Question: Consider a one-period binomial model, where the time-0 stock price is $100, and where the time-1 prices are either $120 or $95. That is, in

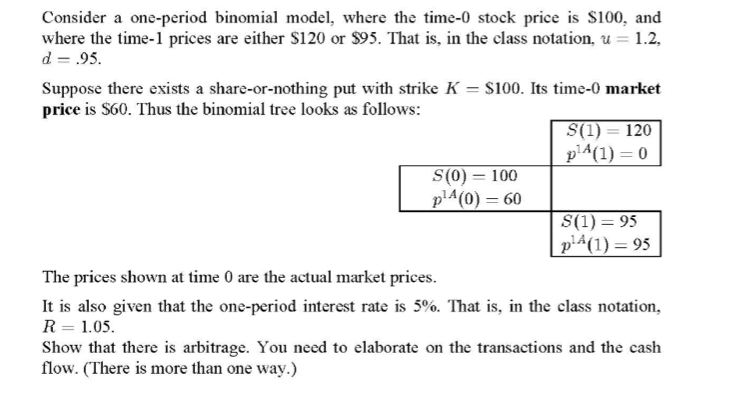

Consider a one-period binomial model, where the time-0 stock price is $100, and where the time-1 prices are either $120 or $95. That is, in the class notation, u = 1.2, d= .95. Suppose there exists a share-or-nothing put with strike K = $100. Its time-o market price is $60. Thus the binomial tree looks as follows: S(I) = 120 plA(1) = 0 S(0) = 100 p.A(0) = 60 S(1) = 95 p.A(1) = 95 The prices shown at time 0 are the actual market prices. It is also given that the one-period interest rate is 5%. That is, in the class notation, R = 1.05. Show that there is arbitrage. You need to elaborate on the transactions and the cash flow. (There is more than one way.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts