Answered step by step

Verified Expert Solution

Question

1 Approved Answer

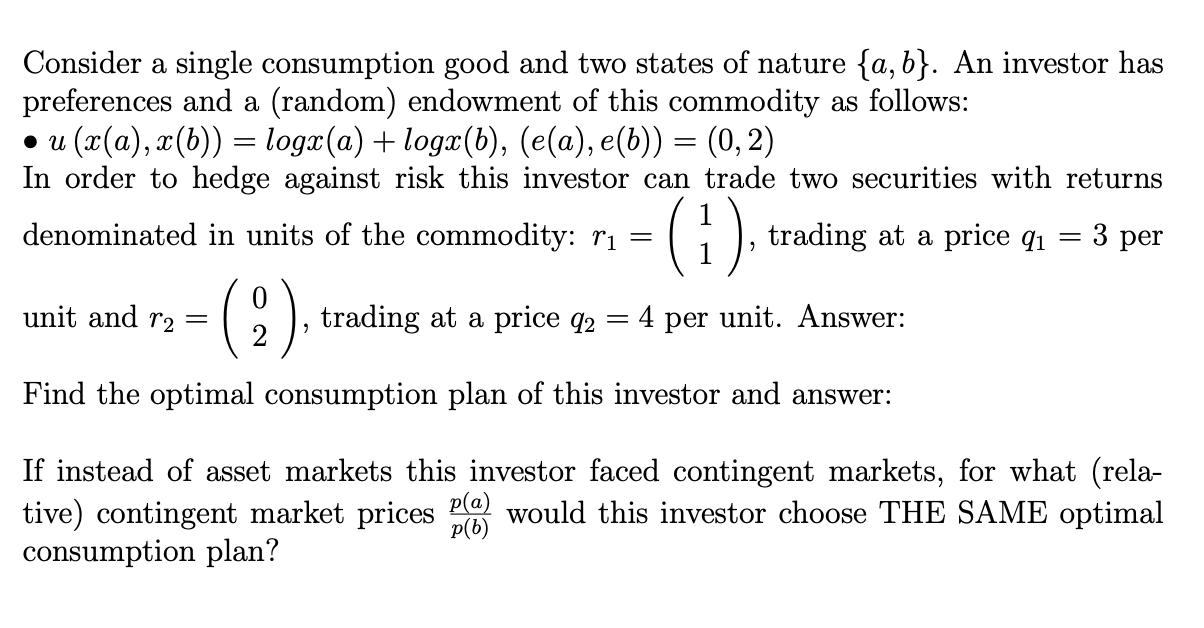

Consider a single consumption good and two states of nature {a, b}. An investor has preferences and a (random) endowment of this commodity as

Consider a single consumption good and two states of nature {a, b}. An investor has preferences and a (random) endowment of this commodity as follows: u (x(a), x(b)) = logx(a) + logx(b), (e(a), e(b)) = (0, 2) In order to hedge against risk this investor can trade two securities with returns trading at a price q = 3 per (), denominated in units of the commodity: r = unit and r2 = (2), trading at a price 92 Find the optimal consumption plan of this investor and answer: If instead of asset markets this investor faced contingent markets, for what (rela- tive) contingent market prices would this investor choose THE SAME optimal p(b) consumption plan? = = 4 per unit. Answer:

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER To find the optimal consumption plan of the investor we can use the expected utility maximiza...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started