Answered step by step

Verified Expert Solution

Question

1 Approved Answer

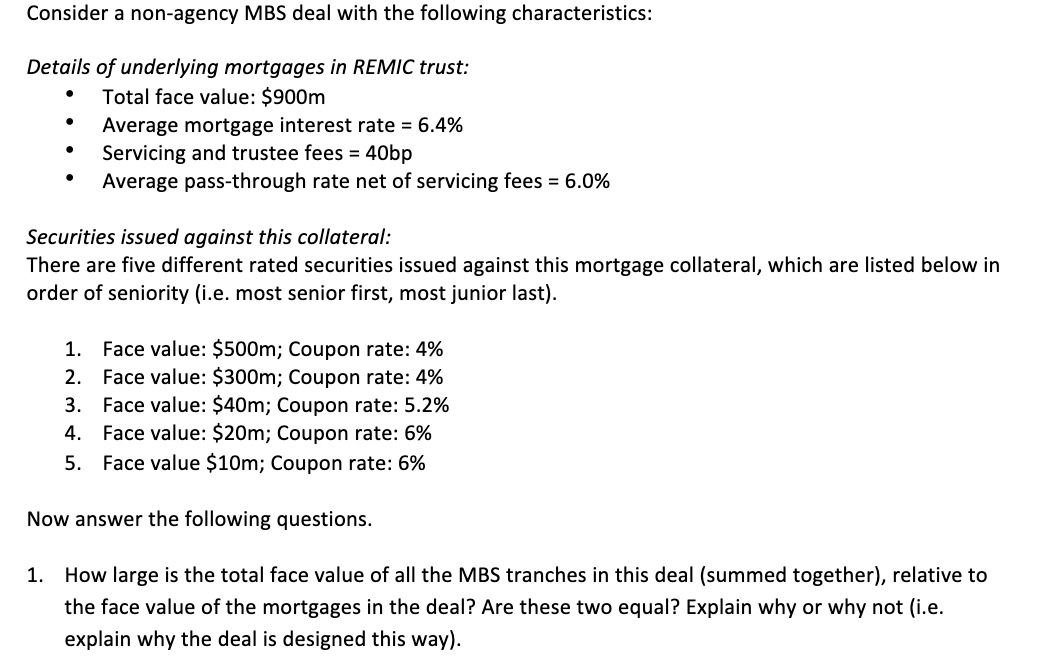

Consider a non-agency MBS deal with the following characteristics: Details of underlying mortgages in REMIC trust: Total face value: $900m Average mortgage interest rate

Consider a non-agency MBS deal with the following characteristics: Details of underlying mortgages in REMIC trust: Total face value: $900m Average mortgage interest rate = 6.4% Servicing and trustee fees = 40bp Average pass-through rate net of servicing fees = 6.0% Securities issued against this collateral: There are five different rated securities issued against this mortgage collateral, which are listed below in order of seniority (i.e. most senior first, most junior last). 1. Face value: $500m; Coupon rate: 4% 2. Face value: $300m; Coupon rate: 4% 3. Face value: $40m; Coupon rate: 5.2% 4. Face value: $20m; Coupon rate: 6% 5. Face value $10m; Coupon rate: 6% Now answer the following questions. 1. How large is the total face value of all the MBS tranches in this deal (summed together), relative to the face value of the mortgages in the deal? Are these two equal? Explain why or why not (i.e. explain why the deal is designed this way).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The total face value of all the MBS tranches is 870m 500m 300m 40m 20m 10m T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started