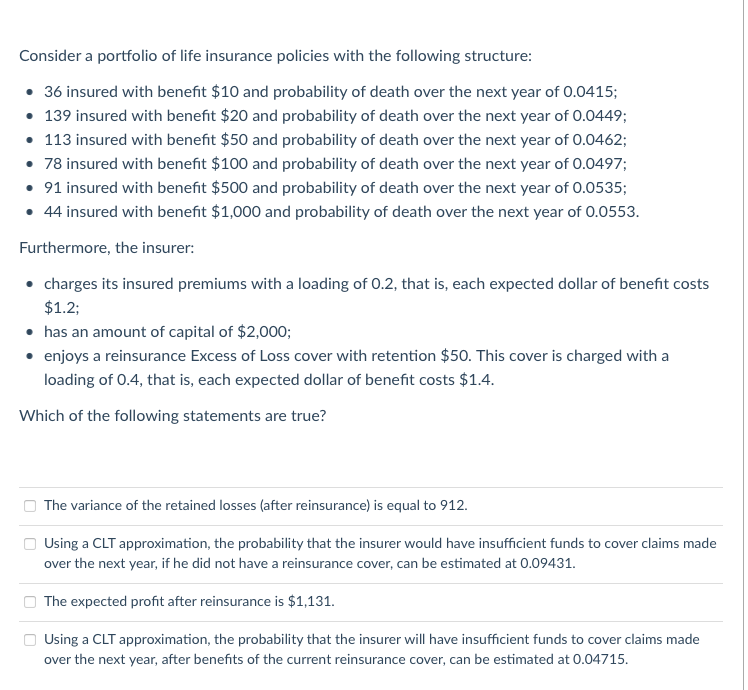

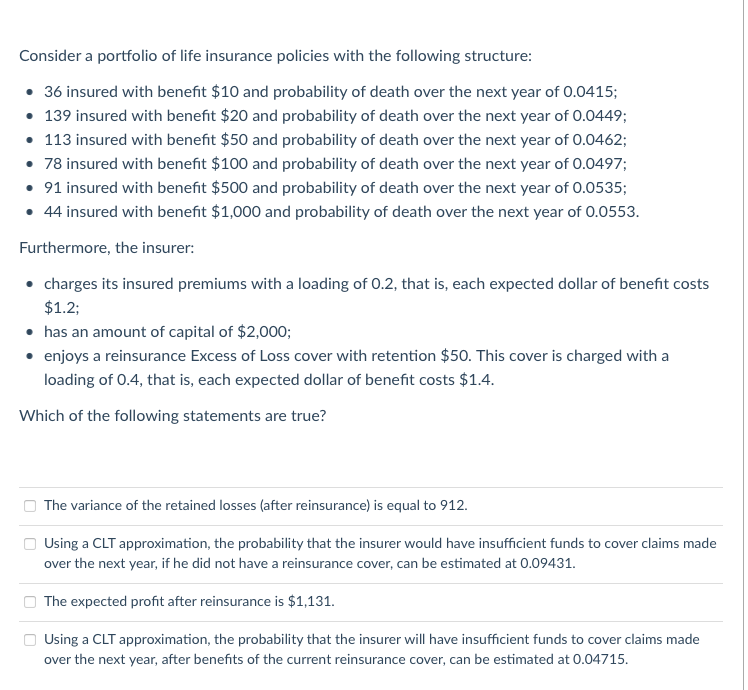

Consider a portfolio of life insurance policies with the following structure: 36 insured with benefit $10 and probability of death over the next year of 0.0415; 139 insured with benefit $20 and probability of death over the next year of 0.0449; 113 insured with benefit $50 and probability of death over the next year of 0.0462; 78 insured with benefit $100 and probability of death over the next year of 0.0497; 91 insured with benefit $500 and probability of death over the next year of 0.0535; 44 insured with benefit $1,000 and probability of death over the next year of 0.0553. Furthermore, the insurer: charges its insured premiums with a loading of 0.2, that is, each expected dollar of benefit costs $1.2; has an amount of capital of $2,000; enjoys a reinsurance Excess of Loss cover with retention $50. This cover is charged with a loading of 0.4, that is, each expected dollar of benefit costs $1.4. Which of the following statements are true? The variance of the retained losses (after reinsurance) is equal to 912. Using a CLT approximation, the probability that the insurer would have insufficient funds to cover claims made over the next year, if he did not have a reinsurance cover, can be estimated at 0.09431. The expected profit after reinsurance is $1,131. Using a CLT approximation, the probability that the insurer will have insufficient funds to cover claims made over the next year, after benefits of the current reinsurance cover, can be estimated at 0.04715. Consider a portfolio of life insurance policies with the following structure: 36 insured with benefit $10 and probability of death over the next year of 0.0415; 139 insured with benefit $20 and probability of death over the next year of 0.0449; 113 insured with benefit $50 and probability of death over the next year of 0.0462; 78 insured with benefit $100 and probability of death over the next year of 0.0497; 91 insured with benefit $500 and probability of death over the next year of 0.0535; 44 insured with benefit $1,000 and probability of death over the next year of 0.0553. Furthermore, the insurer: charges its insured premiums with a loading of 0.2, that is, each expected dollar of benefit costs $1.2; has an amount of capital of $2,000; enjoys a reinsurance Excess of Loss cover with retention $50. This cover is charged with a loading of 0.4, that is, each expected dollar of benefit costs $1.4. Which of the following statements are true? The variance of the retained losses (after reinsurance) is equal to 912. Using a CLT approximation, the probability that the insurer would have insufficient funds to cover claims made over the next year, if he did not have a reinsurance cover, can be estimated at 0.09431. The expected profit after reinsurance is $1,131. Using a CLT approximation, the probability that the insurer will have insufficient funds to cover claims made over the next year, after benefits of the current reinsurance cover, can be estimated at 0.04715