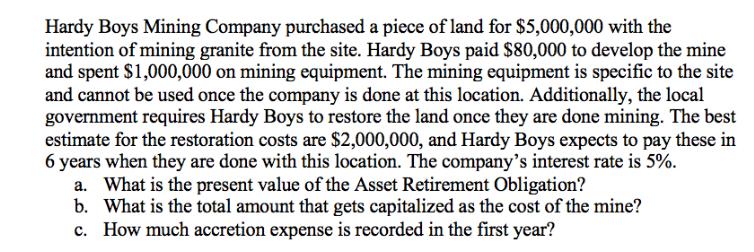

Hardy Boys Mining Company purchased a piece of land for $5,000,000 with the intention of mining granite from the site. Hardy Boys paid $80,000 to develop the mine and spent $1,000,000 on mining equipment. The mining equipment is specific to the site and cannot be used once the company is done at this location. Additionally, the local government requires Hardy Boys to restore the land once they are done mining. The best estimate for the restoration costs are $2,000,000, and Hardy Boys expects to pay these in 6 years when they are done with this location. The company's interest rate is 5%. a. What is the present value of the Asset Retirement Obligation? b. What is the total amount that gets capitalized as the cost of the mine? c. How much accretion expense is recorded in the first year?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a b C given details purchase price cost to develop mine mi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started